Title: Dallas Texas Sale of Deceased Partner's Interest to Surviving Partner: Purchase Agreement and Bill of Sale Explained Keywords: Dallas Texas, sale of deceased partner's interest, surviving partner, purchase agreement, bill of sale Introduction: In the event of the death of a partner in a business located in Dallas, Texas, it becomes necessary to transfer their interest to the surviving partner(s). This process involves executing a legally binding document known as a Purchase Agreement and Bill of Sale. In Dallas, Texas, several types of Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale may exist, including the following: 1. Sole Proprietorship: If the business was structured as a sole proprietorship, the surviving partner will typically become the sole owner and have full control over the business assets, liabilities, and operations. 2. Partnership: In a partnership, the surviving partner or partners can purchase the deceased partner's interest and assume their share of ownership, depending on the terms outlined in the partnership agreement. This agreement may dictate the method of valuation and how the purchase process will occur. 3. Limited Liability Company (LLC): For an LLC, the operating agreement will specify the process of transferring ownership upon the death of a partner. Typically, the surviving partner(s) can buy the deceased partner's interest, with the purchase terms and valuation method defined within the operating agreement. Detailed Description: When it comes to executing the Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale in Dallas, Texas, the transaction must adhere to specific legal requirements. The Purchase Agreement and Bill of Sale play vital roles in ensuring a smooth and legally valid transfer of the deceased partner's interest to the surviving partner(s). Here's a breakdown of the essential components typically included: 1. Identifying Information: The Purchase Agreement and Bill of Sale must start by clearly identifying the parties involved, including both the deceased partner and the surviving partner(s). Accurate details, such as full legal names, residential addresses, and business information, should be mentioned. 2. Terms and Conditions: This section outlines the terms and conditions of the purchase transaction, including the purchase price, payment method, and any financing arrangements. It may also include provisions for non-competition agreements, confidentiality clauses, and any other pertinent terms relevant to the interests being transferred. 3. Valuation of Partner's Interest: The method of determining the value of the deceased partner's interest should be clearly specified in the agreement. This could involve using a pre-determined formula, an independent appraisal, or negotiating mutually agreed-upon terms. 4. Representations and Warranties: Both parties should make certain representations and warranties to ensure the validity and legality of the transaction. This may include confirming ownership of the interest being transferred, absence of liens or encumbrances, compliance with laws and regulations, and authorization to enter into the agreement. 5. Closing Procedures: This section outlines the procedures to be followed at the closing of the transaction. It includes details such as the date and location of the closing, the required documents, and any additional actions necessary to complete the sale. Conclusion: In Dallas, Texas, the Sale of Deceased Partner's Interest to Surviving Partner varies depending on the type of business entity involved. Whether it's a sole proprietorship, partnership, or limited liability company, understanding the legal requirements and proper execution of a Purchase Agreement and Bill of Sale is crucial. Consulting with a qualified attorney familiar with Texas state laws and business practices can help facilitate a smooth and seamless transfer of ownership.

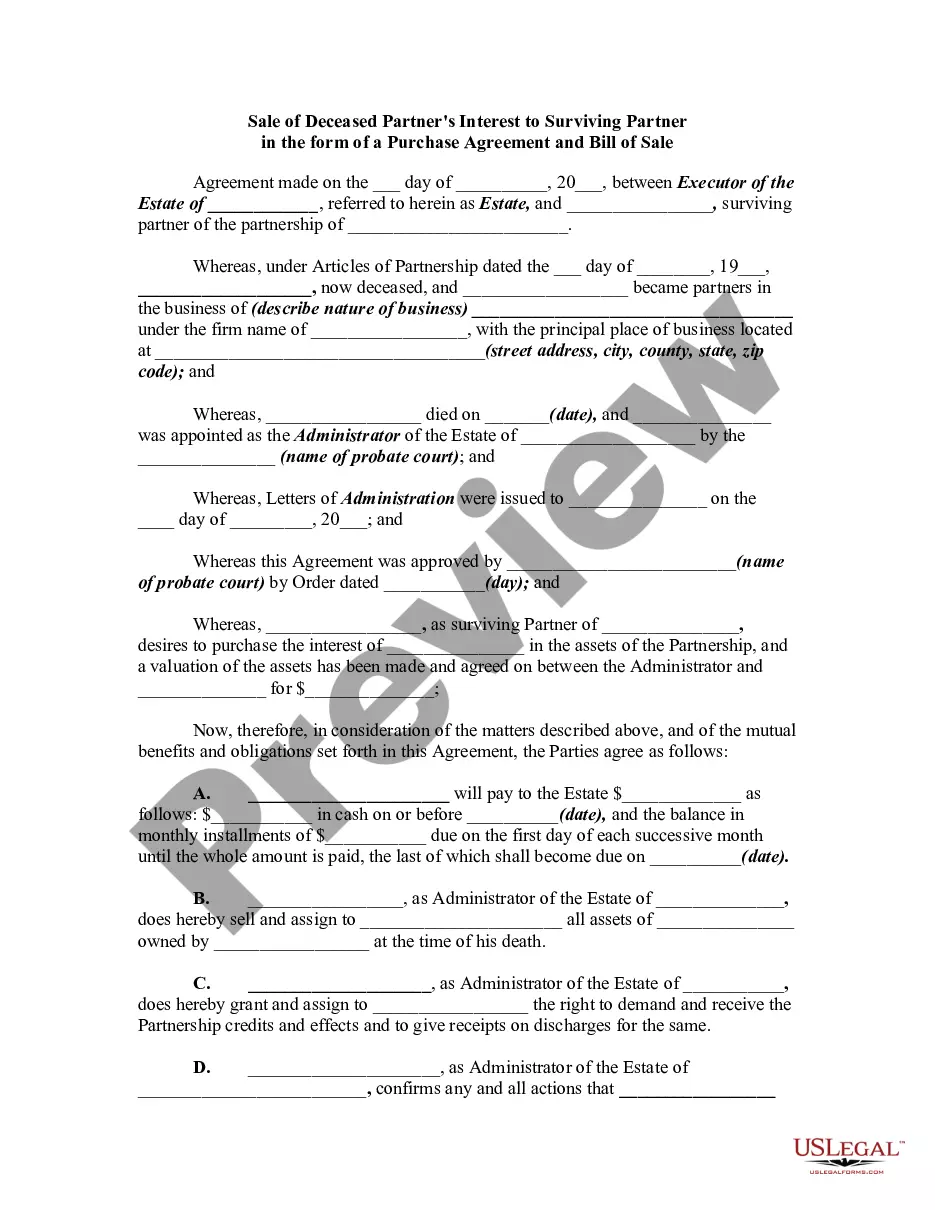

Dallas Texas Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale

Description

How to fill out Dallas Texas Sale Of Deceased Partner's Interest To Surviving Partner In The Form Of A Purchase Agreement And Bill Of Sale?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask a legal professional to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Dallas Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any use case gathered all in one place. Consequently, if you need the current version of the Dallas Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Dallas Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the document format for your Dallas Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale and download it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

When a partnership interest is acquired by gift, the transferee partner's basis generally equals the donor's basis. The basis of an inherited partnership interest equals the fair market value of the partnership interest at the decedent's date of death or the alternative valuation date, if applicable.

If a Limited Partner dies, the personal representative or other successor in interest of the deceased Limited Partner shall have all the rights and privileges of a Limited Partner. Death of a Limited Partner. The death of a Limited Partner shall not dissolve or terminate the Partnership.

It should be noted that under section 37 of the Partnership Act, the executors would be entitled, at their choice, to interest at 6% p.a. on the amount due from the date of death to the date of payment or to that portion of profit which is earned by the firm with the help of the amount due to the deceased partner.

person partnership does not terminate upon a partner's death if the deceased partner's successor in interest (usually the estate) continues to share in the partnership's profits or losses (Regs. Sec. 1. 7081(b)(1)(I)).

Partnerships automatically dissolve if any partner dies or becomes bankrupt, unless otherwise agreed. Thus partnerships should have a written partnership agreement, with provisions that permit the partnership to continue.

The Partnership Deed provided that the representatives of the deceased partner shall be entitled to: (a) Balance in the Capital Account of the deceased partner. (b) Interest on Capital @ 6% per annum up to the date of his death. (c) His share in the undistributed profits or losses as per the Balance Sheet.

Keeping it successful is even harder, and coping with the death of a partner may be the hardest situation of all. When that happens, your deceased partner's share in the business usually passes to a surviving spouse, either by terms of a will or simply by default as the primary heir.

This means that a partner wishing to leave the partnership must first offer their interest to the other members in the company before offering it to an outside party. If all of the members refuse this offer, the partner is then allowed to transfer interest to anyone they choose.

A partner may acquire an interest in a partnership in a variety of ways. For example, the partner may purchase his interest from an existing partner. Like any other asset, a partnership interest may be acquired through a gift or an inheritance.