Mecklenburg North Carolina Dividend Policy — Resolution For— - Corporate Resolutions In Mecklenburg County, North Carolina, a dividend policy resolution form is an essential document used by corporations to establish guidelines and procedures related to the distribution of dividends to shareholders. This corporate resolution form plays a crucial role in maintaining transparency, fairness, and legal compliance in dividend distribution. The Mecklenburg County dividend policy resolution form outlines the specific rules and regulations that govern the declaration, payment, and timing of dividends. It caters to different types of corporations, including public, private, and nonprofit entities. The form may vary slightly depending on the nature and structure of the corporation. Key elements addressed within the Mecklenburg North Carolina Dividend Policy — Resolution For— - Corporate Resolutions include: 1. Purpose and Objectives: This section highlights the rationale behind establishing a dividend policy and outlines the objectives the corporation aims to achieve through dividends. 2. Resolution Details: The form specifies the resolution number, the date of approval, and the parties involved, ensuring that all stakeholders are aware of the decision-making process. 3. Dividend Declaration: The resolution form outlines the criteria for declaring dividends, such as profitability, cash flow, and legal compliance. It may also describe any restrictions, limitations, or special conditions regarding dividend distribution. 4. Dividend Calculation: This section defines the methodology for calculating dividends, considering factors such as the class of shares, outstanding shares, and any applicable preferences or prerequisites. 5. Dividend Payment: The form clarifies the mechanisms for dividend payment, including the frequency (quarterly, annually, etc.) and the payment method (cash, stock, or a combination). It also includes provisions for record dates and ex-dividend dates. 6. Dividend Reinvestment: If applicable, the form may include provisions for dividend reinvestment plans, allowing shareholders to reinvest their dividends back into the corporation through the purchase of additional shares. 7. Legal Compliance: The dividend policy resolution form ensures compliance with relevant laws, regulations, and corporate bylaws. It confirms adherence to the appropriate statutes and ensures that the dividend policy does not violate any legal obligations or contractual agreements. The Mecklenburg County dividend policy resolution form can vary based on the specific needs and requirements of each corporation. Some corporations might have different variants of this form to accommodate unique circumstances or varying shareholder rights. Overall, the Mecklenburg North Carolina Dividend Policy — Resolution For— - Corporate Resolutions serves as a crucial tool for corporations operating in Mecklenburg County to formally establish their dividend policy, ensuring clarity, consistency, and compliance in the distribution of dividends to shareholders.

Mecklenburg North Carolina Dividend Policy - Resolution Form - Corporate Resolutions

Description

How to fill out Mecklenburg North Carolina Dividend Policy - Resolution Form - Corporate Resolutions?

Draftwing forms, like Mecklenburg Dividend Policy - Resolution Form - Corporate Resolutions, to take care of your legal matters is a difficult and time-consumming task. Many circumstances require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can acquire your legal issues into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal documents intended for different cases and life circumstances. We make sure each form is in adherence with the regulations of each state, so you don’t have to worry about potential legal pitfalls associated with compliance.

If you're already aware of our website and have a subscription with US, you know how effortless it is to get the Mecklenburg Dividend Policy - Resolution Form - Corporate Resolutions form. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is fairly easy! Here’s what you need to do before getting Mecklenburg Dividend Policy - Resolution Form - Corporate Resolutions:

- Make sure that your document is compliant with your state/county since the rules for creating legal documents may differ from one state another.

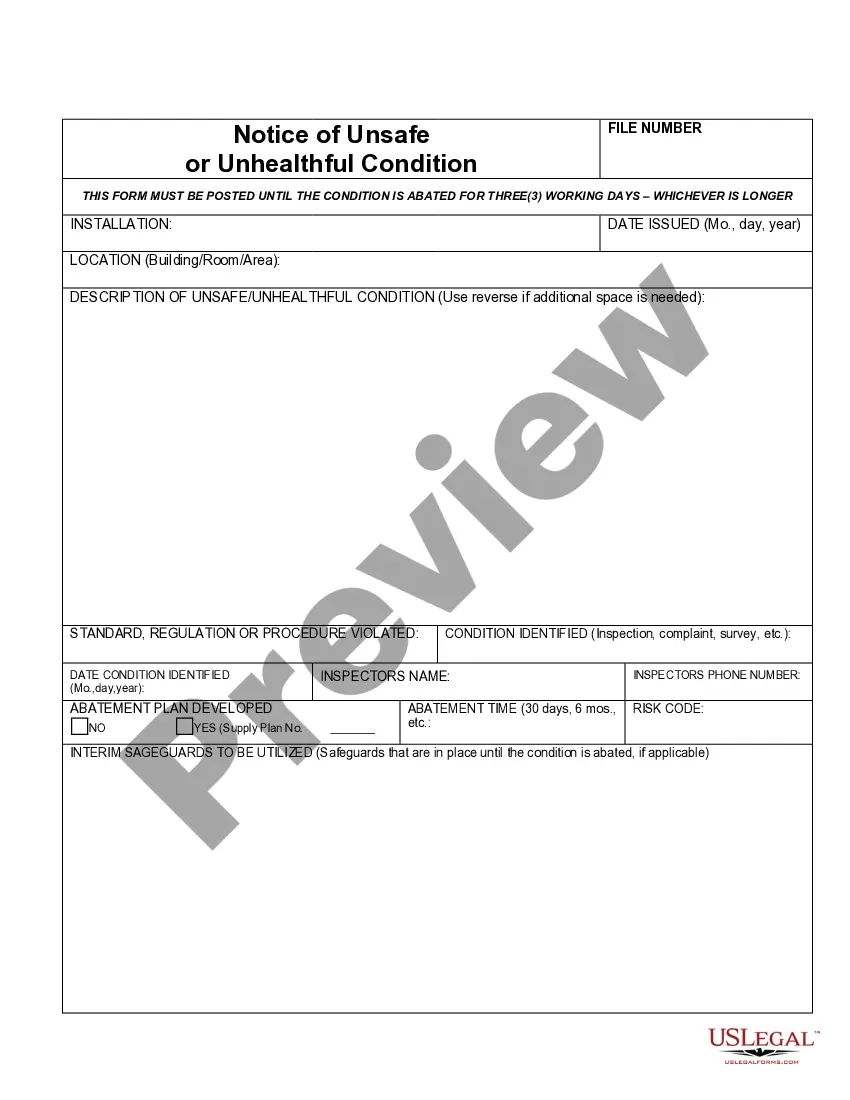

- Learn more about the form by previewing it or reading a brief intro. If the Mecklenburg Dividend Policy - Resolution Form - Corporate Resolutions isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to begin utilizing our service and get the form.

- Everything looks good on your end? Click the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your template is ready to go. You can try and download it.

It’s an easy task to find and buy the needed template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Sign up for it now if you want to check what other perks you can get with US Legal Forms!