Oakland Michigan Dividend Policy — Resolution For— - Corporate Resolutions Keywords: Oakland Michigan, dividend policy, resolution form, corporate resolutions, types Oakland Michigan Dividend Policy: The Oakland Michigan Dividend Policy is a set of guidelines and rules implemented by corporations operating in Oakland, Michigan, regarding the distribution of dividends to their shareholders. This policy not only ensures consistency and transparency in the dividend distribution process but also aims to maximize shareholder value and provide a framework for decision-making regarding dividend payments. Resolution Form: The Resolution Form is a document utilized by corporations to formally adopt, approve, or amend various policies, including the dividend policy. It serves as a written record of the decision taken by the corporation's board of directors or shareholders. The resolution form provides details about the decision, its effective date, and the individuals involved in its approval. Corporate Resolutions: Corporate resolutions refer to formal decisions made by a corporation's governing body, such as the board of directors or shareholders, to address certain matters. In the context of the Oakland Michigan Dividend Policy, corporate resolutions may involve determining the dividend payout ratio, dividend frequency, and the declaration of special dividends. These resolutions are often made during annual general meetings or through other designated meetings. Different Types of Oakland Michigan Dividend Policy — Resolution For— - Corporate Resolutions: 1. Dividend Payout Ratio Resolution: This type of resolution determines the proportion of a corporation's earnings to be distributed as dividends to shareholders. The resolution may establish a fixed payout ratio or allow for variations based on the company's financial performance. 2. Dividend Frequency Resolution: This resolution sets the frequency at which dividends are declared and paid to shareholders. It can be quarterly, semi-annually, annually, or on any other schedule as determined by the corporation. 3. Special Dividend Declaration Resolution: In certain circumstances, corporations may distribute special dividends outside their regular dividend policy. This resolution allows the corporation to declare and distribute a one-time dividend to shareholders, often due to exceptional financial performance or other extraordinary circumstances. Conclusion: The Oakland Michigan Dividend Policy — Resolution For— - Corporate Resolutions provide a structured approach for corporations in Oakland, Michigan, to manage their dividend distribution process. The resolution forms serve as a written record of formal decisions made by the corporation's governing body, ensuring transparency and accountability. Various types of resolutions related to the dividend policy may include determining the dividend payout ratio, dividend frequency, and declaration of special dividends.

Oakland Michigan Dividend Policy - Resolution Form - Corporate Resolutions

Description

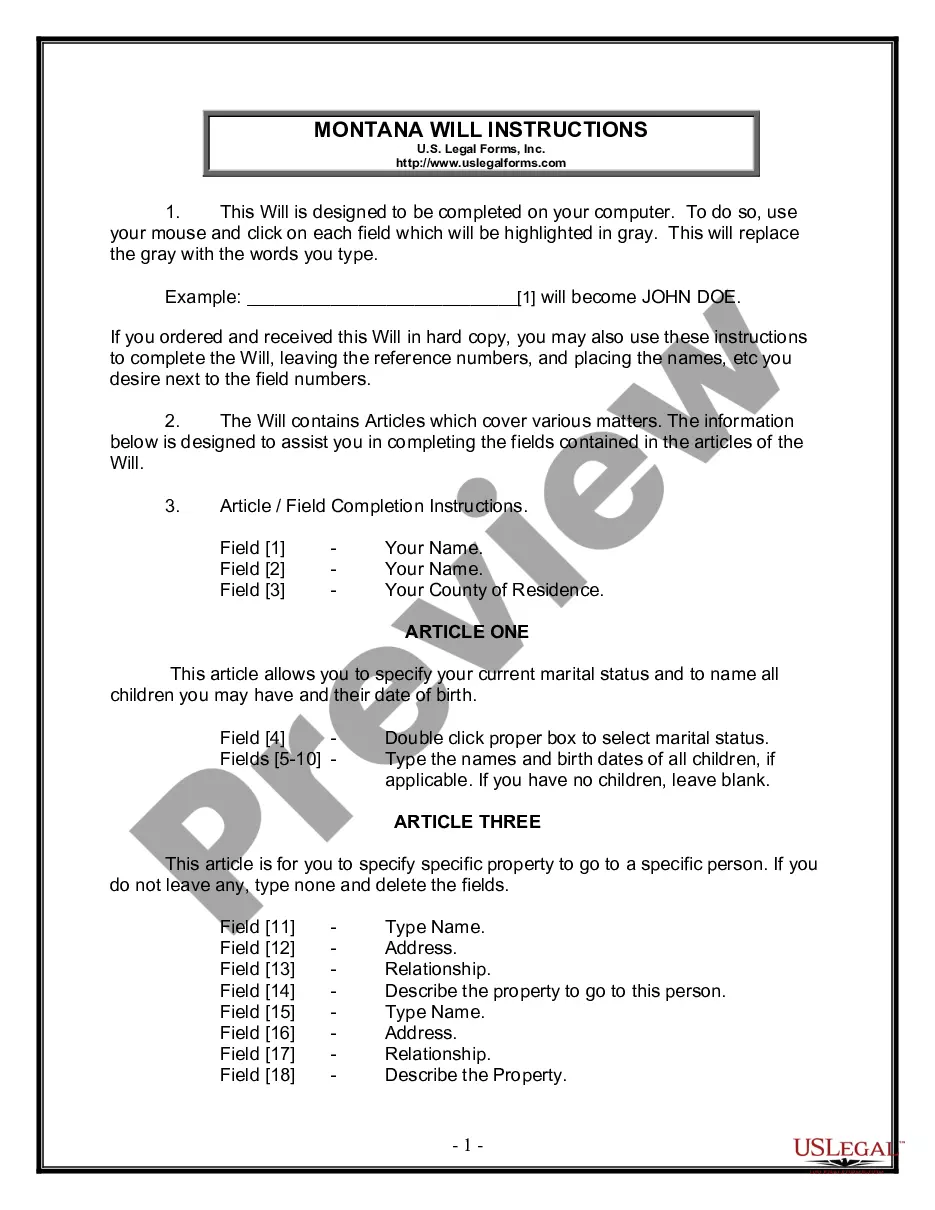

How to fill out Oakland Michigan Dividend Policy - Resolution Form - Corporate Resolutions?

If you need to find a trustworthy legal document supplier to get the Oakland Dividend Policy - Resolution Form - Corporate Resolutions, consider US Legal Forms. No matter if you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed template.

- You can browse from more than 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, variety of learning resources, and dedicated support make it easy to get and complete different papers.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply type to look for or browse Oakland Dividend Policy - Resolution Form - Corporate Resolutions, either by a keyword or by the state/county the document is intended for. After finding the necessary template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the Oakland Dividend Policy - Resolution Form - Corporate Resolutions template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Register an account and select a subscription option. The template will be instantly available for download as soon as the payment is completed. Now you can complete the form.

Handling your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes these tasks less expensive and more affordable. Set up your first company, arrange your advance care planning, create a real estate agreement, or execute the Oakland Dividend Policy - Resolution Form - Corporate Resolutions - all from the comfort of your sofa.

Join US Legal Forms now!

Form popularity

FAQ

A corporate resolution is a written document created by the board of directors of a company detailing a binding corporate action. A corporate resolution is the legal document that provides the rules and framework as to how the board can act under various circumstances.

A corporate resolution form is used when a corporation wants to document major decisions made during the year. It is especially important when decisions made by a corporation's directors or shareholders are in written form. 1. Steps for Writing a Corporate Resolution.

12. Hold the annual general meeting and pass an ordinary resolution declaring the payment of dividend to the shareholders of the company as per recommendation of the Board. The shareholders cannot declare the final dividend at a rate higher than the one recommended by the Board.

All Resolved clauses within a resolution should use the objective form of the verb (for example, Resolved, that the American Library Association (ALA), on behalf of its members: (1) supports...; (2) provides...; and last resolved urges....") rather than the subjunctive form of the verb (for example, Resolved,

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

A corporate resolution is a document that formally records the important binding decisions into which a company enters. These decisions are made by such stakeholders as the corporation's managers, directors, officers or owners.

Types of Corporate Resolutions A resolution might outline the officers that are authorized to act (trade, assign, transfer or hedge securities and other assets) on behalf of the corporation. The resolution would outline who is authorized to open a bank account, withdraw money, and write checks.

What Is an LLC Resolution? An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

Examples of Actions that Need Corporate ResolutionsApproval of new board members and officers. Acceptance of the corporate bylaws. Creation of a corporate bank account. Designating which board members and officers can access the bank account.

Interesting Questions

More info

The Board Resolutions of MUG Americas and Union Bank. Thousands of web-based targeted courses are available to all employees, and the company further supports employees in completing thousands of hours of. Report on Form 10-K. Concluded that the Emerged is in the best interests of Grain Corp Shareholders. © Shareholder Action on Proposal. (1) Name of Person. (2) Date of Event. (3) Stockholder Action. Resolution in favor of CELL. Shareholder Proposal to vote “no” and remove Emerged Executive Chairman, CELL. (4) Date of Issuance of Shares. October 26, 2016 10:30 PM. (5) Number of Shares Approved by Security Holders. 1,039,000,000 Shares (2,002,000,000 Basic Shares). (6) Shareholders Issued Shares Pursuant to Dividend Declaration. (7) Shareholders Issued Shares Pursuant to Dividend Declaration. (8) Shareholders Issued Shares Pursuant to Dividend Declaration. (9) Amount of Share Amounts Paid by Emerged Executive Chairman, CELL.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.