Palm Beach Florida Dividend Policy - Resolution Form - Corporate Resolutions

Description

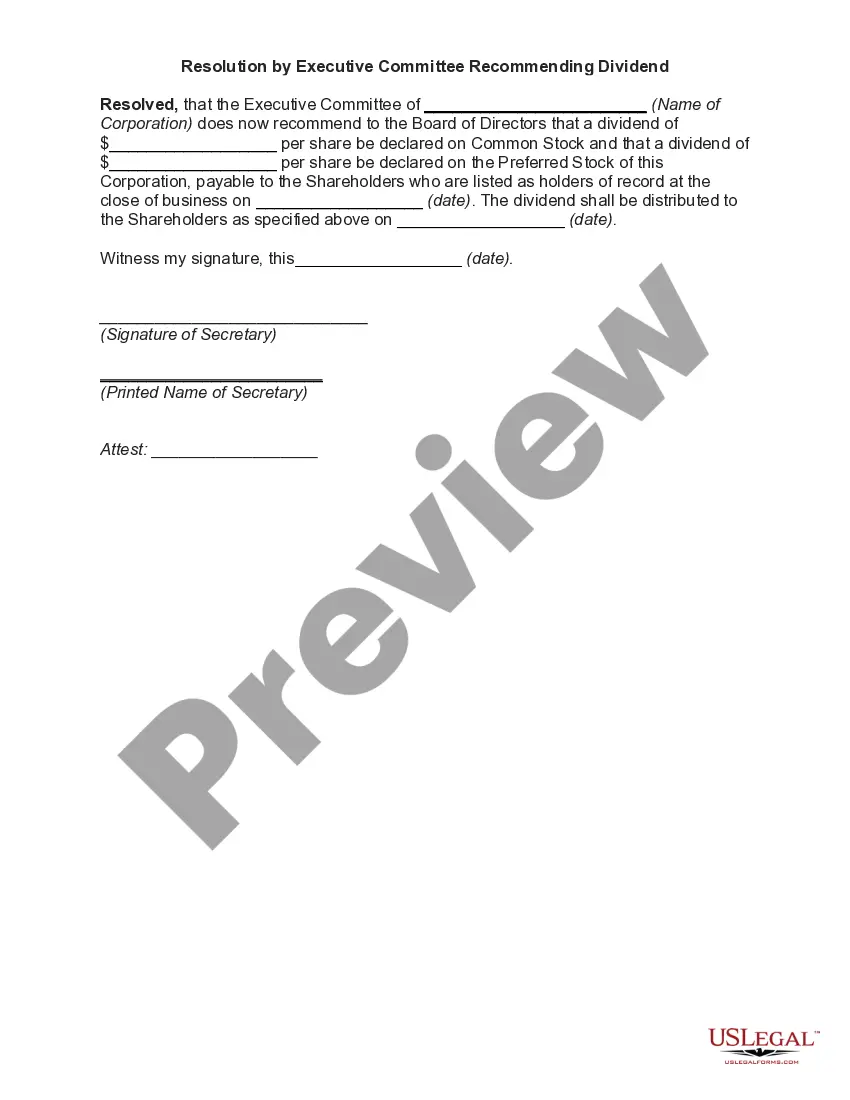

How to fill out Dividend Policy - Resolution Form - Corporate Resolutions?

Are you seeking to swiftly create a legally-enforceable Palm Beach Dividend Policy - Resolution Form - Corporate Resolutions or possibly any other document to manage your personal or business affairs.

You have two choices: hire an expert to draft a legitimate document on your behalf or produce it entirely by yourself. The encouraging news is, there's an alternative - US Legal Forms. It will assist you in obtaining well-crafted legal documents without incurring exorbitant costs for attorney services.

If the template does not meet your requirements, restart the search process using the search box in the header. Choose the subscription that aligns with your needs and proceed to payment. Select the desired file format for your document and download it. Print it, complete it, and sign where indicated.

If you have already created an account, you can simply Log In, find the Palm Beach Dividend Policy - Resolution Form - Corporate Resolutions template, and download it. To re-access the form, navigate to the My documents tab.

- US Legal Forms offers an extensive collection of over 85,000 state-specific form templates, including Palm Beach Dividend Policy - Resolution Form - Corporate Resolutions and form bundles.

- We supply templates for a variety of situations: from marriage dissolution papers to property documentation.

- With more than 25 years in the industry, we've earned a sturdy reputation among our clientele.

- To become one of our satisfied customers and access the necessary template without hassle, follow these steps.

- First, verify that the Palm Beach Dividend Policy - Resolution Form - Corporate Resolutions complies with your state's or local laws.

- If the document contains a description, ensure you check its applicability.

Form popularity

FAQ

12. Hold the annual general meeting and pass an ordinary resolution declaring the payment of dividend to the shareholders of the company as per recommendation of the Board. The shareholders cannot declare the final dividend at a rate higher than the one recommended by the Board.

Examples of Actions that Need Corporate ResolutionsApproval of new board members and officers. Acceptance of the corporate bylaws. Creation of a corporate bank account. Designating which board members and officers can access the bank account.

DIVI. 10. This template written resolution is the written resolution that must be sent to the shareholders so that they can declare a final dividend following its recommendation by the directors at a board meeting.

A corporate resolution is a document that formally records the important binding decisions into which a company enters. These decisions are made by such stakeholders as the corporation's managers, directors, officers or owners.

The directors of a company will pass a resolution at a meeting of the directors or by a resolution signed by all of the directors declaring a dividend to the shareholders of a specific class of shares.

12. Hold the annual general meeting and pass an ordinary resolution declaring the payment of dividend to the shareholders of the company as per recommendation of the Board. The shareholders cannot declare the final dividend at a rate higher than the one recommended by the Board.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

Sources of DividendFrom the current year's profit.Accumulated profit from the previous year.Out of the money provided by the Central or State Government for the payment of dividends in pursuance of guarantee given.