Title: Cook Illinois Letter to Credit Reporting Company or Bureau Regarding Identity Theft: A Comprehensive Guide Introduction: In this article, we will provide a detailed description of Cook Illinois Letter to Credit Reporting Company or Bureau regarding Identity Theft, aiming to educate readers about the necessary steps to take when facing identity theft issues. We will explore the different types of letters one can send to credit reporting companies or bureaus and highlight key keywords associated with each type. 1. General Cook Illinois Letter to Credit Reporting Company or Bureau: This letter is used to report identity theft incidents to credit reporting companies or bureaus, such as Equifax, Experian, and TransUnion. It serves as an official document to request a thorough investigation into fraudulent activities on your credit report. Keywords associated with this type of letter include identity theft, fraud, credit report, investigation, and unauthorized transactions. 2. Cook Illinois Letter Requesting a Fraud Alert: A fraud alert is a crucial step in combating identity theft. This letter is specifically designed to request credit reporting agencies to place a fraud alert on your credit report. Keywords often included are fraud alert, security freeze, credit monitoring, victim statement, and personal identification information. 3. Cook Illinois Letter Requesting an Extended Fraud Alert: If you suspect that you have been a victim of identity theft and have filed an identity theft report with law enforcement, this letter is used to request a more extended fraud alert on your credit report. It ensures that potential creditors take additional precautions before granting credit in your name. Keywords associated with this letter include extended fraud alert, identity theft report, police report, affidavit, and security measures. 4. Cook Illinois Letter Requesting a Credit Freeze or Security Freeze: This letter is specifically used to request credit reporting companies or bureaus to place a security freeze on your credit file, adding an extra layer of protection against identity theft. Keywords to consider are credit freeze, security freeze, credit report lock, PIN, restricted access, and thawing process. 5. Cook Illinois Letter Disputing Fraudulent Accounts: If you identify fraudulent accounts or unauthorized transactions on your credit report, this letter is used to dispute and remove these items from your record. Keywords associated with this type of letter include dispute, fraudulent account, unauthorized charges, investigation, evidence, and resolution. Conclusion: Knowing how to draft a Cook Illinois Letter to Credit Reporting Company or Bureau regarding Identity Theft is essential for victims of identity theft. By providing various types of letters and relevant keywords, we aim to assist readers in submitting accurate and effective documentation to protect their financial well-being. Remember to adapt these letters according to your unique situation and always include any necessary supporting documents to strengthen your case.

Cook Illinois Letter to Credit Reporting Company or Bureau regarding Identity Theft

Description

How to fill out Cook Illinois Letter To Credit Reporting Company Or Bureau Regarding Identity Theft?

Preparing legal paperwork can be burdensome. In addition, if you decide to ask an attorney to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Cook Letter to Credit Reporting Company or Bureau regarding Identity Theft, it may cost you a lot of money. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case collected all in one place. Therefore, if you need the current version of the Cook Letter to Credit Reporting Company or Bureau regarding Identity Theft, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Cook Letter to Credit Reporting Company or Bureau regarding Identity Theft:

- Glance through the page and verify there is a sample for your region.

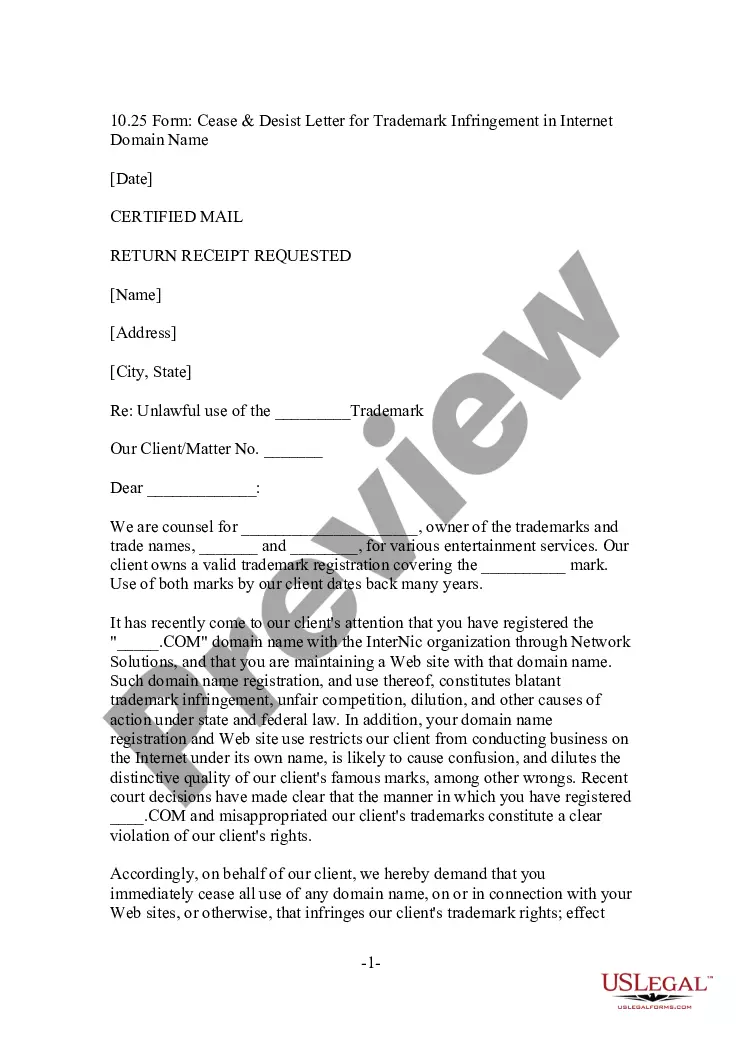

- Examine the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Cook Letter to Credit Reporting Company or Bureau regarding Identity Theft and save it.

Once finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!