Title: Harris Texas Letter to Credit Reporting Company or Bureau regarding Identity Theft Introduction: In the digital age, identity theft has become an alarming concern across the United States, including Harris County, Texas. When individuals fall victim to this crime, it becomes essential to take immediate action to mitigate the negative consequences. One crucial step is to submit a detailed letter to the credit reporting company or bureau to initiate an investigation. This article delves into the various types of Harris Texas letters specifically drafted for credit reporting companies or bureaus concerning identity theft, unraveling the key elements and necessary information to include. Types of Harris Texas Letters to Credit Reporting Company or Bureau regarding Identity Theft: 1. Initial Identity Theft Alert Letter: The initial letter acts as a precautionary measure when an individual suspects that their identity has been compromised. It informs the credit reporting company or bureau about the suspected identity theft and establishes an initial fraud alert on the person's credit file. Keywords: Harris Texas, letter, initial, identity theft, alert, suspicion, credit file. 2. Detailed Identity Theft Report Letter: Following the initial alert, a detailed identity theft report letter provides comprehensive information regarding the incident, including specific instances of fraudulent activities, unauthorized accounts, or transactions. This letter helps the credit reporting company or bureau initiate a thorough investigation. Keywords: Harris Texas, letter, detailed, identity theft, report, fraudulent activities, unauthorized accounts, transactions, investigation. 3. Dispute Letter for Fraudulent Accounts or Inaccurate Information: If fraudulent accounts or inaccurate information appear on an individual's credit report due to identity theft, a dispute letter is drafted, notifying the credit reporting company or bureau about the discrepancy. This type of letter aims to rectify the credit report by requesting the removal or correction of the fraudulent accounts or inaccurate information. Keywords: Harris Texas, letter, dispute, fraudulent accounts, inaccurate information, rectify, removal, correction. 4. Request for Credit Report Monitoring Letter: When someone falls victim to identity theft, monitoring credit reports becomes crucial. A letter can be written to the credit reporting company or bureau, requesting ongoing credit report monitoring. This service helps detect any further fraudulent activities that might occur. Keywords: Harris Texas, letter, request, credit report monitoring, ongoing, detect, fraudulent activities. 5. Request for Extended Fraud Alert Letter: In severe identity theft cases, victims can request an extended fraud alert to be placed on their credit reports. This type of letter informs the credit reporting company or bureau about the need for an extended fraud alert, which provides additional security measures and requires to be increased authentication before approving any credit applications. Keywords: Harris Texas, letter, request, extended fraud alert, credit report, security, authentication, credit applications. Conclusion: When tackling identity theft in Harris County, Texas, drafting an appropriate letter to credit reporting companies or bureaus plays a crucial role in initiating investigations, rectifying credit reports, and preventing further fraudulent activities. By understanding the different types of Harris Texas letters and incorporating relevant keywords, individuals can effectively communicate their concerns and seek resolution for their identity theft issues.

Harris Texas Letter to Credit Reporting Company or Bureau regarding Identity Theft

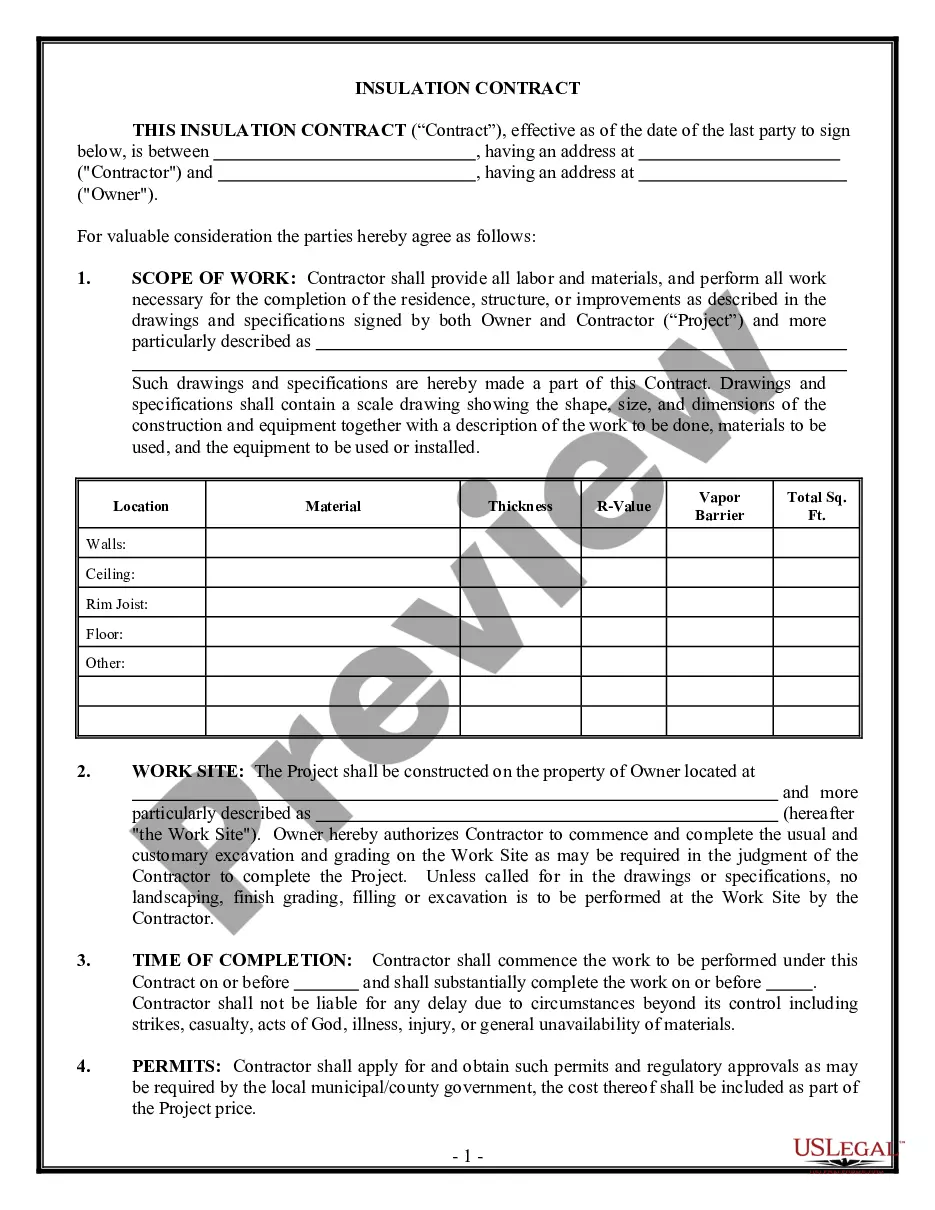

Description

How to fill out Harris Texas Letter To Credit Reporting Company Or Bureau Regarding Identity Theft?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare formal documentation that varies from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. Here, you can easily locate and download a document for any personal or business objective utilized in your county, including the Harris Letter to Credit Reporting Company or Bureau regarding Identity Theft.

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Harris Letter to Credit Reporting Company or Bureau regarding Identity Theft will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guide to obtain the Harris Letter to Credit Reporting Company or Bureau regarding Identity Theft:

- Make sure you have opened the proper page with your regional form.

- Make use of the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template satisfies your needs.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Harris Letter to Credit Reporting Company or Bureau regarding Identity Theft on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!