Title: Protecting Your Identity: Detailed Guide on Phoenix, Arizona Letter to Creditors Notifying Them of Identity Theft Keywords: Phoenix Arizona, letter to creditors, identity theft, protect identity, notifying creditors, types of letters, reporting identity theft, credit bureaus, fraud alerts Introduction: Identity theft is becoming increasingly common in today's digital age, where personal information is vulnerable to malicious individuals. As residents in Phoenix, Arizona, it is crucial to stay vigilant and take immediate action if you suspect that your identity has been compromised. One of the essential steps in combating identity theft is to notify your creditors through a professionally crafted letter. In this detailed guide, we will explore the different types of Phoenix, Arizona letters to creditors notifying them of identity theft, along with their significance and the steps to take. 1. Standard Letter to Creditors Notifying Them of Identity Theft: This type of letter is a general template that individuals can use to notify their creditors about the identity theft situation. It includes essential information such as your contact details, a brief description of the fraudulent activity, and any additional details related to the compromised accounts. The purpose of this letter is to initiate the identity theft reporting process, enabling creditors to investigate the matter further. 2. Request for Fraudulent Account Closure Letter: In cases where you have identified specific fraudulent accounts, writing a letter requesting the immediate closure of those accounts is critical. This letter should contain the account details, a clear explanation of why you believe it is fraudulent, and any supporting evidence you might have obtained. 3. Fraud Alert Placement Letter: Requesting a fraud alert placement on your credit report is an essential step in protecting your identity and preventing further damage. This letter notifies the credit bureaus (such as Equifax, Experian, and TransUnion) about the identity theft, helping to prevent any new accounts from being opened fraudulently. 4. Placing a Credit Freeze Letter: A credit freeze restricts access to your credit report, making it difficult for fraudsters to open new accounts in your name. This letter informs the credit bureaus about the identity theft, urging them to activate the credit freeze to provide an added layer of security. 5. Identity Theft Report Follow-up Letter: After sending your initial letter to creditors, it is crucial to follow up regularly to ensure that the necessary actions are being taken to resolve the identity theft issue. This letter should emphasize your concern, request an update on the investigation, and remind the creditors of their responsibility in rectifying the situation. Conclusion: In Phoenix, Arizona, battling identity theft requires taking prompt action and notifying your creditors effectively. By utilizing the appropriate types of letters to creditors, you can safeguard your finances, personal information, and creditworthiness. Remember to provide accurate and concise details, keep copies of all correspondence, and maintain open communication channels with your creditors during the resolution process. Stay proactive and stay protected!

Phoenix Arizona Letter to Creditors notifying them of Identity Theft

Description

How to fill out Phoenix Arizona Letter To Creditors Notifying Them Of Identity Theft?

Drafting documents for the business or individual demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws and regulations of the particular region. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to generate Phoenix Letter to Creditors notifying them of Identity Theft without professional assistance.

It's possible to avoid wasting money on attorneys drafting your paperwork and create a legally valid Phoenix Letter to Creditors notifying them of Identity Theft by yourself, using the US Legal Forms web library. It is the biggest online collection of state-specific legal documents that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the Phoenix Letter to Creditors notifying them of Identity Theft:

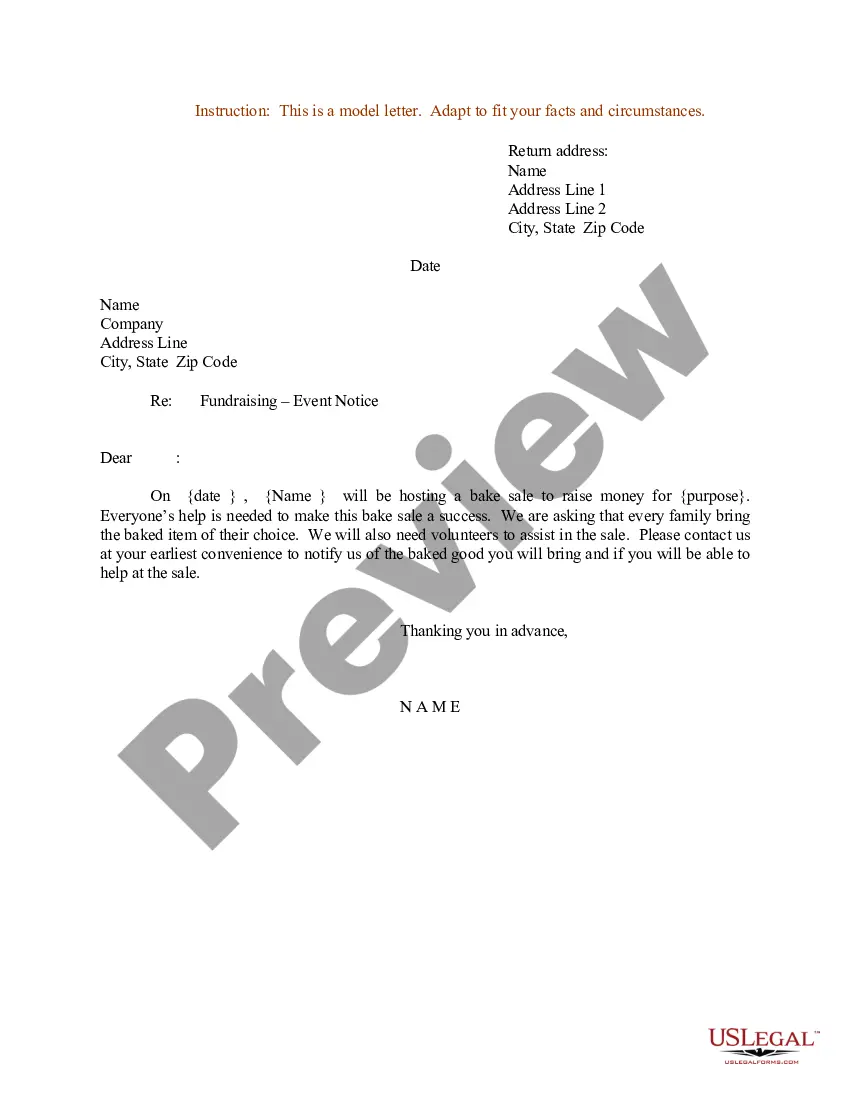

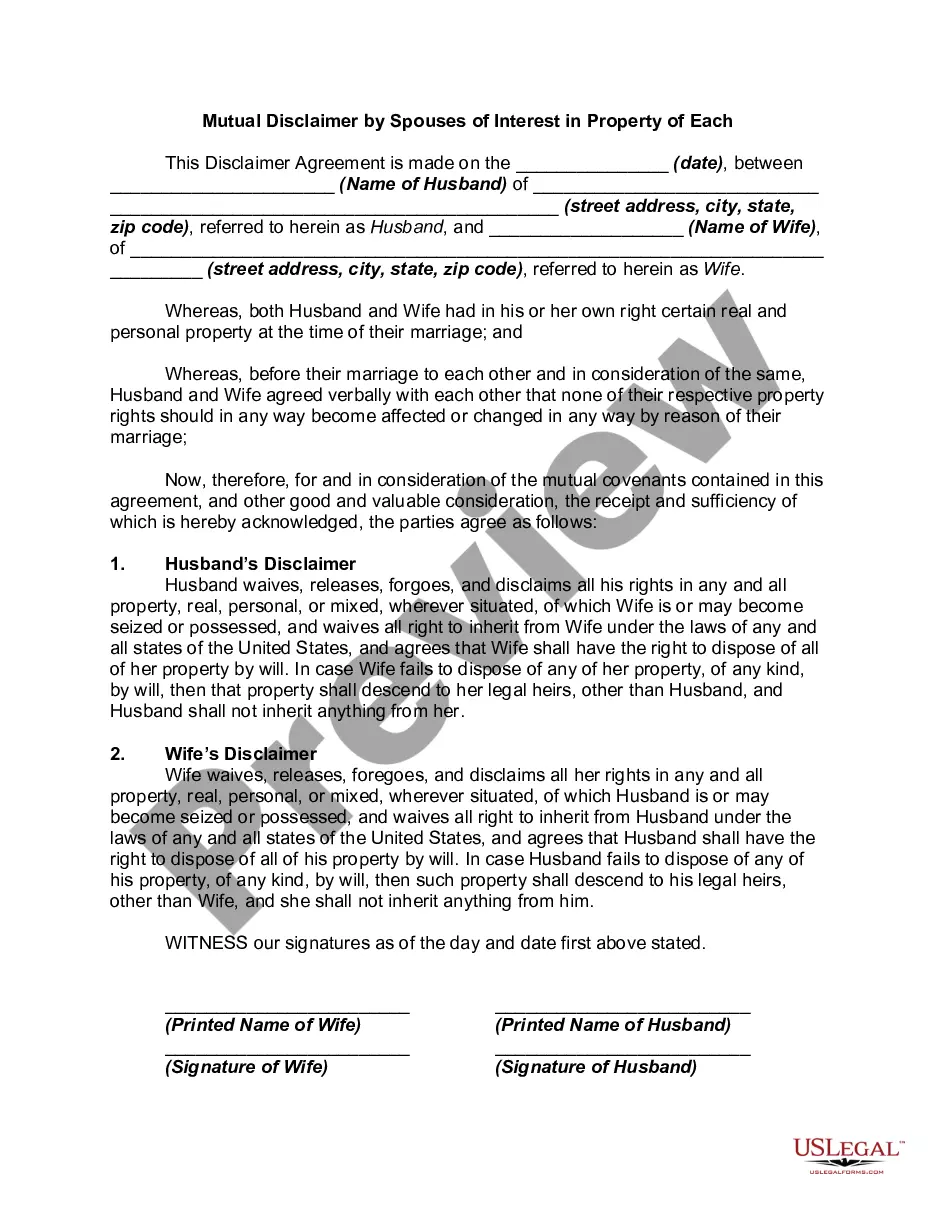

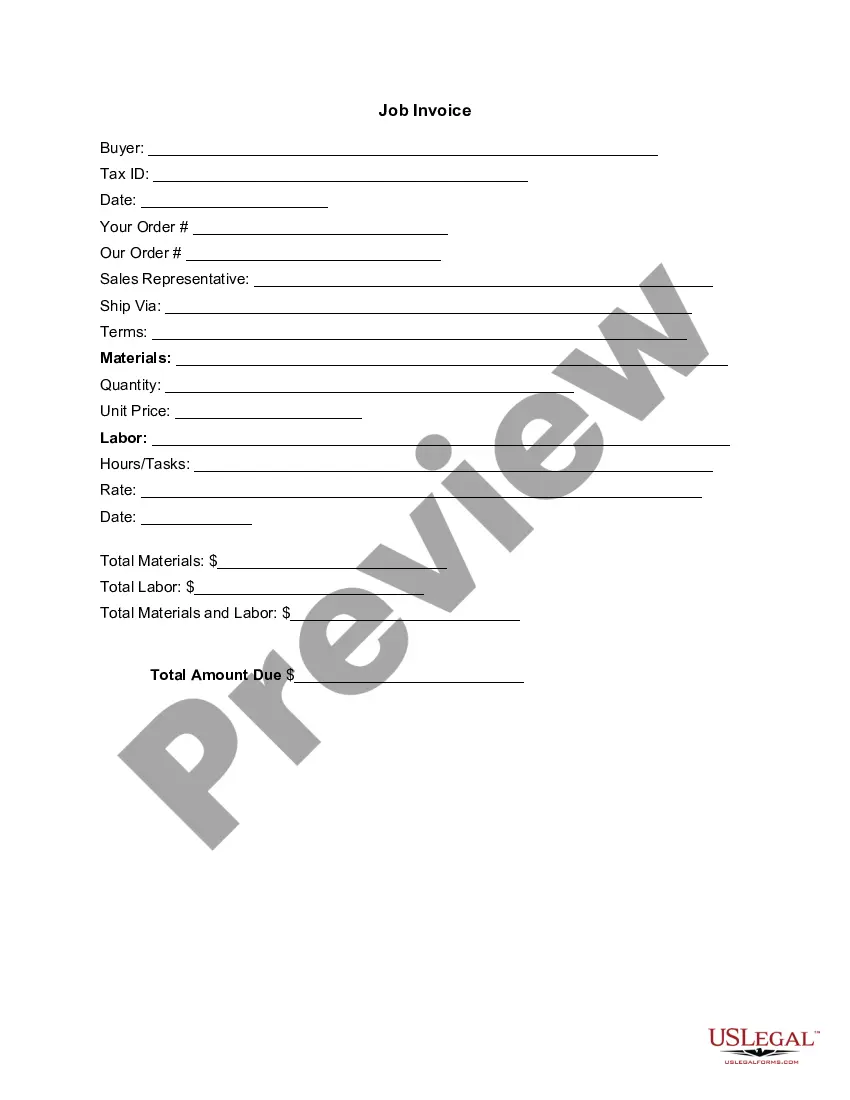

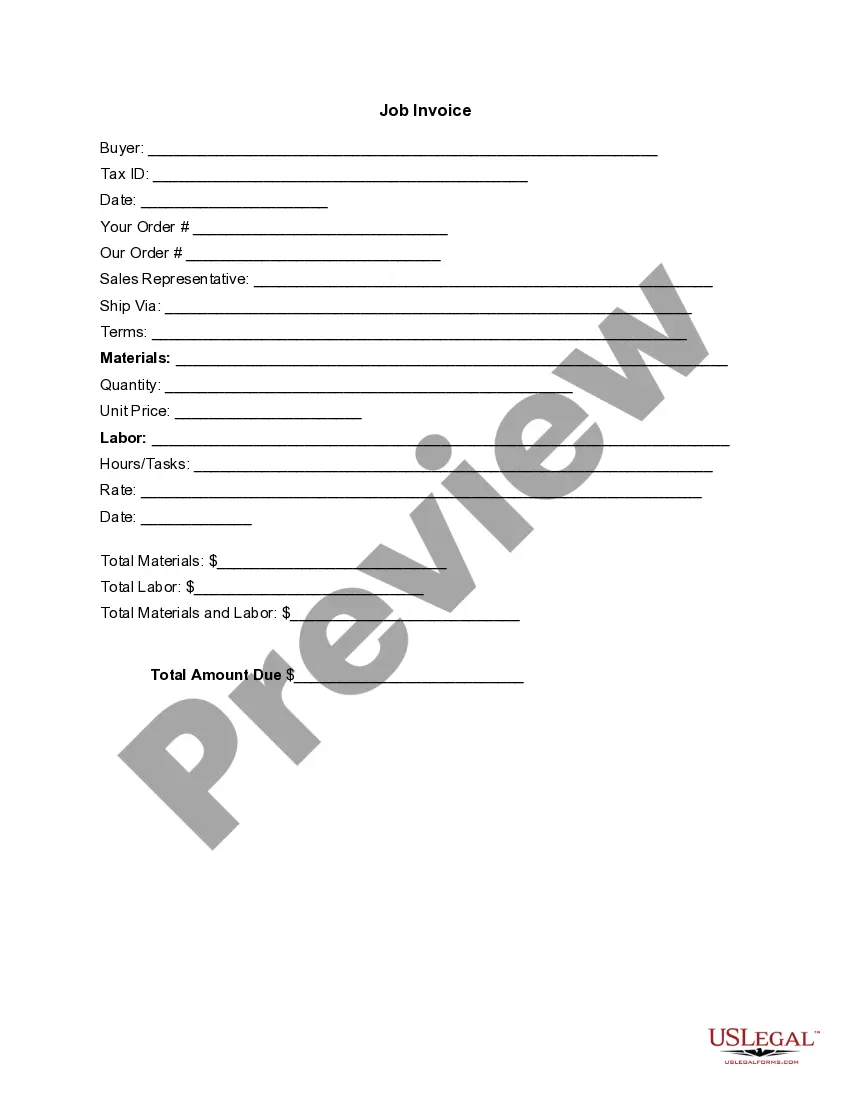

- Look through the page you've opened and check if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that satisfies your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any situation with just a couple of clicks!