Santa Clara California Letter to Creditors notifying them of Identity Theft

Description

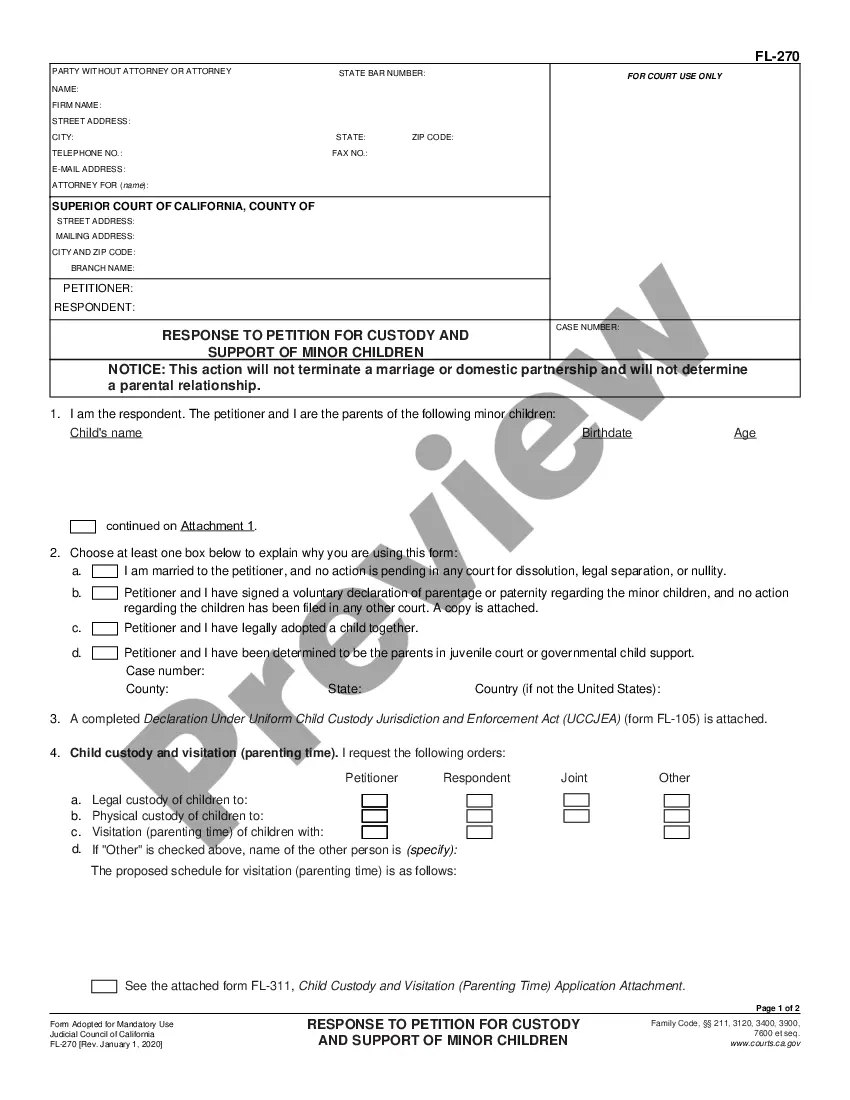

How to fill out Santa Clara California Letter To Creditors Notifying Them Of Identity Theft?

Whether you intend to open your company, enter into a deal, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific documentation meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business case. All files are grouped by state and area of use, so opting for a copy like Santa Clara Letter to Creditors notifying them of Identity Theft is fast and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a few additional steps to get the Santa Clara Letter to Creditors notifying them of Identity Theft. Follow the guide below:

- Make certain the sample meets your personal needs and state law regulations.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to find another template.

- Click Buy Now to get the sample when you find the right one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Santa Clara Letter to Creditors notifying them of Identity Theft in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

California Identity Theft Law Allows for the Recovery of a Civil Penalty Up to $ 30,000.00 From Claimants For Identity Theft Victims Who Meet Certain Criteria. Many victims of identity theft face debt collection attempts by banks, creditors and debt collectors.

A person convicted of misdemeanor identity theft faces up to one year in county jail, a fine of up to $1,000, or both. A person convicted of felony identity theft faces up to three years in California state prison, a fine of up to $10,000, or both. Federal law prohibits identity theft more severely than California law.

Place when you've had your identity stolen and completed an FTC identity theft report at IdentityTheft.gov or filed a police report. It makes it harder for someone to open a new credit account in your name and removes you from unsolicited credit and insurance offers for 5 years. It's free and lasts 7 years.

What you can do to detect identity theftTrack what bills you owe and when they're due. If you stop getting a bill, that could be a sign that someone changed your billing address.Review your bills.Check your bank account statement.Get and review your credit reports.

File a police report with your local law enforcement agency. A police report provides you with a document saying you've been a victim, which can be helpful when requesting a 7-year extended fraud alert on your credit reports, for instance. This type of fraud alert requires a police or FTC Identity Theft Report.

Here are steps to take if your identity is stolen:Notify the company or agency that issued your stolen credentials.Put a freeze or fraud alert on your credit.Report the theft to the Federal Trade Commission.File a report with your local law enforcement agency.More items...?

The statute of limitations (SOL) for most California theft charges is one year if the charge is filed as a misdemeanor or three years if the charge is filed as a felony. Under California criminal law, the SOL refers to the maximum time period in which a prosecutor can file criminal charges.

Under California Penal Code Section 530.5 PC, identity theft is a "wobbler" which can be charged as either a felony or a misdemeanor, depending on the criminal history of the defendant, the extent of the loss caused by the crime, and other relevant factors.

California Penal Code 530.5 PC defines the crime of identity theft as using someone's personal identifying information without their consent and using it for fraudulent purposes. PC 530.5 identity theft is a wobbler crime that can be filed as a misdemeanor or felony.