Title: Broward Florida Letter to Creditors Notifying Them of Identity Theft for New Accounts: A Comprehensive Guide Keywords: Broward Florida, letter, creditors, identity theft, new accounts Introduction: Welcome to our comprehensive guide on writing a Broward Florida Letter to Creditors Notifying Them of Identity Theft for New Accounts. Identity theft is a serious crime that affects countless individuals in Broward County, Florida, and the state as a whole. To prevent further damage and protect your financial wellbeing, it is crucial to notify your creditors promptly. In this guide, we will provide useful insights, tips, and sample letters to assist you in effectively addressing this issue. 1. Understanding Broward Florida's Identity Theft Laws: Broward County, Florida has specific laws and regulations in place to combat identity theft. Familiarize yourself with these laws to ensure your letter aligns with local legal requirements and helps establish a strong case against the identity thief. 2. Types of Broward Florida Letters to Creditors: a) Initial Notification Letter: State the purpose of the letter clearly and provide an overview of the incident. Request immediate action, such as freezing accounts or denying any fraudulent transactions associated with the stolen identity. Attach any supporting documents as evidence. b) Follow-Up Letter: If the initial notification fails to yield the desired response, a follow-up letter becomes necessary. Express concern over the slow progress, reiterate the urgency of the matter, and demand resolution. c) Cease and Desist Letter: A cease and desist letter may be required if the creditor continues to take questionable actions despite being notified of the identity theft. This letter warns the creditor to stop any further collection activities related to the fraudulent accounts and may also seek legal remedies. 3. Essential Elements of the Letter: a) Contact Information: Include your full name, physical address, phone number, email address, and any relevant account or identification numbers. b) Salutation: Address the appropriate authority at the creditor institution, such as the fraud department or legal department. c) Incident Description: Provide a detailed account of the identity theft incident, including when it occurred, how you became aware of it, and the specific fraudulent accounts associated with it. d) Supporting Documents: Attach copies of any relevant documents, such as police reports, identity theft affidavits, and credit bureau notifications. Mention the enclosed attachments in your letter. e) Request for Action: Clearly state your desired outcome, whether it be freezing the accounts, removing fraudulent charges, or providing identity theft protection services. Specify a deadline for a response. f) Proof of Identity: In order to prove your identity, include a copy of your driver's license, Social Security card, or other official identification documents. Conclusion: Writing a Broward Florida letter to creditors notifying them of identity theft for new accounts requires a thorough understanding of local laws and regulations. By following the guidelines outlined in this guide and tailoring the sample letters to your specific situation, you can effectively communicate with creditors and take necessary steps towards resolving the identity theft incident. Remember to document all communication for future reference and maintain constant vigilance to safeguard your financial well-being.

Broward Florida Letter to Creditors Notifying Them of Identity Theft for New Accounts

Description

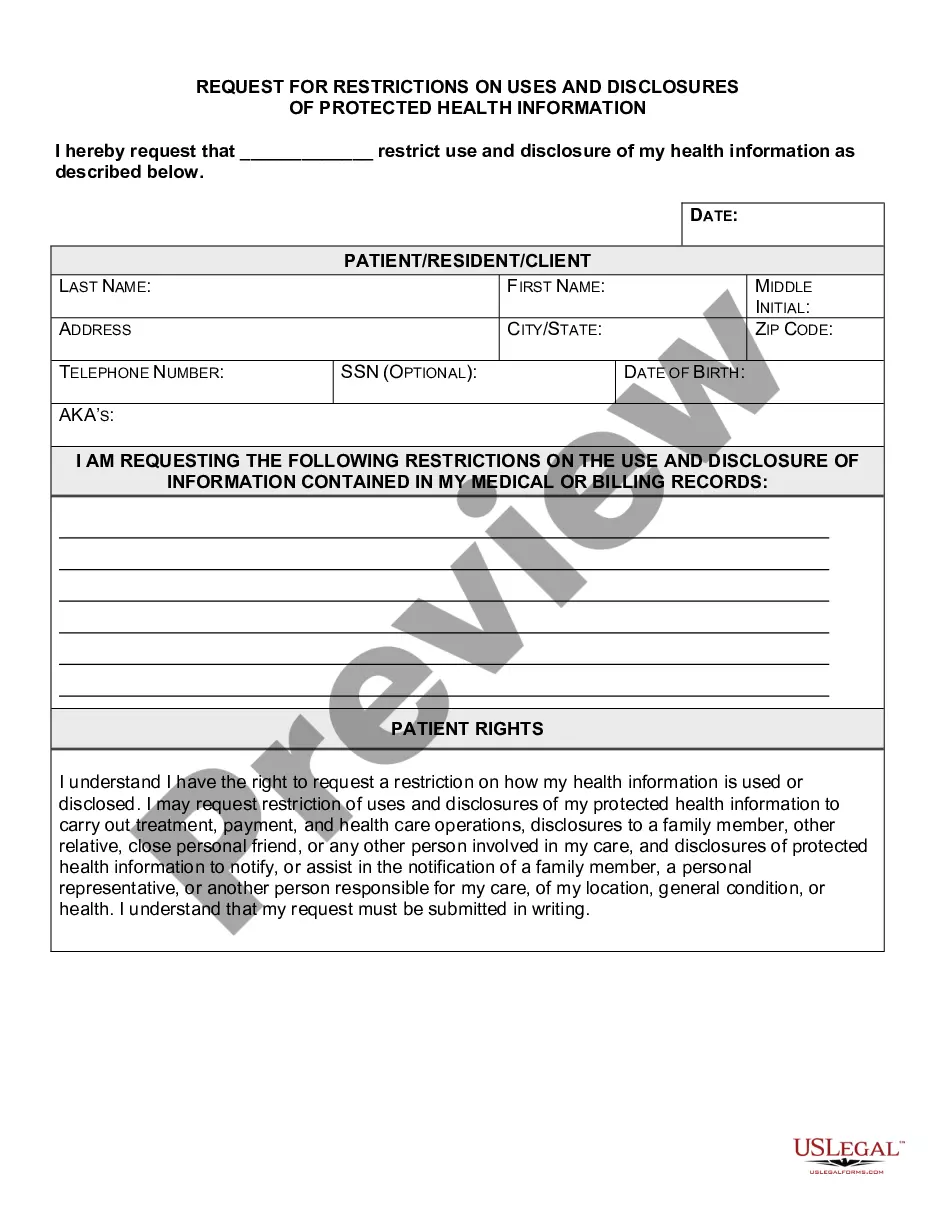

How to fill out Broward Florida Letter To Creditors Notifying Them Of Identity Theft For New Accounts?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Broward Letter to Creditors Notifying Them of Identity Theft for New Accounts, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used many times: once you obtain a sample, it remains available in your profile for further use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Broward Letter to Creditors Notifying Them of Identity Theft for New Accounts from the My Forms tab.

For new users, it's necessary to make several more steps to obtain the Broward Letter to Creditors Notifying Them of Identity Theft for New Accounts:

- Analyze the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to obtain the template once you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Because the agencies are so involved in your credit activity, it's important to notify them if your identity has been stolenas identity theft can lead to abuse of your credit, and you want to try to keep that from happening.

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

If you learn that you have become a victim of identity theft, do the following: Immediately contact the fraud departments of the three major credit bureaus (Equifax, Experian, and Trans Union) to let them know about your situation.

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.

Select the statement that best describes your situation from the list provided.I want to report identity theft.Someone else filed a tax return using my information.Someone has my information or tried to use it, and I'm worried about identity theft.My information was exposed in a data breach.More items...?

A 609 letter is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. It's named after section 609 of the Fair Credit Reporting Act (FCRA), a federal law that protects consumers from unfair credit and collection practices. Written by Natasha Wiebusch, J.D..

Report Identity Theft. Report identity (ID) theft to the Federal Trade Commission (FTC) online at IdentityTheft.gov or by phone at 1-877-438-4338. The FTC will collect the details of your situation.

Report Identity Theft. Report identity (ID) theft to the Federal Trade Commission (FTC) online at IdentityTheft.gov or by phone at 1-877-438-4338.

File a claim with your identity theft insurance, if applicable.Notify companies of your stolen identity.File a report with the Federal Trade Commission.Contact your local police department.Place a fraud alert on your credit reports.Freeze your credit.Sign up for a credit monitoring service, if offered.More items...