Title: Cook Illinois Letter to Creditors Notifying Them of Identity Theft for New Accounts Description: A Cook Illinois Letter to Creditors Notifying Them of Identity Theft for New Accounts is an official document that individuals can use to alert their creditors about fraudulent activities or potential identity theft affecting their accounts. By promptly notifying the creditors, victims of identity theft can take proactive measures to mitigate further financial damages and protect their credit scores. Keywords to Include: Cook Illinois, Letter to Creditors, Identity Theft, New Accounts, Fraud Alert, Credit Monitoring, Credit Reports, Credit Freeze, Credit Score, Financial Damage, Personal Information, Sensitive Data, Fraudulent Activities. Types of Cook Illinois Letter to Creditors Notifying Them of Identity Theft for New Accounts: 1. General Identity Theft Letter: This is a standard letter template that provides a comprehensive overview of the situation and requests immediate action from the creditors to prevent any unauthorized account opening or transactions. The letter should also include instructions for the creditor to contact the victim to verify any application received or transactions made. 2. Follow-Up Identity Theft Letter: Once the initial notification letter has been sent, this follow-up letter serves as a reminder to ensure that appropriate measures have been taken by the creditor to investigate the reported identity theft and prevent any further unauthorized access. Victims may also use this opportunity to inquire about the progress of their case. 3. Credit Monitoring Request Letter: In some instances, victims may opt to request credit monitoring services from the creditor as an added layer of protection against future fraudulent activities. This letter emphasizes the importance of monitoring the victim's credit report closely to identify any suspicious or unauthorized activities promptly. 4. Credit Freeze Request Letter: To better safeguard against further identity theft, victims may consider a credit freeze. This letter requests the creditor to impose a freeze on the victim's credit report, ensuring that no new accounts can be opened without express permission from the victim. The letter should provide clear instructions on how to lift the freeze if necessary. 5. Identity Theft Dispute Letter: In cases where fraudulent charges have already been made, this letter is used by victims to dispute the unauthorized transactions and request a removal of any associated negative information from their credit reports. It should provide detailed evidence supporting the claim and explain why the creditor should take action to resolve the issue promptly. By using the appropriate Cook Illinois Letter to Creditors Notifying Them of Identity Theft for New Accounts, victims can take proactive steps to protect their financial well-being and minimize the impact of identity theft on their credit history. Remember to consult legal or financial professionals for personalized guidance in dealing with identity theft incidents.

Cook Illinois Letter to Creditors Notifying Them of Identity Theft for New Accounts

Description

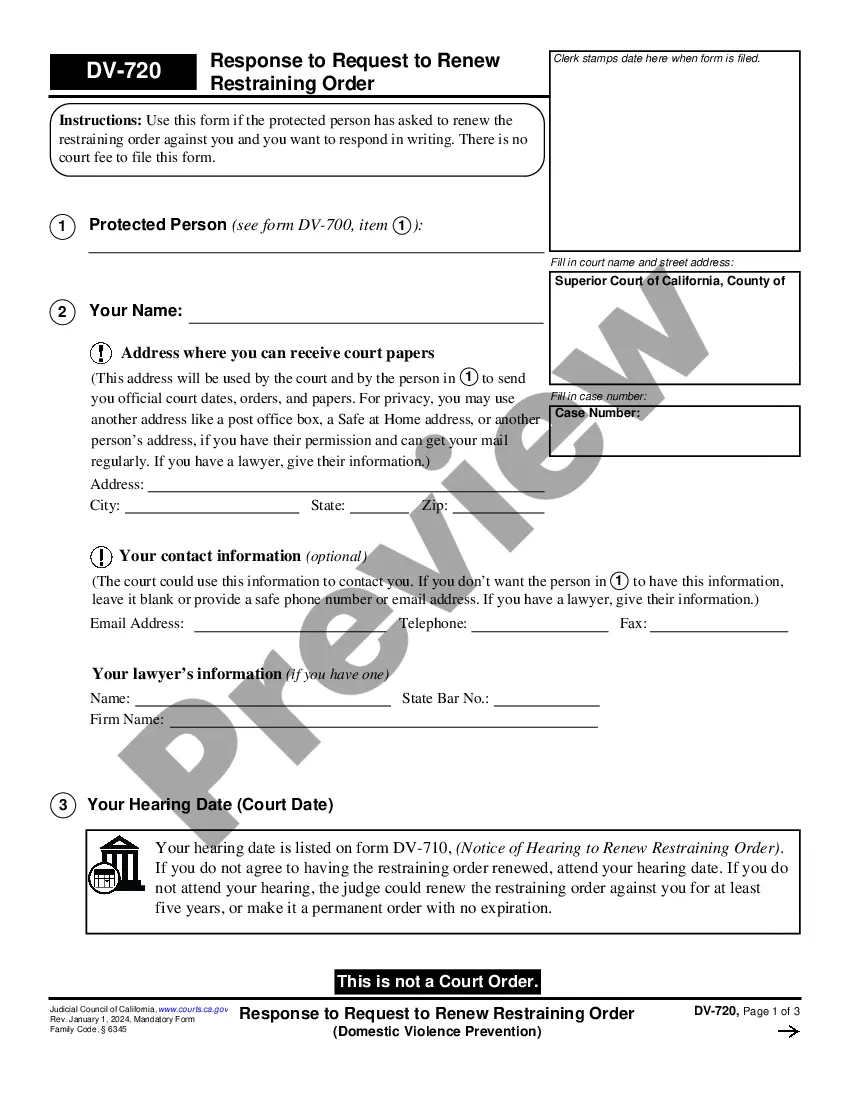

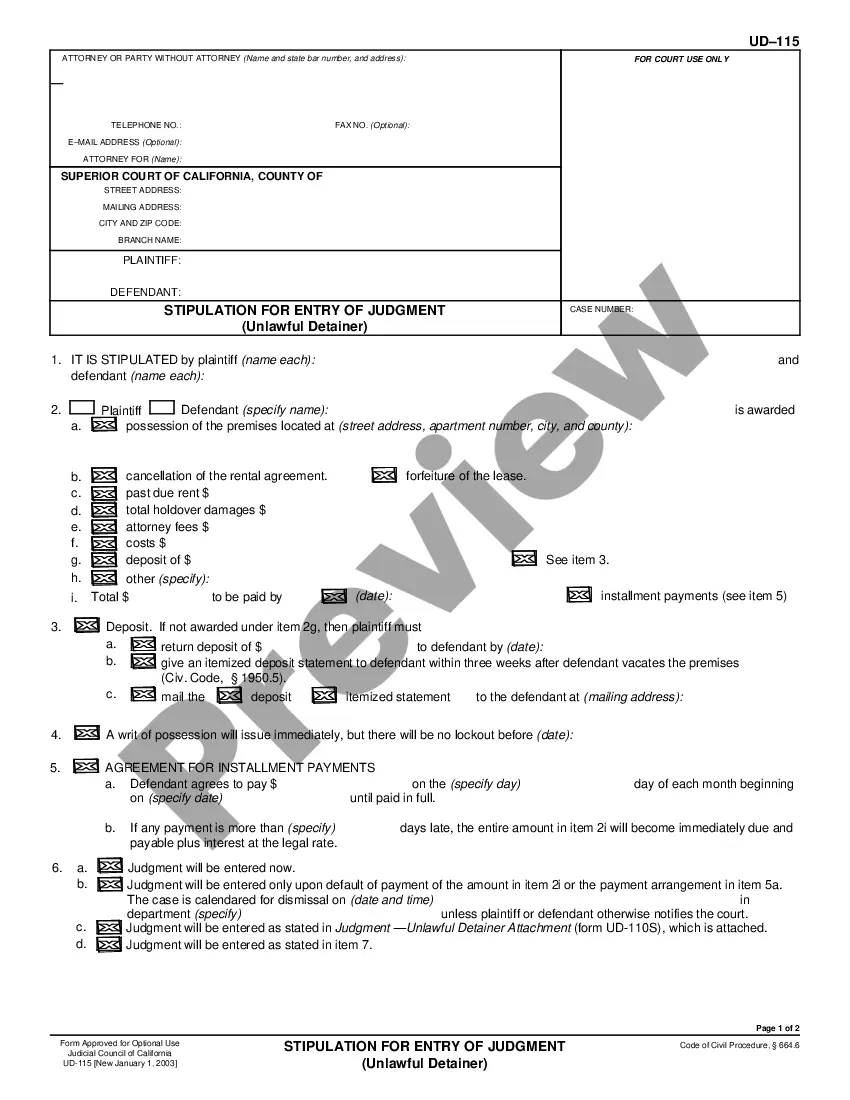

How to fill out Cook Illinois Letter To Creditors Notifying Them Of Identity Theft For New Accounts?

Whether you intend to open your business, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and checked legal templates for any personal or business occasion. All files are collected by state and area of use, so opting for a copy like Cook Letter to Creditors Notifying Them of Identity Theft for New Accounts is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of more steps to obtain the Cook Letter to Creditors Notifying Them of Identity Theft for New Accounts. Adhere to the guide below:

- Make certain the sample fulfills your personal needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Use the search tab specifying your state above to find another template.

- Click Buy Now to get the file when you find the right one.

- Choose the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Cook Letter to Creditors Notifying Them of Identity Theft for New Accounts in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you can access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date official documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!

Form popularity

FAQ

Report Identity Theft. Report identity (ID) theft to the Federal Trade Commission (FTC) online at IdentityTheft.gov or by phone at 1-877-438-4338. The FTC will collect the details of your situation.

Put a freeze or fraud alert on your credit. Report the theft to the Federal Trade Commission. File a report with your local law enforcement agency. Obtain copies of documents used to open accounts or make fraudulent transactions.

The first step of your recovery plan is to call the credit bureaus. Ask the credit bureau for an initial fraud alert. It is free and lasts for 90 days. The fraud alert makes it harder for thieves to open accounts in your name.

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

Report identity (ID) theft to the Federal Trade Commission (FTC) online at IdentityTheft.gov or by phone at 1-877-438-4338....It could be necessary if:You know the identity thief.The thief used your name in an interaction with the police.A creditor or another company requires you to provide a police report.

Here are steps to take if your identity is stolen:Notify the company or agency that issued your stolen credentials.Put a freeze or fraud alert on your credit.Report the theft to the Federal Trade Commission.File a report with your local law enforcement agency.More items...?

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.

Select the statement that best describes your situation from the list provided.I want to report identity theft.Someone else filed a tax return using my information.Someone has my information or tried to use it, and I'm worried about identity theft.My information was exposed in a data breach.More items...?

5 Immediate Steps to Take if Your Identity is StolenStep 1: Notify Any Affected Financial Institutions.Step 2: File a Police Report.Step 3: Flag Your Credit Report.Step 4: Consider a Credit Freeze.Step 5: Change Your Passwords.

A Red Flag is a pattern, practice, or specific activity that indicates the possible existence of identity theft.2 It is purposely broad, the intention being to cast a wide net.

Interesting Questions

More info

A new technology that many people are unaware of, is the Internet. In this regard, the federal government, which is the largest issuer of debt in the world, which is not known for its honesty, can simply buy information from the Internet, and it can effectively censor. With a 1.5 trillion credit market, you can find out who owns what type of property (bank accounts versus real properties), when, by whom, and for how much. This will help them to understand the market better, and to avoid a default. Also, this new technology would allow their attorneys to be proactive, rather than reactive, and this will help their clients avoid the unnecessary delays that plague the criminal justice system. The Federal Government will be able to buy information without any restrictions on where the data can be sold. This will benefit the federal government very greatly.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.