Title: Kings New York Letter to Creditors Notifying Them of Identity Theft for New Accounts Introduction: In instances of identity theft, it is crucial to promptly notify your creditors and take necessary steps to minimize the financial damage. This comprehensive article explores Kings New York's letter to creditors, notifying them of identity theft for new accounts. Discover the different types of letters designed to address specific situations. 1. Kings New York Letter for Unauthorized Account Openings: This type of letter is tailored for individuals who have been victimized by identity theft resulting in the unauthorized opening of new accounts. It outlines the necessary steps to be taken by both the creditor and the victim to resolve the issue amicably. Keywords: Identity theft, unauthorized account openings, creditors, resolution, victim, letter, Kings New York. 2. Kings New York Letter for Suspicious Account Activity: This variation of the letter caters to cases where the victim notices suspicious account activity without their knowledge. By bringing such instances to the creditor's attention, this letter helps initiate an investigation to determine the involvement of identity theft. Keywords: Suspicious account activity, identity theft, investigation, creditor, victim, letter, Kings New York. 3. Kings New York Letter for Existing Accounts Targeted by Identity Theft: Identity theft occasionally involves unauthorized access to existing accounts, causing financial distress to victims. This specialized letter acts as an alert to creditors, notifying them of identity theft targeting established accounts and requesting immediate actions to safeguard the victim's financial assets. Keywords: Existing accounts, identity theft, financial distress, creditor alert, victim, letter, Kings New York. 4. Kings New York Letter for Identity Theft Reporting and Recovery Assistance: This comprehensive letter serves as a go-to resource for victims, providing guidance for notifying creditors about identity theft incidents and requesting their cooperation in the recovery process. It may include information on credit freezes, fraud alerts, and steps to enhance overall account security. Keywords: Identity theft reporting, recovery assistance, creditors, victim, resources, credit freeze, fraud alerts, account security, letter, Kings New York. Conclusion: Kings New York not only acknowledges the seriousness of identity theft but also understands the importance of promptly notifying creditors about such incidents. Employing the appropriate letter templates can assist victims in resolving identity theft-related issues with their creditors, allowing them to regain control over their finances more efficiently.

Kings New York Letter to Creditors Notifying Them of Identity Theft for New Accounts

Description

How to fill out Kings New York Letter To Creditors Notifying Them Of Identity Theft For New Accounts?

Laws and regulations in every sphere vary from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Kings Letter to Creditors Notifying Them of Identity Theft for New Accounts, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals looking for do-it-yourself templates for various life and business situations. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for future use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Kings Letter to Creditors Notifying Them of Identity Theft for New Accounts from the My Forms tab.

For new users, it's necessary to make some more steps to get the Kings Letter to Creditors Notifying Them of Identity Theft for New Accounts:

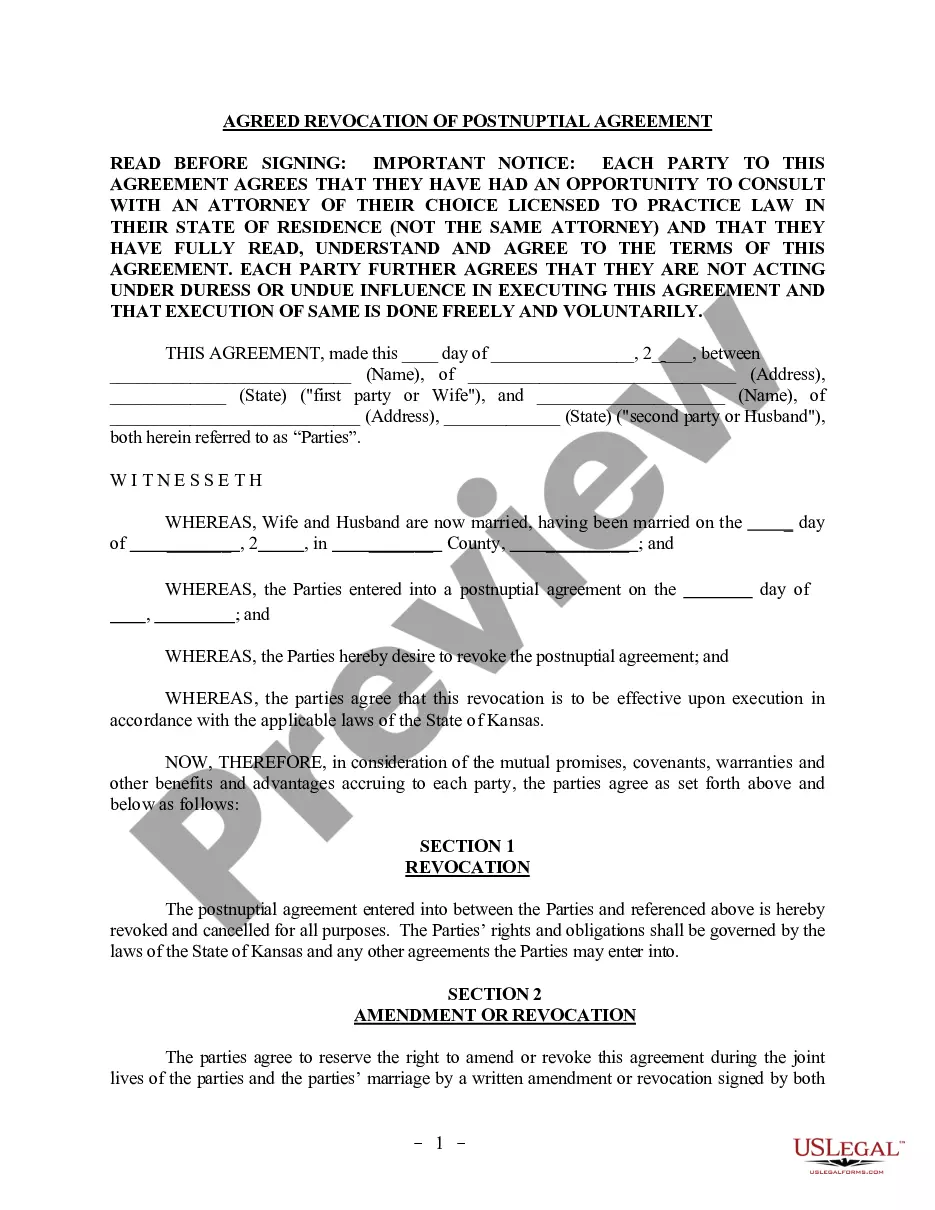

- Analyze the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the template when you find the appropriate one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your paperwork in order with the US Legal Forms!