Title: Montgomery Maryland Letter to Creditors Notifying Them of Identity Theft for New Accounts — Protecting Your Financial Security Introduction: Discovering that your personal information has been compromised through identity theft can be a distressing experience. However, taking immediate action to inform your creditors about this theft is crucial. This article aims to provide a detailed description of Montgomery Maryland's letter to creditors notifying them of identity theft for new accounts, highlighting essential steps to protect your financial security. 1. Understanding Montgomery Maryland's Legal Framework for Identity Theft Protection: In Montgomery County, Maryland, specific laws are in place to safeguard residents from identity theft. The law grants individuals the right to notify creditors promptly once they discover fraudulent activity on their accounts or suspect an identity theft incident has occurred. 2. Types of Montgomery Maryland Letters to Creditors: a. Initial Identity Theft Notification: This letter is sent to creditors promptly after discovering the fraudulent activity or suspecting an identity theft incident. It serves as your initial communication to alert the creditor about unauthorized accounts opened under your name. b. Detailed Identity Theft Notification: After notifying the creditor of the fraudulent activity, a detailed letter is sent to provide comprehensive information on the unauthorized accounts opened, including account numbers, dates, and any other relevant details that supports your claim. c. Identity Theft Resolution Letter: Once the initial notification and detailed information have been shared, you may send an identity theft resolution letter to the creditor, outlining your expectations regarding resolving the issue promptly. This letter also urges the creditor to take necessary measures to prevent further fraudulent activities. 3. Key Components of a Montgomery Maryland Letter to Creditors: a. Your Personal Information: Start the letter by providing your full name, address, telephone number, and any other essential contact information. This information will help the creditor verify your identity and process your request accordingly. b. Account Information: Clearly state the account number(s) associated with the fraudulent activity, as well as the date the account(s) were opened or any suspicious activity noted. c. Timeline of Discovery: Briefly explain when and how you became aware of the identity theft incident. Include any relevant supporting documents, such as police reports or credit monitoring alerts. d. Request for Immediate Action: Clearly state your expectation for the creditor to investigate the matter promptly, freeze the fraudulent account(s), and remove any unauthorized charges or liabilities associated with them. e. Request for Written Confirmation: Ask the creditor to communicate with you in writing, acknowledging receipt of your letter and detailing the actions they have taken to resolve the issue. 4. Conclusion: In conclusion, promptly notifying your creditors about identity theft for new accounts is crucial to safeguard your financial security. By sending a well-crafted Montgomery Maryland letter outlining the fraudulent activities, you can protect yourself from further harm and assist in unraveling the identity theft incident. Remember to monitor your credit reports regularly and maintain open communication with your creditors to ensure a swift resolution.

Montgomery Maryland Letter to Creditors Notifying Them of Identity Theft for New Accounts

Description

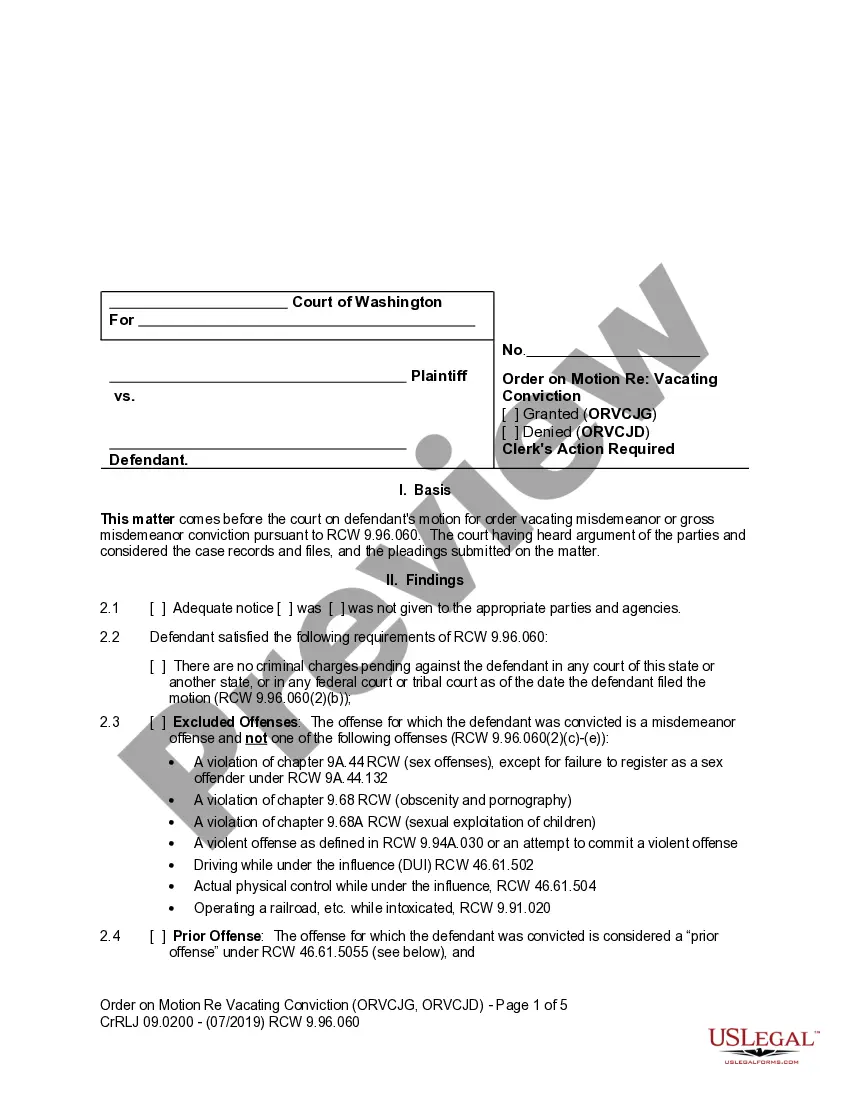

How to fill out Montgomery Maryland Letter To Creditors Notifying Them Of Identity Theft For New Accounts?

If you need to find a trustworthy legal paperwork provider to obtain the Montgomery Letter to Creditors Notifying Them of Identity Theft for New Accounts, consider US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the needed form.

- You can browse from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of learning materials, and dedicated support team make it simple to find and execute different documents.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply type to look for or browse Montgomery Letter to Creditors Notifying Them of Identity Theft for New Accounts, either by a keyword or by the state/county the form is intended for. After finding the required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply find the Montgomery Letter to Creditors Notifying Them of Identity Theft for New Accounts template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Create an account and select a subscription plan. The template will be instantly ready for download once the payment is completed. Now you can execute the form.

Taking care of your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes these tasks less expensive and more reasonably priced. Create your first company, organize your advance care planning, draft a real estate agreement, or execute the Montgomery Letter to Creditors Notifying Them of Identity Theft for New Accounts - all from the comfort of your sofa.

Join US Legal Forms now!

Form popularity

FAQ

File a claim with your identity theft insurance, if applicable.Notify companies of your stolen identity.File a report with the Federal Trade Commission.Contact your local police department.Place a fraud alert on your credit reports.Freeze your credit.Sign up for a credit monitoring service, if offered.More items...

Select the statement that best describes your situation from the list provided.I want to report identity theft.Someone else filed a tax return using my information.Someone has my information or tried to use it, and I'm worried about identity theft.My information was exposed in a data breach.More items...?

Report identity (ID) theft to the Federal Trade Commission (FTC) online at IdentityTheft.gov or by phone at 1-877-438-4338. The FTC will collect the details of your situation.

Freeze your credit. Sign up for a credit monitoring service, if offered. Tighten security on your accounts. Review your credit reports for mystery accounts.

An Identity Theft Affidavit is a document used by victims of identity theft to prove to businesses that their personal information was used to open a fraudulent account. This document includes personal information as well as a formal statement about the facts surrounding the identity theft.

If you have been a victim of identity theft, the Identity Theft Statement helps you notify financial institutions, credit card issuers and other companies that the identity theft occurred, tell them that you did not create the debt or charges, and give them information they need to begin an investigation.

Report Identity Theft. Report identity (ID) theft to the Federal Trade Commission (FTC) online at IdentityTheft.gov or by phone at 1-877-438-4338. The FTC will collect the details of your situation.

Report Identity Theft. Report identity (ID) theft to the Federal Trade Commission (FTC) online at IdentityTheft.gov or by phone at 1-877-438-4338.

The options are as follows: I want to report identity theft. Someone else filed a tax return using my information. Someone has my information or tried to use it, and I'm worried about identity theft.

Identity theft occurs when someone steals your personal informationsuch as your Social Security number, bank account number, and credit card information. Identity theft can be committed in many different ways. Some identity thieves sift through trash bins looking for bank account and credit card statements.