Tarrant Texas Letter to Creditors Notifying Them of Identity Theft for New Accounts

Description

How to fill out Tarrant Texas Letter To Creditors Notifying Them Of Identity Theft For New Accounts?

How much time does it normally take you to create a legal document? Because every state has its laws and regulations for every life sphere, finding a Tarrant Letter to Creditors Notifying Them of Identity Theft for New Accounts suiting all local requirements can be tiring, and ordering it from a professional lawyer is often pricey. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, grouped by states and areas of use. Aside from the Tarrant Letter to Creditors Notifying Them of Identity Theft for New Accounts, here you can get any specific form to run your business or personal deeds, complying with your county requirements. Specialists verify all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is fairly easy. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can retain the file in your profile at any moment later on. Otherwise, if you are new to the platform, there will be a few more actions to complete before you get your Tarrant Letter to Creditors Notifying Them of Identity Theft for New Accounts:

- Check the content of the page you’re on.

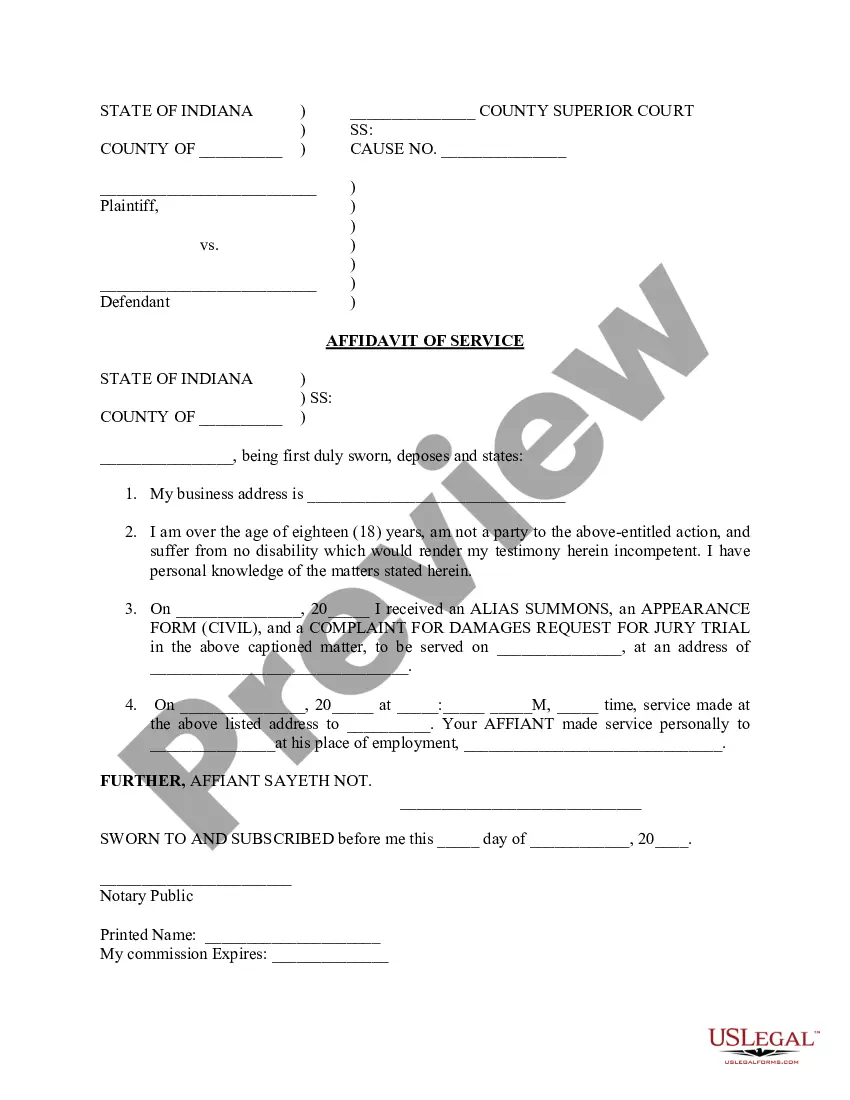

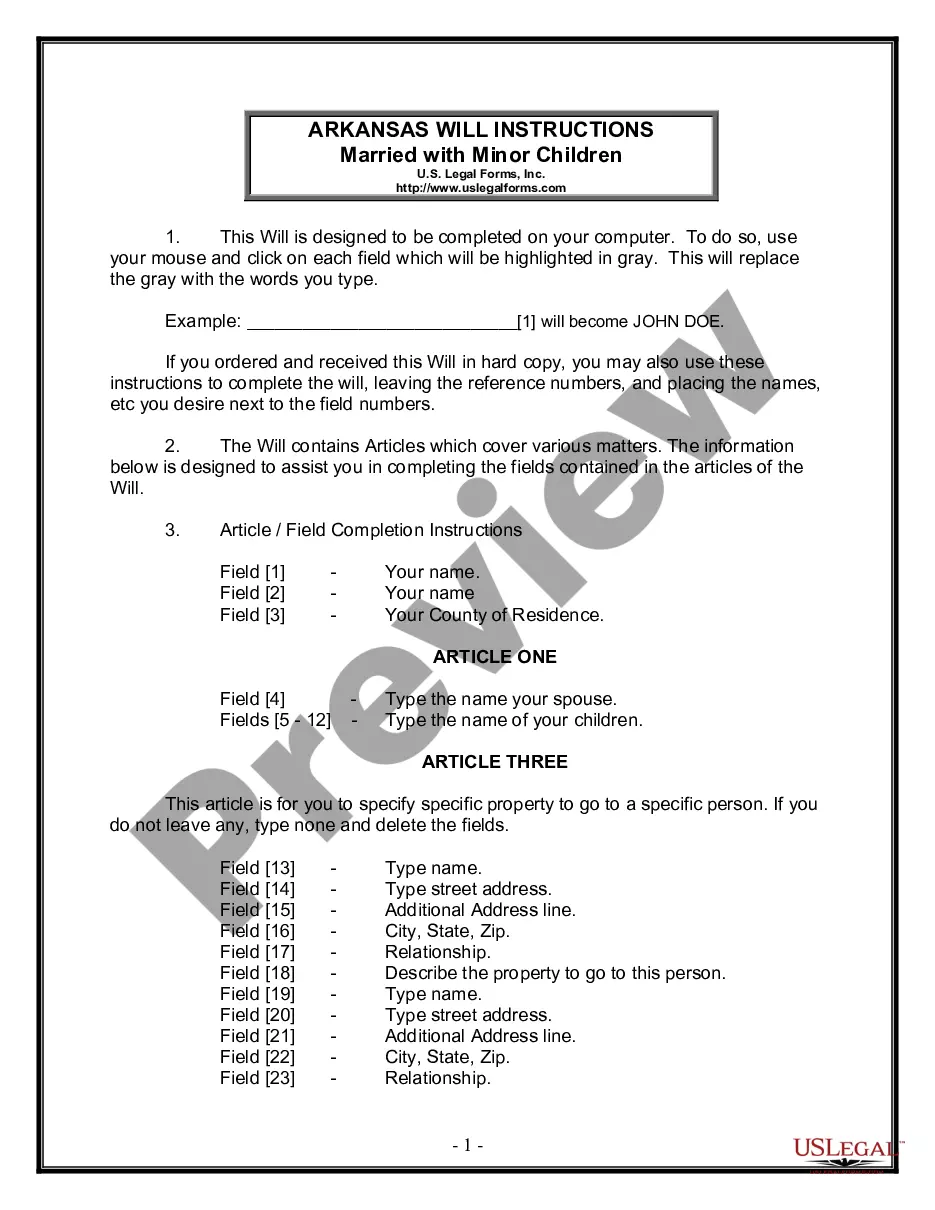

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if necessary.

- Click Download to save the Tarrant Letter to Creditors Notifying Them of Identity Theft for New Accounts.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

A 609 letter is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. It's named after section 609 of the Fair Credit Reporting Act (FCRA), a federal law that protects consumers from unfair credit and collection practices. Written by Natasha Wiebusch, J.D..

Select the statement that best describes your situation from the list provided.I want to report identity theft.Someone else filed a tax return using my information.Someone has my information or tried to use it, and I'm worried about identity theft.My information was exposed in a data breach.More items...?

What to do if your identity is stolenContact the companies and banks where you know identity fraud occurred.Contact the credit reporting agencies and place fraud alerts.Ask for copies of your credit reports.Place a security freeze on your credit report.More items...

Report Identity Theft. Report identity (ID) theft to the Federal Trade Commission (FTC) online at IdentityTheft.gov or by phone at 1-877-438-4338.

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.

If you learn that you have become a victim of identity theft, do the following: Immediately contact the fraud departments of the three major credit bureaus (Equifax, Experian, and Trans Union) to let them know about your situation.

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

Report Identity Theft. Report identity (ID) theft to the Federal Trade Commission (FTC) online at IdentityTheft.gov or by phone at 1-877-438-4338. The FTC will collect the details of your situation.

File a claim with your identity theft insurance, if applicable.Notify companies of your stolen identity.File a report with the Federal Trade Commission.Contact your local police department.Place a fraud alert on your credit reports.Freeze your credit.Sign up for a credit monitoring service, if offered.More items...