Title: Travis Texas Letter to Creditors: Detailed Notification of Identity Theft for New Accounts Keywords: Travis Texas, letter to creditors, notifying, identity theft, new accounts, detailed description, types Introduction: In this article, we will provide a comprehensive and detailed description of a Travis Texas letter to creditors that notifies them of identity theft for new accounts. Identity theft is a significant concern in today's digital era, and it is crucial to take proactive measures to protect oneself. A well-drafted letter to creditors can help individuals inform relevant financial institutions and prevent further misuse of their personal information. Let's explore the different types and essential components of a Travis Texas letter to creditors for notifying them of identity theft for new accounts. 1. Standard Travis Texas Letter to Creditors: The standard Travis Texas letter template serves as a general framework for notifying creditors about instances of identity theft for new accounts. It includes essential elements such as contact information, account details, a description of the identity theft incident, and a request for immediate action. This concise letter formally notifies the creditors and provides the necessary information to initiate an investigation. 2. Extended Travis Texas Letter to Creditors: The extended version of the Travis Texas letter to creditors offers a more detailed account of the identity theft incident. It may include additional information such as the date and time of the discovery, a summary of the affected accounts, any suspicious activities observed, and a chronology of the steps taken to mitigate the situation. This more in-depth letter assists the creditors in better understanding the severity and impact of the identity theft, enabling them to take appropriate action swiftly. 3. Travis Texas Letter to Creditors with Supporting Documentation: Some individuals may opt to accompany their letter with supporting documentation to strengthen their case against identity theft. This type of letter includes copies of police reports, identity theft affidavits, credit bureau reports, and any other relevant evidence. By providing thorough documentation, individuals can present a compelling case to creditors and increase their chances of successful resolution. Conclusion: A Travis Texas letter to creditors notifying them of identity theft for new accounts is an essential step in resolving the issue promptly. By familiarizing yourself with the different types of letters, you can choose the one that best suits the severity and complexity of your situation. Remember to provide accurate and detailed information while adopting a professional tone throughout the letter. Promptly sending this letter to creditors is crucial in minimizing the potential damage caused by identity theft and safeguarding your financial stability.

Travis Texas Letter to Creditors Notifying Them of Identity Theft for New Accounts

Description

How to fill out Travis Texas Letter To Creditors Notifying Them Of Identity Theft For New Accounts?

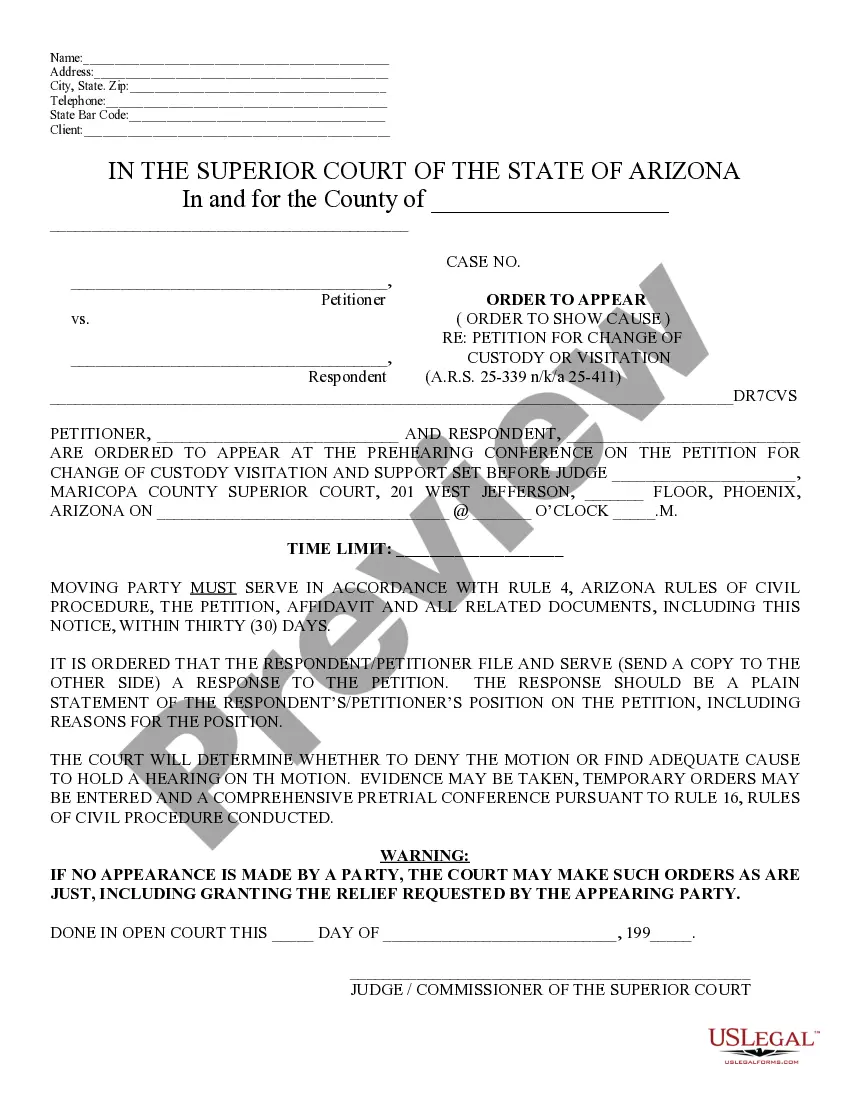

Do you need to quickly draft a legally-binding Travis Letter to Creditors Notifying Them of Identity Theft for New Accounts or probably any other document to handle your own or business matters? You can go with two options: hire a professional to write a legal paper for you or create it completely on your own. The good news is, there's an alternative option - US Legal Forms. It will help you get neatly written legal papers without paying sky-high fees for legal services.

US Legal Forms provides a huge collection of over 85,000 state-compliant document templates, including Travis Letter to Creditors Notifying Them of Identity Theft for New Accounts and form packages. We offer documents for a myriad of use cases: from divorce papers to real estate document templates. We've been out there for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the necessary template without extra troubles.

- To start with, double-check if the Travis Letter to Creditors Notifying Them of Identity Theft for New Accounts is tailored to your state's or county's regulations.

- In case the document comes with a desciption, make sure to check what it's intended for.

- Start the searching process over if the form isn’t what you were hoping to find by utilizing the search box in the header.

- Select the plan that best fits your needs and move forward to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Travis Letter to Creditors Notifying Them of Identity Theft for New Accounts template, and download it. To re-download the form, just head to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. Additionally, the paperwork we offer are reviewed by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

The options are as follows: I want to report identity theft. Someone else filed a tax return using my information. Someone has my information or tried to use it, and I'm worried about identity theft.

Immediately notify your security point of contact. What should you do if a reporter asks you about potentially classified information on the web? Neither confirm nor deny the information is classified.

Identity theft occurs when someone steals your personal informationsuch as your Social Security number, bank account number, and credit card information. Identity theft can be committed in many different ways. Some identity thieves sift through trash bins looking for bank account and credit card statements.

Here are steps to take if your identity is stolen:Notify the company or agency that issued your stolen credentials.Put a freeze or fraud alert on your credit.Report the theft to the Federal Trade Commission.File a report with your local law enforcement agency.More items...?

What is something you should do if you become a victim of identity theft? Call the fraud division of the three credit bureaus, explain that you are a victim of identity theft, and ask them to put a fraud alert on your credit files.

Report identity (ID) theft to the Federal Trade Commission (FTC) online at IdentityTheft.gov or by phone at 1-877-438-4338. The FTC will collect the details of your situation.

Report identity (ID) theft to the Federal Trade Commission (FTC) online at IdentityTheft.gov or by phone at 1-877-438-4338....It could be necessary if:You know the identity thief.The thief used your name in an interaction with the police.A creditor or another company requires you to provide a police report.

Select the statement that best describes your situation from the list provided.I want to report identity theft.Someone else filed a tax return using my information.Someone has my information or tried to use it, and I'm worried about identity theft.My information was exposed in a data breach.More items...?

9 warning signs of identity theftYour bank statement doesn't look right or your checks bounce.You see unfamiliar and unauthorized activity on your credit card or credit report.Your bills are missing or you receive unfamiliar bills.Your cellphone or another utility loses service.More items...?

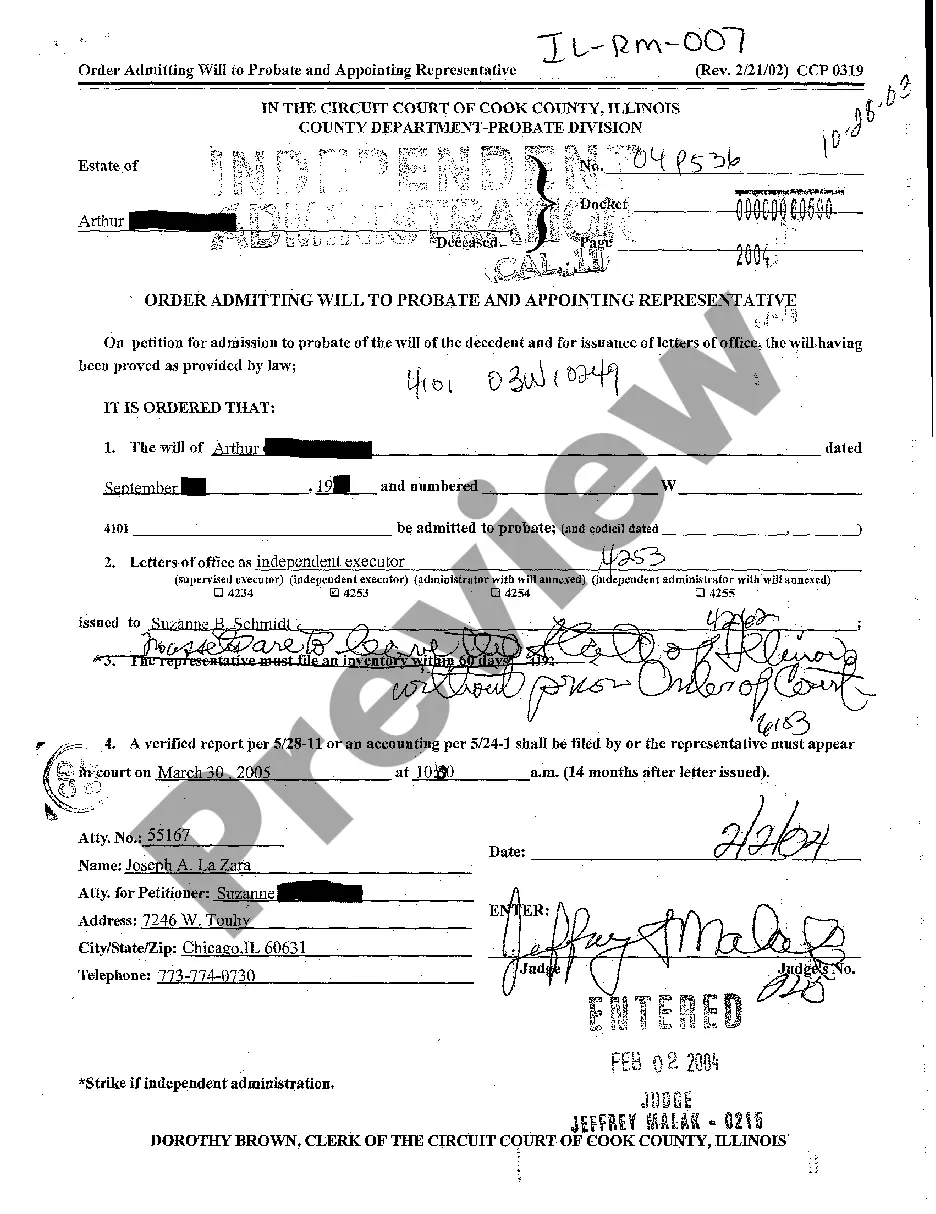

An Identity Theft Affidavit is a document used by victims of identity theft to prove to businesses that their personal information was used to open a fraudulent account. This document includes personal information as well as a formal statement about the facts surrounding the identity theft.