Cook Illinois Corporation is a well-established company that specializes in transportation services, primarily school bus transportation. A crucial aspect of the company's financial decisions involves determining the distribution of profits to shareholders in the form of dividends. To formalize this process, Cook Illinois has developed a specialized document called the "Cook Illinois Increase Dividend — Resolution Form." The Cook Illinois Increase Dividend — Resolution Form is a corporate resolution designed to address the issue of increasing dividends for shareholders. This document provides a detailed framework for the decision-making process by outlining the necessary steps and guidelines to be followed. This form serves as an official record of the company's commitment to enhancing shareholder value through higher dividend payouts. Keywords: Cook Illinois, Increase Dividend, Resolution Form, Corporate Resolutions, transportation services, school bus transportation, profits, shareholders, dividends, decision-making process, guidelines, shareholder value, higher dividends, official record. Types of Cook Illinois Increase Dividend — Resolution Forms: 1. Annual Dividend Increase Resolution: This type of resolution form is prepared annually to determine the increase in dividends to be distributed to shareholders. It typically takes into account the company's financial performance, profitability, and any other relevant factors before deciding on the quantum of increase. 2. Special Dividend Increase Resolution: In certain circumstances, Cook Illinois may decide to issue a special dividend outside the regular dividend distribution schedule. A special dividend increase resolution form is used to document the special dividend decision and outline the reasons and justifications behind it. 3. Interim Dividend Increase Resolution: Cook Illinois may choose to distribute dividends before the end of the financial year if it has surplus profits. The interim dividend increase resolution form is created to formalize this decision, specifying the amount and timing of the interim dividend payout. 4. Dividend Increase Confirmation Resolution: This type of resolution form is employed to confirm the increase in dividends previously proposed and approved by the company's board of directors. It serves as a final step to validate the dividend increase decision and ensures proper documentation for legal and financial purposes. By implementing the Cook Illinois Increase Dividend — Resolution Form, the Cook Illinois Corporation ensures transparency, accountability, and professionalism in their dividend increase process. This document plays a crucial role in maintaining consistent and fair dividend distributions while safeguarding the interests of shareholders.

Cook Illinois Increase Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Cook Illinois Increase Dividend - Resolution Form - Corporate Resolutions?

Laws and regulations in every area differ around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Cook Increase Dividend - Resolution Form - Corporate Resolutions, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's an excellent solution for specialists and individuals looking for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can simply log in and re-download the Cook Increase Dividend - Resolution Form - Corporate Resolutions from the My Forms tab.

For new users, it's necessary to make some more steps to get the Cook Increase Dividend - Resolution Form - Corporate Resolutions:

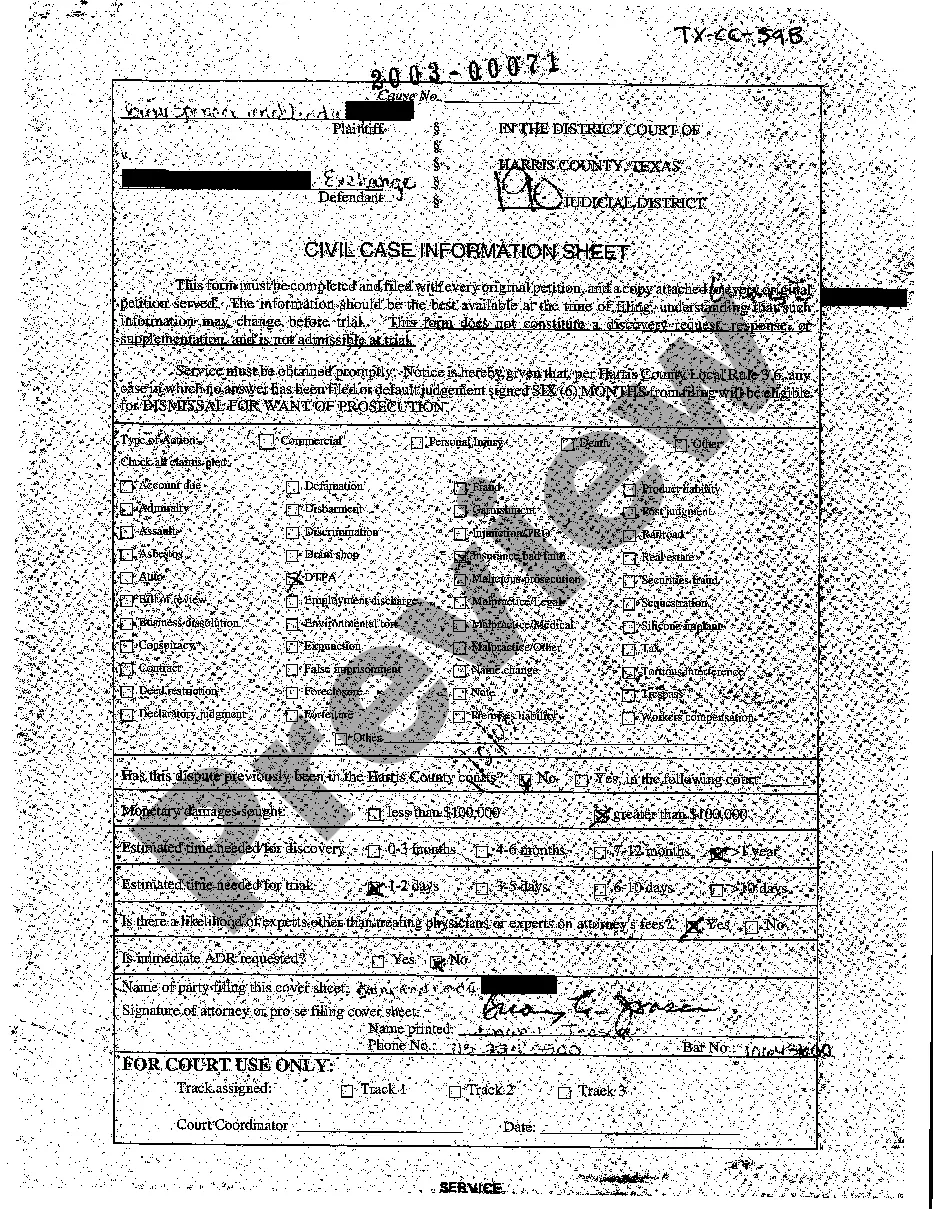

- Examine the page content to ensure you found the correct sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document once you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!