Los Angeles California Identity Theft Checklist is a comprehensive guide aimed at safeguarding individuals residing in Los Angeles from falling victim to identity theft. This checklist covers various aspects of personal information protection and highlights key steps that everyone should take to minimize the risk of identity theft. Key Points to Include in Los Angeles California Identity Theft Checklist: 1. Shredding Documents: To thwart potential identity thieves, it is important to shred all personal documents that contain sensitive information like social security numbers, bank statements, credit card bills, and medical records using a cross-cut shredder. 2. Securing Mail: Adequate measures should be taken to secure mailboxes to prevent theft of sensitive information. Individuals should consider installing locked mailboxes or picking up their mail promptly. 3. Monitoring Credit Reports: Regularly monitoring credit reports is crucial to detect any suspicious activity. The checklist advises individuals to obtain free annual credit reports from major credit reporting agencies and review them thoroughly for any inaccuracies or unauthorized accounts. 4. Avoiding Suspicious Emails/Phone Calls: Individuals should be cautious while responding to emails or phone calls requesting personal information. Always verify the authenticity of the source before sharing any sensitive details. 5. Safeguarding Social Security Number: It is essential to protect your social security number (SSN) at all costs. The checklist suggests not carrying the SSN card in the wallet and refraining from sharing it unnecessarily. 6. Using Strong Passwords: Emphasize the importance of creating strong, unique passwords for online accounts. Regularly updating passwords and enabling two-factor authentication are recommended practices. 7. Securing Personal Devices: Implementing security measures such as the use of strong passcodes, activating remote tracking and erasing options, and keeping software updated can protect personal devices from unauthorized access. 8. Being Cautious in Public Places: Remind individuals to be cautious when using public Wi-Fi networks or ATMs to avoid potential identity theft attempts. They should refrain from conducting sensitive transactions on public networks and ensure to cover the keypad while entering Pins. Different Types of Los Angeles California Identity Theft Checklists: 1. Basic Identity Theft Checklist: This checklist covers the fundamental steps to protect personal information and minimize the risk of identity theft, making it suitable for individuals who are new to the topic. 2. Advanced Identity Theft Checklist: Designed for individuals who have already implemented basic security measures, this checklist focuses on additional strategies to enhance personal information protection, such as advanced encryption techniques and proactive credit monitoring services. 3. Business Identity Theft Checklist: This checklist caters specifically to the needs of business owners and entrepreneurs in Los Angeles. It includes measures aimed at protecting business-related data and preventing identity theft within the company. By utilizing the Los Angeles California Identity Theft Checklist, individuals can stay proactive in safeguarding their personal information and reduce the likelihood of falling victim to identity theft.

Los Angeles California Identity Theft Checklist

Description

How to fill out Los Angeles California Identity Theft Checklist?

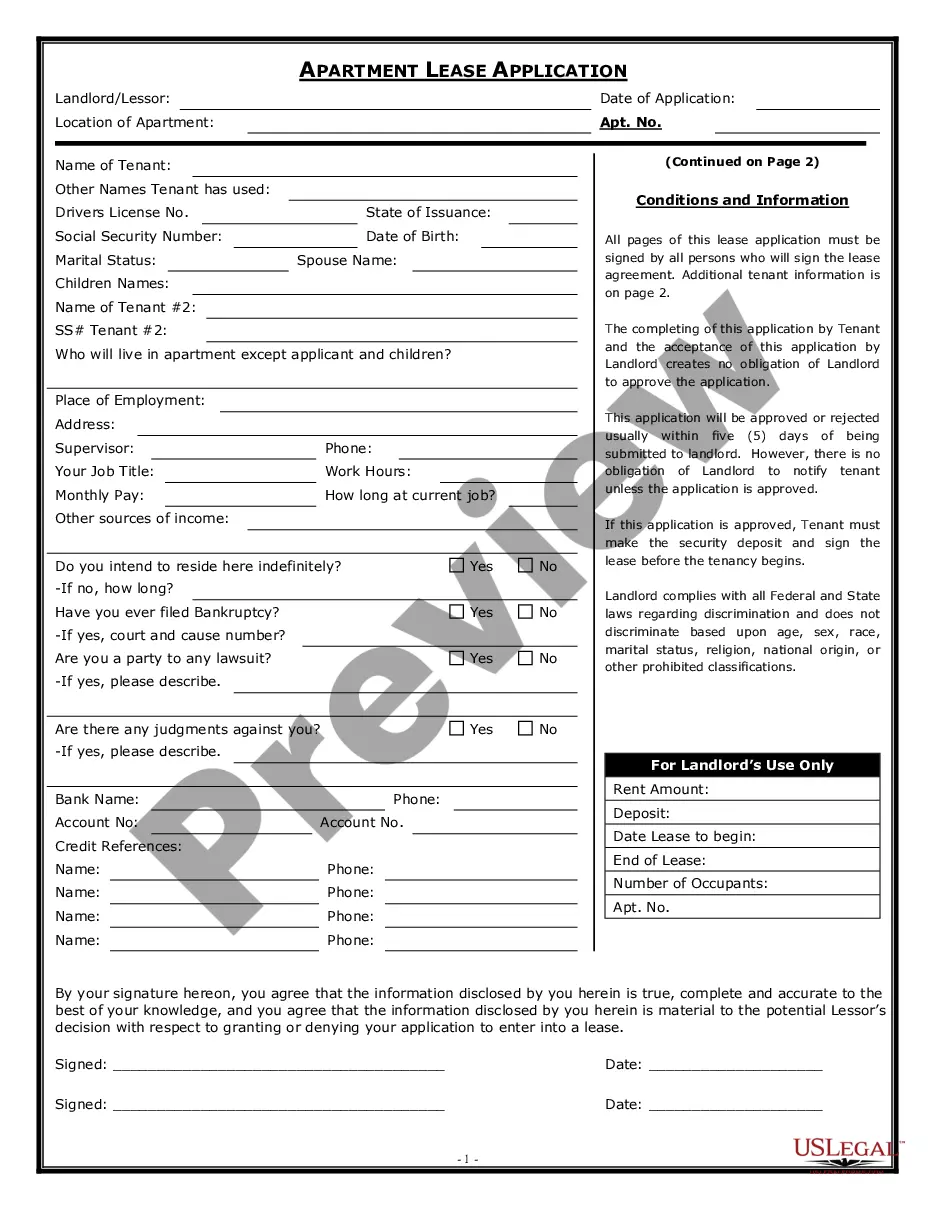

Whether you plan to open your business, enter into a contract, apply for your ID renewal, or resolve family-related legal issues, you must prepare specific paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal documents for any individual or business occurrence. All files are collected by state and area of use, so opting for a copy like Los Angeles Identity Theft Checklist is quick and straightforward.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of additional steps to get the Los Angeles Identity Theft Checklist. Adhere to the guidelines below:

- Make sure the sample fulfills your individual needs and state law requirements.

- Read the form description and check the Preview if available on the page.

- Make use of the search tab providing your state above to locate another template.

- Click Buy Now to obtain the file once you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Los Angeles Identity Theft Checklist in the file format you need.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

9 warning signs of identity theftYour bank statement doesn't look right or your checks bounce.You see unfamiliar and unauthorized activity on your credit card or credit report.Your bills are missing or you receive unfamiliar bills.Your cellphone or another utility loses service.More items...?

The 6 Types of Identity Theft#1 New Account Fraud. Using another's personal identifying information to obtain products and services using that person's good credit standing.#2 Account Takeover Fraud.#3 Criminal Identity Theft.#4 Medical Identity Theft.#5 Business or Commercial Identity Theft.#6 Identity Cloning.

Here are the ten ways thieves steal your identity, along with a handful of tips on how to reduce the risk of it happening to you.Credit Card Theft.Insecure Websites.Phishing.Hacking.Shoulder Surfing.Skimming.Fraudulent Credit Reports.Pretexting.More items...?

9 warning signs of identity theftYour bank statement doesn't look right or your checks bounce.You see unfamiliar and unauthorized activity on your credit card or credit report.Your bills are missing or you receive unfamiliar bills.Your cellphone or another utility loses service.More items...?

Here are ten red flags that indicate someone has stolen your identity.You receive unexpected credit cards or account statements.You're denied credit for no apparent reason.You receive calls or letters from unknown debt collectors.Your bills and bank statements don't arrive in the mail.More items...

How identity thieves obtain your personal informationData breaches. Data breaches often make headlines, so this is one method you've likely heard about before.Phishing.Unsafe Internet connections.Mail theft.Dumpster diving.Lost Social Security card.Weak data protection.

9 Signs of Identity TheftUnexplained charges or withdrawals.Medical bills for doctors you haven't visited.New credit cards you didn't apply for.Errors on your credit report.Collection notices or calls for unknown debt.Your credit card or application for credit is denied.Missing mail or email.More items...

Much like a Social Security number, a thief only needs your name and credit card number to go on a spending spree. Many merchants, particularly online, also ask for your credit card expiration date and security code.

Beware of These 7 Signs of Identity TheftUnexplained Transactions on Your Credit and Bank Accounts.Your Credit Card Is Declined.You're Flooded With Calls or Notices From Debt Collectors.You're Denied for New Credit.There's New Information on Your Credit Report That You Don't Recognize.More items...

But Aura is here to help if you notice any of these 25 red flags, it's likely that you are the victim of identity theft.Unfamiliar Charges on Your Bank Statement.Unfamiliar Credit Card Charges.New Credit Cards or Loans in Your Name.Calls from Debt Collectors.You're Denied Credit.Bounced Checks.Drop in Credit Score.More items...?