Title: San Jose, California Identity Theft Checklist — Detailed Guide to Safeguard Your Personal Information Introduction: In the technologically advanced world we live in, protecting our personal information from identity theft has become an essential priority. This comprehensive San Jose, California Identity Theft Checklist provides you with a detailed guide to help safeguard your personal information from potential threats. By following the steps outlined in this checklist, you can minimize the risk of falling victim to identity theft in San Jose, California. Keywords: San Jose, California, identity theft, checklist, personal information, safeguard, potential threats, minimize risk Types of San Jose, California Identity Theft Checklists: 1. San Jose, California Identity Theft Prevention Checklist: Key points: — Secure your personal documents: Store sensitive documents (such as passports, driver's licenses, Social Security cards) in a safe place. — Regularly review financial statements: Monitor credit card statements and bank accounts for any suspicious activity or unauthorized transactions. — Protect your Social Security Number (SSN): Avoid sharing your SSN unless absolutely necessary and be cautious about submitting it online. — Secure your online presence: Set strong passwords, use two-factor authentication, and avoid sharing personal information on social media platforms. — Shred sensitive documents: Dispose of financial statements, bills, and other important documents by shredding them to prevent dumpster diving. Keywords: San Jose, California, identity theft prevention, personal documents, financial statements, secure, Social Security Number (SSN), online presence, strong passwords, two-factor authentication, shredding 2. San Jose, California Identity Theft Reporting Checklist: Key points: — Act immediately: Report any suspected identity theft incidents to your local law enforcement agency in San Jose, California. — Contact financial institutions: Inform banks, credit card companies, and other financial institutions about the fraudulent activity. — Notify credit reporting agencies: Place a fraud alert or freeze on your credit reports to prevent further unauthorized access. — File a complaint: Report the identity theft to the Federal Trade Commission (FTC) through their online portal or by phone. — Keep records: Document all communications, including dates, names of involved parties, and any relevant case numbers. Keywords: San Jose, California, identity theft reporting, law enforcement agency, financial institutions, credit reporting agencies, fraud alert, freeze, Federal Trade Commission (FTC), complaint, records 3. San Jose, California Identity Theft Recovery Checklist: Key points: — Review credit reports: Regularly monitor your credit reports from all three major credit bureaus (Equifax, Experian, TransUnion) for any new suspicious accounts or discrepancies. — Dispute fraudulent activity: If you notice fraudulent accounts or incorrect information, contact the respective credit bureau to dispute and rectify the errors. — Update account passwords: Change passwords for all online accounts to ensure heightened security. — Report unauthorized charges: If you identify any fraudulent charges on your credit card statements, promptly contact the card issuer to report and resolve the issue. — Seek professional assistance if needed: Consider working with an identity theft specialist or credit counseling agency to guide you through the recovery process. Keywords: San Jose, California, identity theft recovery, credit reports, credit bureaus, dispute, account passwords, unauthorized charges, professional assistance, identity theft specialist, credit counseling agency Conclusion: By diligently following the San Jose, California Identity Theft Checklist, you can proactively protect your personal information from potential identity thieves. From prevention and reporting to recovery, this comprehensive guide equips you with essential steps to mitigate the risk of identity theft in San Jose, California. Keywords: San Jose, California, identity theft checklist, personal information, protect, identity thieves, prevention, reporting, recovery, mitigate risk.

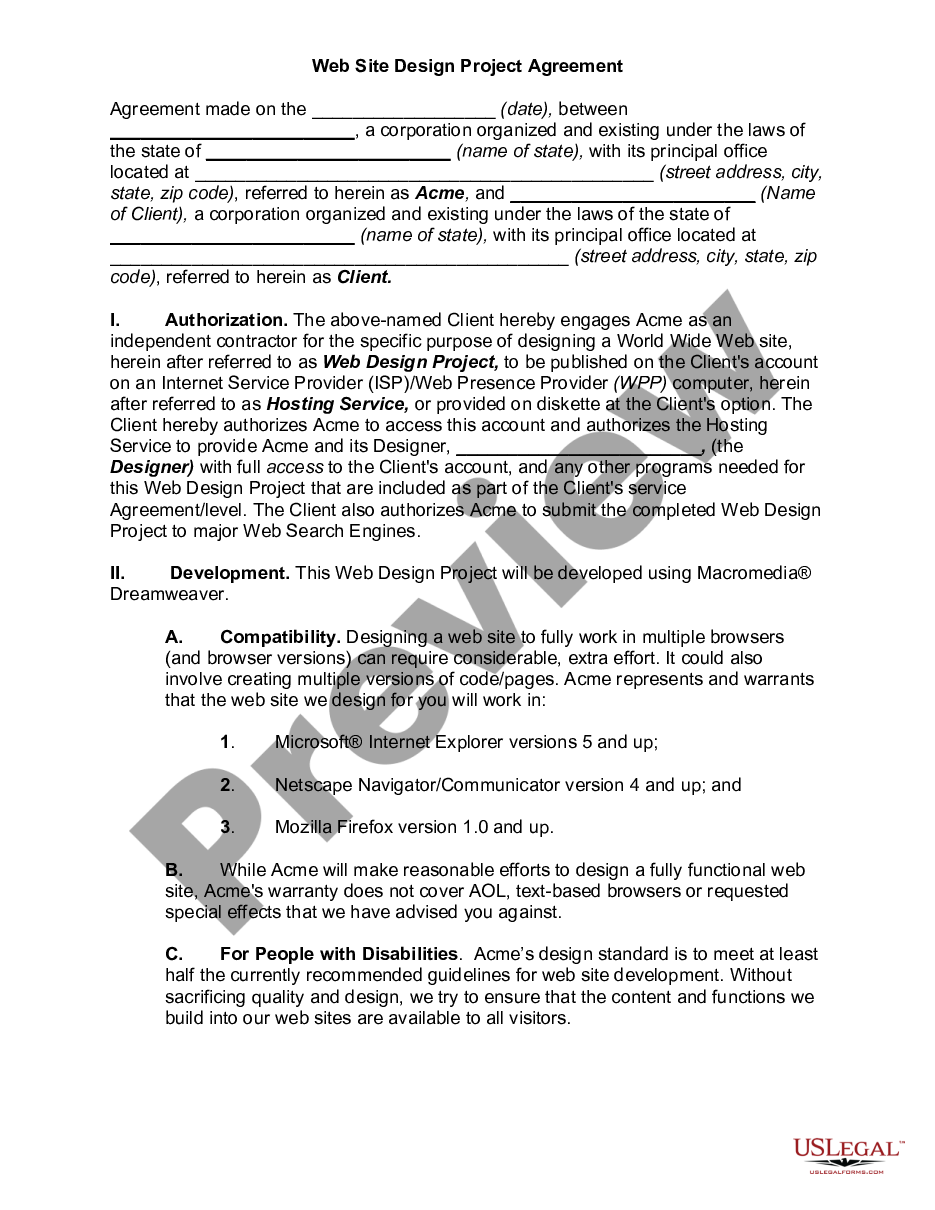

San Jose California Identity Theft Checklist

Description

How to fill out San Jose California Identity Theft Checklist?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and many other life situations demand you prepare formal paperwork that varies throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any personal or business purpose utilized in your county, including the San Jose Identity Theft Checklist.

Locating templates on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the San Jose Identity Theft Checklist will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to obtain the San Jose Identity Theft Checklist:

- Ensure you have opened the proper page with your regional form.

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form meets your needs.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the appropriate subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the San Jose Identity Theft Checklist on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!

Form popularity

FAQ

9 warning signs of identity theftYour bank statement doesn't look right or your checks bounce.You see unfamiliar and unauthorized activity on your credit card or credit report.Your bills are missing or you receive unfamiliar bills.Your cellphone or another utility loses service.More items...?

But Aura is here to help if you notice any of these 25 red flags, it's likely that you are the victim of identity theft.Unfamiliar Charges on Your Bank Statement.Unfamiliar Credit Card Charges.New Credit Cards or Loans in Your Name.Calls from Debt Collectors.You're Denied Credit.Bounced Checks.Drop in Credit Score.More items...?

What you can do to detect identity theftTrack what bills you owe and when they're due. If you stop getting a bill, that could be a sign that someone changed your billing address.Review your bills.Check your bank account statement.Get and review your credit reports.

The FTC's fraud reporting website, IdentityTheft.gov, is where you'll find detailed instructions on dealing with various forms of identity theft. To be safe, you'll also want to review your credit report for any information that's appearing as a result of fraud.

If you believe someone is using your Social Security number to work, get your tax refund, or other abuses involving taxes, contact the IRS online or call 1-800-908-4490. You can order free credit reports annually from the three major credit bureaus (Equifax, Experian and TransUnion).

9 warning signs of identity theftYour bank statement doesn't look right or your checks bounce.You see unfamiliar and unauthorized activity on your credit card or credit report.Your bills are missing or you receive unfamiliar bills.Your cellphone or another utility loses service.More items...?

Here's How To Know If Your Identity Has Been StolenYour Credit Report Doesn't Seem Accurate.Suspicious Activity on Your Credit Card and Bank Statements.Unexpected Physical Mail.Missing Physical Mail.Your Personally Identifying Documents Are Lost (or Stolen)Suspicious Phone Calls and Voicemails.More items...?

File a claim with your identity theft insurance, if applicable. Notify companies of your stolen identity. File a report with the Federal Trade Commission. Contact your local police department.

How to check if your identity has been stolenCheck your credit card statements and bank account. If you notice any suspicious activity, alert your bank or credit union right away.Run a credit report. U.S. citizens are entitled to a free one every 12 months.Monitor your finances closely.

Other things that could be warning signs that your identity has been stolen include: Statements or bills for accounts you never opened arriving in the mail. Statements or bills for legitimate accounts not showing up. You're unexpectedly denied credit.

Interesting Questions

More info

Check out our Autodesk ID & CVS Store page for the latest information and resources). . Can an EIP request include EIP payments, insurance payments, and any other third-party payments? . How should an electronic funds transfer (EFT) request for a payment be written?. Why should electronic transfers be used?, what is the difference between an online transfer and an EFT?, and what kind of information are you collecting when you use online transfers?

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.