Title: Suffolk New York Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts Introduction: In Suffolk, New York, instances of identity theft targeting minors have unfortunately become more prevalent. This letter serves as a formal notification to creditors regarding the fraudulent account(s) opened under the minor's name. This content aims to provide relevant information, guidelines, and possible variations to address specific circumstances. Part I: General Structure and Content 1. Salutation: — Greetings [Creditor's Name]— - Dear [Creditor's Name], 2. Introduction: — I am reaching out to you on behalf of [Minor's Name], a resident of Suffolk, New York, and their legal guardian. — We have recently discovered that an unauthorized/fraudulent account has been opened using the minor's personal information. 3. Identification of Account: — Provide the account details associated with the identity theft, such as the account number, date of creation, or any other relevant information available. 4. Detailed Description of Identity Theft: — Explain how the identity theft was discovered or reported. — State the impact of the unauthorized account on the minor's financial well-being. — Include any evidence available, such as police reports or affidavits from credit monitoring agencies. 5. Request for Action: — Clearly state the desired action from the creditor, which is typically to close the fraudulent account(s) associated with the minor. — Request cooperation in investigating the incident and providing information related to the fraudulent account(s). 6. Enclosed Documents: — Mention any documents supporting the case enclosed with the letter, such as copies of police reports or identity theft affidavits. — Request prompt acknowledgment of receipt of the enclosed documents. 7. Contact Information: — Provide the contact details of the legal guardian and request direct communication for any correspondence or updates. 8. Expression of Gratitude: — Express appreciation for the creditor's attention, cooperation, and prompt action regarding this matter. — Show willingness to assist in the resolution process. 9. Closing: — Sincerely— - Respectfully yours, Part II: Variations 1. Letter for Reporting Multiple Fraudulent Accounts: — Use this variation when notifying creditors about multiple unauthorized accounts opened under the minor's name. — Provide separate details for each account and clearly indicate the need to close and investigate all accounts mentioned. 2. Letter for Contacting Credit Bureaus: — Use this variation when the letter is intended to notify credit bureaus about the identity theft affecting the minor's credit history. — Emphasize the importance of initiating credit reports and freezing the minor's credit file to prevent further damage. 3. Letter for Requesting Enhanced Security Measures: — Use this variation to request additional security measures from the creditor to prevent future identity theft incidents affecting the minor. — Suggest implementing stringent identity verification protocols before opening any account under the minor's name. Note: Customize the content and structure of the letter based on specific circumstances and include any relevant state laws regarding identity theft, if applicable.

Suffolk New York Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts

Description

How to fill out Suffolk New York Letter To Creditors Notifying Them Of Identity Theft Of Minor For New Accounts?

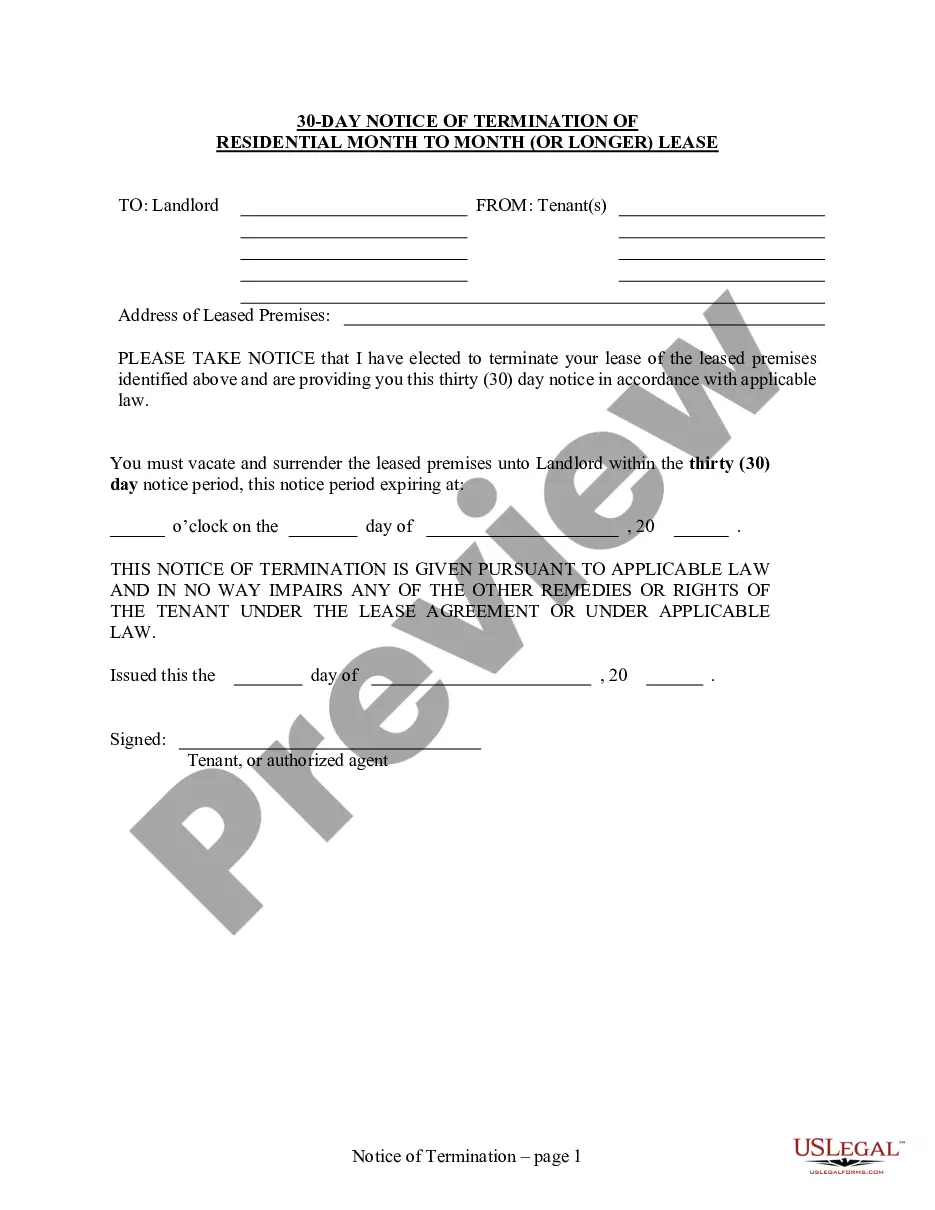

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to look for professional help to draft some of them from the ground up, including Suffolk Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different categories varying from living wills to real estate paperwork to divorce papers. All forms are arranged based on their valid state, making the searching process less frustrating. You can also find detailed resources and guides on the website to make any tasks related to document completion simple.

Here's how to find and download Suffolk Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts.

- Go over the document's preview and description (if provided) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the document of your choice is specific to your state/county/area since state laws can impact the validity of some records.

- Examine the related document templates or start the search over to find the appropriate file.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment gateway, and buy Suffolk Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts.

- Choose to save the form template in any offered format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Suffolk Letter to Creditors Notifying Them of Identity Theft of Minor for New Accounts, log in to your account, and download it. Of course, our platform can’t replace an attorney entirely. If you need to deal with an exceptionally difficult situation, we advise getting an attorney to examine your form before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Become one of them today and get your state-compliant documents effortlessly!

Form popularity

FAQ

Think of it as a red flag to potential lenders and creditors. Fraud alerts are free. To place a fraud alert on your Equifax credit report, you can create a myEquifaxTM account online; call Equifax at (800) 525-6285; or download this form to request a fraud alert by mail.

Once you have placed an active duty alert on your credit report with one of the bureaus, that bureau will send a request to the other two bureaus to do the same, so you do not have to contact all three. To place an active duty alert, create or sign in to a myEquifax account, or call our automated line at 888-836-6351.

Either open a dispute process via the credit reporting agency, or do it with the credit issuer. They will decide if they will accept the claim of identity theft or not. Finally, contact the fraud department of the corporations and companies where your child's information has been used for identity theft.

Submit an identity theft report with the Federal Trade Commission online at . By reporting your theft online, you can receive an identity theft report and a recovery plan.

Report identity (ID) theft to the Federal Trade Commission (FTC) online at IdentityTheft.gov or by phone at 1-877-438-4338. The FTC will collect the details of your situation.

Think of it as a red flag to potential lenders and creditors. Fraud alerts are free. To place a fraud alert on your Equifax credit report, you can create a myEquifaxTM account online; call Equifax at (800) 525-6285; or download this form to request a fraud alert by mail.

The options are as follows: I want to report identity theft. Someone else filed a tax return using my information. Someone has my information or tried to use it, and I'm worried about identity theft.

Identity theft occurs when someone steals your personal informationsuch as your Social Security number, bank account number, and credit card information. Identity theft can be committed in many different ways. Some identity thieves sift through trash bins looking for bank account and credit card statements.

Select the statement that best describes your situation from the list provided.I want to report identity theft.Someone else filed a tax return using my information.Someone has my information or tried to use it, and I'm worried about identity theft.My information was exposed in a data breach.More items...?

1. File a Report With the FTC. The very first thing you should do is notify the Federal Trade Commission (FTC) that you are a victim of identity theft. The information you give them can be utilized by the FBI and local law enforcement agencies to pursue criminal charges.