Phoenix Arizona Letter Notifying Social Security Administration of Identity Theft of Minor

Description

How to fill out Letter Notifying Social Security Administration Of Identity Theft Of Minor?

Drafting paperwork for the business or individual needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the particular region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to draft Phoenix Letter Notifying Social Security Administration of Identity Theft of Minor without expert help.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Phoenix Letter Notifying Social Security Administration of Identity Theft of Minor by yourself, using the US Legal Forms web library. It is the largest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

In case you still don't have a subscription, adhere to the step-by-step guide below to obtain the Phoenix Letter Notifying Social Security Administration of Identity Theft of Minor:

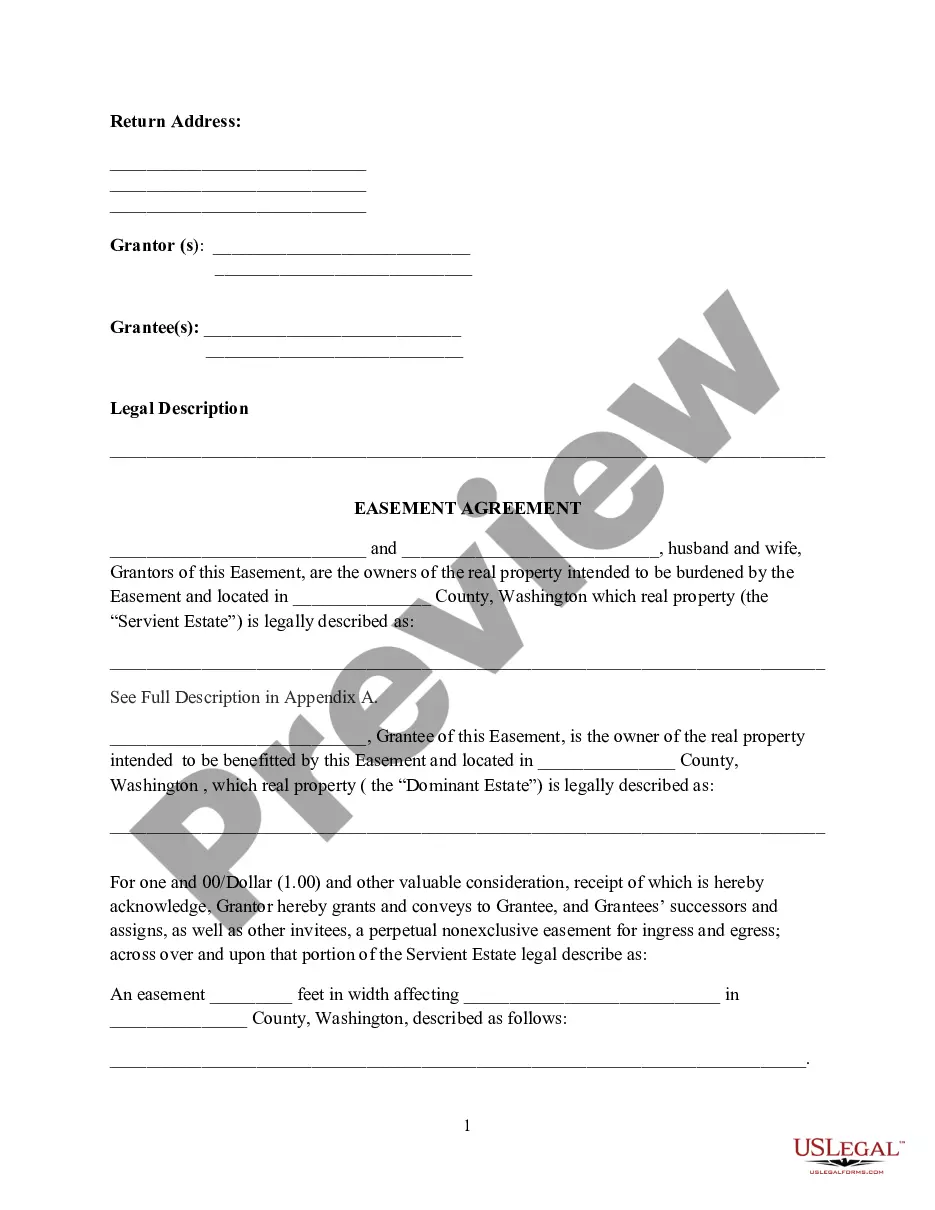

- Look through the page you've opened and verify if it has the document you need.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that satisfies your requirements, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any situation with just a couple of clicks!

Form popularity

FAQ

To file an identity theft report , you must file either a police report or a report with a government agency such as the Federal Trade Commission. You can place an initial fraud alert on your credit report if you believe you are (or are about to become), a victim of fraud or identity theft.

If your child is a victim of identity theftContact the Federal Trade Commission (FTC) to report the ID theft and get a recovery plan.Contact your local law enforcement and get a police report.Contact the fraud departments of companies where accounts were opened in your child's name.More items...

You can contact the OIG's fraud hotline at 1-800-269-0271 or submit a report online at .

A child's identity is very attractive to thieves. It's also a relatively easy crime to commit; a thief could pair any name and birth date with a stolen Social Security number, essentially creating a false identity.

This notice provides information about the amount of the payment, how the payment was made and how to report any payment that wasn't received. Notice 1444, Your Economic Impact Payment. The IRS mailed this notice within 15 days after the first payment was issued in 2020.

Either open a dispute process via the credit reporting agency, or do it with the credit issuer. They will decide if they will accept the claim of identity theft or not. Finally, contact the fraud department of the corporations and companies where your child's information has been used for identity theft.

If you believe someone is using your Social Security number to work, get your tax refund, or other abuses involving taxes, contact the IRS online or call 1-800-908-4490. You can order free credit reports annually from the three major credit bureaus (Equifax, Experian and TransUnion).

What this notice is about. We believe another person may have used your Social Security number (SSN) to obtain employment. There is no known impact to your tax return or refund related to the potential misuse of your SSN.

Here are the identity fraud letters the IRS may send to taxpayers: Letter 5071C, Potential Identity Theft with Online Option. This letter asks the taxpayer to use an online tool to verify their identity and tell the IRS if they filed that return. Letter 4883C, Potential Identity Theft.

At 1-877-IDTHEFT (1-877-438-4338) or go to: To order a copy of your Social Security Administration earnings and benefits statement, or to check whether someone has used your Social Security number to get a job or to avoid paying taxes, visit .