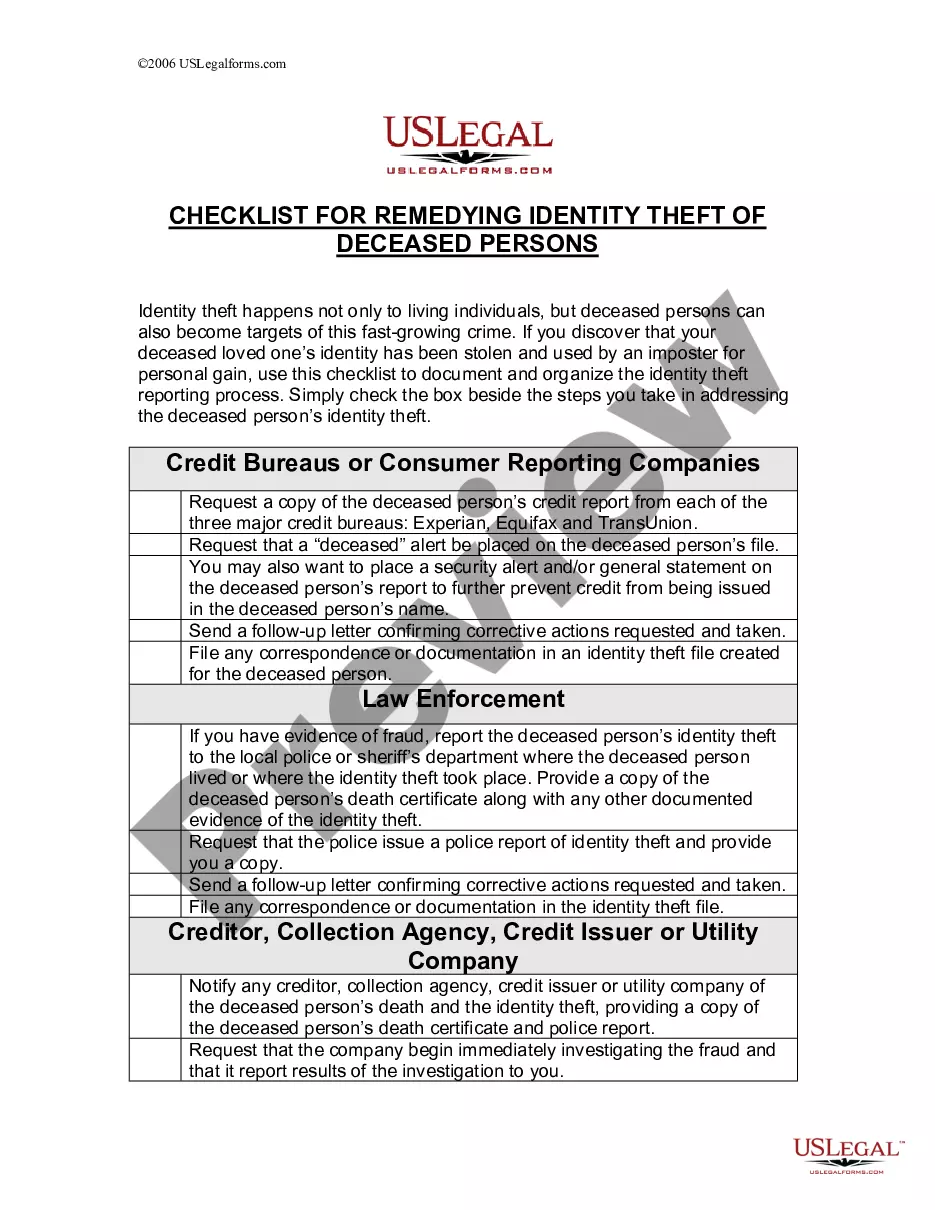

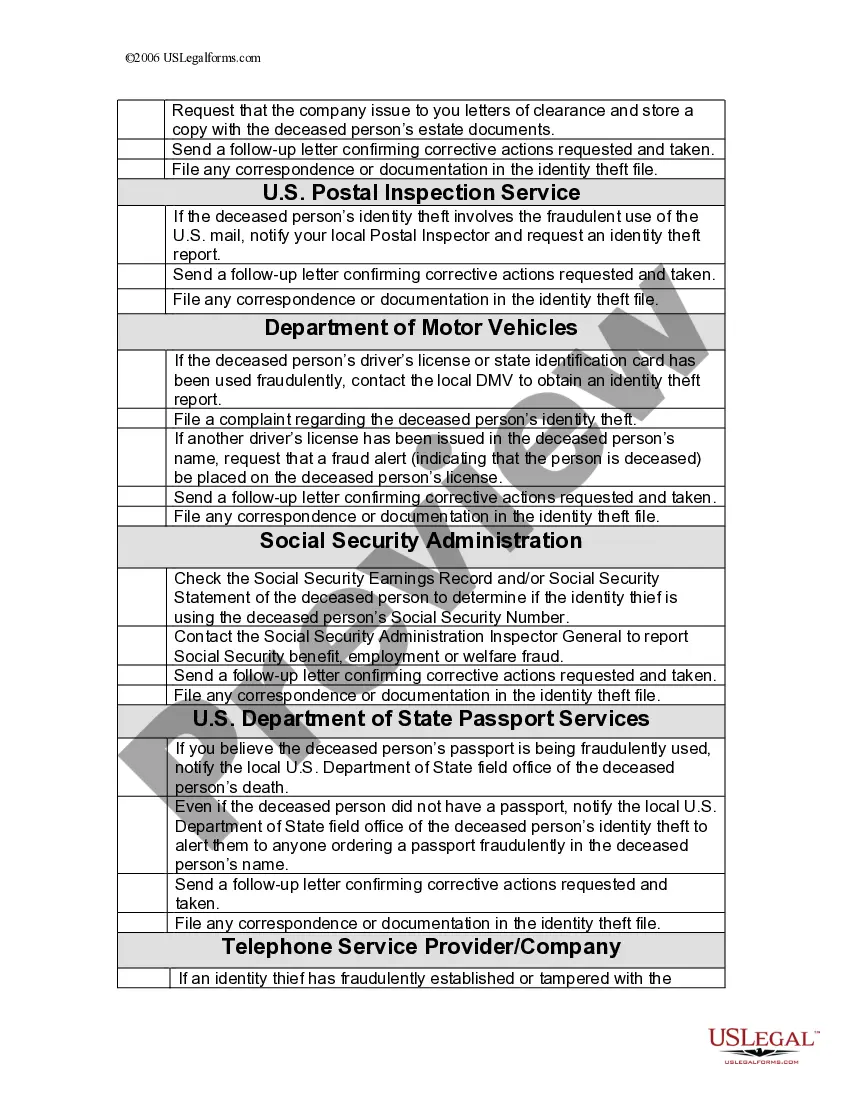

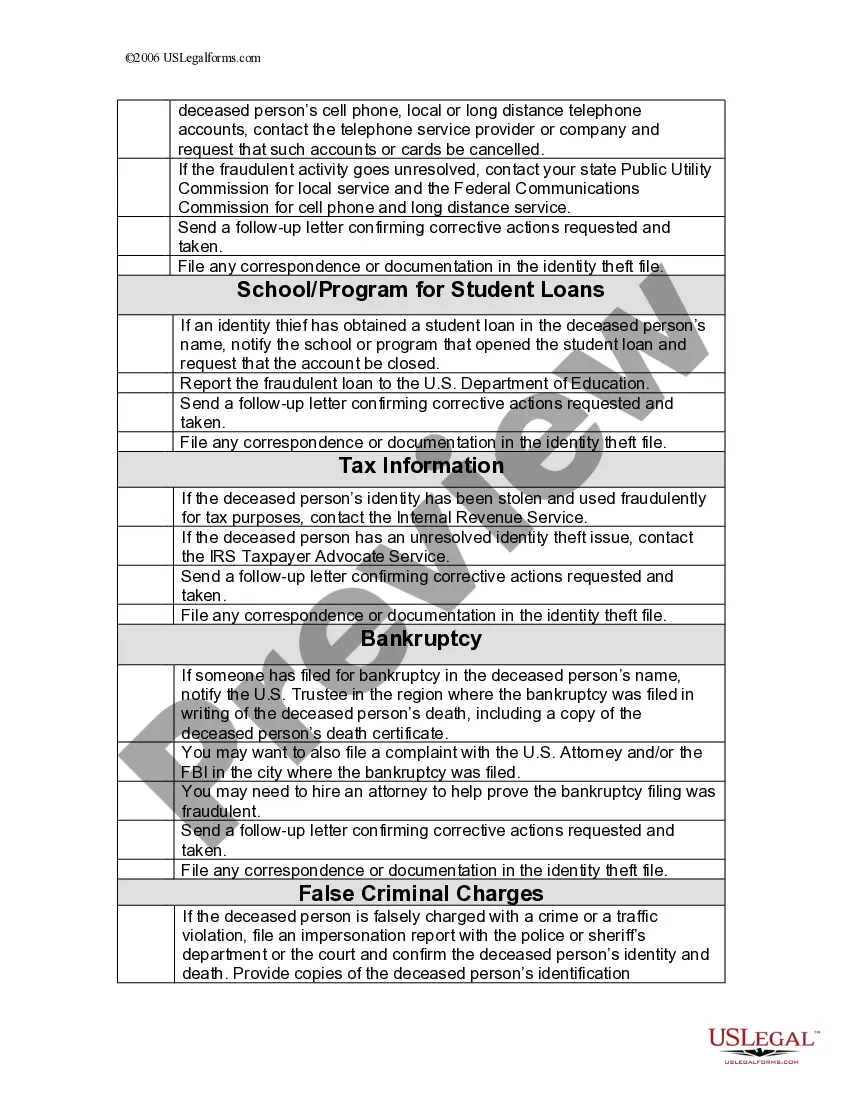

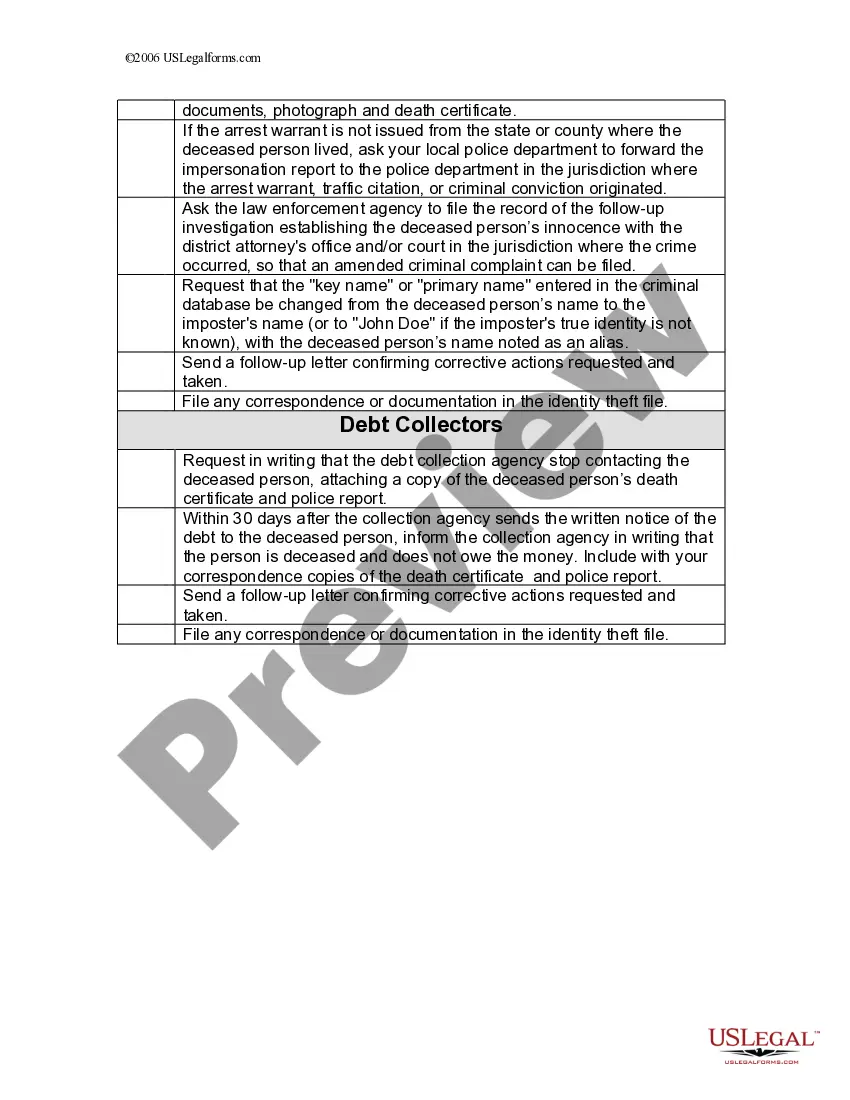

Title: Chicago, Illinois: Checklist for Remedying Identity Theft of Deceased Persons Introduction: Chicago, the bustling city in the state of Illinois, unfortunately, isn't immune to identity theft cases, even after a person passes away. With the rising instances of identity theft targeting deceased individuals, it is crucial to be aware of the measures required to protect the identities of our loved ones. This checklist will guide you through the necessary steps to address and resolve identity theft issues for deceased persons in Chicago, Illinois. 1. Immediate steps after discovering identity theft: — Contact law enforcement: Report the incident to the local police department in Chicago, Illinois, and file a police report documenting the identity theft case. — Notify relevant financial institutions: Reach out to banks, credit card companies, and other financial institutions where the deceased person held accounts. Inform them about the identity theft and initiate the process of freezing or closing the accounts. 2. Gather essential documents: — Death certificate: Obtain multiple certified copies of the deceased person's death certificate from the vital records office or the funeral home where the death was recorded. These documents will serve as official proof for various processes. — Social Security Administration (SSA): Inform the SSA about the death and request them to flag the social security number to prevent any misuse. 3. Inform credit reporting agencies: — Contact major credit reporting agencies: Notify Experian, Equifax, and TransUnion about the identity theft. Provide them with a copy of the death certificate and any supporting documents to prove the person's death. — Place a credit freeze: Request a credit freeze or fraud alert to prevent any unauthorized access or new account openings using the deceased person's information. 4. Verify existing accounts: — Review bank and financial statements: Scrutinize the previous bank and credit card statements of the deceased person for any suspicious activity. Report any fraudulent charges or transactions immediately. — Monitor credit reports: Regularly check the credit reports of the deceased person to identify any fraudulent accounts or unauthorized inquiries. 5. Address fraudulent accounts and charges: — Contact creditors and lenders: Inform any institutions where fraudulent accounts were opened using the deceased person's identity. Provide them with a copy of the death certificate and dispute the charges. — Work with credit bureaus: File disputes with the credit reporting agencies to remove fraudulent accounts and inquiries related to the identity theft. 6. Secure personal information: — Safeguard personal documents: Ensure that all personal documents, such as birth certificates, social insurance cards, and passports, are secured in a safe place to prevent further misuse. — Dispose of sensitive information: Shred or destroy documents that contain personal details to prevent them from falling into the wrong hands. Types of Chicago, Illinois Checklist for Remedying Identity Theft of Deceased Persons: 1. Estate-related identity theft: Addressing identity theft when it occurs within the probate process, impacting the deceased person's estate, assets, and financial obligations. 2. Social security number misuse: Focusing on cases where fraudsters misuse the deceased person's social security number to open fraudulent accounts or apply for benefits. 3. Credit and financial account misuse: Guiding individuals through the steps to identify and resolve fraudulent accounts and charges, such as unauthorized credit card usage or loans taken out in the deceased person's name. Conclusion: Chicago, Illinois, faces the same identity theft challenges that many urban areas encounter. To protect the identities of deceased individuals and prevent the misuse of their personal information, following this checklist is essential. Taking immediate action, gathering proper documentation, and notifying the relevant authorities will help remediate identity theft cases for deceased persons effectively. Stay vigilant and take the necessary steps to safeguard the identities of your loved ones even after they have passed away.

Chicago Illinois Checklist for Remedying Identity Theft of Deceased Persons

Description

How to fill out Chicago Illinois Checklist For Remedying Identity Theft Of Deceased Persons?

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Chicago Checklist for Remedying Identity Theft of Deceased Persons, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used multiple times: once you obtain a sample, it remains available in your profile for further use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Chicago Checklist for Remedying Identity Theft of Deceased Persons from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Chicago Checklist for Remedying Identity Theft of Deceased Persons:

- Analyze the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document when you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!