San Diego, California is a vibrant city located on the Pacific coast of the United States. Known for its stunning beaches, warm climate, and diverse culture, San Diego offers an array of activities and attractions for both residents and tourists. From the famous San Diego Zoo to the historic Gas lamp Quarter, there is something for everyone to enjoy in this beautiful city. Now, let's delve into the checklist for remedying identity theft of deceased persons in San Diego, California. Identity theft is a serious crime that can occur even after a person's passing. To ensure the restoration of the deceased individual's identity and prevent any unauthorized use of their personal information, certain steps should be followed. Below is a detailed checklist outlining these crucial measures: 1. File a police report: Contact the San Diego Police Department or the local law enforcement agency to report the identity theft of the deceased person. Provide any relevant information and documentation to assist in the investigation. 2. Notify financial institutions: Reach out to all banks, credit unions, and financial institutions the deceased person had accounts with. Inform them immediately about the identity theft case and request to freeze or close the accounts to prevent further fraudulent activity. 3. Contact credit bureaus: Inform Equifax, Experian, and TransUnion, the major credit reporting agencies, about the identity theft. Request to place a "deceased alert" or "deceased freeze" on the deceased person's credit report. This will make it more difficult for identity thieves to open new accounts using the deceased person's information. 4. Notify government agencies: Contact the Social Security Administration (SSA), Internal Revenue Service (IRS), and the Department of Motor Vehicles (DMV) to inform them about the identity theft. Provide them with a death certificate and any other necessary documentation to update their records accordingly. 5. Notify the deceased person's employer and insurance providers: If applicable, inform the deceased person's employer and any insurance providers about the identity theft. This will help prevent fraudulent claims or misuse of employment benefits. 6. Check for fraudulent accounts or charges: Thoroughly review the deceased person's financial statements, credit reports, and any other relevant documents to identify any suspicious activity or fraudulent accounts. Report these to the respective institutions and request to have them closed or reversed. 7. Monitor deceased person's online presence: Regularly monitor the deceased person's social media accounts, email accounts, and any other online platforms they may have used. Report any unauthorized activity or attempts to continue using their identity. 8. Seek legal assistance if necessary: Is the identity theft case becomes complex or there are legal considerations involved, consult with an attorney specializing in identity theft or estate law to guide you through the process and protect the deceased person's estate. Different types of San Diego, California Checklists for Remedying Identity Theft of Deceased Persons might include specific instructions or resources customized for various stakeholders, such as family members, estate executors, or legal representatives. However, the general checklist mentioned above serves as a comprehensive guide for anyone dealing with identity theft issues after the death of an individual in San Diego, California.

San Diego California Checklist for Remedying Identity Theft of Deceased Persons

Description

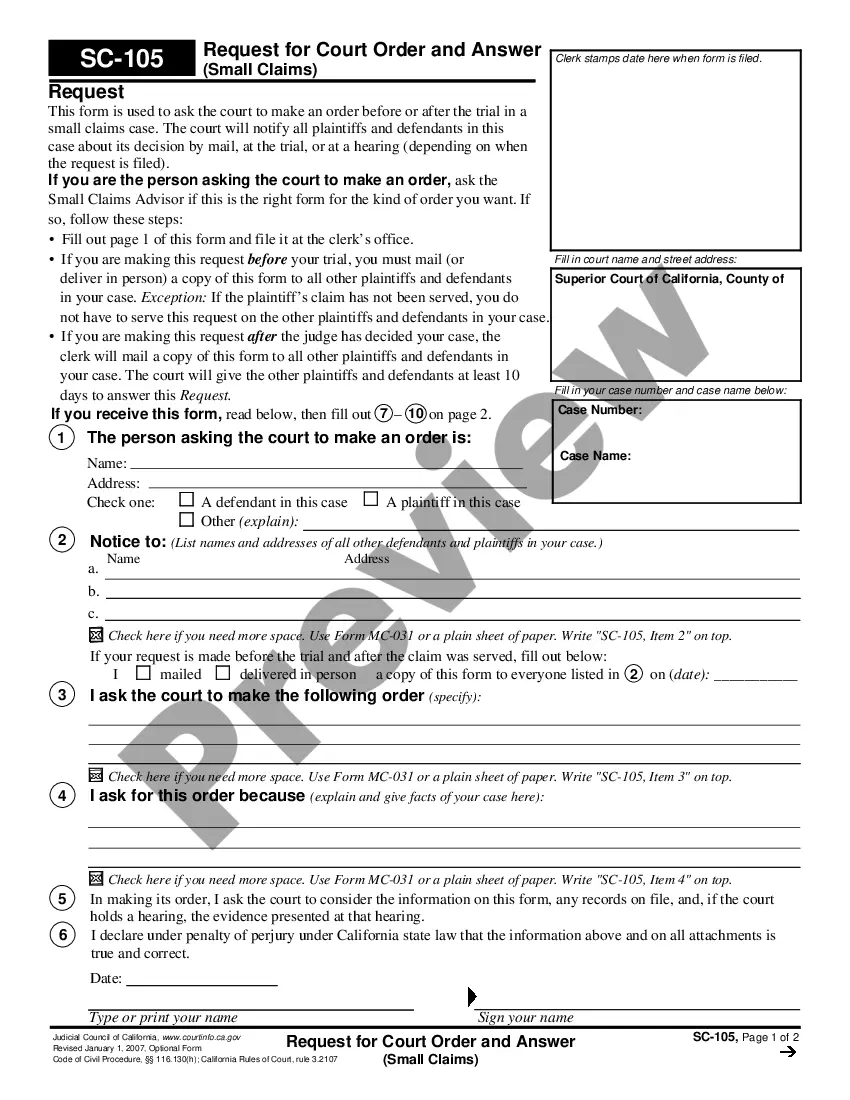

How to fill out San Diego California Checklist For Remedying Identity Theft Of Deceased Persons?

Laws and regulations in every sphere vary from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid high priced legal assistance when preparing the San Diego Checklist for Remedying Identity Theft of Deceased Persons, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for different life and business situations. All the documents can be used multiple times: once you purchase a sample, it remains accessible in your profile for future use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the San Diego Checklist for Remedying Identity Theft of Deceased Persons from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the San Diego Checklist for Remedying Identity Theft of Deceased Persons:

- Take a look at the page content to ensure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!

Form popularity

FAQ

Contact the Social Security Administration and let them know the recipient has passed away. Contact the police department in the deceased person's jurisdiction if you have evidence of fraud.

Here are 10 steps to take if you feel that you may have been a victim of identity fraud.Notify affected creditors or banks.Put a fraud alert on your credit report.Check your credit reports.Freeze your credit.Report the identity theft to the FTC.Go to the police.Remove fraudulent info from your credit report.More items...?09-Jul-2019

Identity Theft of a Deceased PersonIdentity thieves can get personal information about deceased individuals by reading obituaries, stealing death certificates, or searching genealogy websites that sometimes provide death records from the Social Security Death Index.

Can thieves steal identities with only a name and address? In short, the answer is no. Which is a good thing, as your name and address are in fact part of the public record. Anyone can get a hold of them. However, because they are public information, they are still tools that identity thieves can use.

Ghosting is a form of identity theft in which someone steals the identity, and sometimes even the role within society, of a specific dead person (the "ghost") whose death is not widely known.

Identity theft occurs when someone uses your personally identifying information, like your name, Social Security number, or credit card number, without your permission, to commit fraud or other crimes. It is estimated that as many as 9 million Americans have their identities stolen each year.

Five Steps to Take if You Are a Victim of Identity TheftPlace a Fraud Alert on Your Credit Reports. Call one of the three credit bureaus and request to place a fraud alert on your credit report.Review Your Credit Report.Document Everything.Consider Placing a Credit Freeze.File an Identity Theft Report.

Speak to an account representative at the deceased's bank and explain that you need to close an account. Provide the account representative with the name of the deceased as well as the account number and explain that the account owner has died.

File a claim with your identity theft insurance, if applicable. Notify companies of your stolen identity. File a report with the Federal Trade Commission. Contact your local police department.

Ways to Protect Yourself From Identity TheftPassword-Protect Your Devices.Use a Password Manager.Watch Out for Phishing Attempts.Never Give Out Personal Information Over the Phone.Regularly Check Your Credit Reports.Protect Your Personal Documents.Limit Your Exposure.08-Mar-2021