Chicago Illinois Stock Dividend — Resolution For— - Corporate Resolutions is a legal document used by corporations in Chicago, Illinois, to declare and approve the payment of stock dividends to their shareholders. This resolution form outlines the essential details of the stock dividend distribution, ensuring compliance with local laws and regulations. The Chicago Illinois Stock Dividend — Resolution For— - Corporate Resolutions typically includes information such as the corporation's name and address, the date of the resolution, and the details of the dividend payment. This form specifies the stock dividend's amount or percentage to be distributed, the record date on which shareholders must be registered to receive the dividend, and the payment date when the dividend will be distributed. By utilizing the Chicago Illinois Stock Dividend — Resolution For— - Corporate Resolutions, corporations ensure transparency and proper documentation of their dividend distribution process. This legal document protects the interests of both the corporation and its shareholders, as it serves as evidence of the decision to pay stock dividends and establishes the terms and conditions for their issuance. Different types of Chicago Illinois Stock Dividend — Resolution Form— - Corporate Resolutions may include variations based on the specific requirements or preferences of the corporation. Some variations may include additional clauses related to taxation, corporate governance, or shareholder rights. However, regardless of the specific type, the main purpose of these resolution forms remains constant — to authorize and regulate stock dividend payments. Overall, the Chicago Illinois Stock Dividend — Resolution For— - Corporate Resolutions is a vital tool for corporations in the region to formalize the process of declaring and disbursing stock dividends, ensuring proper documentation, adherence to regulations, and protection of shareholder interests.

Chicago Illinois Stock Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Chicago Illinois Stock Dividend - Resolution Form - Corporate Resolutions?

Whether you plan to open your business, enter into a deal, apply for your ID update, or resolve family-related legal issues, you must prepare certain paperwork meeting your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and verified legal templates for any individual or business case. All files are grouped by state and area of use, so opting for a copy like Chicago Stock Dividend - Resolution Form - Corporate Resolutions is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a few more steps to get the Chicago Stock Dividend - Resolution Form - Corporate Resolutions. Follow the instructions below:

- Make certain the sample fulfills your personal needs and state law regulations.

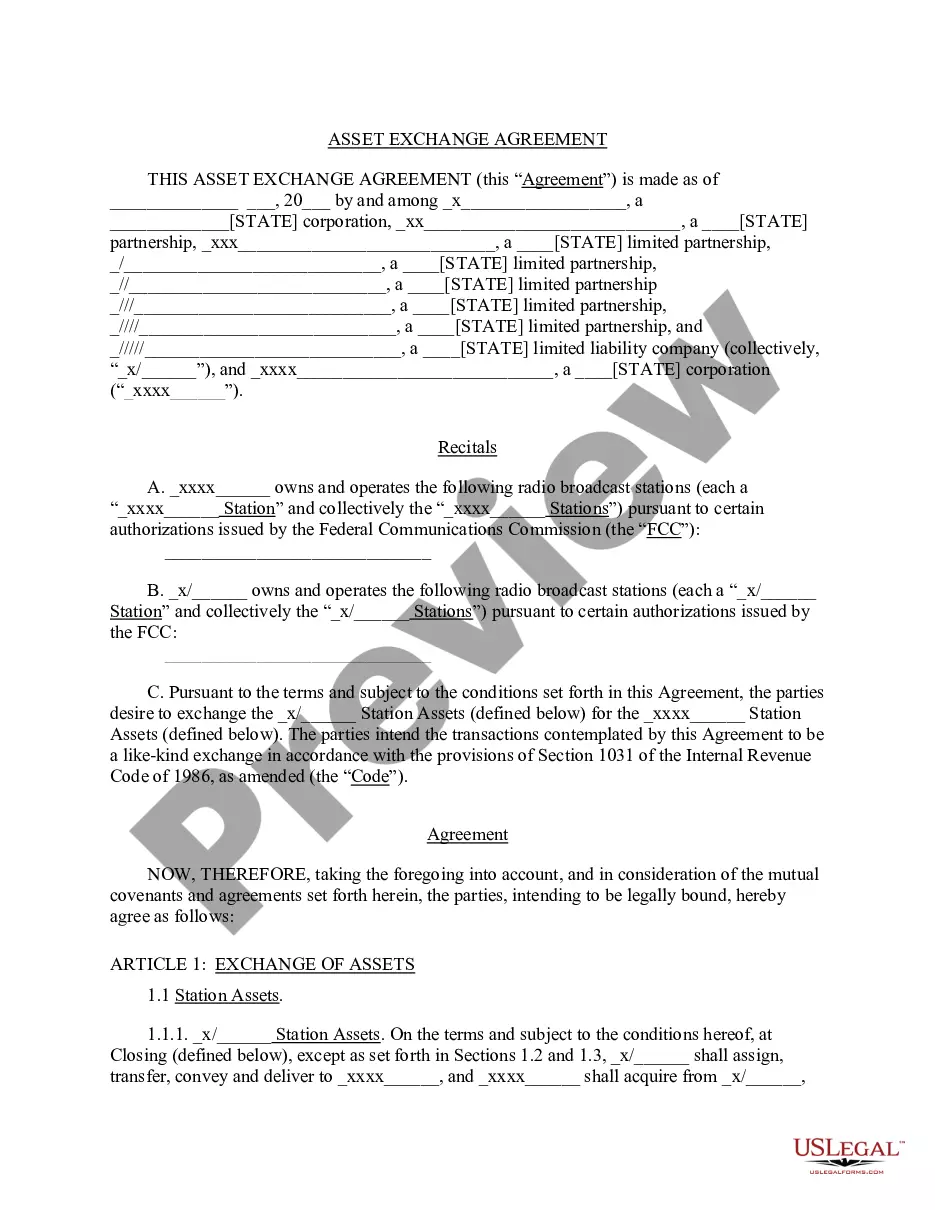

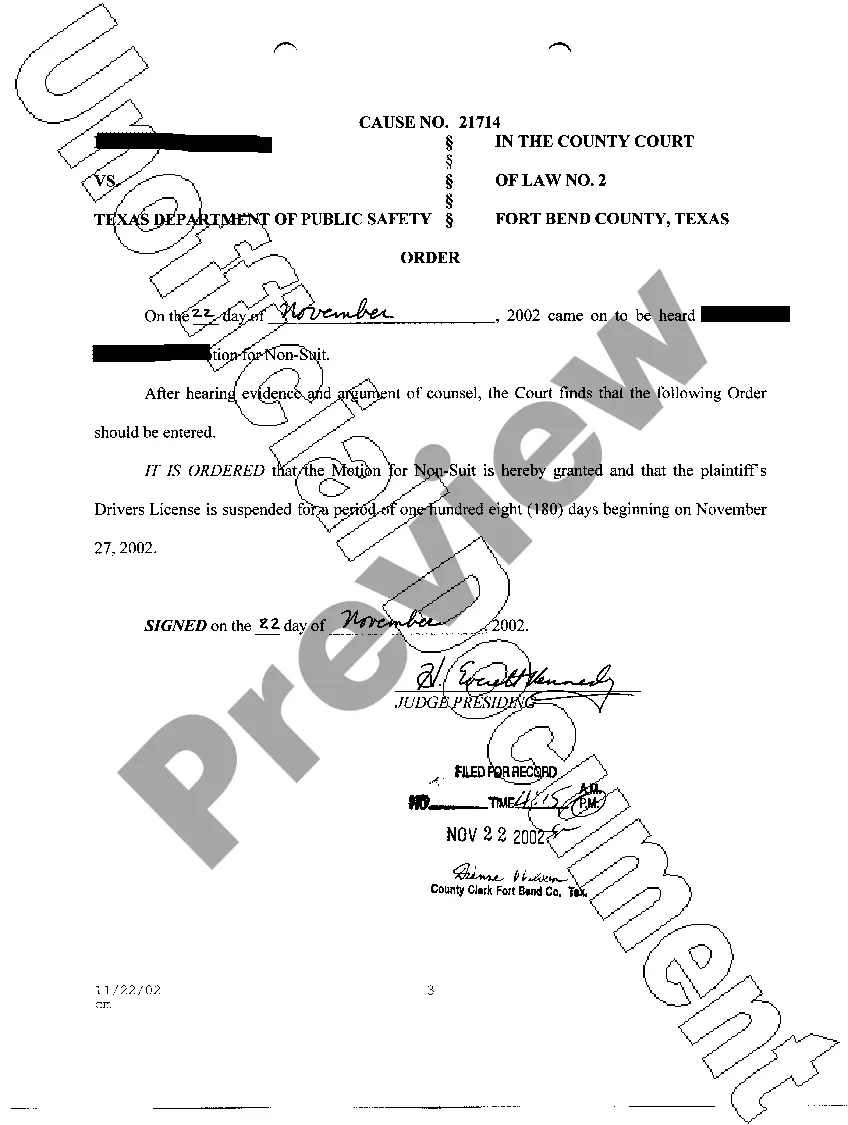

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to get the file once you find the proper one.

- Opt for the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Chicago Stock Dividend - Resolution Form - Corporate Resolutions in the file format you prefer.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form library!