Middlesex Massachusetts is a county located in the state of Massachusetts, United States. It is home to numerous businesses and corporations, many of which issue stock dividends to their shareholders. A stock dividend is a distribution of additional shares of stock to existing shareholders, typically in proportion to their existing holdings. This dividend can be in the form of additional common stock, preferred stock, or any other class of shares. To properly execute a stock dividend, a corporation often requires a Stock Dividend — Resolution Form, which is a document used to formally authorize and record the decision to issue stock dividends. This form outlines the details of the dividend, including the number and type of shares to be distributed, the record date on which shareholders must be registered to receive the dividend, and any other relevant information. Corporate Resolutions are legal documents created by a corporation's board of directors that serve as official declarations of the company's decisions or actions. In the case of stock dividends, the Stock Dividend — Resolution Form would be considered a type of corporate resolution specifically tailored to authorize and document the issuance of stock dividends. Different types of Middlesex Massachusetts Stock Dividend — Resolution Form— - Corporate Resolutions may include: 1. Common Stock Dividend Resolution: This type of resolution form is used when a corporation decides to distribute additional common stock to its shareholders as a dividend. 2. Preferred Stock Dividend Resolution: In some cases, a corporation may issue additional shares of preferred stock as a dividend, which requires a Preferred Stock Dividend Resolution Form to authorize this action. 3. Class-Specific Stock Dividend Resolution: If a corporation has multiple classes of stock, such as Class A, Class B, or Class C, and decides to distribute dividends in a class-specific manner, a Class-Specific Stock Dividend Resolution Form may be used to outline the details of the dividend for each class. 4. Cumulative Stock Dividend Resolution: This type of resolution form applies when a corporation declares a stock dividend that accumulates or compounds over time, providing additional shares to shareholders based on the number of shares they already own. It is essential for corporations to complete and file these Stock Dividend — Resolution Form— - Corporate Resolutions correctly to ensure compliance with applicable laws and regulations. Shareholders benefit from having a clear understanding of the dividend distribution and any related implications for their investment.

Middlesex Massachusetts Stock Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Middlesex Massachusetts Stock Dividend - Resolution Form - Corporate Resolutions?

Laws and regulations in every sphere differ from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Middlesex Stock Dividend - Resolution Form - Corporate Resolutions, you need a verified template legitimate for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal templates. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you purchase a sample, it remains available in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Middlesex Stock Dividend - Resolution Form - Corporate Resolutions from the My Forms tab.

For new users, it's necessary to make some more steps to get the Middlesex Stock Dividend - Resolution Form - Corporate Resolutions:

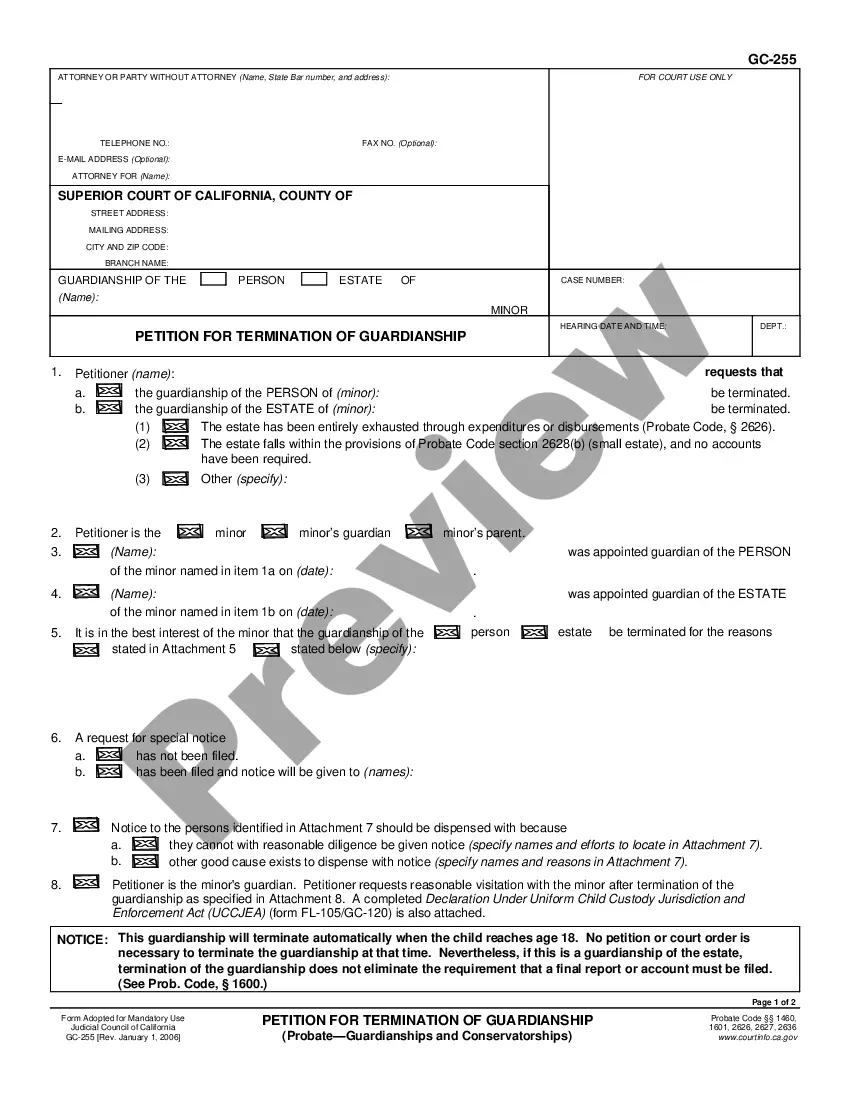

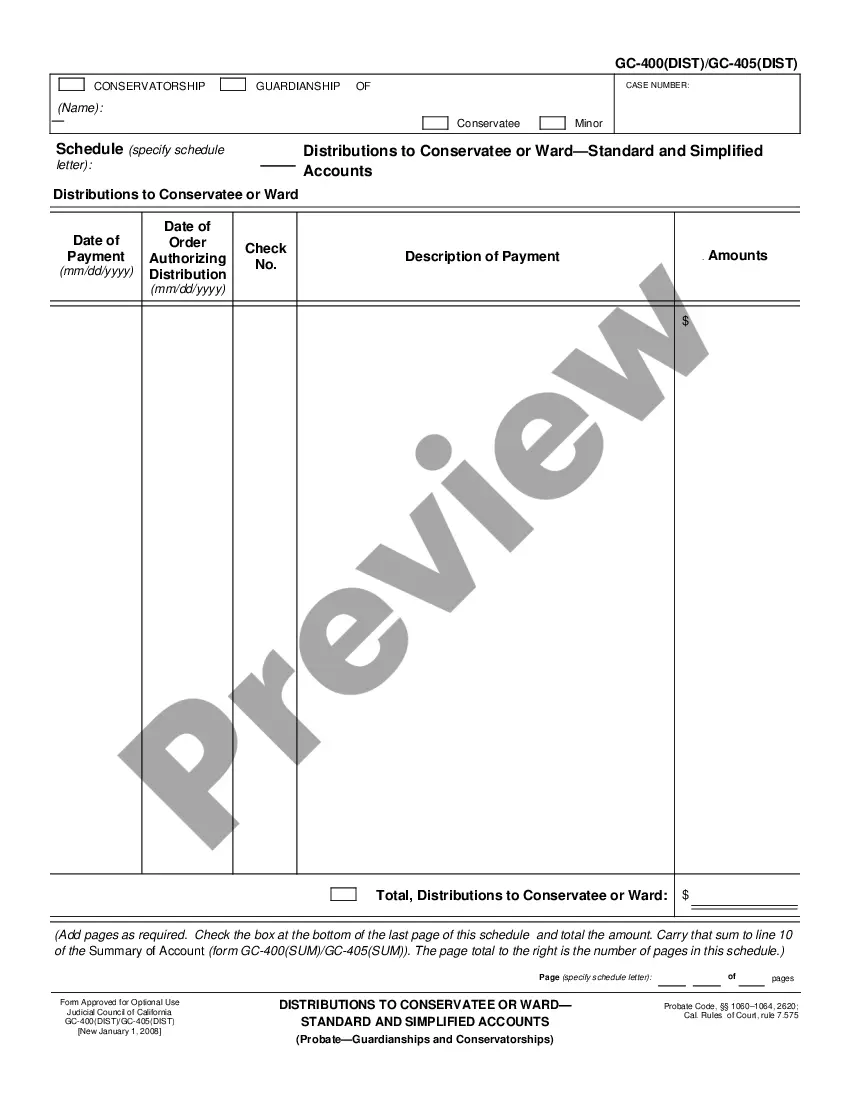

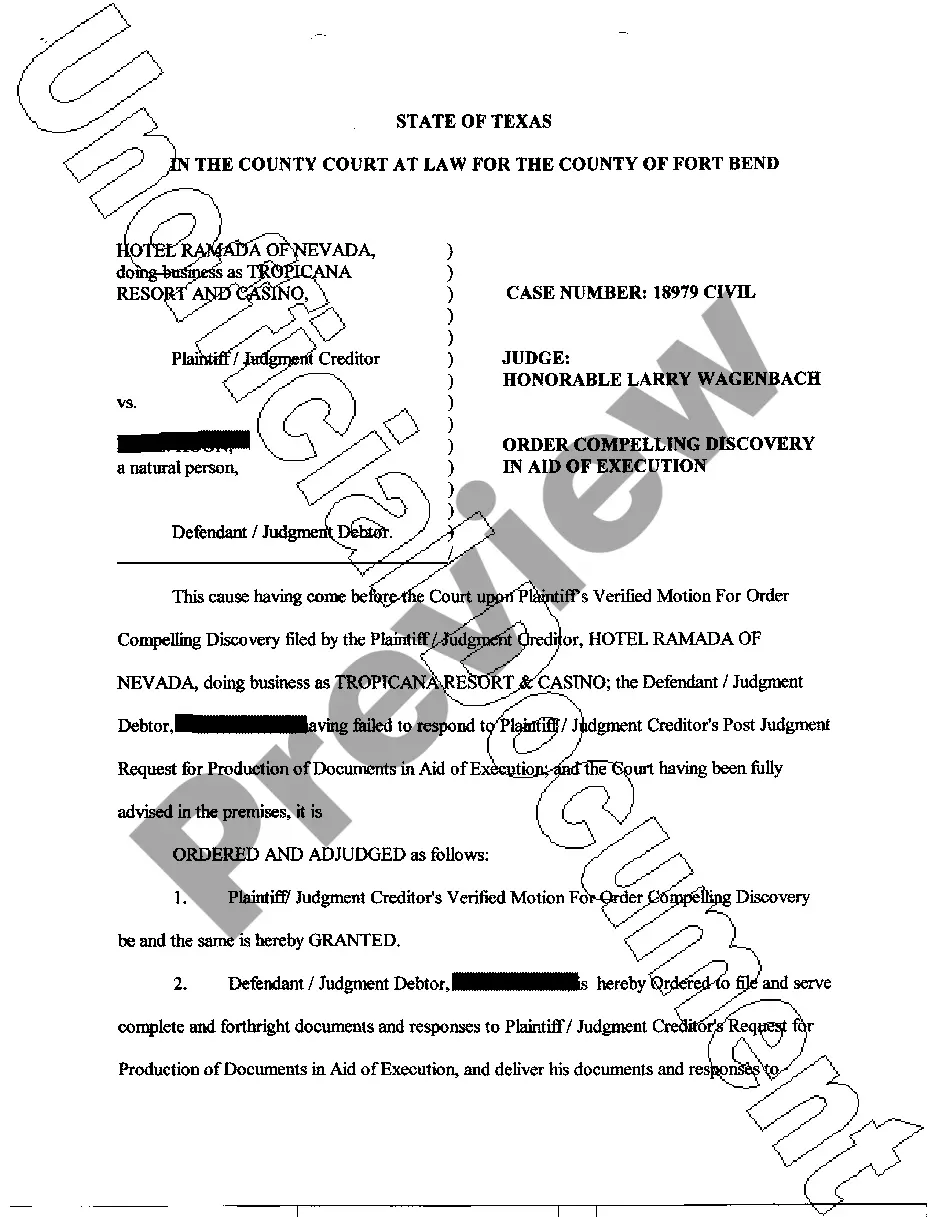

- Analyze the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the document when you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

12. Hold the annual general meeting and pass an ordinary resolution declaring the payment of dividend to the shareholders of the company as per recommendation of the Board. The shareholders cannot declare the final dividend at a rate higher than the one recommended by the Board.

12. Hold the annual general meeting and pass an ordinary resolution declaring the payment of dividend to the shareholders of the company as per recommendation of the Board. The shareholders cannot declare the final dividend at a rate higher than the one recommended by the Board.

A corporate resolution form is used when a corporation wants to document major decisions made during the year. It is especially important when decisions made by a corporation's directors or shareholders are in written form. 1. Steps for Writing a Corporate Resolution.

DIVI. 10. This template written resolution is the written resolution that must be sent to the shareholders so that they can declare a final dividend following its recommendation by the directors at a board meeting.

The directors of a company will pass a resolution at a meeting of the directors or by a resolution signed by all of the directors declaring a dividend to the shareholders of a specific class of shares.

A corporate resolution is a written document created by the board of directors of a company detailing a binding corporate action. A corporate resolution is the legal document that provides the rules and framework as to how the board can act under various circumstances.

Generally, a corporate resolution is created, voted upon, and signed at a corporate meeting. The resolution will then be detailed in the meeting minutes including information about whether the resolution was approved or voted down.

Examples of Actions that Need Corporate ResolutionsApproval of new board members and officers. Acceptance of the corporate bylaws. Creation of a corporate bank account. Designating which board members and officers can access the bank account.

A corporate resolution is a document that formally records the important binding decisions into which a company enters. These decisions are made by such stakeholders as the corporation's managers, directors, officers or owners.