Chicago, Illinois Letter to Credit Card Companies and Financial Institutions Notifying Them of Death: A Comprehensive Guide Introduction: Losing a loved one is an incredibly challenging and emotionally difficult time. Apart from dealing with the grieving process, there is also a need to manage the deceased person's financial affairs. One crucial aspect involves notifying credit card companies and financial institutions about the individual's death. In this comprehensive guide, we will provide a detailed description of what a Chicago, Illinois letter to credit card companies and financial institutions notifying them of death should contain. We will also highlight different types of such letters that may be required based on specific circumstances. Key Keywords: Chicago, Illinois; letter; credit card companies; financial institutions; death. 1. General Format and Information: When drafting a letter to credit card companies and financial institutions, the following components are crucial to include: — The deceased individual's full name, address, and date of birth — The date of death and the location where it occurred — A reference to the death certificate, which should be attached to the letter — Executor or administrator's name and contact information — The account number associated with the deceased person — In case of joint accounts, mention the co-account holders and their relation to the deceased — A request for funeral/memorial expenses to be paid from the accounts, if applicable — Request to freeze the accounts and stop any additional charges — Reminder to cancel any automatic payments or direct debits associated with the accounts — A deadline for the institution's response and acknowledgment of the letter — Enclosure of a copy of the death certificate and any other supporting documents — Expressing gratitude for their prompt attention and sensitivity towards the matter 2. Different Types of Chicago, Illinois Letters: Based on the specific scenarios, different types of letters may need to be sent to credit card companies and financial institutions. These include: a) Individual Credit Card/Accounts: When an individual has solo credit card or accounts, a letter solely addressing their accounts should be sent, following the general format mentioned above. b) Joint Credit Card/Accounts: In the case of accounts jointly held by the deceased and another individual, a different letter should be drafted. This letter should mention the co-account holder's name, contact information, and their relation to the deceased. Additionally, the instructions about freezing the account, stopping any charges, and canceling automatic payments should remain the same. c) Authorized User Credit Card/Accounts: If the deceased person was an authorized user on someone else's credit card or accounts, the letter should specify that the deceased has no independent responsibilities or liabilities concerning the account. Include the account owner's name, contact information, and the respective account details. d) Business Credit Card/Accounts: In instances where the deceased held credit cards or accounts related to a business, a separate letter must be sent. It should include the business's legal name, address, and relevant account details. Additionally, provide your role as the executor or administrator, along with your contact information for any necessary correspondence. Conclusion: Dealing with the various financial aspects after someone's passing is essential to ensure a smooth transition and prevent any unauthorized access or misuse of accounts. By following the general format and addressing the specific types of credit card or accounts, the Chicago, Illinois letter to credit card companies and financial institutions notifying them of death can effectively communicate the necessary information. Remember, maintaining open communication and providing all required documentation is vital in streamlining the process during such a difficult time.

Chicago Illinois Letter to Credit Card Companies and Financial Institutions Notifying Them of Death

Description

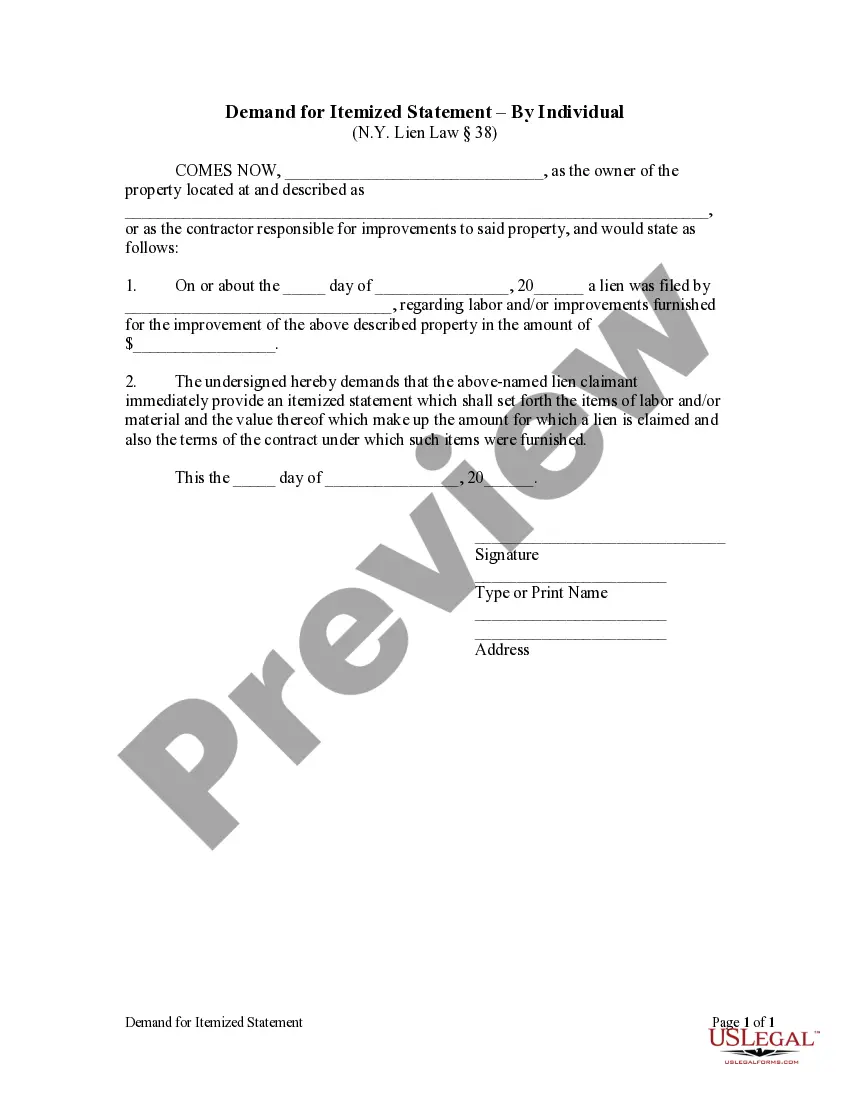

How to fill out Chicago Illinois Letter To Credit Card Companies And Financial Institutions Notifying Them Of Death?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask an attorney to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Chicago Letter to Credit Card Companies and Financial Institutions Notifying Them of Death, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario gathered all in one place. Consequently, if you need the latest version of the Chicago Letter to Credit Card Companies and Financial Institutions Notifying Them of Death, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Chicago Letter to Credit Card Companies and Financial Institutions Notifying Them of Death:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Chicago Letter to Credit Card Companies and Financial Institutions Notifying Them of Death and save it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!