Title: Phoenix, Arizona Letter to Creditor, Collection Agencies, Credit Issuer, or Utility Company Notifying Them of a Death Introduction: This detailed description provides important information on writing a letter to notify creditors, collection agencies, credit issuers, or utility companies in Phoenix, Arizona of a deceased individual. It covers the purpose, essential elements, best practices, and different types of such letters. 1. Purpose of the Letter: A Phoenix, Arizona Letter to Creditor, Collection Agencies, Credit Issuer, or Utility Company Notifying Them of a Death serves to inform the relevant entity about the demise of an account holder or customer. It requests the freezing of the account, suspension of ongoing services, and provides necessary information for account settlement. 2. Essential Elements of the Letter: a. Header: Include the full name and contact information of the deceased individual's legal representative or next of kin. b. Date: Clearly state the date the letter is being written to establish a timeline for reference. c. Recipient Information: Provide the name and contact details of the creditor, collection agency, credit issuer, or utility company as accurately as possible. d. Subject: Briefly mention the purpose of the letter, e.g., "Notification of Death and Account Settlement." e. Deceased Individual's Details: Mention the full name, account number, and any other relevant identification details of the deceased account holder. f. Date and Cause of Death: Provide the date and cause of the individual's passing, if available. g. Supporting Documents: Enclose necessary documents, including a certified death certificate and a copy of the representative's authority (e.g., executor, administrator, next of kin). h. Request for Account Actions: Clearly state the desired actions, such as freezing the account, discontinuing services, or transferring the responsibility to another party. i. Contact Information: Include the representative's contact information for further communication and ensuring a smooth process. j. Closing and Signature: End the letter with a professional closing and signature of the representative. 3. Best Practices for Writing the Letter: a. Use a polite and respectful tone throughout the letter. b. Be concise and clear, specifying the required actions precisely. c. Include all relevant details and supporting documents to avoid any delays. d. Maintain a professional format and language. e. Send the letter via certified mail or registered post to ensure proper tracking and record-keeping. 4. Types of Phoenix, Arizona Letters to Creditor, Collection Agencies, Credit Issuer, or Utility Company Notifying Them of Death: a. Credit Card Notifying Death Letter: To inform credit card companies about the account holder's demise and request account closure. b. Loan Provider Death Notification Letter: To inform lenders about the individual's passing and initiate discussions regarding settlement or transfer of responsibility. c. Utility Company Death Notification Letter: To alert utility companies of the individual's death and to discontinue services, transfer responsibility, or arrange for final billing. d. Collection Agency Death Notification Letter: To notify collection agencies about the deceased's account and request ceasing of collection efforts. e. Additional specialized letters may be required based on specific creditors, issuers, or companies involved. Conclusion: Writing a proper Phoenix, Arizona Letter to Creditor, Collection Agencies, Credit Issuer, or Utility Company Notifying Them of a Death is crucial for ensuring a smooth transition and resolving account matters after an individual's passing. By adhering to the provided guidelines and including all relevant information, representatives can ensure that the necessary actions are taken promptly.

Phoenix Arizona Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death

Description

How to fill out Phoenix Arizona Letter To Creditor, Collection Agencies, Credit Issuer Or Utility Company Notifying Them Of Death?

Drafting documents for the business or individual demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it burdensome and time-consuming to draft Phoenix Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death without expert help.

It's easy to avoid wasting money on lawyers drafting your documentation and create a legally valid Phoenix Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death by yourself, using the US Legal Forms web library. It is the most extensive online collection of state-specific legal templates that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the required document.

In case you still don't have a subscription, follow the step-by-step guideline below to obtain the Phoenix Letter to Creditor, Collection Agencies, Credit Issuer or Utility Company Notifying Them of Death:

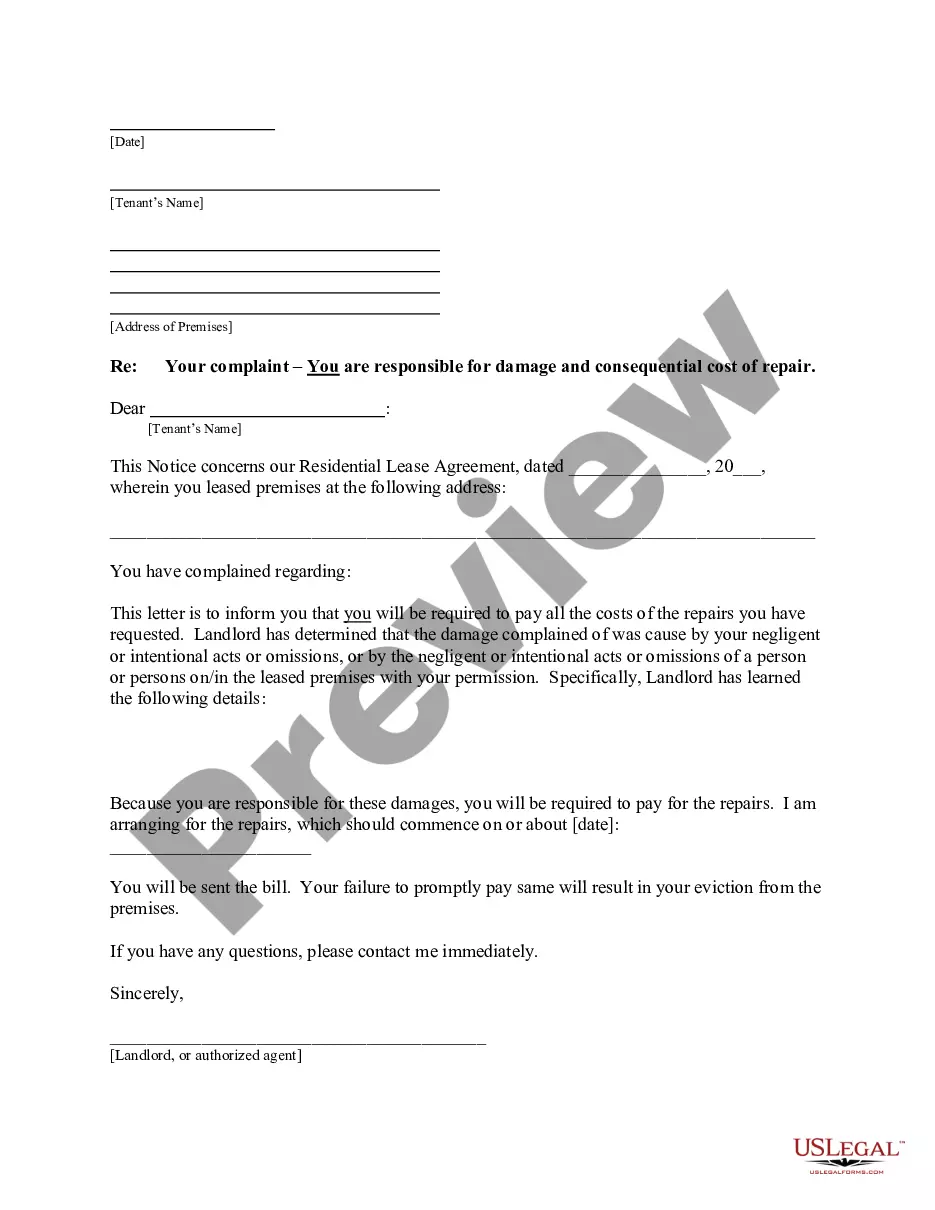

- Examine the page you've opened and check if it has the sample you require.

- To accomplish this, use the form description and preview if these options are available.

- To locate the one that meets your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal templates for any scenario with just a few clicks!

Form popularity

FAQ

Collectors can discuss the debt with the deceased person's spouse, parent (if the deceased was a minor child), guardian, executor or administrator, or any other person authorized to pay debts with assets from the estate. The debt collector may not talk to anyone else about these debts.

For instance, "(Deceased) has passed away leaving no assets behind. I apologize for the inconvenience, but there is no money or assets to liquidate to pay this debt. Please do not contact me in regard to this matter; I am not responsible for this debt because (give reason)."

No, when someone dies owing a debt, the debt does not go away. Generally, the deceased person's estate is responsible for paying any unpaid debts. When a person dies, their assets pass to their estate. If there is no money or property left, then the debt generally will not be paid.

It's possible to negotiate the credit card debt of a deceased person if you're legally responsible for paying the debt. That means you must be the executor or the administrator of the estate, a cosigner or joint account holder on the credit card, or a surviving spouse in a community property state.

After you die, the following four parties could become responsible for your debts:Co-signers on a loan.Joint owners or account holders.Spouses in community property states: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin.More items...

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

Being a personal representative means you can use estate assets to settle your loved one's debts, after making payments to survivors according to state law. Generally, no one else is required to pay the debts of someone who died, unless it is a shared debt.

The purpose of this letter is to inform you of the death of full name. I am requesting that you list a formal notification of death in his/her credit file and that you notify the other credit bureaus. My name is full name. I am the deceased's state your relationship.

What debt is forgiven when you die? Most debts have to be paid through your estate in the event of death. However, federal student loan debts and some private student loan debts may be forgiven if the primary borrower dies.

Generally, the deceased person's estate is responsible for paying any unpaid debts. The estate's finances are handled by the personal representative, executor, or administrator. That person pays any debts from the money in the estate, not from their own money.

Interesting Questions

More info

Information. Rules of the Office for Judicial Complaints. See section 9 for information. The Financial Consumer Agency Oversight Office (FOLIO). Regulation No 11 (Consumer Credit Contracts — Fair Credit Disclosure, Rules) [Rule No 12] [2014.23]. FOLIO regulations are available online at:. Money Order Rules (MRS 921,000). This statute attempts to allow consumers to assert defenses for goods or services acquired. Money Order Dispute Resolution Guide Money Transmitters, Money Service Businesses, and Money Transmitter Agents. Regulation No 11 (Consumer Credit Contracts — Fair Credit Disclosure, Rules) [Rule No 12] [2013.40]. Money Transmitter Agencies. Regulation No 11 (Consumer Credit Contracts — Fair Credit Disclosure, Rules) [Rule No 12] [2013.40]. Rules for Money Service Businesses Money Transmitters and Money Service Businesses: Rules of the Financial Conduct Authority for Money Service Businesses [RFS MBR.2014.13].

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.