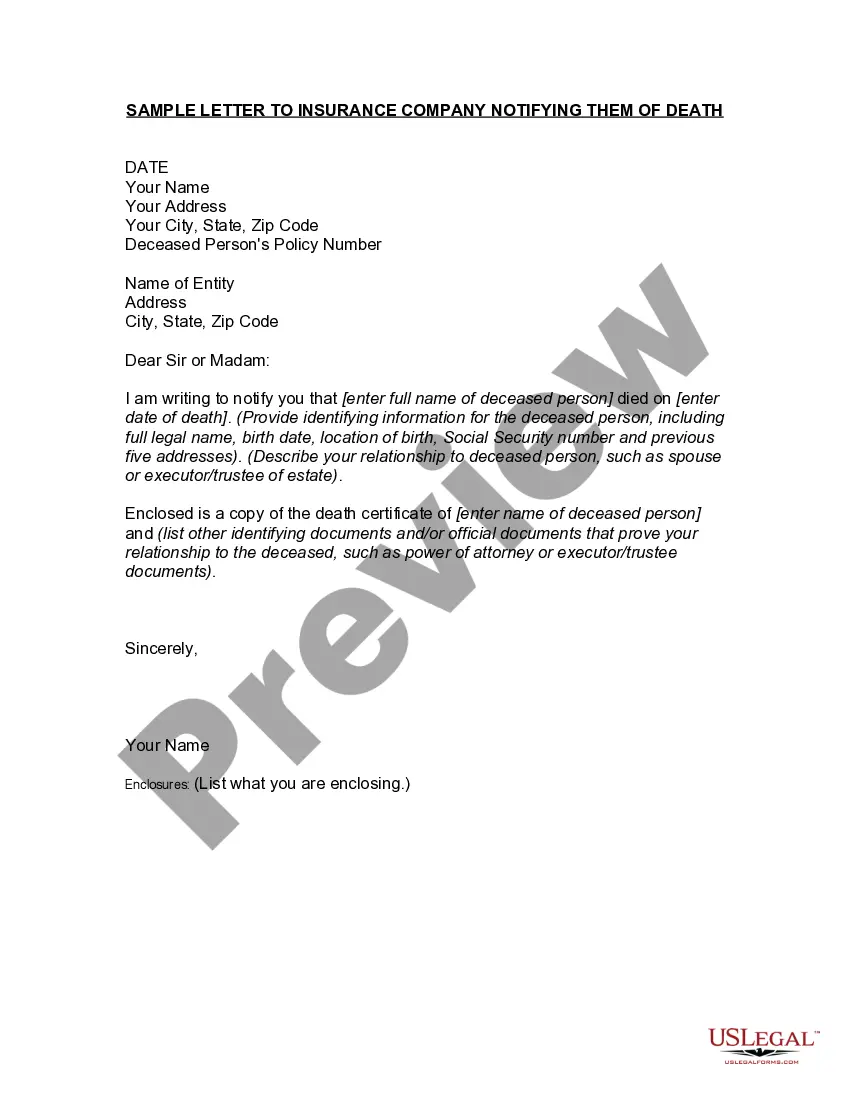

Title: Hennepin Minnesota Letter to Insurance Company Notifying Them of Death: Writing a Comprehensive Notification Introduction: In the unfortunate event of a policyholder's passing, it is crucial to inform their insurance company promptly and efficiently. This article provides a detailed description of writing a Hennepin Minnesota letter to an insurance company notifying them of an insured person's death. We will cover the essential components, required information, and crucial keywords to include. 1. Purpose and Importance: The purpose of this letter is to officially inform the insurance company of the policyholder's demise. This notification ensures that the necessary steps are taken promptly, such as ceasing coverage, initiating payouts, and settling outstanding claims. Timely communication is vital to streamline the overall claim process effectively. 2. Composing the Letter: — Salutation: Begin the letter with a respectful salutation such as "Dear [Insurance Company's Name] Claims Department" or "To Whom It May Concern." — Policyholder's Information: Clearly state the deceased policyholder's full name, policy number, and date of death. — Relationship: Mention your relationship with the deceased, confirming your authority to inform the insurer. — Supporting Documents: List essential documents attached, such as the death certificate, policy contract, and any other required documentation specified by the insurer. — Contact Information: Provide your contact details, including full name, address, phone number, and email, for any follow-up inquiries. 3. Keywords to Include: To ensure the insurance company effectively identifies and processes the letter, incorporate relevant keywords such as: — Hennepin Minnesota: Mention the specific county and state to ensure accurate processing, as jurisdictional differences may apply. — Letter of Notification: Clearly indicate that the purpose of the letter is to inform the insurance company about the policyholder's death. — Policyholder's Full Name: Provide the deceased's complete legal name as it appears on the insurance policy. — Insurance Policy Number: Include the policy number to streamline identification and avoid confusion. — Date of Death: Highlight the exact date on which the policyholder passed away for accurate record-keeping. — Supporting Documents: Emphasize the importance of attaching necessary documents like the death certificate and policy contract to facilitate the claims process. Types of Hennepin Minnesota Letters to Insurance Company Notifying Them of Death: 1. Life Insurance Policy Notification: Informing the insurer about the policyholder's death and beginning the claims process. 2. Health Insurance Policy Notification: Updating the insurance company of the policyholder's demise to terminate coverage and address any outstanding claims. 3. Auto Insurance Policy Notification: Notifying the insurer of a deceased policyholder to update ownership or remove their name from the policy, if applicable. 4. Homeowners' Insurance Policy Notification: Informing the insurance company of a policyholder's death to address property coverage and potential claims. Conclusion: Writing a detailed Hennepin Minnesota letter to an insurance company notifying them of a policyholder's death requires careful attention to include relevant keywords and accurate information. By following the guidelines provided in this article, you can ensure efficient communication, prompt response, and a smoother claims process during a challenging time.

Hennepin Minnesota Letter to Insurance Company Notifying Them of Death

Description

How to fill out Hennepin Minnesota Letter To Insurance Company Notifying Them Of Death?

How much time does it usually take you to create a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Hennepin Letter to Insurance Company Notifying Them of Death suiting all local requirements can be tiring, and ordering it from a professional attorney is often pricey. Many online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online catalog of templates, collected by states and areas of use. Aside from the Hennepin Letter to Insurance Company Notifying Them of Death, here you can find any specific form to run your business or personal affairs, complying with your regional requirements. Experts check all samples for their actuality, so you can be sure to prepare your documentation properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can pick the file in your profile at any moment in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you get your Hennepin Letter to Insurance Company Notifying Them of Death:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Hennepin Letter to Insurance Company Notifying Them of Death.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!