Hillsborough County, located in Florida, is an expansive area known for its vibrant community and rich history. This county is home to numerous cities and towns, including Tampa, the county seat and largest city in Hillsborough. A Hillsborough Florida Letter to Insurance Company Notifying Them of Death is a formal document that serves as a notification to an insurance company, informing them about the passing of an insured individual. This letter helps initiate the process of making claims, accessing policy benefits, and settling any outstanding affairs associated with the deceased policyholder. When it comes to different types of Hillsborough Florida Letters to Insurance Company Notifying Them of Death, there may be variations based on specific policies and circumstances. Here are a few examples: 1. Hillsborough Florida Life Insurance Death Notification Letter: This type of letter is used to inform the insurance company about the death of an individual who held a life insurance policy. 2. Hillsborough Florida Health Insurance Death Notification Letter: In case of the insured's demise, a letter of this nature is sent to the health insurance provider to intimate them about the situation. 3. Hillsborough Florida Auto Insurance Death Notification Letter: If the deceased individual was the primary policyholder of an auto insurance policy, this letter notifies the insurance company regarding their passing and allows necessary actions to be taken, such as transferring coverage to another individual. 4. Hillsborough Florida Homeowners Insurance Death Notification Letter: This type of letter is used to inform the insurance company about the demise of a homeowner who held an active insurance policy for their property, providing necessary information for updating the policy accordingly. 5. Hillsborough Florida Travel Insurance Death Notification Letter: When the insured person passes away while traveling and holds a travel insurance policy, this letter serves to notify the insurance company and initiate the claims process. In all Hillsborough Florida Letters to Insurance Company Notifying Them of Death, it is crucial to include relevant details, such as the policyholder's full name, policy number, date of death, cause of death (if available), and any additional necessary information requested by the insurance company. The letter should be concise, clear, and respectful, maintaining a professional tone throughout.

Hillsborough Florida Letter to Insurance Company Notifying Them of Death

Description

How to fill out Hillsborough Florida Letter To Insurance Company Notifying Them Of Death?

Drafting paperwork for the business or individual needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to generate Hillsborough Letter to Insurance Company Notifying Them of Death without expert help.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Hillsborough Letter to Insurance Company Notifying Them of Death on your own, using the US Legal Forms web library. It is the greatest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the needed document.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Hillsborough Letter to Insurance Company Notifying Them of Death:

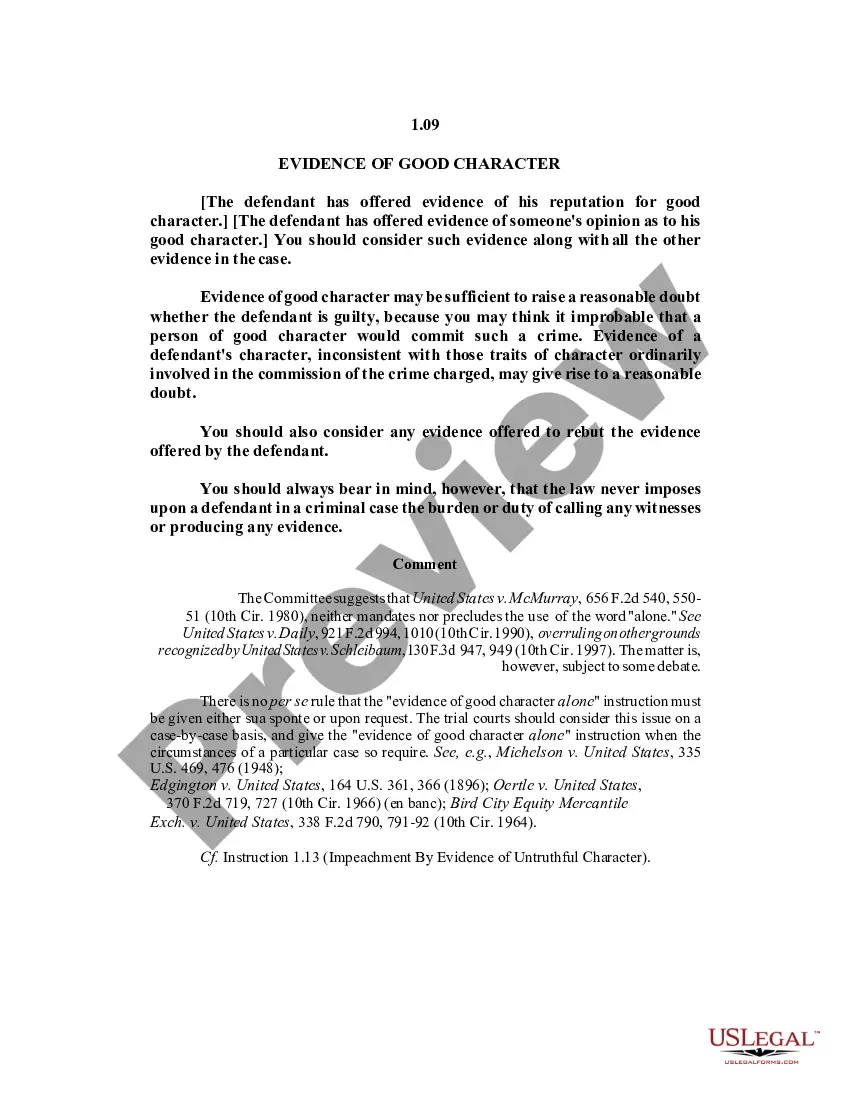

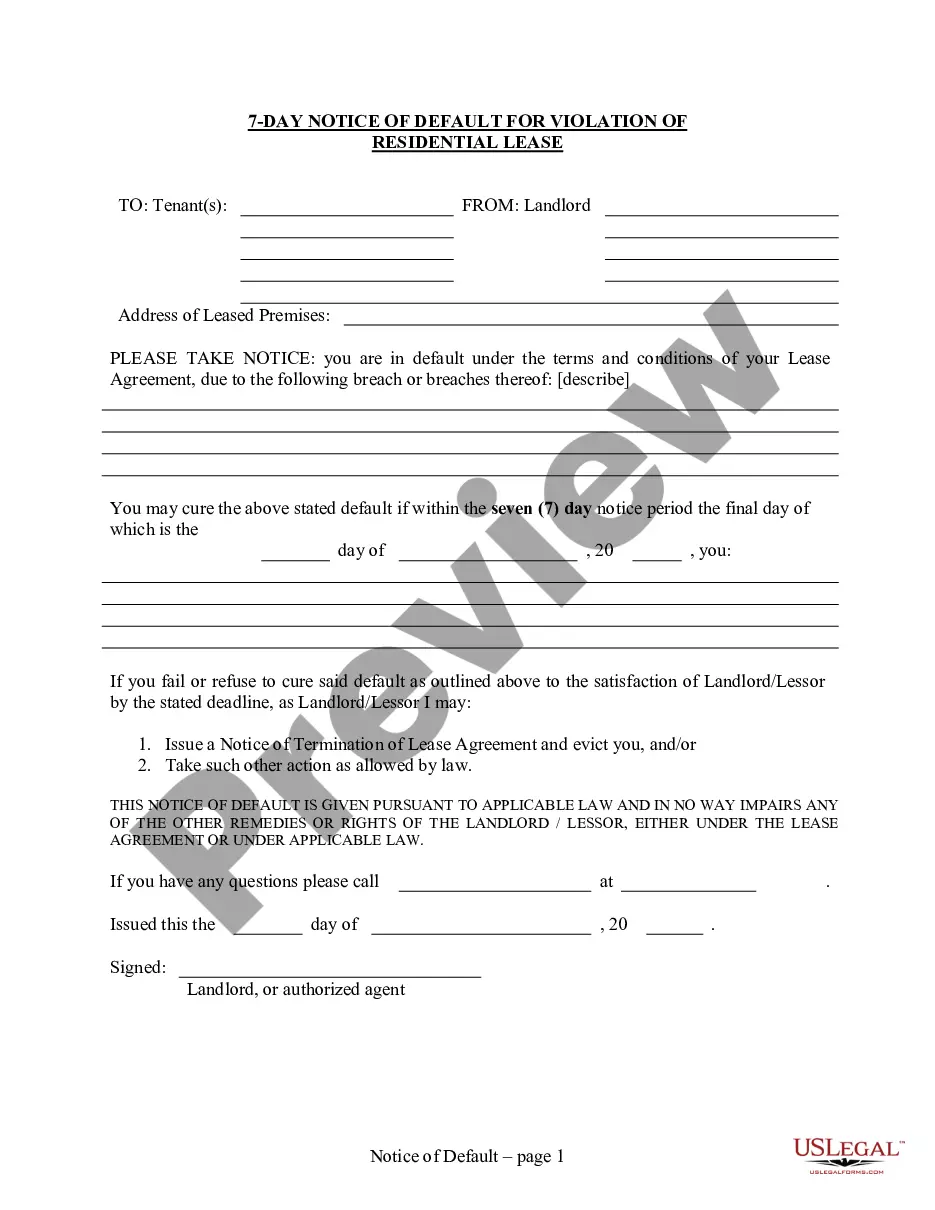

- Examine the page you've opened and verify if it has the document you need.

- To do so, use the form description and preview if these options are available.

- To locate the one that suits your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any situation with just a few clicks!

Form popularity

FAQ

If the current policyholder dies, what happens to the policy? If the person who owns the car insurance policy dies, technically, the policy ends and is no longer valid. However, if there is more than one name on the policy, then the other party must inform the insurance company as soon as possible.

Key Takeaways. There is usually no time limit on life insurance death benefits, so you don't have to worry about filling a claim too late. To file a claim, you can call the company or, in many cases, start the process online.

Life insurance companies generally offer a payment grace period" of around 30 or 31 days. Your coverage continues as long as you pay the amount owed within the grace period. If you die during the grace period without paying the bill, your beneficiary will receive the death benefit, minus the money you owe.

Most insurance companies have terms that allow a surviving spouse to retain their current car insurance policy. The car insurance policy can be passed on to the surviving spouse or estate executor after notifying the insurance company of the policyholder's death.

Life insurance companies typically do not know when a policyholder dies until they are informed of his or her death, usually by the policy's beneficiary. Even if a policy is in a premium-paying stage and the payments stop, the insurance company has no reason to assume that the insured has died.

Call the insurance company: Contact the insurance company and let them know that the policyholder has passed away and that you would like to cancel their policy. If you are also insured on the policy, they may ask if you want to keep the policy and become the primary policyholder.

Life insurance benefits are typically paid when the insured party dies. Beneficiaries file a death claim with the insurance company by submitting a certified copy of the death certificate.

While there is no time limit for claiming life insurance death benefits, life insurance companies do have time limits they must adhere to when it comes to paying out claims. It is usually very uncommon for large companies to not pay within 30 days of an insured individual's death.

Life insurance is a contract between you and an insurance company. Essentially, in exchange for your premium payments, the insurance company will pay a lump sum known as a death benefit to your beneficiaries after your death. Your beneficiaries can use the money for whatever purpose they choose.