Title: Understanding San Bernardino, California: A Comprehensive Guide to Writing a Death Notification Letter to an Insurance Company Introduction: San Bernardino, California, is a diverse city located in the Inland Empire region of Southern California. Known for its stunning natural beauty, rich cultural heritage, and bustling economy, San Bernardino serves as a vibrant hub for residents and businesses alike. When faced with the unfortunate task of notifying an insurance company of a policyholder's death, it is important to approach the process with sensitivity and clarity. This letter serves as a guide to assist you in crafting a detailed notification to the insurance company, ensuring that your communication includes all essential information. Below, we will discuss different situations that may require such a letter and provide relevant keywords to help you create a comprehensive and effective document. I. Death Announcements and Insurance Notifications 1. Death Announcement Letter to Insurance Company 2. Life Insurance Death Claim Notification 3. Accidental Death Insurance Notification Letter 4. Permanent Life Insurance Policy Claim Letter 5. Universal Life Insurance Policy Notification of Death II. Understanding San Bernardino, California San Bernardino's Unique Characteristics: 1. Cultural Diversity: — Demographics in San Bernardino, California — Multicultural Community of San Bernardino 2. Natural Beauty: — San Bernardino National Forest Attractions — Outdoor Recreational Activities in San Bernardino 3. Economic Significance: — Thriving Business Scene in San Bernardino, California — San Bernardino's Industries and Job Market III. Crafting a Detailed Death Notification Letter 1. Identify the Insurance Policy: — Policy Number, Beneficiary Designation, and Policy Type — Relevant Keywords: Insurance policy, Beneficiary, Policy number 2. State the Purpose and Relationship to the Policyholder: — Keywords: Death notification, Beneficiary, Relationship 3. Provide Decedent's Information: — Full name, Date of birth, Date of death, Social Security Number — Keywords: Deceased individual, Personal information, Dates 4. Attach the Certified Death Certificate: — Bodily Injury or Accident insurance claim — Social Security Number 5. Request Necessary Claim Forms: — Keywords: Claim forms, Documentation, Required documents 6. Provide Contact Information: — Keywords: Contact details, Phone number, Mailing address 7. Deadline for Submission and Response: — Keywords: Claim submission deadline, Response timeframe, Timely manner Conclusion: Writing a thoughtful and detailed death notification letter is crucial when informing an insurance company of the passing of a policyholder. By including the appropriate keywords and important details about the deceased, the policy, and necessary documentation, you can ensure efficient communication with the insurance company during this difficult time. San Bernardino, California's diverse and dynamic characteristics further enrich the context surrounding the letter, demonstrating the unique aspects of the city and potentially providing perspective for the insurance company.

San Bernardino California Letter to Insurance Company Notifying Them of Death

Description

How to fill out San Bernardino California Letter To Insurance Company Notifying Them Of Death?

A document routine always accompanies any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare official documentation that differs throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and get a document for any personal or business purpose utilized in your region, including the San Bernardino Letter to Insurance Company Notifying Them of Death.

Locating samples on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the San Bernardino Letter to Insurance Company Notifying Them of Death will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to get the San Bernardino Letter to Insurance Company Notifying Them of Death:

- Ensure you have opened the right page with your localised form.

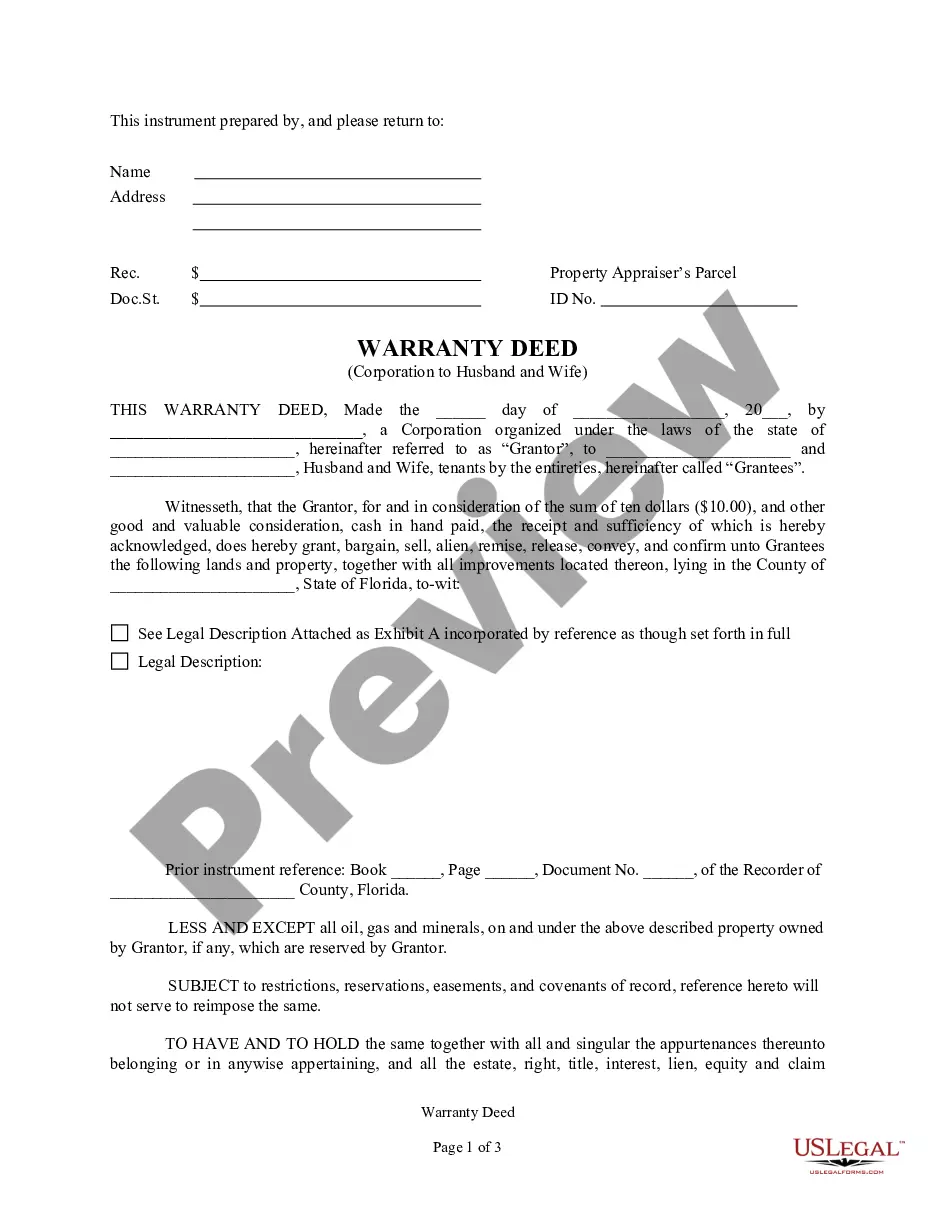

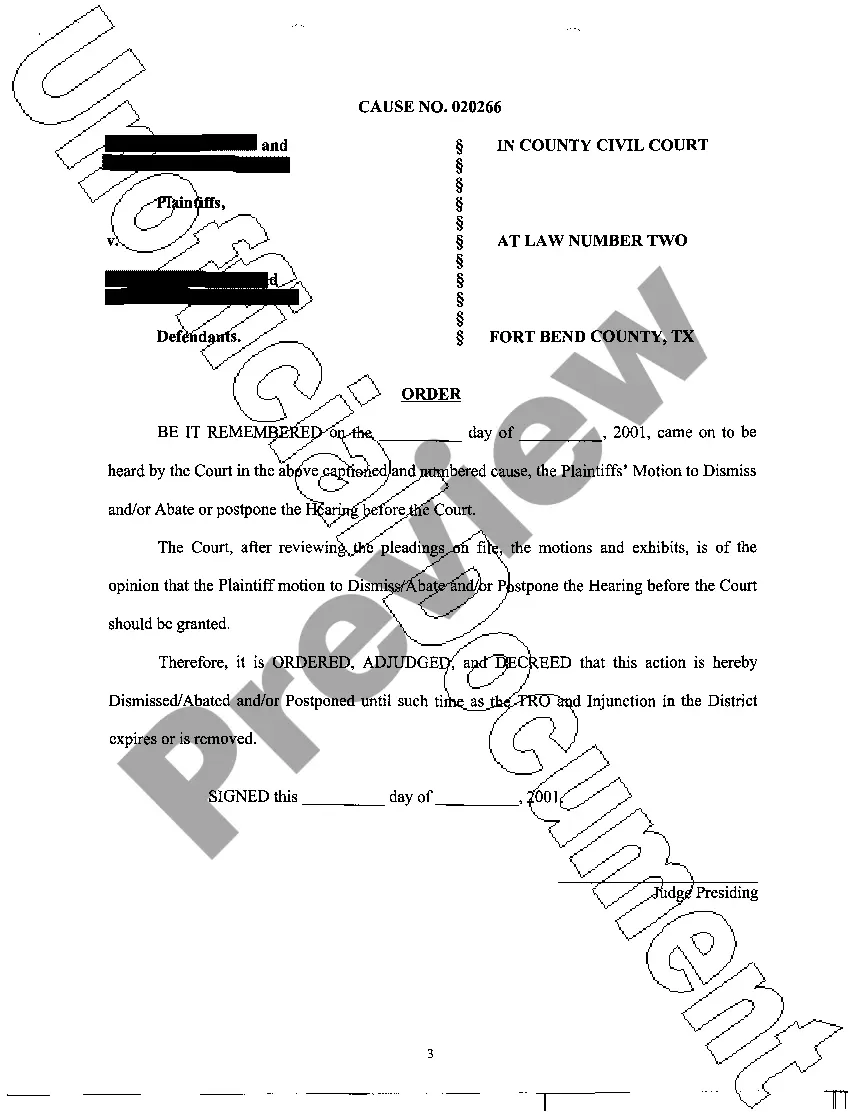

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the San Bernardino Letter to Insurance Company Notifying Them of Death on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!