Alameda California is a vibrant city located in Alameda County, California, known for its beautiful coastal views, diverse community, and historical significance. It is situated on Alameda Island and benefits from a mild Mediterranean climate. With a population of approximately 78,000 residents, Alameda offers a high quality of life with its numerous parks, recreational facilities, and thriving local businesses. Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft: Subject: Urgent Notice Regarding Known Imposter Identity Theft — Alameda, California Resident Dear Credit Issuer, I am writing this letter as a victim of identity theft, with the unfortunate experience of a known imposter attempting to defraud me. I am a resident of Alameda, California, and have recently discovered suspicious activities on my credit report, indicating that my personal information has been compromised. First and foremost, I request your immediate attention to this matter, as it requires swift action to protect my financial well-being and restore my integrity. I have enclosed supporting documentation, including the police report I filed with the Alameda Police Department, outlining the details of the incident. The incident number is [Incident Number], and it is imperative that you validate the authenticity of this report with the appropriate authorities. Additionally, I have taken the necessary steps to safeguard my identity by placing a fraud alert with the credit reporting agencies (Equifax, Experian, and TransUnion) and freezing my credit files to prevent any further unauthorized activities. I strongly urge you to review my account with utmost scrutiny, flagging any suspicious activities associated with the known imposter's identity. The specific details of the known imposter identity theft are as follows: 1. Name of the imposter: [Imposter's Name] 2. Date of birth: [Imposter's Date of Birth] 3. Social security number: [Imposter's SSN, if known] 4. Description of fraudulent activities: [Provide a detailed account of how the imposter has attempted to misuse my personal information] As a responsible victim of identity theft, I have contacted the local authorities, my attorney, and credit monitoring services to assist in resolving this matter. However, I now implore your cooperation and support to rectify the damage caused by this imposter and prevent any further harm to my credit history. Please provide me with detailed steps and instructions on how to proceed further, including any additional documents or forms that need to be completed. I kindly request your prompt response, as time is of the essence in addressing this malicious act. I appreciate your immediate attention to this matter and trust that you will take this incident seriously. Together, we can work towards restoring the integrity of my credit and preventing any further damage from occurring. Thank you for your understanding and support in this challenging time. Sincerely, [Your Name] [Your Address] [City, State, ZIP Code] [Phone Number] [Email Address]

Alameda California Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft

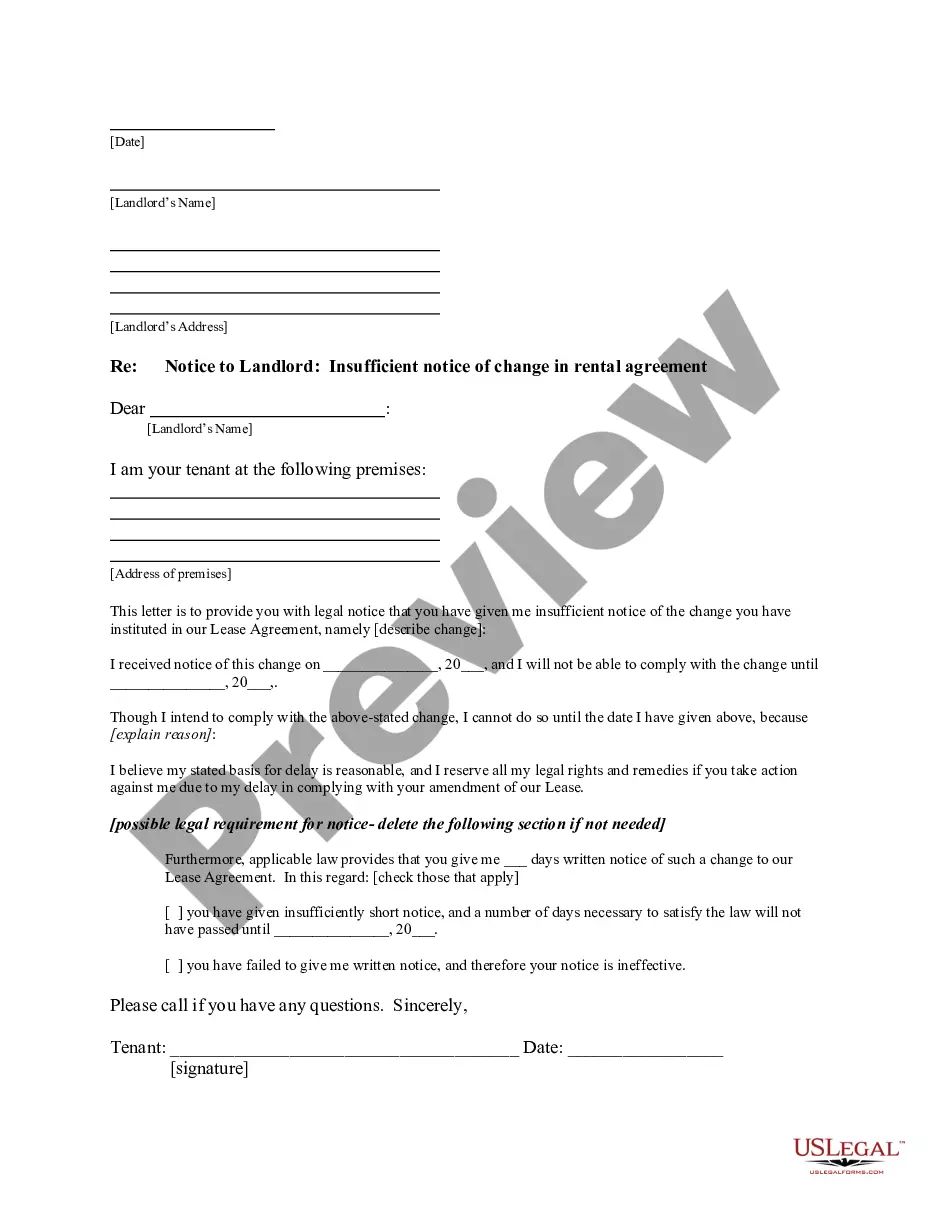

Description

How to fill out Alameda California Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare official documentation that varies from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any personal or business purpose utilized in your region, including the Alameda Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft.

Locating samples on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the Alameda Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guide to get the Alameda Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft:

- Make sure you have opened the proper page with your localised form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template meets your needs.

- Look for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Select the appropriate subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Alameda Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

Unfortunately, being a victim of identity theft means your credit scores may be negatively impacted. Thieves could open new lines of credit or credit cards in your name -- and fail to pay the bills.

You can place an initial fraud alert on your credit report if you believe you are (or are about to become), a victim of fraud or identity theft. Credit reporting companies will keep that alert on your file for one year.

What you can do to detect identity theftTrack what bills you owe and when they're due. If you stop getting a bill, that could be a sign that someone changed your billing address.Review your bills.Check your bank account statement.Get and review your credit reports.

Place when you've had your identity stolen and completed an FTC identity theft report at IdentityTheft.gov or filed a police report. It makes it harder for someone to open a new credit account in your name and removes you from unsolicited credit and insurance offers for 5 years. It's free and lasts 7 years.

File a police report with your local law enforcement agency. A police report provides you with a document saying you've been a victim, which can be helpful when requesting a 7-year extended fraud alert on your credit reports, for instance. This type of fraud alert requires a police or FTC Identity Theft Report.

9 warning signs of identity theftYour bank statement doesn't look right or your checks bounce.You see unfamiliar and unauthorized activity on your credit card or credit report.Your bills are missing or you receive unfamiliar bills.Your cellphone or another utility loses service.More items...?

The best way to do this is to go to the police with an "identity theft report" that you have already prepared. You can create an identity theft report through the FTC's website. Prepare a dispute letter to mail to Experian, Equifax & TransUnion requesting the fraudulent account(s) be removed from your credit reports.

Here are ten red flags that indicate someone has stolen your identity.You receive unexpected credit cards or account statements.You're denied credit for no apparent reason.You receive calls or letters from unknown debt collectors.Your bills and bank statements don't arrive in the mail.More items...

Statements or bills for accounts you never opened arriving in the mail. Statements or bills for legitimate accounts not showing up. You're unexpectedly denied credit. Unauthorized bank transactions or withdrawals.

9 warning signs of identity theftYour bank statement doesn't look right or your checks bounce.You see unfamiliar and unauthorized activity on your credit card or credit report.Your bills are missing or you receive unfamiliar bills.Your cellphone or another utility loses service.More items...?