Title: Fairfax Virginia: A Comprehensive Guide to Identity Theft Prevention Keywords: Fairfax Virginia, identity theft victim, credit issuer, known imposter identity theft, letter, prevention Introduction: Identity theft has become a pervasive issue, impacting countless individuals across Fairfax, Virginia, and the entire United States. This detailed description will shed light on the steps an identity theft victim should take when writing a letter to their credit issuer about the known imposter identity theft. By using specific keywords and details relevant to Fairfax Virginia, we aim to provide a comprehensive guide that empowers individuals to protect themselves. 1. Understanding Identity Theft in Fairfax Virginia: — Statistics and trends: Explore the prevalence of identity theft cases within Fairfax Virginia, highlighting the increasing concern among residents. — Types of identity theft: Explain the various types of identity theft commonly encountered, including financial, medical, and criminal imposter theft. — Local law enforcement involvement: Discuss Fairfax Virginia's law enforcement agencies' initiatives in combating identity theft and supporting victims. 2. Signing an Identity Theft Affidavit in Fairfax Virginia: — Purpose of the affidavit: Explain the significance and importance of completing an identity theft affidavit, providing victims with a legally binding document to support their claims. — Local resources and assistance: Highlight resources available to identity theft victims in Fairfax Virginia, such as local police departments, consumer protection agencies, and credit bureaus. 3. Writing a Letter to Credit Issuers: — Addressing the credit issuer: Provide an overview of the proper format and content to include when writing a letter to notify credit issuers about known imposter identity theft. — Mentioning Fairfax Virginia identity theft laws: Inform victims about specific laws and regulations within Fairfax Virginia that protect their rights and facilitate resolution processes. 4. Additional Types of Letters for Identity Theft Victims: — Victim Statement Letter: Detail the purpose and content of a victim statement letter, which allows individuals to have a formal statement on record to dispute fraudulent charges and accounts. — Cease and Desist Letter: Explain when and how an identity theft victim should send a cease and desist letter to stop harassing communication from debt collectors or imposters. Conclusion: Identity theft can significantly impact victims' lives, both financially and emotionally. Therefore, understanding the steps to take and the appropriate letters to write when dealing with known imposter identity theft is crucial. This comprehensive guide specifically caters to Fairfax Virginia residents, equipping them with the knowledge they need to protect themselves and seek justice against imposters. Through careful documentation, cooperation with credit issuers, and leveraging local resources, victims can regain control of their identities and restore their financial well-being.

Fairfax Virginia Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft

Description

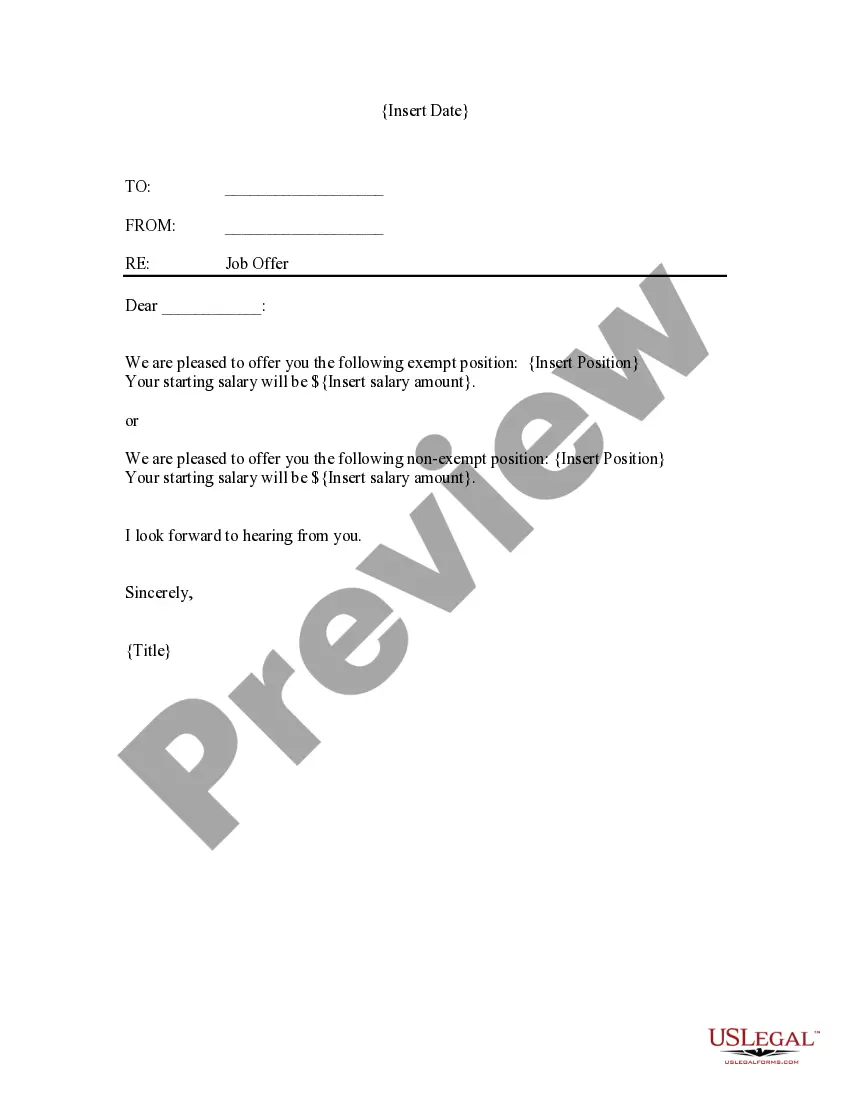

How to fill out Fairfax Virginia Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft?

Laws and regulations in every sphere vary throughout the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid costly legal assistance when preparing the Fairfax Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used many times: once you purchase a sample, it remains accessible in your profile for further use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Fairfax Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Fairfax Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft:

- Examine the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template once you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

You can place an initial fraud alert on your credit report if you believe you are (or are about to become), a victim of fraud or identity theft. Credit reporting companies will keep that alert on your file for one year.

Unfortunately, being a victim of identity theft means your credit scores may be negatively impacted. Thieves could open new lines of credit or credit cards in your name -- and fail to pay the bills.

Place when you've had your identity stolen and completed an FTC identity theft report at IdentityTheft.gov or filed a police report. It makes it harder for someone to open a new credit account in your name and removes you from unsolicited credit and insurance offers for 5 years. It's free and lasts 7 years.

Can thieves steal identities with only a name and address? In short, the answer is no. Which is a good thing, as your name and address are in fact part of the public record. Anyone can get a hold of them. However, because they are public information, they are still tools that identity thieves can use.

What you can do to detect identity theftTrack what bills you owe and when they're due. If you stop getting a bill, that could be a sign that someone changed your billing address.Review your bills.Check your bank account statement.Get and review your credit reports.

9 warning signs of identity theftYour bank statement doesn't look right or your checks bounce.You see unfamiliar and unauthorized activity on your credit card or credit report.Your bills are missing or you receive unfamiliar bills.Your cellphone or another utility loses service.More items...?

Statements or bills for accounts you never opened arriving in the mail. Statements or bills for legitimate accounts not showing up. You're unexpectedly denied credit. Unauthorized bank transactions or withdrawals.

Beware of These 7 Signs of Identity TheftUnexplained Transactions on Your Credit and Bank Accounts.Your Credit Card Is Declined.You're Flooded With Calls or Notices From Debt Collectors.You're Denied for New Credit.There's New Information on Your Credit Report That You Don't Recognize.More items...

9 warning signs of identity theftYour bank statement doesn't look right or your checks bounce.You see unfamiliar and unauthorized activity on your credit card or credit report.Your bills are missing or you receive unfamiliar bills.Your cellphone or another utility loses service.More items...?

File a police report with your local law enforcement agency. A police report provides you with a document saying you've been a victim, which can be helpful when requesting a 7-year extended fraud alert on your credit reports, for instance. This type of fraud alert requires a police or FTC Identity Theft Report.