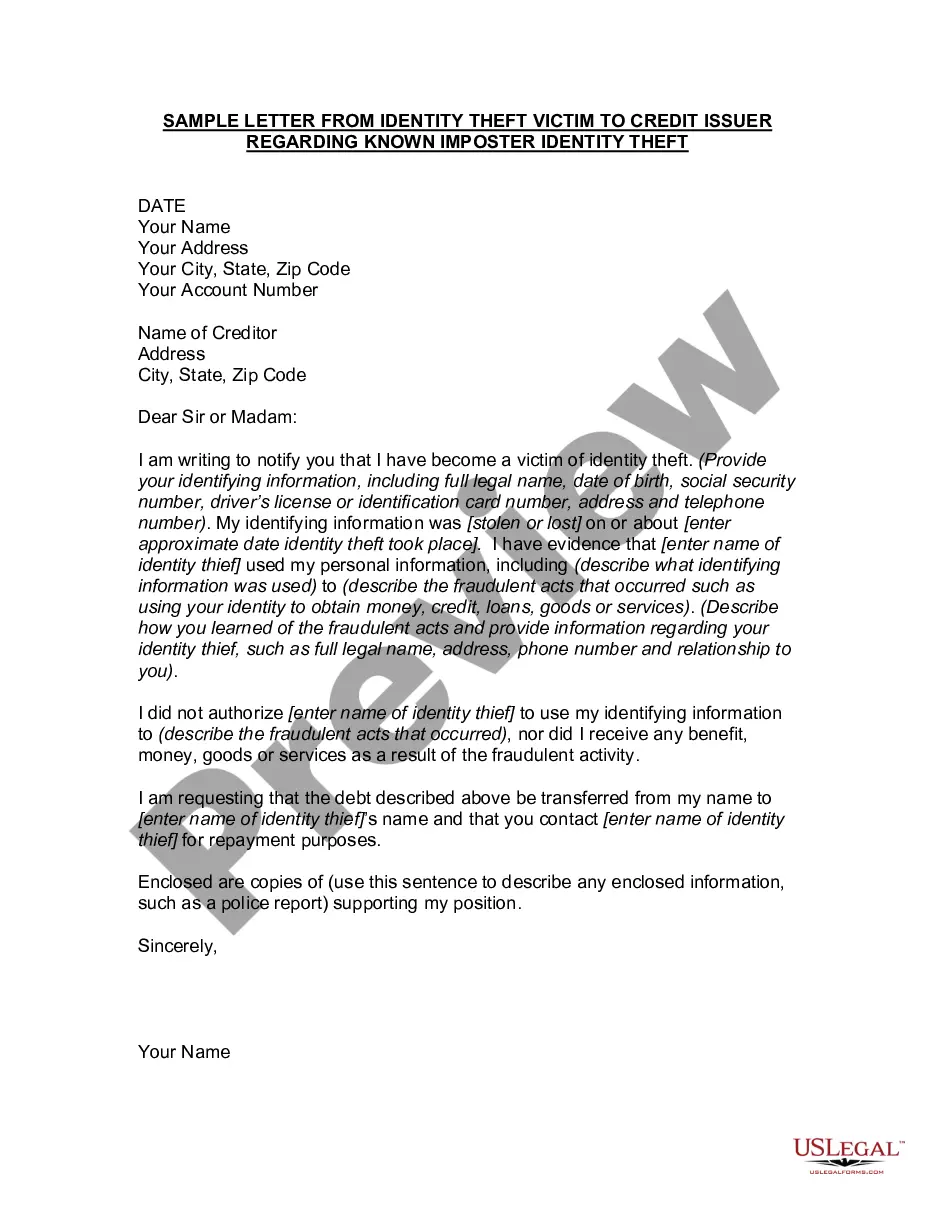

Philadelphia Pennsylvania is a bustling city rich in history and culture. Known as the birthplace of America, it is filled with iconic landmarks such as Independence Hall and the Liberty Bell. With its vibrant arts scene, delicious cuisine, and passionate sports fans, Philadelphia offers something for everyone. However, amidst the city's charm, there is a growing issue of identity theft. This crime can have devastating consequences for its victims, leaving them in financial ruin and dealing with the arduous task of reclaiming their stolen identity. One type of letter that an identity theft victim in Philadelphia Pennsylvania may write is a detailed description of the known imposter identity theft to a credit issuer. This letter serves as a formal communication to the entity responsible for handling the victim's credit accounts. It aims to provide a comprehensive account of the imposter's actions, the impact on the victim's credit history, and any supporting evidence. Keywords: Philadelphia Pennsylvania, identity theft, imposter, credit issuer, known imposter identity theft, letter, victim, credit accounts, credit history, supporting evidence. In addition to the general letter outlined above, there may be various types of letters that an identity theft victim in Philadelphia Pennsylvania can craft, depending on the specific circumstances. Some possible variations might include: 1. Letter to Credit Reporting Agencies: This letter would be addressed to credit reporting agencies such as Equifax, Experian, and TransUnion. Its purpose would be to inform these agencies about the imposter identity theft, request a fraud alert or credit freeze, and provide documentation and evidence supporting the victim's claims. 2. Letter to Law Enforcement: This type of letter would be aimed at local law enforcement agencies, such as the Philadelphia Police Department, providing a detailed account of the identity theft and urging them to take action. The victim should include any relevant police reports, court documents, or other supporting evidence. 3. Letter to Financial Institutions: This letter would be directed to banks, credit card companies, or other financial institutions where the imposter attempted to open accounts or conduct fraudulent transactions. The victim would explain the situation, providing relevant details and requesting that these institutions take appropriate action to protect their accounts and assist in the investigation. 4. Letter to Creditors and Collection Agencies: If the imposter managed to accumulate debts or delinquencies in the victim's name, a letter to creditors and collection agencies would be necessary. The victim would inform these entities about the identity theft, dispute the fraudulent charges, and provide any supporting evidence. Keywords for these variations: Philadelphia Pennsylvania, identity theft, imposter, credit reporting agencies, Equifax, Experian, TransUnion, fraud alert, credit freeze, law enforcement, Philadelphia Police Department, police reports, court documents, financial institutions, banks, credit card companies, fraudulent transactions, creditors, collection agencies, delinquencies, dispute, fraudulent charges.

Philadelphia Pennsylvania Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft

Description

How to fill out Philadelphia Pennsylvania Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare official paperwork that varies throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any personal or business purpose utilized in your region, including the Philadelphia Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft.

Locating forms on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. After that, the Philadelphia Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guide to obtain the Philadelphia Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft:

- Make sure you have opened the proper page with your localised form.

- Utilize the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template meets your requirements.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Philadelphia Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

FAQ

Here are ten red flags that indicate someone has stolen your identity.You receive unexpected credit cards or account statements.You're denied credit for no apparent reason.You receive calls or letters from unknown debt collectors.Your bills and bank statements don't arrive in the mail.More items...

What you can do to detect identity theftTrack what bills you owe and when they're due. If you stop getting a bill, that could be a sign that someone changed your billing address.Review your bills.Check your bank account statement.Get and review your credit reports.

Place when you've had your identity stolen and completed an FTC identity theft report at IdentityTheft.gov or filed a police report. It makes it harder for someone to open a new credit account in your name and removes you from unsolicited credit and insurance offers for 5 years. It's free and lasts 7 years.

You can place an initial fraud alert on your credit report if you believe you are (or are about to become), a victim of fraud or identity theft. Credit reporting companies will keep that alert on your file for one year.

The best way to do this is to go to the police with an "identity theft report" that you have already prepared. You can create an identity theft report through the FTC's website. Prepare a dispute letter to mail to Experian, Equifax & TransUnion requesting the fraudulent account(s) be removed from your credit reports.

9 warning signs of identity theftYour bank statement doesn't look right or your checks bounce.You see unfamiliar and unauthorized activity on your credit card or credit report.Your bills are missing or you receive unfamiliar bills.Your cellphone or another utility loses service.More items...?

File a police report with your local law enforcement agency. A police report provides you with a document saying you've been a victim, which can be helpful when requesting a 7-year extended fraud alert on your credit reports, for instance. This type of fraud alert requires a police or FTC Identity Theft Report.

9 warning signs of identity theftYour bank statement doesn't look right or your checks bounce.You see unfamiliar and unauthorized activity on your credit card or credit report.Your bills are missing or you receive unfamiliar bills.Your cellphone or another utility loses service.More items...?

Steps to Take if You Are a Victim of Identity TheftFile a police report.Add a fraud alert.Request a credit report from each of the three major credit reporting companies.Dispute any fraud-related items.Contact your lenders.Sign up for credit monitoring.

Submit an identity theft report with the Federal Trade Commission online at . By reporting your theft online, you can receive an identity theft report and a recovery plan.