Lima Arizona is a small town located in Graham County, Arizona. It is home to a close-knit community that values trust and security. However, like any other town, Lima is not immune to the threat of identity theft. Identity theft occurs when someone fraudulently uses another person's personal information without their consent. This can result in severe financial and emotional ramifications for the victim. In the case of a known imposter identity theft, the victim is aware of the individual who has stolen their identity and is seeking assistance from their credit issuer to rectify the situation. Types of Lima Arizona Letters from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft: 1. Initial Communication Letter: This letter is the first step in reporting known imposter identity theft to the credit issuer. It should provide a detailed account of the situation, including the imposter's identity and any evidence or documentation available. The letter should also request immediate action to stop any further fraudulent activity and initiate an investigation. 2. Request for Freeze or Fraud Alert: Victims of known imposter identity theft may opt to include a request to freeze their credit or add a fraud alert to their credit report in their letter to the credit issuer. This helps prevent further unauthorized access to their credit history and adds an extra layer of protection. 3. Dispute Letter: If the credit issuer fails to take appropriate action to resolve the known imposter identity theft situation, a victim may need to send a dispute letter. This letter should outline the credit issuer's negligence in addressing the issue and demand that the fraudulent accounts or transactions be removed from the victim's credit report. 4. Cease and Desist Letter: If the imposter continues to use the victim's identity despite the credit issuer's involvement, a cease and desist letter may be necessary. This letter warns the imposter to stop using the victim's personal information immediately or face legal consequences. In conclusion, addressing known imposter identity theft requires clear and concise communication between the victim and their credit issuer. Lima Arizona, like any other community, needs to be proactive in combating this crime and protecting its residents from the negative impact of identity theft.

Pima Arizona Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft

Description

How to fill out Pima Arizona Letter From Identity Theft Victim To Credit Issuer Regarding Known Imposter Identity Theft?

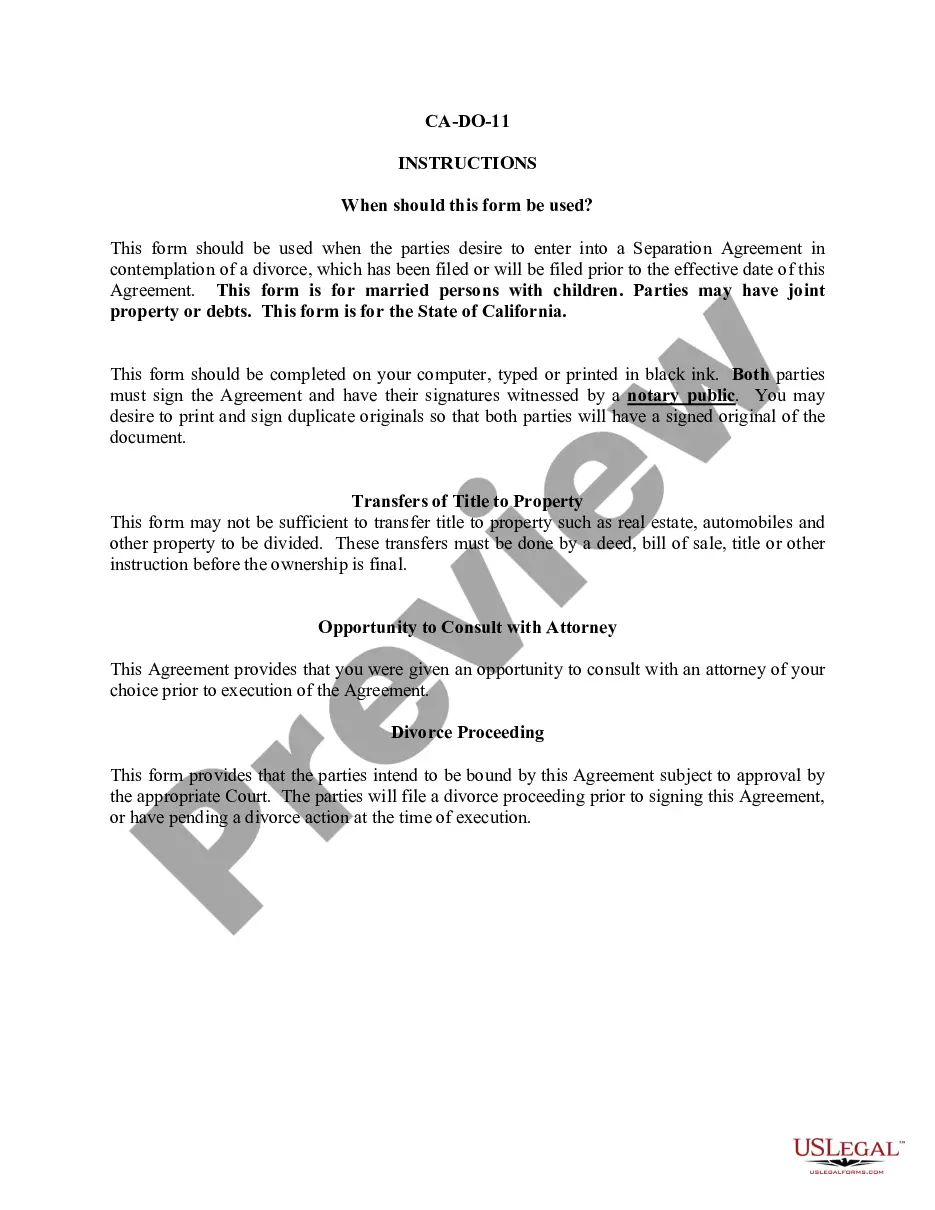

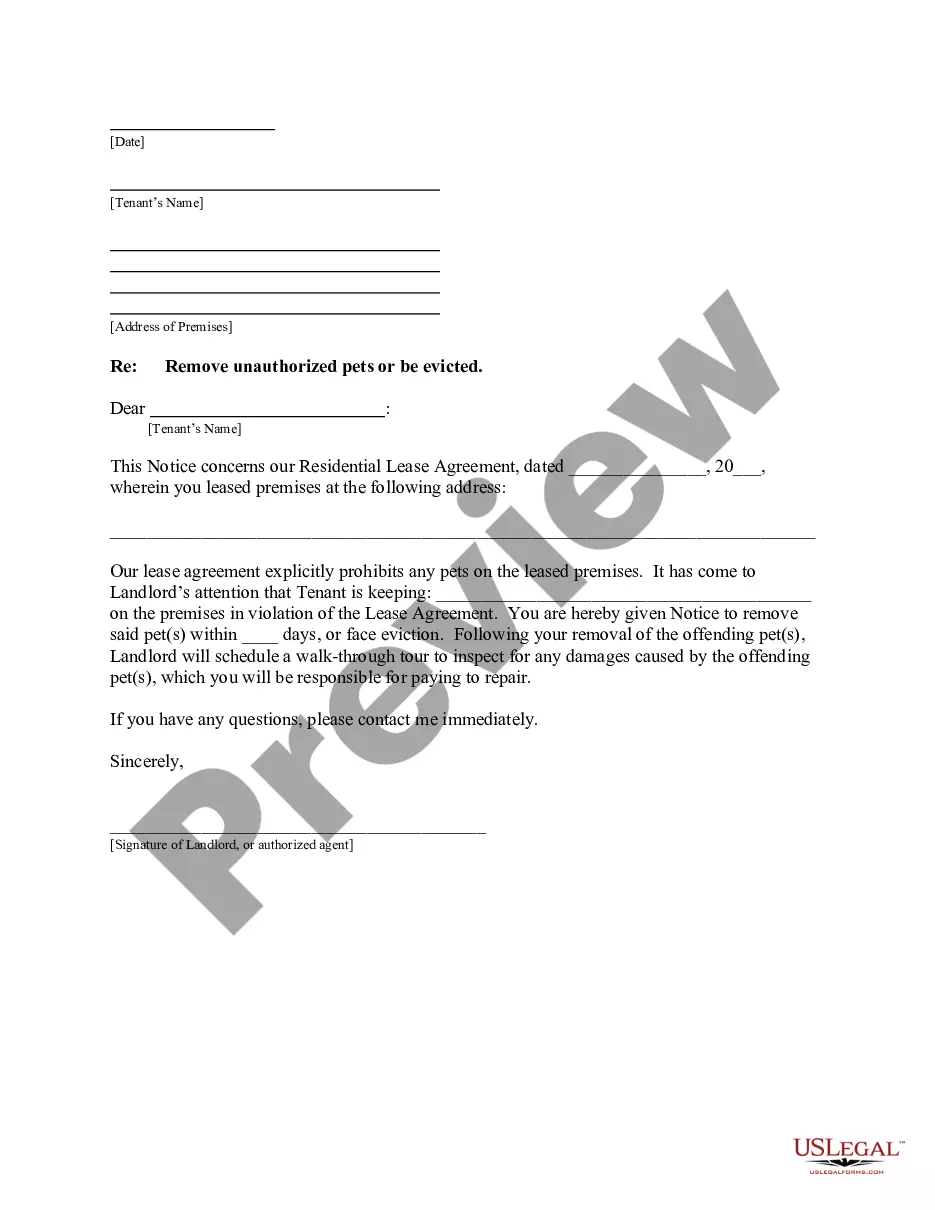

How much time does it usually take you to draw up a legal document? Since every state has its laws and regulations for every life sphere, locating a Pima Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft suiting all regional requirements can be tiring, and ordering it from a professional attorney is often costly. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive online collection of templates, gathered by states and areas of use. In addition to the Pima Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft, here you can get any specific form to run your business or personal affairs, complying with your county requirements. Specialists check all samples for their actuality, so you can be certain to prepare your documentation properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can pick the file in your profile anytime in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you obtain your Pima Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Choose the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Pima Letter from Identity Theft Victim to Credit Issuer Regarding Known Imposter Identity Theft.

- Print the doc or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

IDENTITY THEFT STATEMENT.Part One: Information about You and the Incident.Personal Information.(2) My commonly-used name (if different from above) is:Identity Theft Statement.Please check all that apply.Identity Theft Statement.Additional Comments (for example, a description of the incident, what information.

Check all of your financial accounts.Identify accounts that were compromised.Put fraud alerts in place and freeze your credit reports.Change your passwords.Report your info to the FTC.Dispute fraudulent activity.

The three credit reporting agencies Because the agencies are so involved in your credit activity, it's important to notify them if your identity has been stolenas identity theft can lead to abuse of your credit, and you want to try to keep that from happening.

Five Steps to Take if You Are a Victim of Identity Theft Place a Fraud Alert on Your Credit Reports. Call one of the three credit bureaus and request to place a fraud alert on your credit report.Review Your Credit Report.Document Everything.Consider Placing a Credit Freeze.File an Identity Theft Report.

Here are steps to take if your identity is stolen: Notify the company or agency that issued your stolen credentials. Put a freeze or fraud alert on your credit. Report the theft to the Federal Trade Commission. File a report with your local law enforcement agency.

Contacting the companies and banks where you know identity fraud occurred. Reporting the identity theft to the Federal Trade Commission (FTC). Filing a report of the identity theft with local law enforcement.

Report Identity Theft. Report identity (ID) theft to the Federal Trade Commission (FTC) online at IdentityTheft.gov or by phone at 1-877-438-4338.

File a claim with your identity theft insurance, if applicable. Notify companies of your stolen identity. File a report with the Federal Trade Commission. Contact your local police department.

If you learn that you have become a victim of identity theft, do the following: Immediately contact the fraud departments of the three major credit bureaus (Equifax, Experian, and Trans Union) to let them know about your situation.

Report Identity Theft. Report identity (ID) theft to the Federal Trade Commission (FTC) online at IdentityTheft.gov or by phone at 1-877-438-4338. The FTC will collect the details of your situation.