The Nassau New York Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor is a legally binding document that outlines the terms and conditions agreed upon between a painting general contractor and a self-employed independent contractor or subcontractor. This agreement aims to prevent any competition or bidding conflicts between the parties involved. This agreement is particularly important in ensuring a fair and stable working relationship between the painting general contractor and the self-employed independent contractor or subcontractor. By signing this agreement, the contractor agrees not to bid against the painting general contractor for any painting projects within the Nassau area of New York. The agreement serves to protect the interests of both parties involved. It establishes a clear understanding that the self-employed independent contractor or subcontractor will not engage in bidding or soliciting any painting projects that are within the jurisdiction of the painting general contractor. This helps to maintain a harmonious professional relationship and avoids potential conflicts of interest. Additionally, the Nassau New York Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor can be further categorized into different types based on the specific circumstances or parties involved. Some examples include: 1. Exclusive Agreement: This type of agreement grants the painting general contractor exclusive rights for proposing and bidding on painting projects within Nassau New York, ensuring that no other self-employed independent contractor or subcontractor can bid against them. 2. Limited Agreement: This version of the agreement may limit the scope of the restriction to certain types of painting projects, specific clients, or a defined period. It allows some level of competition but still ensures a fair playing field for both the general contractor and the subcontractor. 3. Joint Agreement: In certain cases, multiple self-employed independent contractors or subcontractors may enter into a joint agreement with a painting general contractor, collectively agreeing not to bid against each other for specific painting projects in Nassau New York. This helps to create a mutually beneficial alliance among the contractors involved. Ultimately, the Nassau New York Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor acts as a crucial legal safeguard, ensuring transparency, fairness, and professionalism in the painting industry. By defining the parameters within which the subcontractor or independent contractor can operate, it fosters a cooperative working environment that benefits both parties and contributes to the overall success of painting projects in Nassau New York.

Nassau New York Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor

Description

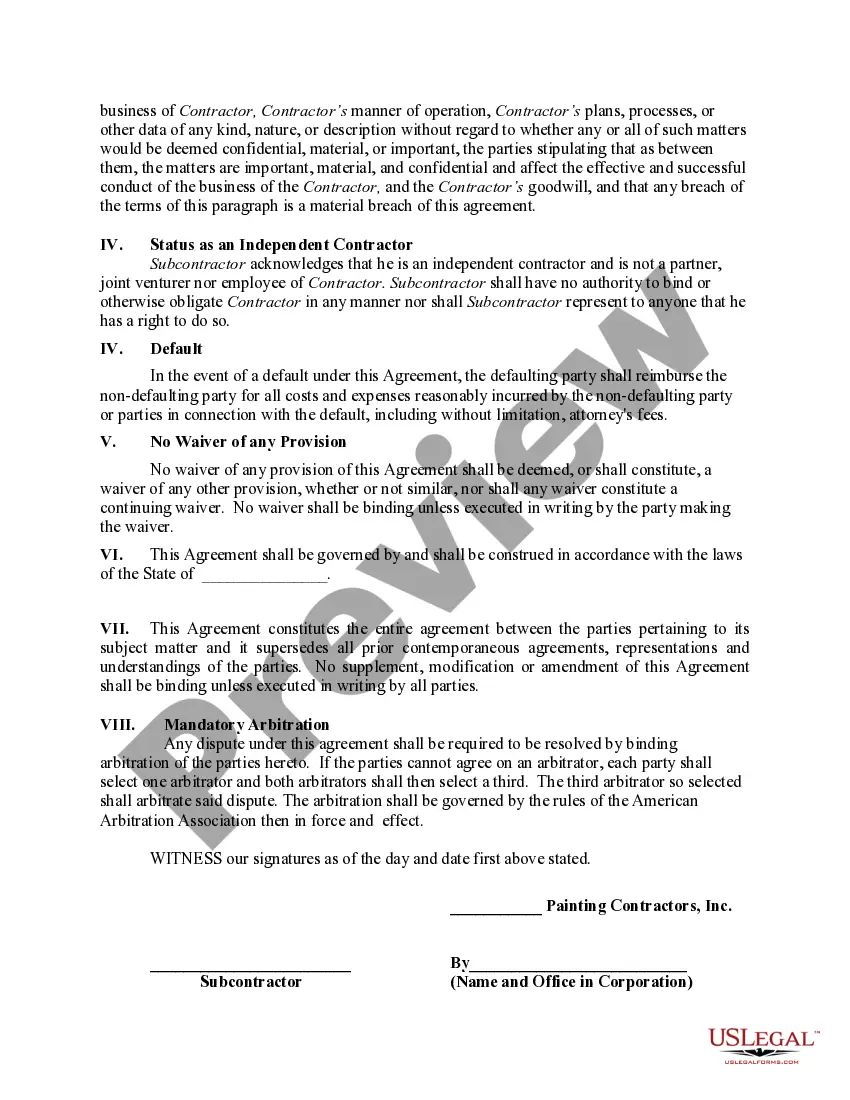

How to fill out Nassau New York Agreement By Self-Employed Independent Contractor Or Subcontractor Not To Bid Against Painting General Contractor?

Preparing legal documentation can be cumbersome. In addition, if you decide to ask a legal professional to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce papers, or the Nassau Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor, it may cost you a lot of money. So what is the best way to save time and money and draft legitimate forms in total compliance with your state and local regulations? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario gathered all in one place. Therefore, if you need the latest version of the Nassau Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Nassau Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to ensure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Nassau Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor and download it.

When finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms enables you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

employed person refers to any person who earns their living from any independent pursuit of economic activity, as opposed to earning a living working for a company or another individual (an employer).

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Subcontractor vs Independent contractor is a difference in an employment relationship with a laborer. Independent contractors are employed and paid directly by the employer while subcontractors are employed by an independent contractor and are paid by them.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

What information do I need for an Independent Contractor Agreement? What the service is and how much the contractor will be paid. If the client/customer will cover expenses or provide resources. When the contract will end. If either party will be penalized for things such as late payments or unfinished work.

What to Include in a Contract The date the contract begins and when it expires. The names of all parties involved in the transaction. Any key terms and definitions. The products and services included in the transaction. Any payment amounts, project schedules, terms, and billing dates.

You give a Form 1099 to a subcontractor showing the amounts you paid him. The subcontractor is responsible for keeping his or her own records and paying his or her own income and self-employment taxes. It is important to note that either classification-employee or subcontractor-can be valid.