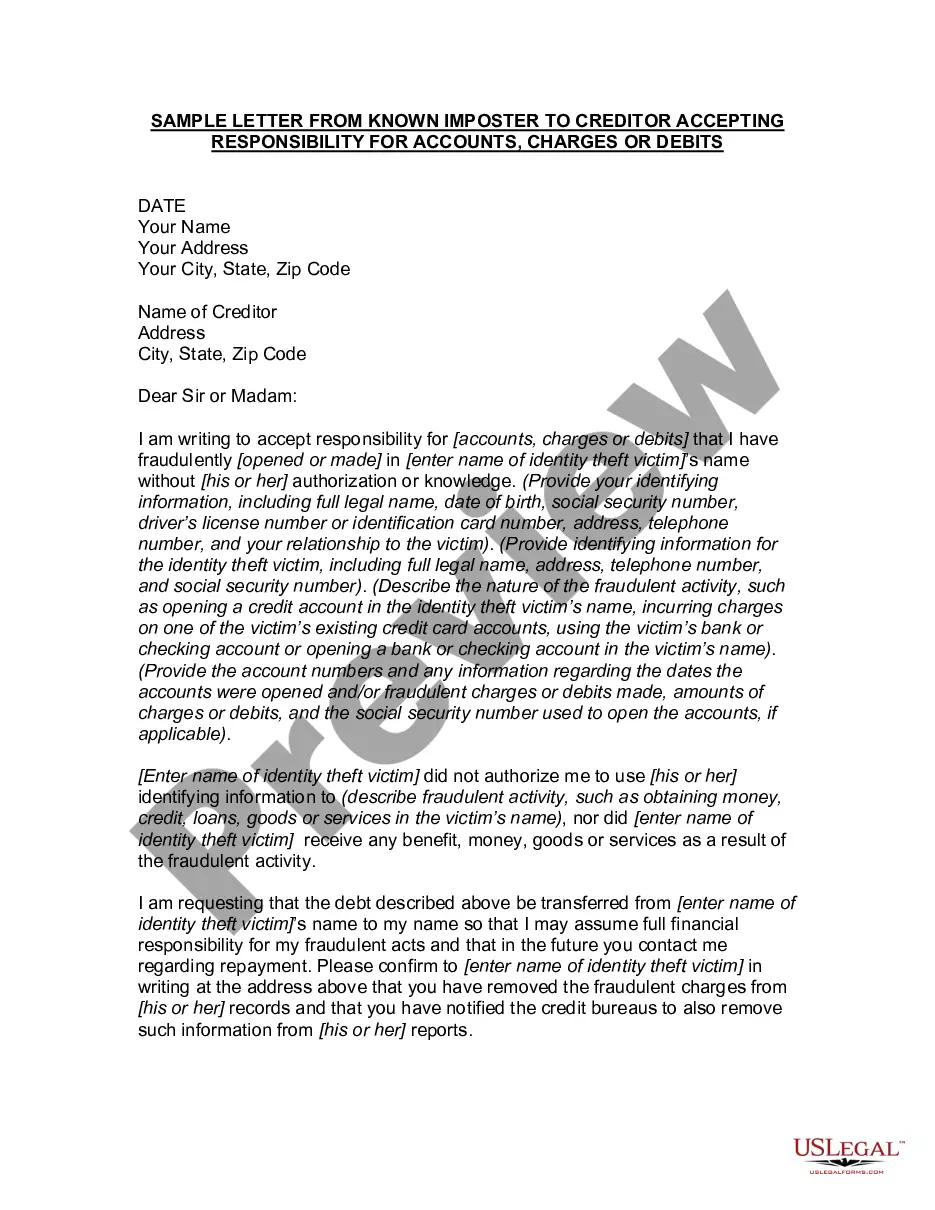

Collin Texas Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits is a legal document used by individuals who have been victims of identity theft or fraud. This detailed description will outline the purpose, components, and importance of such a letter, along with relevant keywords to ensure its effectiveness and clarity. The purpose of a Collin Texas Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits is to notify the creditor or financial institution that the individual acknowledges fraudulent activity on their accounts and accepts responsibility for any charges or debits resulting from it. This letter serves as an official declaration allowing the victim to take control of the situation, work towards resolving the issue, and prevent further damage to their credit history. Keywords: Collin Texas, letter from known imposter, creditor, accepting responsibility, accounts, charges, debits, identity theft, fraud, victim, financial institution, fraudulent activity, official declaration, resolving, credit history. Components of the Collin Texas Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges, or Debits: 1. Heading: Begin the letter with the individual's personal information, including their full name, current address, phone number, and email address. Mention the creditor's name and address, including any relevant account or reference numbers. 2. Salutation: Address the letter to the appropriate department or individual responsible for handling fraud cases within the creditor's organization. Use a formal salutation such as "Dear [Creditor's Name/Department]." 3. Introduction: Clearly state the purpose of the letter, explaining that it is an acceptance of responsibility for fraudulent accounts, charges, or debits associated with the individual's name. Mention that the following information outlines the specific details of the fraudulent transactions and expresses the individual's commitment to resolving the issue. 4. Fraudulent Account/Transaction Details: Provide a comprehensive list of all known fraudulent accounts, charges, or debits associated with the individual's identity. Include any relevant information such as account numbers, transaction dates, and amounts. If possible, attach supporting documentation such as copies of unauthorized statements or transactions. 5. Acknowledgment of Responsibility: Explicitly state that the individual acknowledges their responsibility for these fraudulent activities and that they are taking immediate action to address the issue. Emphasize the importance of resolving the matter quickly to minimize further damage. 6. Request for Assistance: Politely request the creditor's assistance in investigating and resolving the fraudulent accounts, charges, or debits. Ask for their guidance in the necessary steps to restore the victim's credit history, such as freezing or closing affected accounts, correcting credit reports, and pursuing legal actions if required. 7. Contact Information: Provide the individual's contact information again, ensuring it is accurate and up to date. Encourage the creditor or financial institution to reach out for any further information or documentation they may require. Assure them of the individual's willingness to cooperate fully throughout the resolution process. 8. Closing: Conclude the letter with a polite and professional closing, such as "Sincerely" or "Best regards." Sign the letter with the individual's full legal name and include their handwritten signature for added authenticity. Types of Collin Texas Letters from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges, or Debits: 1. Individual Account Letter: Used when the imposter has targeted the individual's personal accounts, such as credit cards, bank accounts, or loans. 2. Business Account Letter: Applicable when the imposter has targeted the individual's business accounts, including business credit cards, corporate bank accounts, or any other business financial services. 3. Mortgage Account Letter: Specifically for cases involving fraudulent activity related to the individual's mortgage account and associated charges or debits. Remember, this detailed description provides an overview of the Collin Texas Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges, or Debits, showcasing the necessary components and highlighting relevant keywords to ensure a comprehensive and effective communication tool in the face of identity theft or fraud.

Collin Texas Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits

Description

How to fill out Collin Texas Letter From Known Imposter To Creditor Accepting Responsibility For Accounts, Charges Or Debits?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and many other life situations require you prepare formal documentation that differs throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any individual or business purpose utilized in your region, including the Collin Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Collin Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guide to obtain the Collin Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits:

- Ensure you have opened the right page with your regional form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form satisfies your needs.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Collin Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!