Title: Phoenix Arizona Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits Introduction: In Phoenix, Arizona, cases of identity theft and fraud are not uncommon. As a victim of such incidents, it is crucial to take immediate action and accept responsibility for any unauthorized accounts, charges, or debits that may have occurred. This letter aims to address the situation promptly and efficiently, assuring the creditor of the victim's willingness to address the issue and resolve any outstanding debts. There can be variations of this letter, depending on the specific circumstances. Let's explore the key aspects and relevant keywords associated with a Phoenix Arizona Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits. 1. Standard Phoenix Arizona Letter from Known Imposter to Creditor Accepting Responsibility: This type of letter acts as a general template, suitable for various scenarios. It acknowledges the identity theft or fraud, accepts liability for the unauthorized accounts, charges, or debits, and demonstrates the victim's commitment to resolving the issue. Relevant keywords may include: — PhoeniArizonaon— - Letter - Known Imposter — Credi—or - AcceptResponsibilityil—t— - Accounts — Char—es - Debits - Identtheth—f— - Fraud — Unauthori—ed - Liab—lity - Resolving 2. Specific Phoenix Arizona Letter from Known Imposter to Creditor Accepting Responsibility: This variation of the letter could address a particular incident, account, or charge, providing more detailed information to the creditor. It may include additional evidence, such as police reports or supporting documents, to strengthen the case. Relevant keywords may include: — Specifiincidenten— - Detailed information — Account - Charg— - Supporting documents — Police report— - Strengthen - Specific circumstances 3. Phoenix Arizona Letter from Known Imposter to Creditor Accepting Responsibility for Debts: In situations involving fraudulent debts, this type of letter focuses on accepting responsibility for outstanding amounts that the creditor may be pursuing. It emphasizes the victim's commitment to resolving the debt, even if the debts are not directly related to unauthorized accounts or charges. Relevant keywords may include: — Debt— - Outstanding amounts - Creditor pursuit — Resolutiocommitmenten— - Unauthorized accounts — Charges - Identittheef— - Fraud Conclusion: When faced with identity theft or fraud in Phoenix, Arizona, it is essential to promptly inform the creditor and accept responsibility for any unauthorized accounts, charges, or debits. Depending on the circumstances, there may be variations of the Phoenix Arizona Letter from Known Imposter to Creditor Accepting Responsibility. These letters address the specific situation, offer assistance, and display a sincere intention to resolve the issue, ensuring a fair outcome for both parties involved.

Phoenix Arizona Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits

Description

How to fill out Phoenix Arizona Letter From Known Imposter To Creditor Accepting Responsibility For Accounts, Charges Or Debits?

Dealing with legal forms is a must in today's world. However, you don't always need to look for qualified assistance to draft some of them from the ground up, including Phoenix Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to pick from in different types ranging from living wills to real estate paperwork to divorce papers. All forms are arranged according to their valid state, making the searching process less overwhelming. You can also find detailed resources and tutorials on the website to make any activities associated with document completion simple.

Here's how to purchase and download Phoenix Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits.

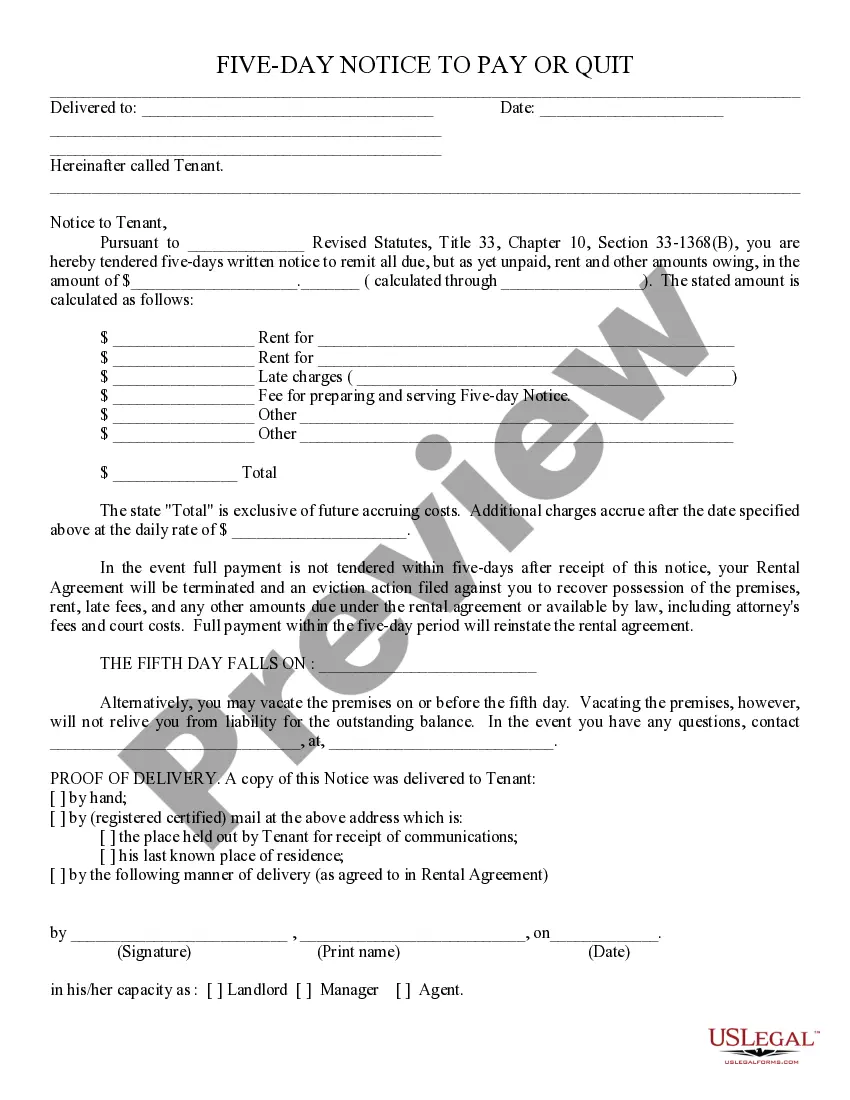

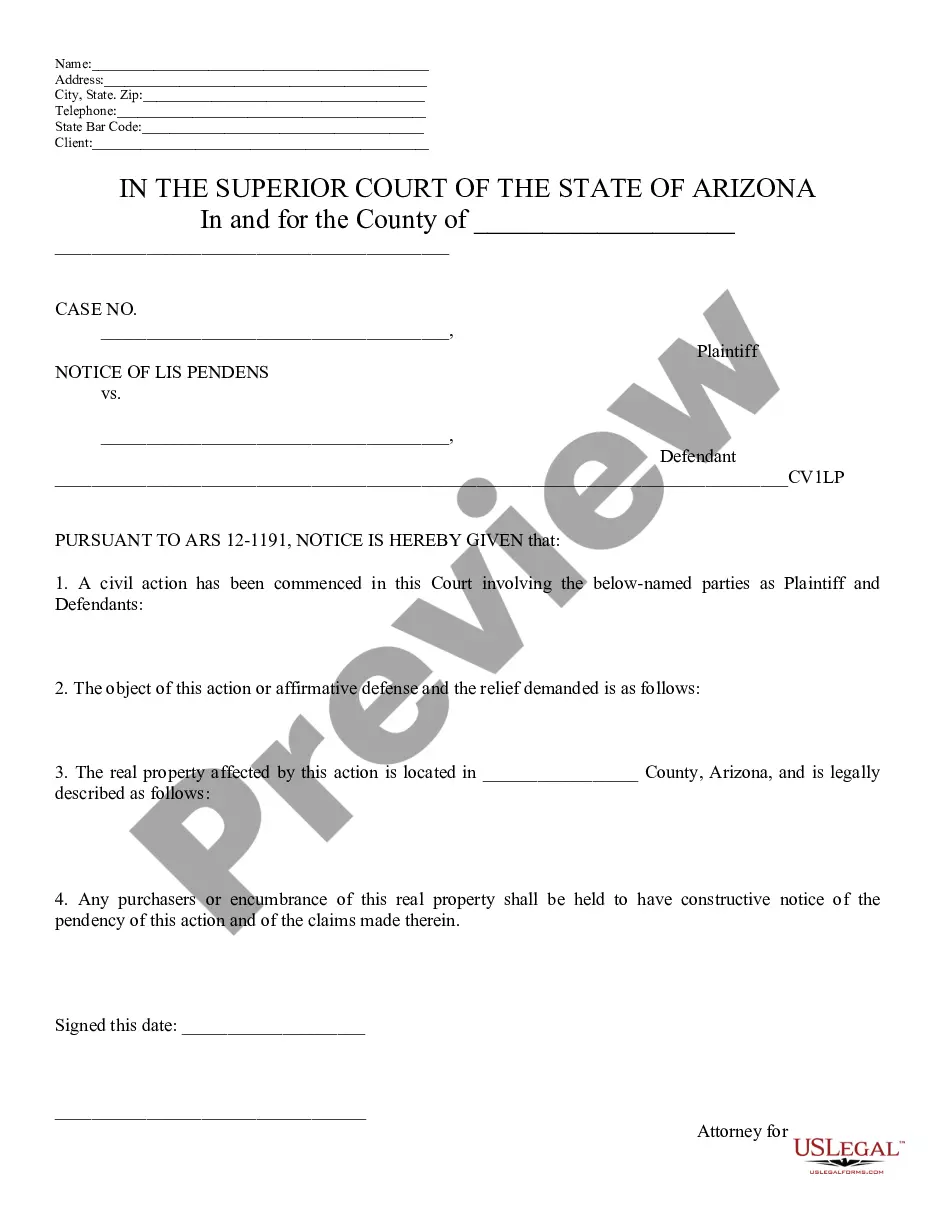

- Take a look at the document's preview and outline (if available) to get a general information on what you’ll get after getting the document.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can impact the legality of some documents.

- Check the similar forms or start the search over to locate the appropriate document.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a needed payment method, and purchase Phoenix Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits.

- Choose to save the form template in any available file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Phoenix Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits, log in to your account, and download it. Needless to say, our platform can’t replace a legal professional completely. If you need to deal with an exceptionally difficult situation, we recommend using the services of a lawyer to check your document before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for various legal forms for millions of customers. Join them today and purchase your state-specific paperwork effortlessly!

Form popularity

FAQ

In dismissing a putative class action under the Fair Debt Collection Practices Act (FDCPA), the Court held that a debt collector may place the validation notice in the body of an email serving as the initial communication with the consumer without having to comply with the Electronic Signatures in Global Commerce Act (

Some examples of events that a lender may consider to be a financial hardship include: Layoff or reduction in pay. New or worsening disability. Serious injury. Serious illness. Divorce or legal separation. Death. Incarceration. Military deployment or Permanent Change of Station orders.

I respectfully request that you forgive my alleged debt, as my condition precludes any employment, and my current and future income does not support any debt repayment. Please respond to my request in writing to the address below at your earliest convenience. Thank-you in advance for your understanding of my situation.

Lost Employment. ? Unemployment Compensation Statement. (Note: this satisfies the proof of income requirement as well.) ? Termination/Furlough letter from Employer. ? Pay stub from previous employer with.

How to Write an Effective Hardship Letter Part 1: Explain what happened and why you are applying.Part 2: Specifically illustrate the time and severity of the hardship.Part 3: Back up the reasons traditional remedies won't work.Part 4: Detail why you are stable enough to succeed with a modification.

A debt forgiveness letter informs a debtor that they no longer have to repay the creditor for money owed or other liabilities.

I am therefore writing to inform you that I no longer require your services and wish to cancel my plan with immediate effect. Please provide a full breakdown of my account with you since it began, outlining all payments I have made, all creditor distributions and to whom they have been made.

Tips for Writing a Hardship Letter Keep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Coach.

This may include either: payment of rental bond. bank statements showing a reduction of income, essential spending and reduced savings. a report from a financial counselling service. debt repayment agreements. any other evidence you have to explain your circumstances.

Under the Fair Debt collection Practices Act (FDCPA), I have the right to request validation of the debt you say I owe you. I am requesting proof that I am indeed the party you are asking to pay this debt, and there is some contractual obligation that is binding on me to pay this debt.