Title: Queens, New York: Understanding the Various Types of Letters from Known Imposters Accepting Responsibility for Accounts, Charges, or Debits Introduction: Queens, New York, known for its cultural diversity and vibrant neighborhoods, is no stranger to financial fraud and identity theft cases. In situations where a known imposter is found to have committed fraudulent activities, it becomes necessary to address the issue promptly and take responsibility for any accounts, charges, or debits involved. This article aims to provide a detailed description of different types of letters that may be drafted in such scenarios. 1. Letter Accepting Responsibility for Fraudulent Credit Card Charges in Queens, New York: In cases where a known imposter has used someone else's credit card information to make unauthorized charges, a letter accepting responsibility should be sent to the creditor. This document should clearly state the details of the charges, confirm the imposter's admission of guilt, and express the intention to resolve any outstanding debts. The letter should include relevant keywords such as "fraudulent charges," "credit card theft," and "credit card fraud." 2. Letter Accepting Responsibility for Identity Theft in Queens, New York: Identity theft can have severe financial consequences. To accept responsibility for the fraudulent activities conducted by a known imposter, a letter should be drafted, acknowledging the identity theft and emphasizing the imposter's acknowledgment of their actions. It should contain relevant keywords like "identity theft," "fraudulent accounts," and "personal information theft." 3. Letter Accepting Responsibility for Unauthorized Debts or Loans in Queens, New York: In situations where an imposter has obtained loans or created debts using someone else's personal information without their consent, a letter to the creditor is necessary to accept responsibility for these actions. This letter should detail the unauthorized debts or loans, outline the steps being taken to rectify the situation, and express a commitment to resolving any outstanding financial obligations. Keywords such as "unauthorized debts," "loan fraud," and "debt responsibility" can be used to address this type of letter. 4. Letter Accepting Responsibility for Fraudulent Bank Account Activity in Queens, New York: If a known imposter has conducted unauthorized activities using another individual's bank account details, a letter should be composed to accept responsibility for the fraudulent transactions. This letter should contain information regarding the invalid account activity, the imposter's acceptance of liability, and intention to reimburse any financial losses. Keywords like "bank account fraud," "unauthorized transactions," and "financial responsibility" can be used effectively here. Conclusion: As Queens, New York continues to thrive, the potential for financial fraud and identity theft remains a concern. However, addressing these issues diligently and accepting responsibility for the fraudulent accounts, charges, or debits is crucial in regaining financial stability. By employing various types of letters, tailor-made to fit different situations and utilizing relevant keywords, individuals can take the necessary steps towards resolving any financial consequences caused by known imposters.

Queens New York Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits

Description

How to fill out Queens New York Letter From Known Imposter To Creditor Accepting Responsibility For Accounts, Charges Or Debits?

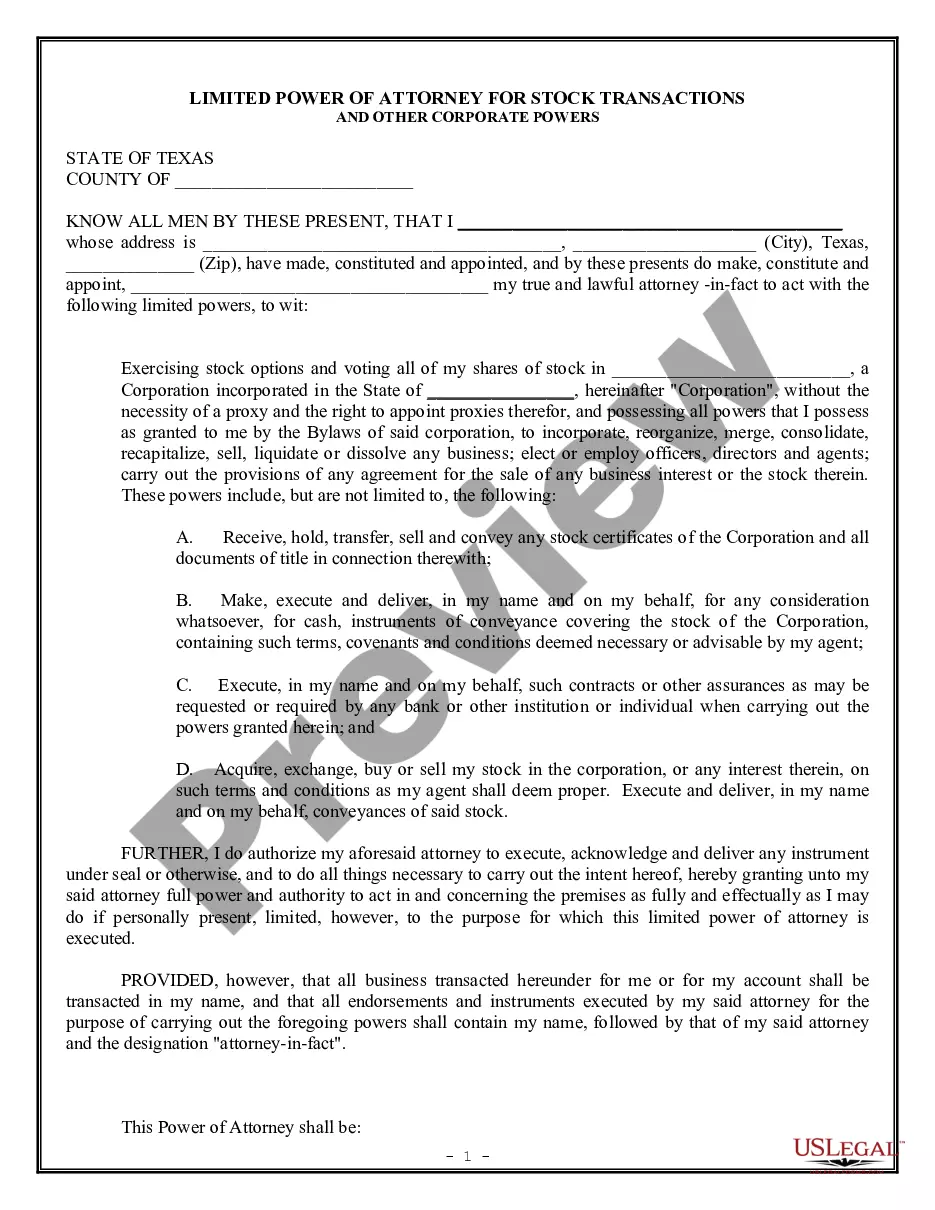

Are you looking to quickly create a legally-binding Queens Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits or probably any other document to handle your personal or business affairs? You can select one of the two options: contact a professional to draft a valid paper for you or create it completely on your own. The good news is, there's a third option - US Legal Forms. It will help you receive professionally written legal papers without having to pay unreasonable prices for legal services.

US Legal Forms offers a rich collection of more than 85,000 state-specific document templates, including Queens Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits and form packages. We offer documents for a myriad of life circumstances: from divorce papers to real estate documents. We've been out there for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the needed template without extra hassles.

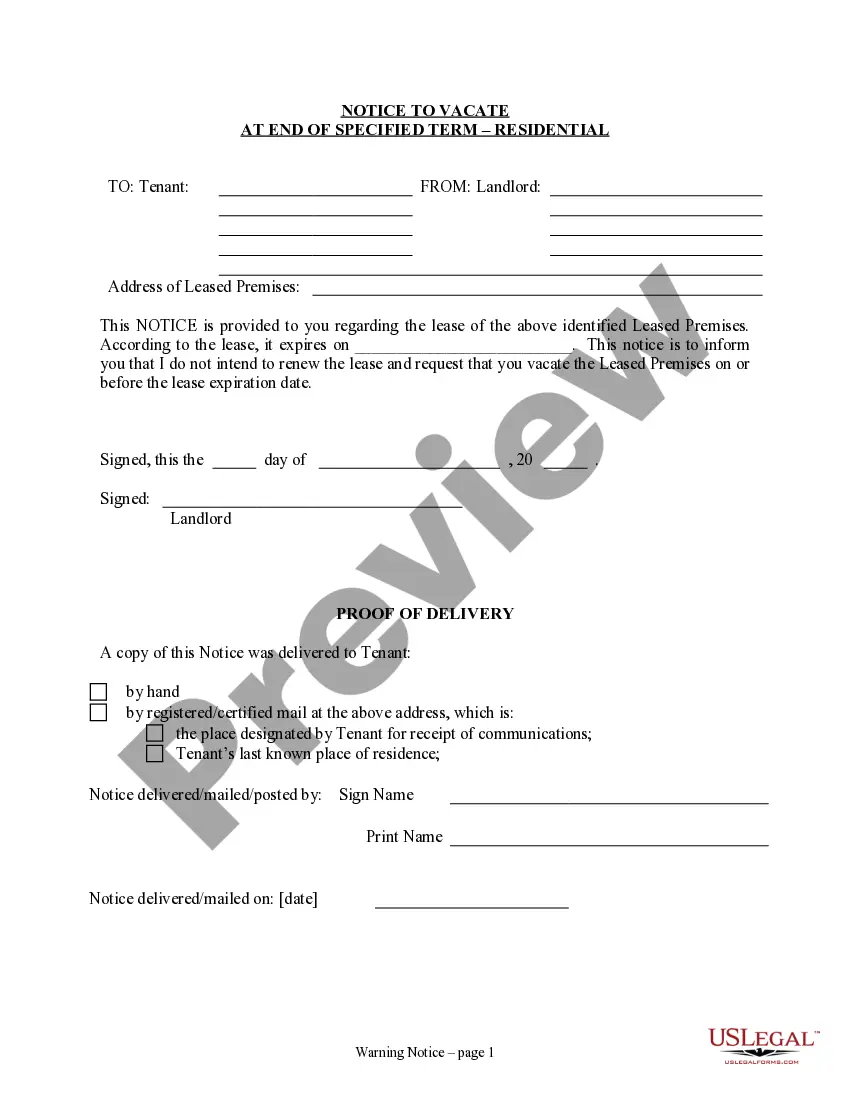

- To start with, double-check if the Queens Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits is adapted to your state's or county's regulations.

- In case the form comes with a desciption, make sure to check what it's intended for.

- Start the search over if the form isn’t what you were looking for by using the search bar in the header.

- Select the subscription that best suits your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Queens Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to find and download legal forms if you use our services. In addition, the documents we offer are updated by law professionals, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

Mail the letter first class. You should send the letter first class, return receipt requested. The receipt will serve as proof that the creditor received the letter. Be sure to attach any supporting documentation, such as a copy of your credit report.

It is important to send your debt validation letter via certified mail because: You'll have proof of delivery with a time stamp and the debt collector can never claim gosh, we never received your debt validation request. You'll get their attention because only serious documents are sent via certified mail.

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors. You should also include all the key information your creditor will need to locate your account on their system, which includes: Your full name used on the account. Your full address.

Information about your debt collection rights, including language that: If you don't dispute the debt within 30 days the debt collector will assume the debt is valid. If you do dispute the debt in writing within 30 days the debt collector must stop collection until it provides you verification of the debt.

A goodwill letter, sometimes called a forgiveness removal letter, is essentially a letter you write to your creditor that nicely asks for them to remove a negative mark from your credit reports. Writing a goodwill letter to a creditor is fairly easy and is definitely something you can do for DIY credit repair.

A Debt Release Letter is a letter written by a creditor to a debtor when their debt has been recouped in full. It establishes that a financial obligation no longer exists between the creditor and debtor.

The term "debt validation letter" refers to a letter that an individual sends to their creditor or collection agency requesting proof that the debt in question is valid and not outside the statute of limitations for collecting the debt.

Debt collectors are legally required to send you a debt validation letter, which outlines what the debt is, how much you owe and other information. If you're still uncertain about the debt you're being asked to pay, you can send the debt collector a debt verification letter requesting more information.