Wayne, Michigan is a vibrant city located in Wayne County, Michigan, United States. With a population of approximately 17,000 residents, it offers a unique blend of small-town charm and urban amenities. Situated just 20 miles west of downtown Detroit, Wayne boasts a rich history, diverse community, and convenient access to a range of entertainment and cultural attractions. In the context of a "Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits," individuals may find themselves in a situation where identity theft or fraudulent activities have occurred. This type of letter serves as a formal acknowledgment by the imposter, accepting responsibility for the accounts, charges, or debits made under false pretenses. This document is essential for rectifying the situation and protecting the victim's credit reputation. Key Points to Include in the Letter: 1. Identifying Information: Ensure that the letter includes the imposter's full name, address, contact number, and any pertinent identification details such as social security number or account numbers if known. This information is crucial for both the imposter and the creditor to accurately identify the relevant accounts or charges. 2. Acknowledgment and Responsibility: Clearly state in the letter that the imposter accepts full responsibility for any fraudulent accounts, charges, or debits that were made using the victim's identity. This demonstrates the imposter's willingness to rectify the situation and accept the consequences. 3. Summary of Incidents: Provide a detailed account of the fraudulent activities that occurred. Include specific dates, account numbers, transaction details, and any supporting documentation that can help the creditor assess the extent of the fraud. This information helps to establish a clear understanding of the situation and assists in resolving the issue promptly. 4. Request for Assistance: Express the imposter's willingness to cooperate fully with the creditor, law enforcement agencies, and any other necessary parties to rectify the fraudulent activities. Offer to provide any additional documentation or information required to support the investigation and to mitigate any further harm. 5. Apology and Intentions: Show remorse for the imposter's actions and the impact it has had on the victim, the creditor, and any affected parties. State the imposter's intentions of rectifying the situation, cooperating fully, and taking the necessary steps to prevent any future fraudulent activities. Different Types of Wayne, Michigan Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits: 1. General Identity Theft: This type of letter is used when an imposter accepts responsibility for various fraudulent accounts, charges, or debits made under the victim's identity. 2. Credit Card Fraud: This letter specifically addresses cases where the imposter acknowledges responsibility for fraudulent credit card charges made using the victim's information. 3. Bank Account Fraud: This type of letter is relevant when the imposter admits to fraudulent activities in the victim's bank accounts, such as unauthorized withdrawals or unauthorized account openings. 4. Loan/Loan Application Fraud: In instances where the imposter accepts responsibility for fraudulent loan applications or unauthorized loans obtained using the victim's identity, this variant of the letter becomes relevant. Remember, each situation may vary, and it is crucial to seek legal advice or consult with an attorney regarding specific cases of identity theft or fraud.

Wayne Michigan Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits

Description

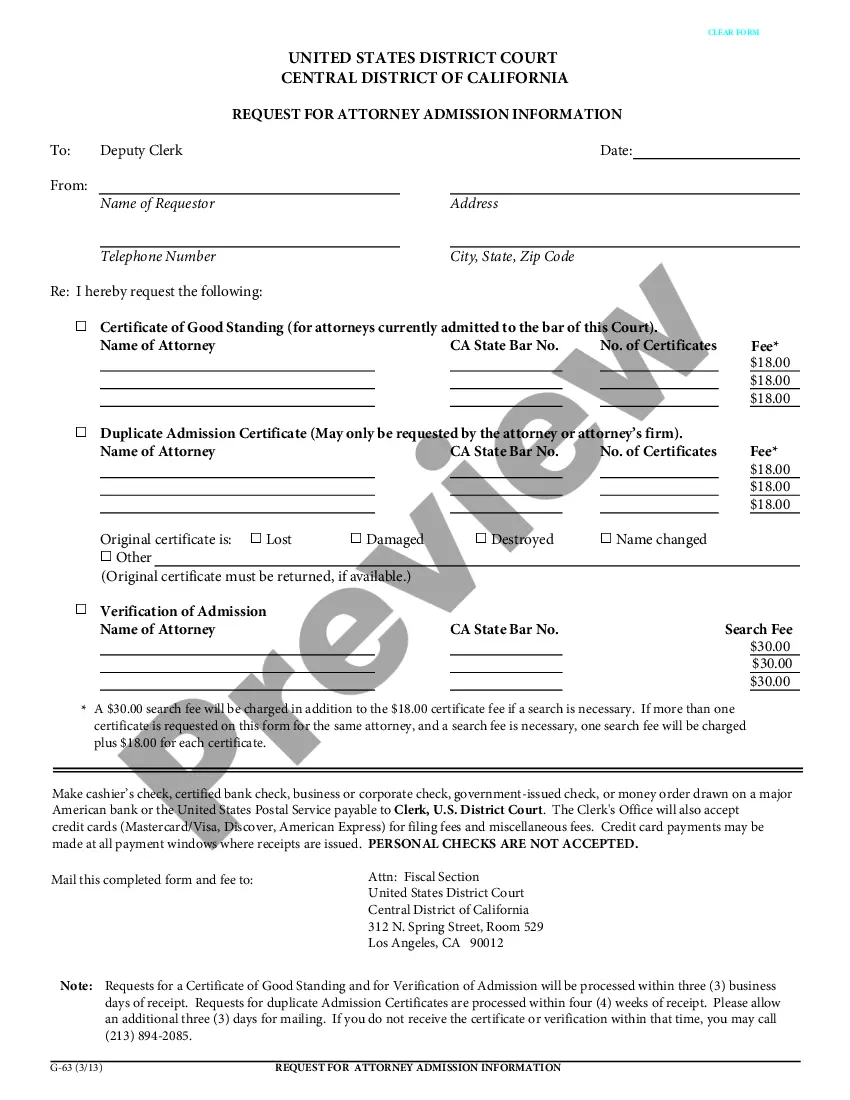

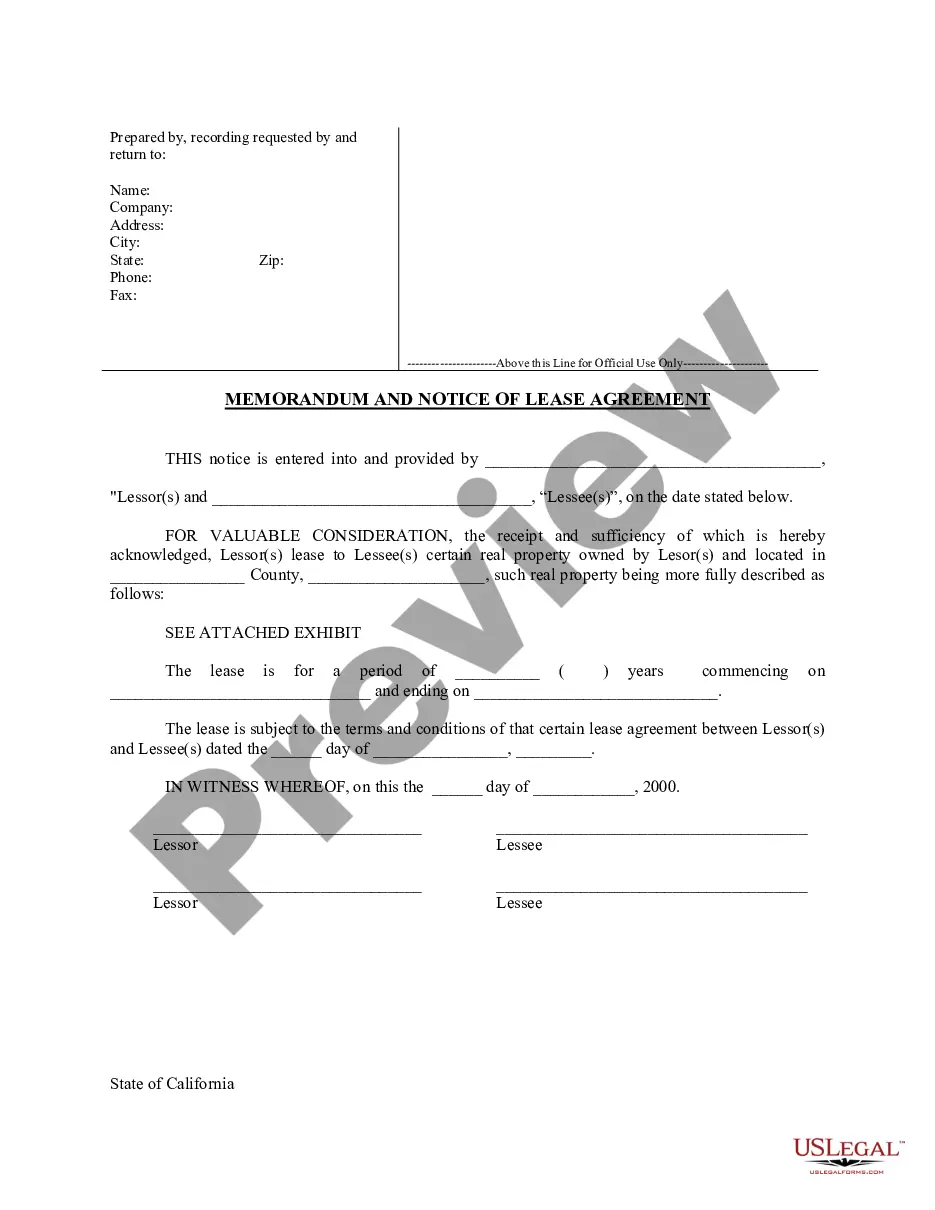

How to fill out Wayne Michigan Letter From Known Imposter To Creditor Accepting Responsibility For Accounts, Charges Or Debits?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask a legal professional to draft a commercial agreement, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Wayne Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits, it may cost you a fortune. So what is the best way to save time and money and create legitimate forms in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario collected all in one place. Therefore, if you need the current version of the Wayne Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Wayne Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits:

- Glance through the page and verify there is a sample for your region.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Opt for the document format for your Wayne Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits and save it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

Debt validation can be extremely effective. If the debt collector is unable to validate your debt, you can request for the debt to be removed. Without validation, your credit report could be filled with multiple debts that don't belong to you.

Mail the letter first class. You should send the letter first class, return receipt requested. The receipt will serve as proof that the creditor received the letter. Be sure to attach any supporting documentation, such as a copy of your credit report.

The term "debt validation letter" refers to a letter that an individual sends to their creditor or collection agency requesting proof that the debt in question is valid and not outside the statute of limitations for collecting the debt.

Send this letter to the credit bureau and include copies of any documentation you have that disputes that you legally owe the debt. Make sure to note that you contacted the creditor and did not receive a response to your validation request, and include copies of the letter and the return receipt as proof.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

Debt collectors are legally required to send you a debt validation letter, which outlines what the debt is, how much you owe and other information. If you're still uncertain about the debt you're being asked to pay, you can send the debt collector a debt verification letter requesting more information.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

The term "debt validation letter" refers to a letter that an individual sends to their creditor or collection agency requesting proof that the debt in question is valid and not outside the statute of limitations for collecting the debt.

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

It is important to send your debt validation letter via certified mail because: You'll have proof of delivery with a time stamp and the debt collector can never claim gosh, we never received your debt validation request. You'll get their attention because only serious documents are sent via certified mail.