Fairfax, Virginia Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan: A Comprehensive Description Introduction: This detailed description focuses on outlining the concept of a Fairfax, Virginia Letter Agreement between a known imposter and a victim to work out a repayment plan. It emphasizes the purpose, application, and benefits of such an agreement. Additionally, it includes various types and scenarios of these agreements, along with relevant keywords to provide an optimized content experience. Definition and Purpose: A Fairfax, Virginia Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan refers to a legally binding document crafted to address situations where a known imposter defrauds an individual, resulting in financial loss or indebtedness. The agreement materializes as a means to facilitate the repayment process in a structured and organized manner. Application and Benefits: This type of agreement serves as a practical tool for victims to recuperate their losses while ensuring the imposter takes appropriate responsibility. By offering a structured repayment plan, victims have the opportunity to recover their finances over time while avoiding more extensive legal action or enforcement processes. The agreement encourages communication, cooperation, and negotiation between the victim and the imposter, thereby fostering a potentially amicable resolution. Types of Fairfax, Virginia Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan: 1. Individual Imposter Agreement: This scenario involves a unique imposter-victim relationship, where a specific individual impersonates another for personal gain or fraudulent activities. The letter agreement aims to establish terms, conditions, and installment plans for the repayment of incurred debts. 2. Organized Imposter Ring Agreement: In instances where imposter fraud involves multiple individuals operating within an organized group or ring, this type of agreement caters to resolving financial restitution. It addresses the complexity of multiple culprits working in coordination and establishes repayment obligations for each individual. 3. Business Imposter Agreement: This category pertains to instances where a known imposter perpetrates fraudulent activities and accumulates debts involving businesses or corporations. The letter agreement aims to forge a repayment plan while considering the imposter's financial capabilities and the victim's recovery expectations. 4. Cyber Impersonation Agreement: With the rise in digital impersonation and identity theft, this specific type of agreement addresses scenarios where the imposter conducts fraudulent activities or financial harm solely through digital means. The agreement focuses on mapping out repayment strategies, potential restitution, and the determination of liability in cyberspace. Conclusion: A Fairfax, Virginia Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan serves as a vital legal instrument to resolve imposter-related financial disputes. By providing structure and guidance for repayment, victims can seek restitution for their losses while avoiding protracted legal battles. Differentiating between types of agreements helps tailor the document to particular scenarios, ensuring efficient resolution and satisfactory outcomes for both parties involved.

Fairfax Virginia Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan

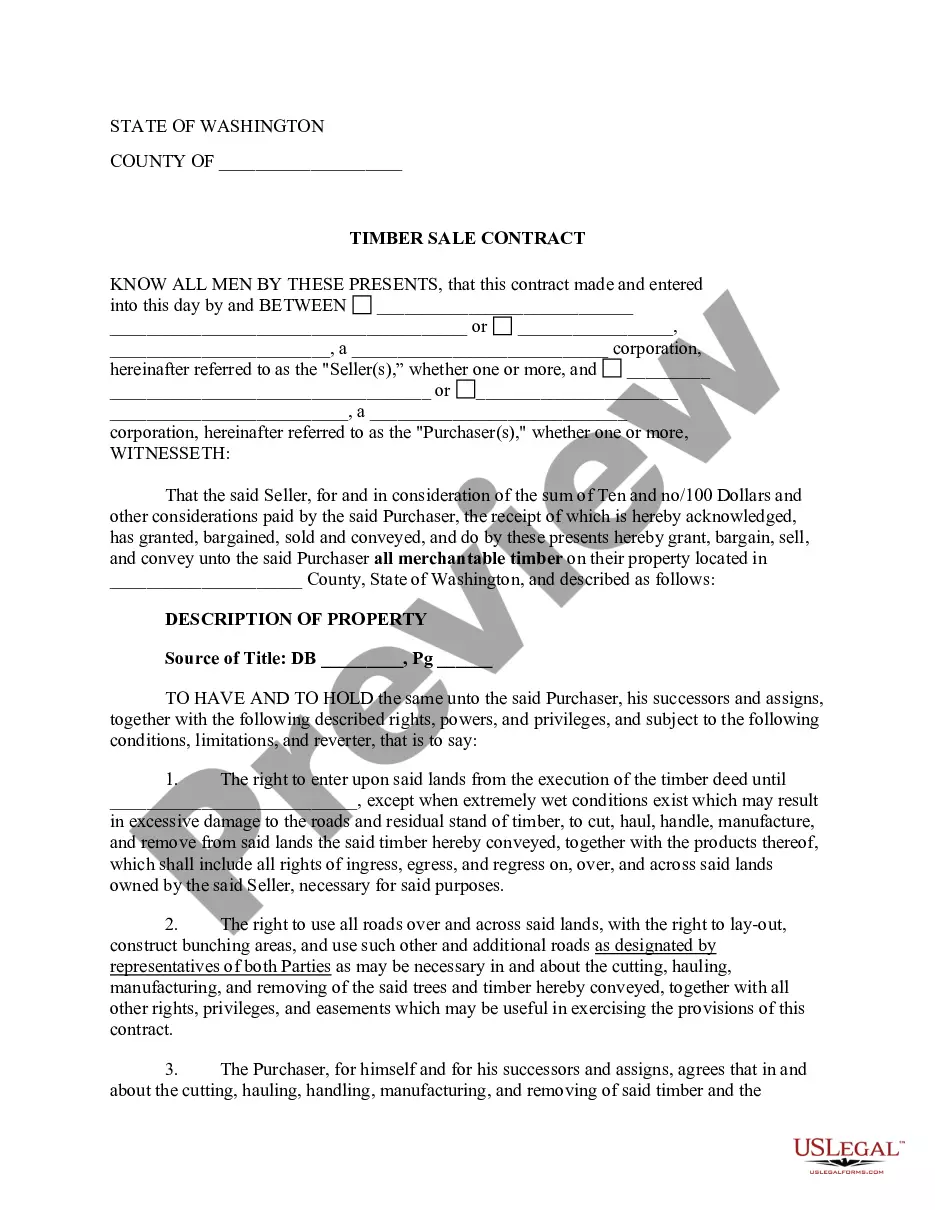

Description

How to fill out Fairfax Virginia Letter Agreement Between Known Imposter And Victim To Work Out Repayment Plan?

If you need to find a trustworthy legal paperwork provider to get the Fairfax Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can search from over 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of learning materials, and dedicated support team make it simple to find and execute different paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply type to look for or browse Fairfax Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan, either by a keyword or by the state/county the document is intended for. After finding the necessary form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Fairfax Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan template and take a look at the form's preview and short introductory information (if available). If you're comfortable with the template’s language, go ahead and hit Buy now. Create an account and choose a subscription plan. The template will be immediately ready for download as soon as the payment is processed. Now you can execute the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes this experience less costly and more affordable. Set up your first company, arrange your advance care planning, draft a real estate contract, or complete the Fairfax Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan - all from the comfort of your sofa.

Sign up for US Legal Forms now!