Title: Kings New York Letter Agreement: Resolving Repayment Plan Between Imposter and Victim Keywords: Kings New York, letter agreement, known imposter, victim, repayment plan. Introduction: The Kings New York Letter Agreement is a legally binding document aimed at resolving financial disputes between a victim and a known imposter. This agreement outlines the terms and conditions for establishing a repayment plan to recover funds that have been fraudulently obtained by the imposter. Let's delve into the details of this agreement and its different types. 1. Basic Elements of a Kings New York Letter Agreement: — Identification: The agreement starts by identifying the involved parties, including their full names, addresses, phone numbers, and other relevant contact information. — Description of Fraud: A detailed explanation of the fraud perpetrated by the imposter must be included to establish the circumstances leading to the dispute. — Acknowledgement of Debt: The imposter formally acknowledges the debt owed to the victim and accepts responsibility for the fraudulent actions committed. — Repayment Plan: The agreement should outline a structured repayment plan specifying the amount to be repaid, the frequency of payments, and any applicable interest rates. — Legal Consequences: A section addressing the consequences of non-compliance or breach of the agreement, including potential legal actions, should be included for enforcement purposes. — Signatures: The agreement should conclude with the signature of both parties and the date of execution, indicating their consent and agreement to the terms. 2. Different Types of Kings New York Letter Agreement: — Impersonation Scam Repayment Plan Agreement: Specifically tailored for victims of impersonation scams, where individuals assumed false identities to extract money from unsuspecting victims. — Ponzi Scheme Repayment Plan Agreement: Designed for those affected by Ponzi schemes, where funds were fraudulently collected for non-existent investments, promising high returns. — Online Fraud Repayment Plan Agreement: Geared towards victims of various online frauds, such as phishing, identity theft, or fraudulent online transactions, seeking financial recovery. Conclusion: The Kings New York Letter Agreement serves as a vital tool in facilitating the resolution of financial disputes between victims and known imposters. By providing a framework for establishing a repayment plan, it allows victims to recover funds obtained through fraudulent means. Whether it be impersonation scams, Ponzi schemes, or online frauds, utilizing this agreement can help victims work towards regaining their financial stability and seek justice.

Kings New York Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan

Description

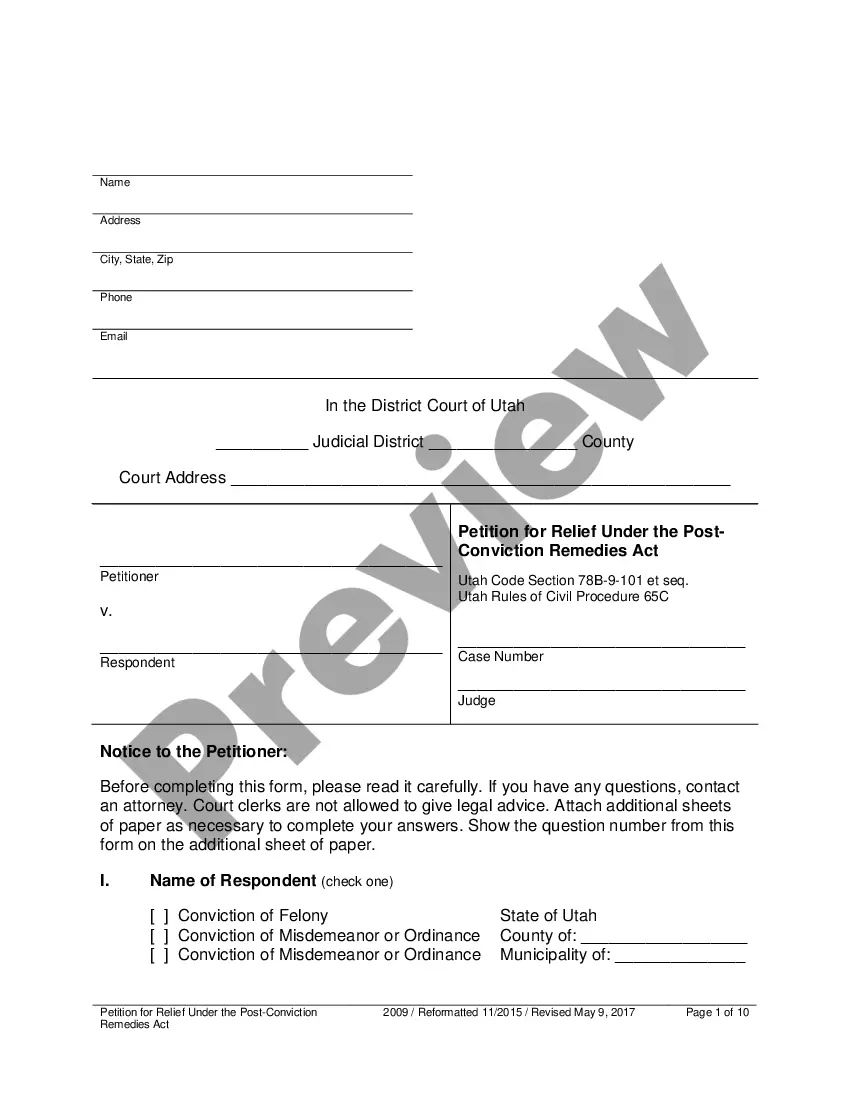

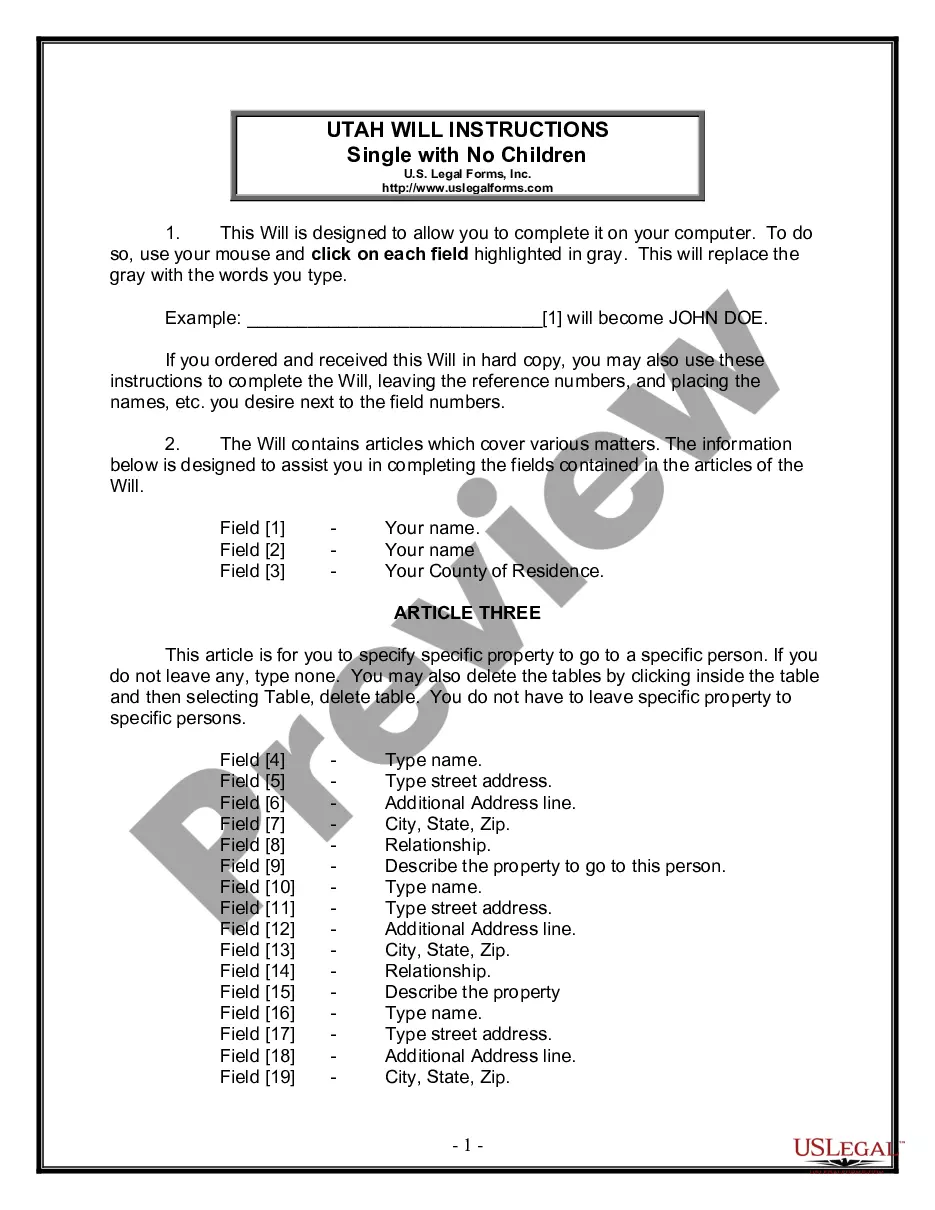

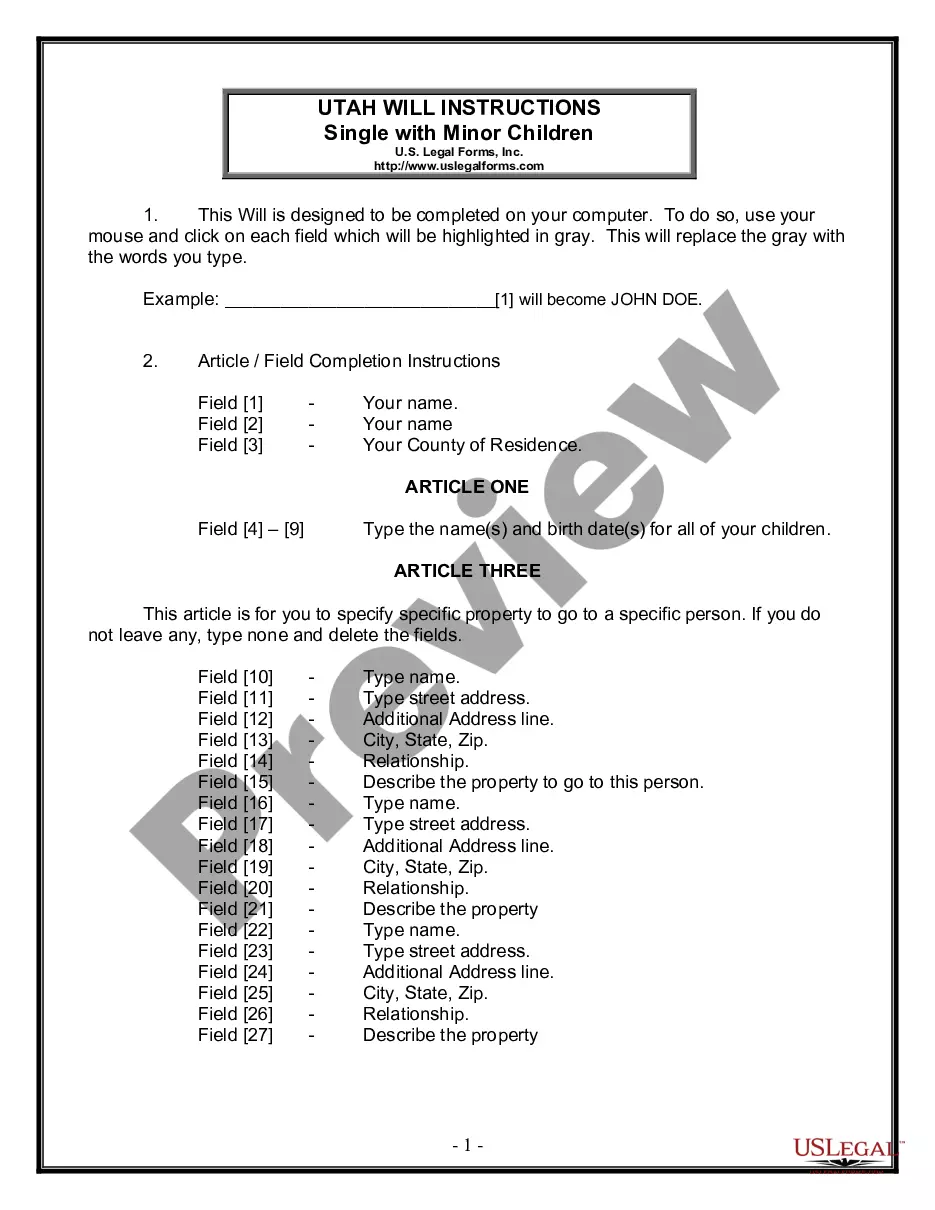

How to fill out Kings New York Letter Agreement Between Known Imposter And Victim To Work Out Repayment Plan?

Creating forms, like Kings Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan, to manage your legal matters is a tough and time-consumming process. A lot of situations require an attorney’s participation, which also makes this task expensive. Nevertheless, you can take your legal matters into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal forms created for various scenarios and life circumstances. We make sure each form is compliant with the laws of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already aware of our website and have a subscription with US, you know how straightforward it is to get the Kings Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan form. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your form? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as easy! Here’s what you need to do before getting Kings Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan:

- Ensure that your template is compliant with your state/county since the rules for writing legal paperwork may vary from one state another.

- Discover more information about the form by previewing it or going through a quick description. If the Kings Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to start utilizing our website and download the form.

- Everything looks good on your side? Click the Buy now button and choose the subscription option.

- Pick the payment gateway and type in your payment details.

- Your form is all set. You can try and download it.

It’s easy to locate and buy the needed template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!