Orange, California is a vibrant city located in Orange County, California. Known for its historic charm and beautiful landscapes, Orange offers its residents and visitors a wide range of attractions and amenities. From its quaint Old Town district, featuring unique shops and restaurants, to its numerous parks and recreational areas, Orange presents a diverse and engaging community. In the context of a "Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan" in Orange, California, it refers to a legally binding document created between a knowingly fraudulent individual and an individual who has fallen victim to their deception. The objective of this agreement is to establish a structured plan to facilitate the repayment of any financial damages caused by the imposter's actions. Keywords: Orange California, letter agreement, known imposter, victim, repayment plan, legal document, fraud, deception, financial damages. Types of Orange California Letter Agreements Between Known Imposter and Victim to Work Out Repayment Plan: 1. Personal Debt Repayment Agreement: This type of agreement is designed for situations where the imposter has defrauded the victim out of money or assets, and the parties involved wish to outline a plan for the imposter to repay the victim over a specified period. 2. Identity Theft Resolution Plan: In cases of identity theft, an imposter may have used the victim's personal information to perpetrate fraud, resulting in financial loss. This type of agreement defines a diligent strategy for the imposter to return any stolen funds and assist the victim in recovering their compromised identity. 3. Property or Asset Reimbursement Agreement: When an imposter has unlawfully acquired property or assets belonging to the victim, this agreement helps establish a structured plan for the imposter to return the items or provide financial compensation. 4. Business Related Restitution Agreement: In situations where an imposter has defrauded a business or entrepreneur, this agreement outlines the terms and conditions for the imposter to reimburse the victimized party for any financial harm caused. 5. Legal Settlement Agreement: If the imposter and victim have pursued legal action, resulting in a settlement being reached, this type of agreement details the payment plan and terms for the imposter to fulfill their financial obligations specified in the settlement. In any of these scenarios, the Orange California Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan acts as a vital tool in outlining the terms and processes for the repayment of financial damages stemming from the imposter's deceitful actions.

Orange California Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan

Description

How to fill out Orange California Letter Agreement Between Known Imposter And Victim To Work Out Repayment Plan?

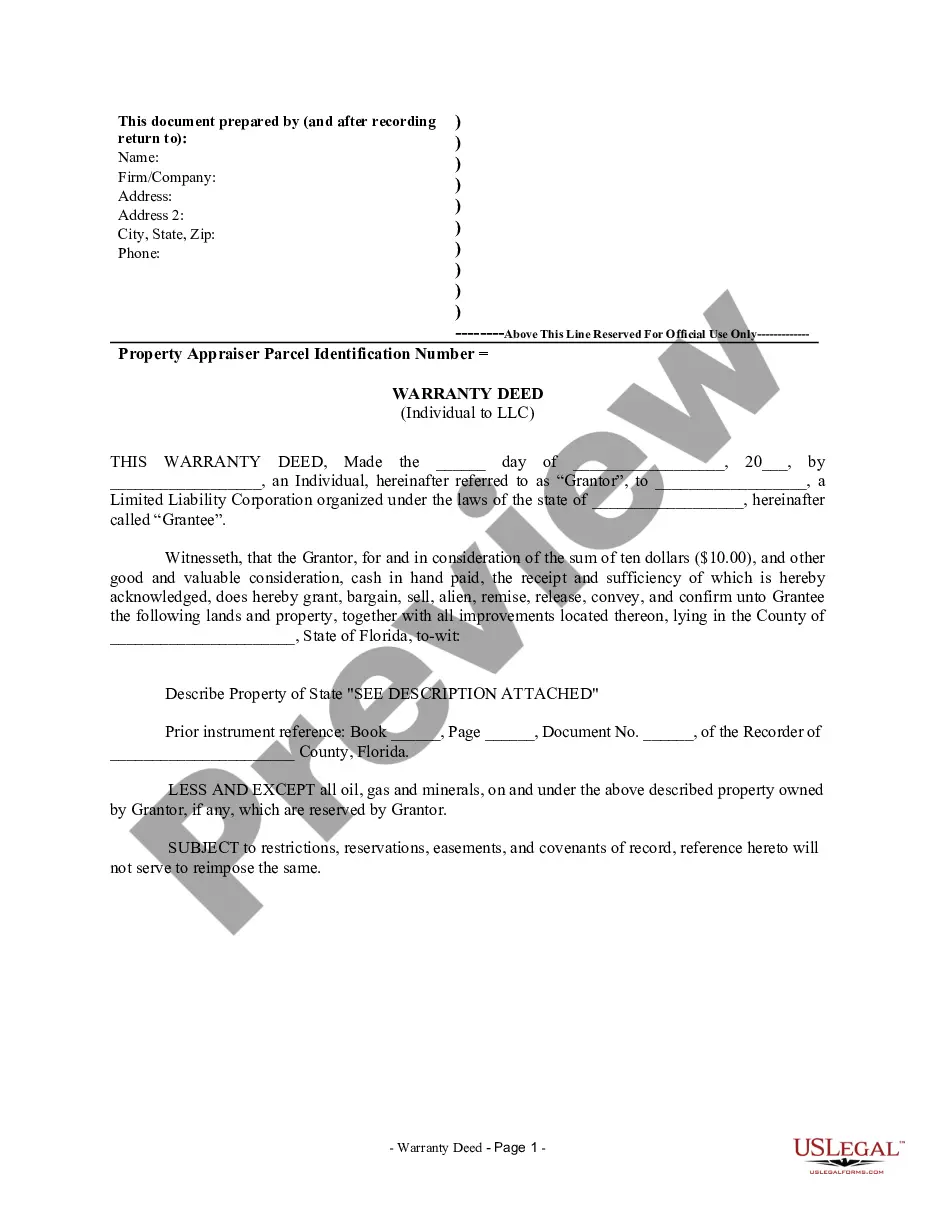

Do you need to quickly draft a legally-binding Orange Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan or probably any other form to handle your personal or business matters? You can select one of the two options: contact a legal advisor to draft a valid paper for you or create it completely on your own. The good news is, there's another solution - US Legal Forms. It will help you get neatly written legal documents without having to pay unreasonable fees for legal services.

US Legal Forms provides a rich collection of more than 85,000 state-specific form templates, including Orange Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan and form packages. We provide documents for a myriad of use cases: from divorce paperwork to real estate documents. We've been out there for more than 25 years and got a spotless reputation among our clients. Here's how you can become one of them and obtain the needed template without extra hassles.

- First and foremost, carefully verify if the Orange Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan is tailored to your state's or county's laws.

- In case the document includes a desciption, make sure to verify what it's suitable for.

- Start the searching process over if the template isn’t what you were looking for by using the search box in the header.

- Select the subscription that best suits your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Orange Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to buy and download legal forms if you use our services. In addition, the documents we provide are updated by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!