Salt Lake Utah Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan: A Salt Lake Utah Letter Agreement between a victim and a known imposter is a legally binding document that outlines the terms and conditions to be followed in order to establish a repayment plan. This agreement is specifically designed for situations where the victim of deceptive practices or fraud resides in Salt Lake City, Utah. Key elements of this agreement include: 1. Parties involved: The agreement identifies the victim who suffered financial loss as a result of the imposter's actions and the known imposter responsible for the fraudulent activities. 2. Intent and purpose: The agreement clarifies the intention to reach a fair and mutually beneficial resolution by creating a repayment plan that enables the imposter to reimburse the victim for their losses over a specified period. 3. Repayment terms: The agreement sets forth the repayment terms, including the total amount owed, the agreed-upon interest rate (if applicable), and the repayment schedule. It may include details on how the payments will be made, such as through installments or lump sum payments. 4. Duration: The agreement establishes the duration of the repayment plan, specifying the timeline within which the imposter must repay the victim in full. This timeframe is typically negotiated and based on the imposter's financial capabilities and the extent of the victim's losses. 5. Consequences of non-compliance: The agreement may include provisions outlining the consequences should the imposter fail to adhere to the prescribed repayment plan. This can entail additional legal actions or penalties, such as a default judgment or credit reporting consequences. Different types of Salt Lake Utah Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan may include variations in the repayment terms, duration, and consequences. Some possible variations might include: 1. Installment-based repayment plan: This type of agreement sets a specific amount to be paid on a regular basis, such as monthly or bi-monthly, until the total sum owed is repaid. 2. Lump sum payment plan: In certain cases, the imposter may opt to repay the victim in a single, larger payment rather than installments, provided both parties agree to it. 3. Negotiated interest rate: The agreement may include an interest rate to be applied to the total amount owed, ensuring that the victim recovers not only the principal but also additional compensation for the financial impact suffered. In conclusion, a Salt Lake Utah Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan is a crucial legal document that assists in establishing a fair and structured approach to recovering financial losses caused by fraud or deceit.

Salt Lake Utah Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan

Description

How to fill out Salt Lake Utah Letter Agreement Between Known Imposter And Victim To Work Out Repayment Plan?

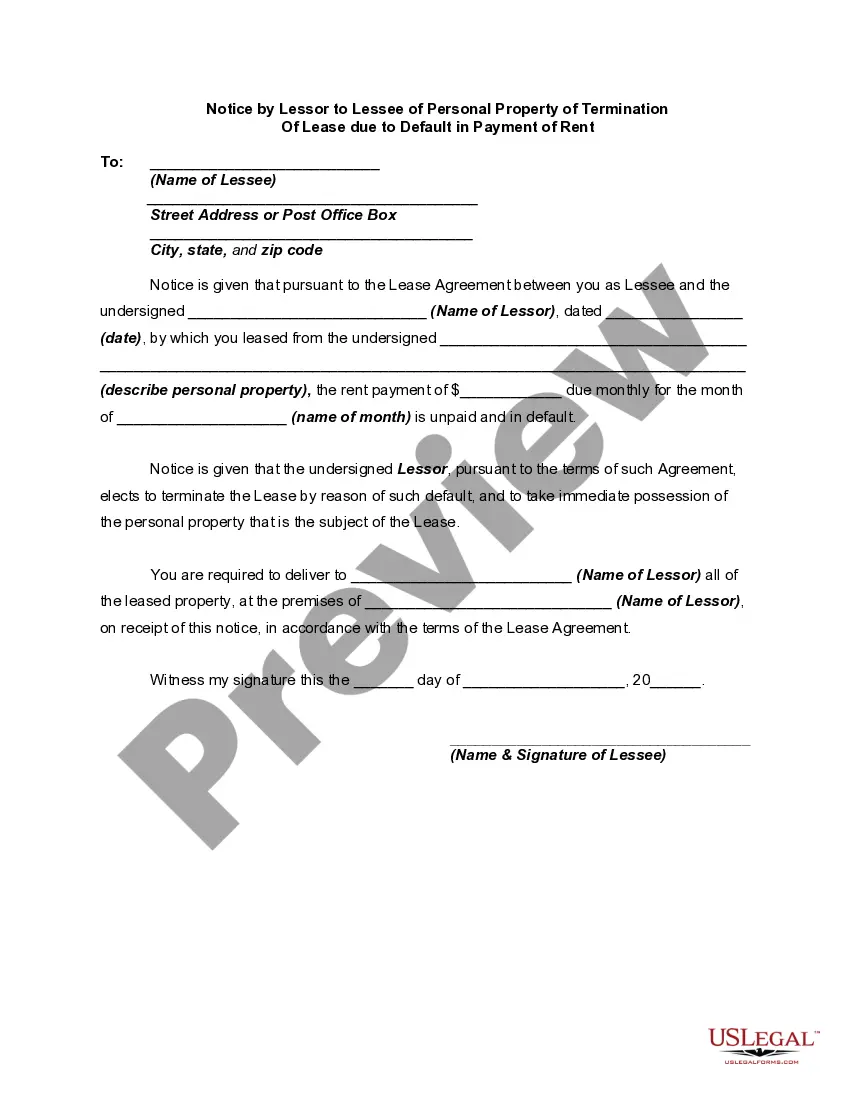

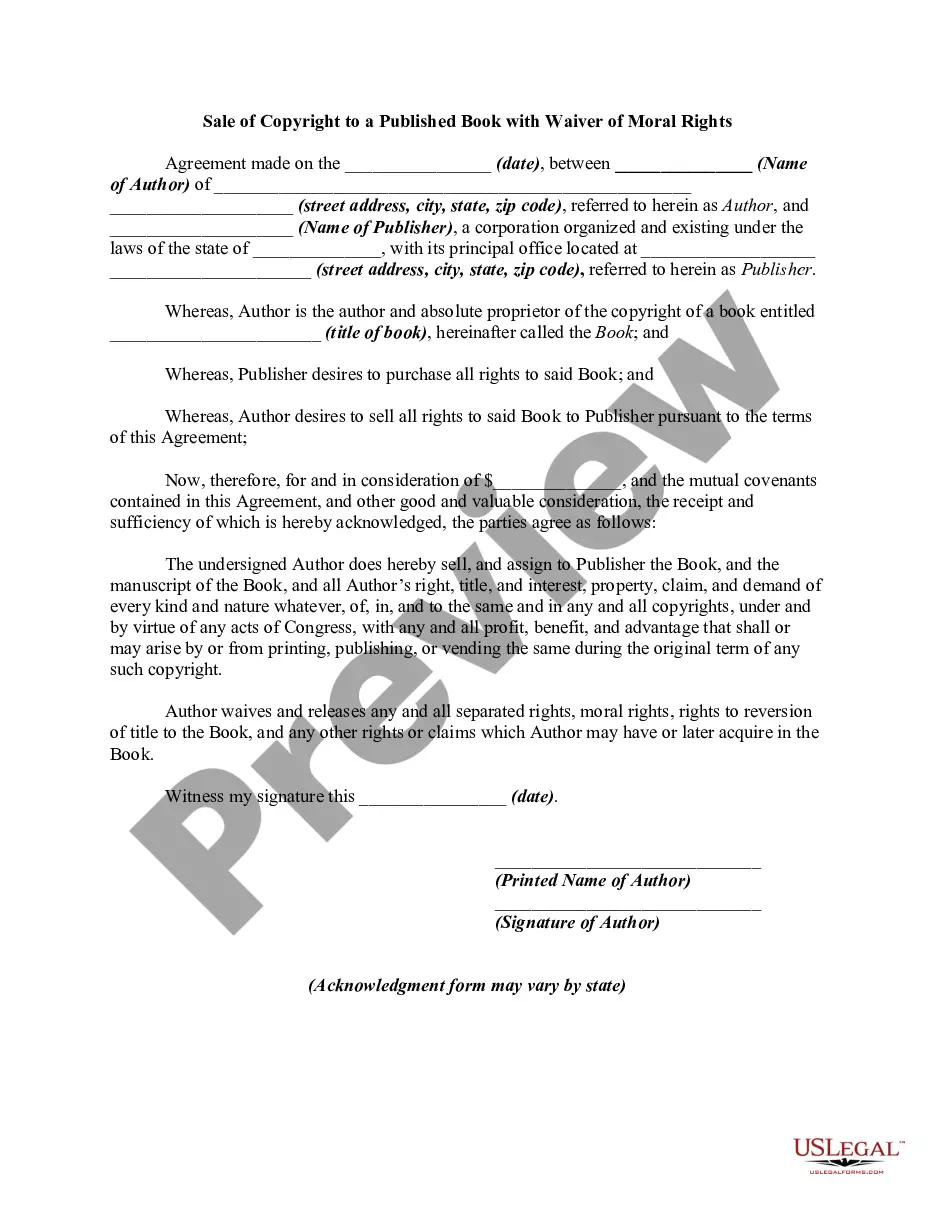

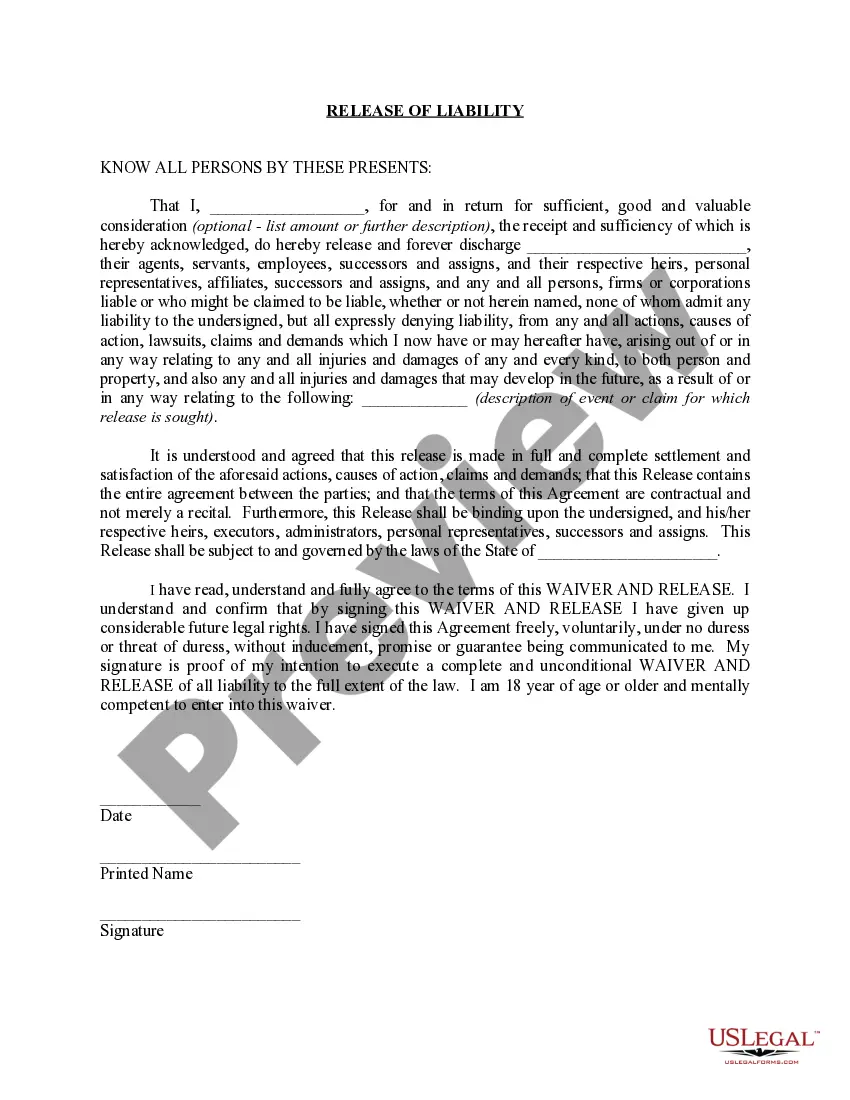

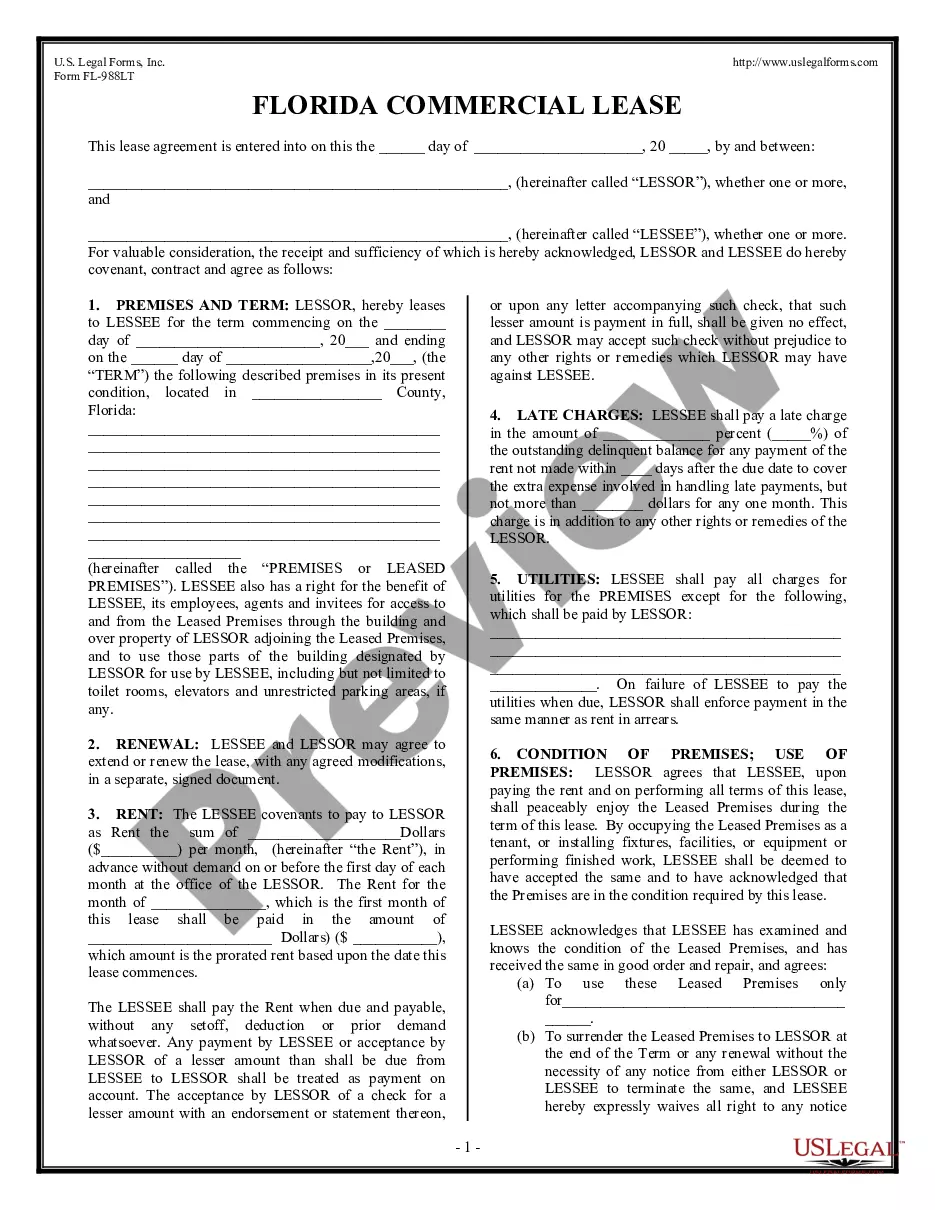

Preparing legal paperwork can be burdensome. In addition, if you decide to ask an attorney to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Salt Lake Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is a perfect solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case gathered all in one place. Therefore, if you need the recent version of the Salt Lake Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the Salt Lake Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the correct one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Choose the document format for your Salt Lake Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan and download it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!

Form popularity

FAQ

It is generally best to file a police report on a scammer, reach out to your bank, and file a complaint with the appropriate federal agency as soon as possible after you have been scammed. To file a police report for a scam, you will need make a call to or visit the fraud division of your local police department.

If you spot a scam or have been scammed, report it and get help. Don't be embarrassed about reporting a scam. Because the scammers are cunning and clever there's no shame in being deceived. By reporting it, you'll make it more difficult for them to deceive others.

Warning signs: Lies romance scammers tell They're far, far away.Their profile seems too good to be true.The relationship moves fast.But they break promises to visit.They claim they need money.And they ask for specific payment methods.Be aware of the warning signs.Evaluate your online presence.

Report the fraudulent transaction to the company behind the money transfer app and ask if they can reverse the payment. If you linked the app to a credit card or debit card, report the fraud to your credit card company or bank. Ask if they can reverse the charge.

At 1-877-IDTHEFT (1-877-438-4338) or go to: To order a copy of your Social Security Administration earnings and benefits statement, or to check whether someone has used your Social Security number to get a job or to avoid paying taxes, visit .

The crime of identity theft is charged as a wobbler offense. A wobbler is a crime that a prosecutor can charge as either a: misdemeanor, or. felony.

Law Enforcement A scam constitutes fraud, which is a criminal act. Notify law enforcement immediately once you realize that you have been conned. This will enable you to obtain a police report, which could possibly help you recoup your losses. It will also allow law enforcement to begin their investigation promptly.

Report the crime Go to or call 877-438-4338 or TDD (202) 326-2502 to file a report with the Federal Trade Commission (FTC). Print out or request an Identity Theft Affidavit. Complete it and save it somewhere safe in your home.

What can I do if I am a victim of a scam? Report the scam to the police. Ask for a copy of the police report.Contact the financial institutions, credit card issuers, or companies that are involved. Tell them about the scam.Contact Equifax and TransUnion.Report the scam to government agencies.

It is generally best to file a police report on a scammer, reach out to your bank, and file a complaint with the appropriate federal agency as soon as possible after you have been scammed. To file a police report for a scam, you will need make a call to or visit the fraud division of your local police department.