Chicago Illinois Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft.: Dear [Credit Reporting Company/Bureau], I am writing to report a case of imposter identity theft that has affected my credit and financial wellbeing. It has come to my attention that someone has fraudulently been using my personal information, posing as me, and engaging in malicious activities resulting in financial damages. As a resident of Chicago, Illinois, I have long been aware of the importance of safeguarding my personal information. However, despite taking necessary precautions, it seems that an imposter has managed to gain access to my sensitive data and has been using it for their own gain. I first noticed the signs of identity theft when I received unfamiliar credit card statements and loan notifications that I had not authorized or applied for. Further investigation revealed numerous discrepancies and suspicious activities on my credit report, indicating that this imposter has been successful in opening various accounts in my name. The impact of this identity theft has been severe and has caused not only financial distress but also considerable emotional strain. As a law-abiding citizen, I find it deeply unsettling that someone could exploit my personal information in such a malicious manner. I am writing to request your immediate assistance in rectifying this matter. I kindly request that you investigate these fraudulent accounts and remove them from my credit report promptly. Additionally, I urge you to implement additional security measures to prevent any further unauthorized access to my personal information. I have taken the necessary steps to report this fraudulent activity to the local authorities, including filing a police report with the Chicago Police Department. Enclosed with this letter are copies of the relevant documents supporting my claim, such as account statements, credit reports, and the police report. In light of this distressing situation, I also request that a fraud alert be placed on my credit file, specifically indicating that my identity has been compromised due to impersonation. Moreover, I would appreciate any guidance or advice you can offer regarding the steps I should take to further protect myself from the consequences of this identity theft. My contact information is provided below. I kindly request that you acknowledge the receipt of this letter promptly and keep me informed of any measures being taken to investigate and address this matter. Thank you for your immediate attention to this matter. I trust your competence and expertise in dealing with such cases and hope for a swift resolution to this challenging situation. Sincerely, [Your Name] [Your Address] [City, State, ZIP] [Phone number] [Email address] Alternative types of Chicago Illinois Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft.: 1. Formal Chicago Illinois Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft. 2. Urgent Chicago Illinois Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft. 3. Complaint Chicago Illinois Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft. 4. Follow-up Chicago Illinois Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft.

Chicago Illinois Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft

Description

How to fill out Chicago Illinois Letter To Credit Reporting Company Or Bureau Regarding Known Imposter Identity Theft?

Whether you plan to start your company, enter into an agreement, apply for your ID renewal, or resolve family-related legal concerns, you must prepare specific documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal templates for any personal or business occurrence. All files are collected by state and area of use, so opting for a copy like Chicago Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft is quick and straightforward.

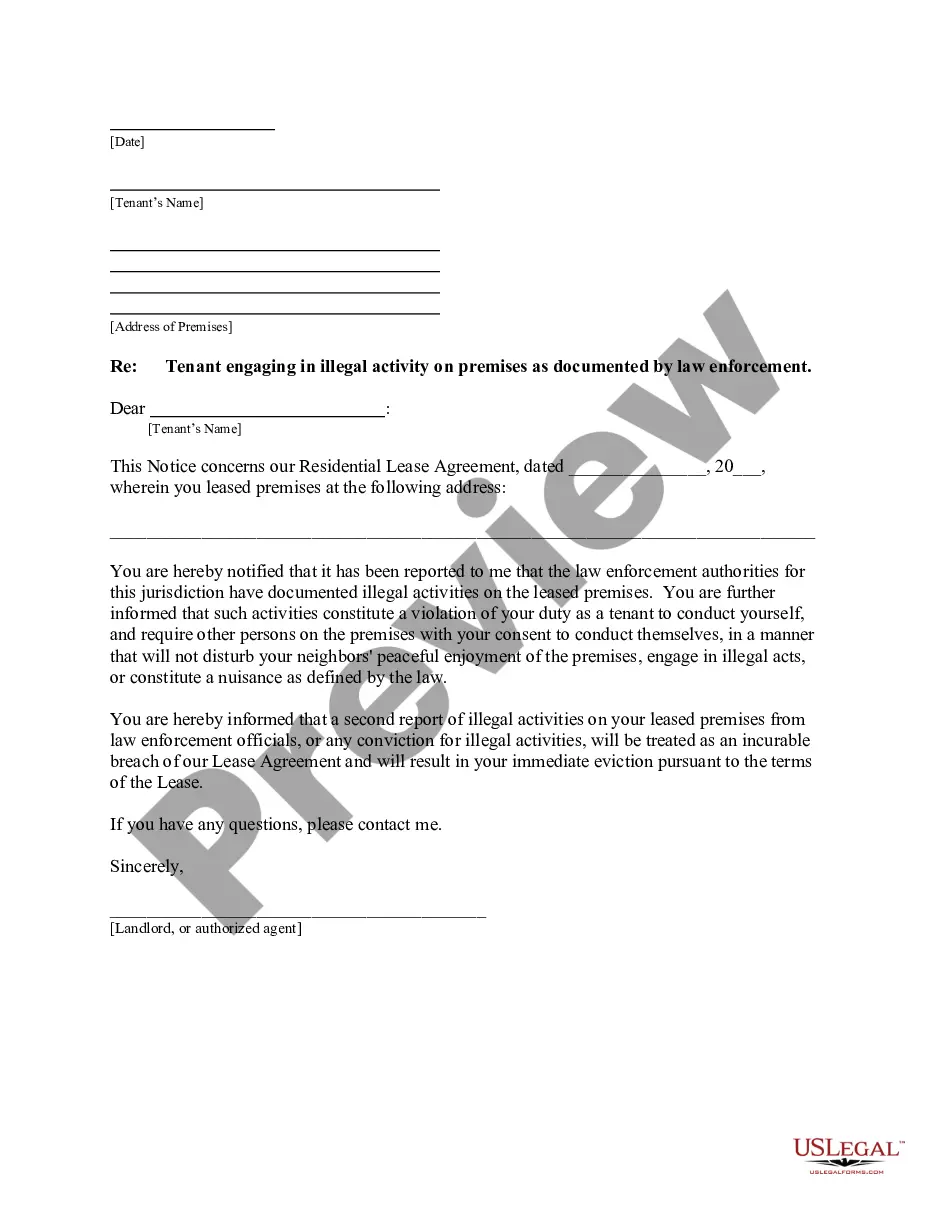

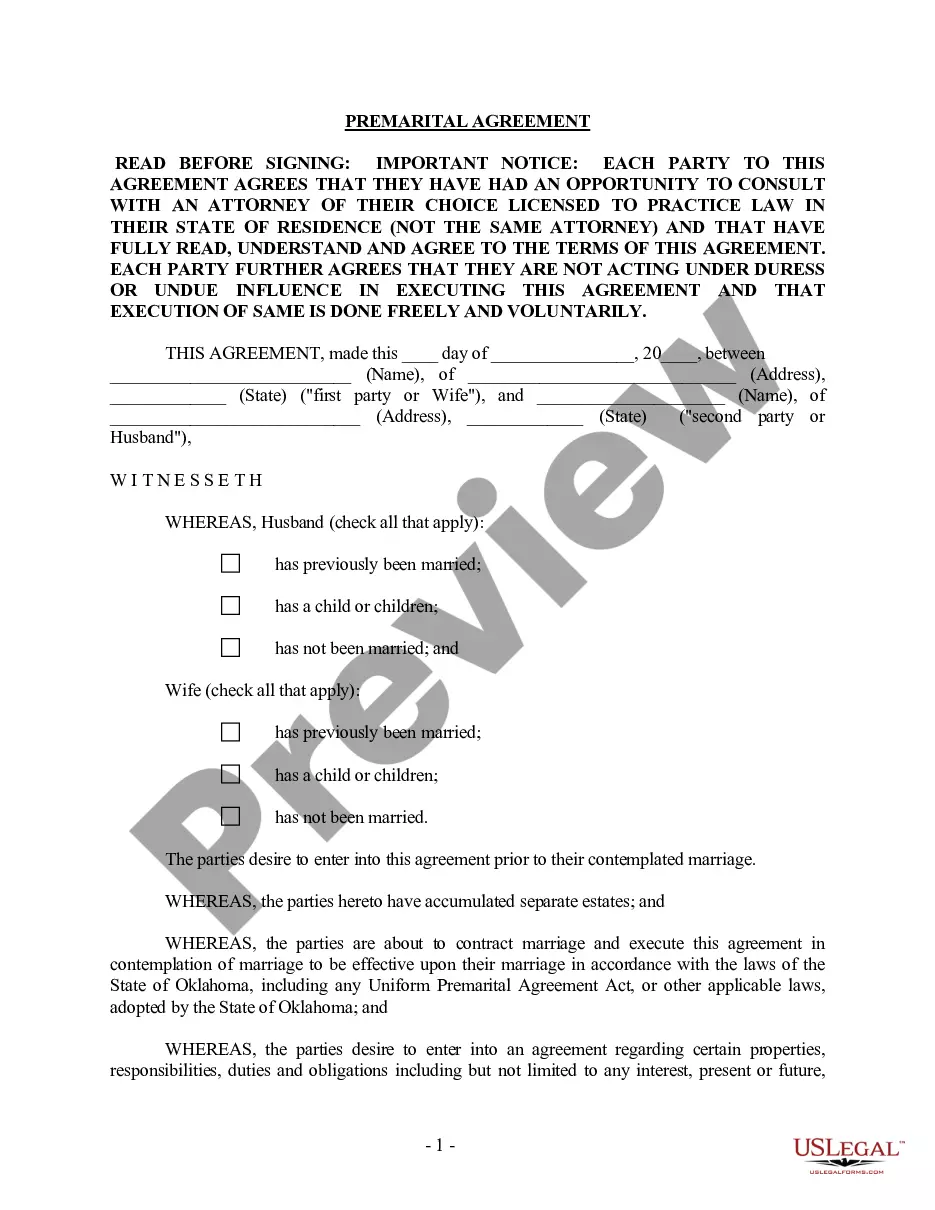

The US Legal Forms library users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of more steps to get the Chicago Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft. Follow the guidelines below:

- Make certain the sample fulfills your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file when you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Chicago Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

If you have been the victim of identity theft or believe your personal or financial information may have been compromised, please call the toll-free Identity Theft Hotline at: 1-866-999-5630 or 1-877-844-5461 (TTY).

CONTACT THE COURT To clear arrest records due to identity theft, you must petition the court for a Judicial Finding of Factual Innocence and inquire about a petition to expunge your criminal record.

As soon as that agency processes your fraud alert, it will notify the other two, which then also must place fraud alerts in your file. Equifax: 1-800-525-6285; . Experian: 1-888-397-3742; . TransUnion: 1-800-680-7289; .

On average, it can take 100 to 200 hours over six months to undo identity theft. One of the best ways to minimize your risk of identity theft before it happens is to reduce the amount of data in your digital footprint.

Identity theft occurs when someone gets or steals your personal information. The information can then be used to open credit accounts in your name or receive benefits, such as employment, insurance or housing. Identity theft may impact your credit reports and credit scores.

Report the Fraud to the Three Major Credit Bureaus Experian 1-888-397-3742. experian.com/fraud/center.html. Equifax 1-800-525-6285. alerts.equifax.com. TransUnion LLC 1-800-680-7289. transunion.com.

Immediately contact the fraud departments of the three major credit bureaus (Equifax, Experian, and Trans Union) to let them know about your situation.

Here are eight recommendations for what to do. Don't ignore any warning signs.Contact the credit bureaus.Check your credit reports.Close the fraudulent cards, loans.Create an identity theft report.File a police report.Fight fraudulent charges.Freeze your credit.

They encourage companies to take additional steps to verify your identity before granting credit in your name. Fraud alerts are free, and you only need to contact one of the three nationwide credit bureaus to have a fraud alert placed on your credit reports -- that bureau will contact the other two.

CONTACT THE COURT To clear arrest records due to identity theft, you must petition the court for a Judicial Finding of Factual Innocence and inquire about a petition to expunge your criminal record.