Title: Kings New York Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft — Types and Detailed Description Introduction: In Kings, New York, individuals who fall victim to known imposter identity theft may need to submit a letter to credit reporting companies or bureaus to protect their financial reputation. This comprehensive guide explores the various types of letters individuals can write in relation to imposter identity theft. It provides detailed descriptions of each type, including the necessary information to include, and emphasizes the importance of taking prompt action to mitigate the potential damage caused by identity theft. 1. Kings New York Letter to Credit Reporting Company — Fraudulent Account Opening: Description: When an individual discovers that an imposter has opened new fraudulent accounts in their name, it is vital to inform credit reporting companies or bureaus. This type of letter serves as a formal notification, urging the company to investigate and remove such fraudulent accounts from the victim's credit report. It highlights the urgency of the situation and provides essential details required for a thorough investigation. Keywords: Kings New York, imposter identity theft, credit reporting company, fraud alert, fraudulent accounts, credit report investigation. 2. Kings New York Letter to Credit Reporting Bureau — Identity Theft Reporting: Description: If an individual in Kings, New York, becomes aware that their personal information has been compromised, they should promptly notify credit reporting bureaus. This letter serves as a reporting tool, providing details of the fraudulent activity and requesting specific actions to protect the victim's credit information. It emphasizes the importance of initiating fraud alerts, freezing credit files, and regularly monitoring credit reports. Keywords: Kings New York, identity theft, credit reporting bureau, fraud reporting, fraud alerts, credit file freeze, credit monitoring. 3. Kings New York Letter to Credit Reporting Company — Dispute Resolution: Description: In situations where a victim of imposter identity theft discovers inaccuracies or unauthorized charges on their credit report, they must file a dispute. This letter serves as a formal communication to credit reporting companies, highlighting the erroneous information and seeking its immediate removal. The letter includes supporting evidence to strengthen the case and requests an investigation and resolution within the required timeframe. Keywords: Kings New York, imposter identity theft, credit reporting company, dispute resolution, credit report inaccuracies, unauthorized charges. Conclusion: Addressing imposter identity theft issues promptly and effectively is crucial to securing one's financial reputation. The Kings New York letters to credit reporting companies or bureaus are valuable tools that victims can utilize to report fraudulent accounts, inform about identity theft incidents, initiate dispute resolutions, and protect their credit information. By following the appropriate protocols and taking swift action, individuals can minimize the potential damage caused by imposter identity theft and reclaim their financial security.

Kings New York Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft

Description

How to fill out Kings New York Letter To Credit Reporting Company Or Bureau Regarding Known Imposter Identity Theft?

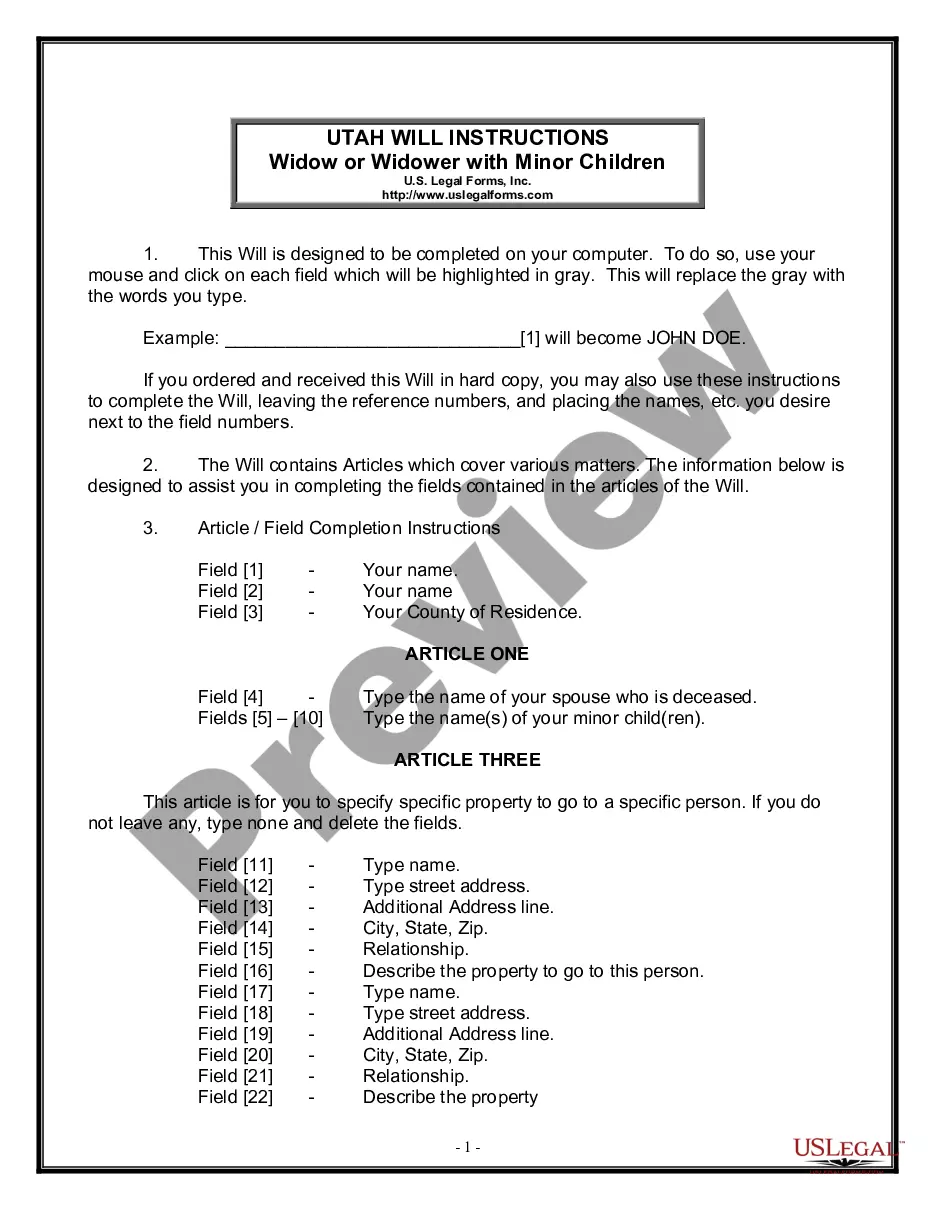

Do you need to quickly draft a legally-binding Kings Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft or maybe any other document to take control of your personal or business matters? You can go with two options: contact a professional to write a legal document for you or create it completely on your own. Thankfully, there's another solution - US Legal Forms. It will help you receive neatly written legal documents without paying sky-high fees for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-specific document templates, including Kings Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft and form packages. We provide documents for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been on the market for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary template without extra troubles.

- First and foremost, carefully verify if the Kings Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft is tailored to your state's or county's regulations.

- If the document comes with a desciption, make sure to check what it's suitable for.

- Start the searching process again if the form isn’t what you were hoping to find by utilizing the search box in the header.

- Choose the subscription that best fits your needs and move forward to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Kings Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. Additionally, the templates we provide are reviewed by law professionals, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!