Cuyahoga County, Ohio is located in the northeastern part of the state. It is the most populous county in Ohio, home to over 1.2 million residents. The county seat is Cleveland, which is also the largest city in the state. Cuyahoga County is known for its rich history, diverse culture, and vibrant communities. When it comes to reporting a known imposter identity theft to the Social Security Administration (SSA), residents of Cuyahoga County have an important responsibility to protect their personal information and prevent further fraudulent activities. Writing a letter to the SSA can help initiate the investigation process and ensure that appropriate measures are taken to resolve the issue. In the Cuyahoga Ohio letter to report known imposter identity theft to the Social Security Administration, several relevant keywords may include: 1. Identity theft: This refers to the fraudulent acquisition and use of someone's personal information without their consent, usually for financial gain. 2. Imposter identity theft: This specific type of identity theft involves someone pretending to be another person, assuming their identity to carry out illegal activities. 3. Social Security Administration (SSA): The governmental agency responsible for administering social security programs in the United States. Reporting identity theft to the SSA is crucial as they can take steps to protect your Social Security number and prevent misuse. 4. Fraudulent activities: This term encompasses various forms of illegal activities carried out by imposters, such as opening fraudulent accounts, using someone's credit card information, or applying for loans under another person's name. 5. Investigation process: When identity theft is reported, the SSA launches an investigation to verify the fraudulent activities, gather evidence, and take appropriate actions to resolve the matter. Different types of Cuyahoga Ohio letters to report known imposter identity theft to the Social Security Administration may include: 1. Initial Identity Theft Report: This letter would be the first communication from the victim to notify the SSA about the fraudulent activities and provide necessary details regarding the imposter identity theft. 2. Follow-up or Additional Information Letter: In case additional evidence or information becomes available after reporting the identity theft, this letter would be sent to the SSA to update them on the ongoing situation. 3. Request for Progress Update Letter: If the victim wants to inquire about the progress of the SSA's investigation or any actions taken, a letter requesting a progress update can be sent to ensure continued communication and vigilance in resolving the identity theft. It is important to note that while this general information can guide you, you may need to tailor the letter's content to your specific circumstances and concerns. Always include relevant personal details and provide any supporting documentation to aid the investigation process.

Cuyahoga Ohio Letter to Report Known Imposter Identity Theft to Social Security Administration

Description

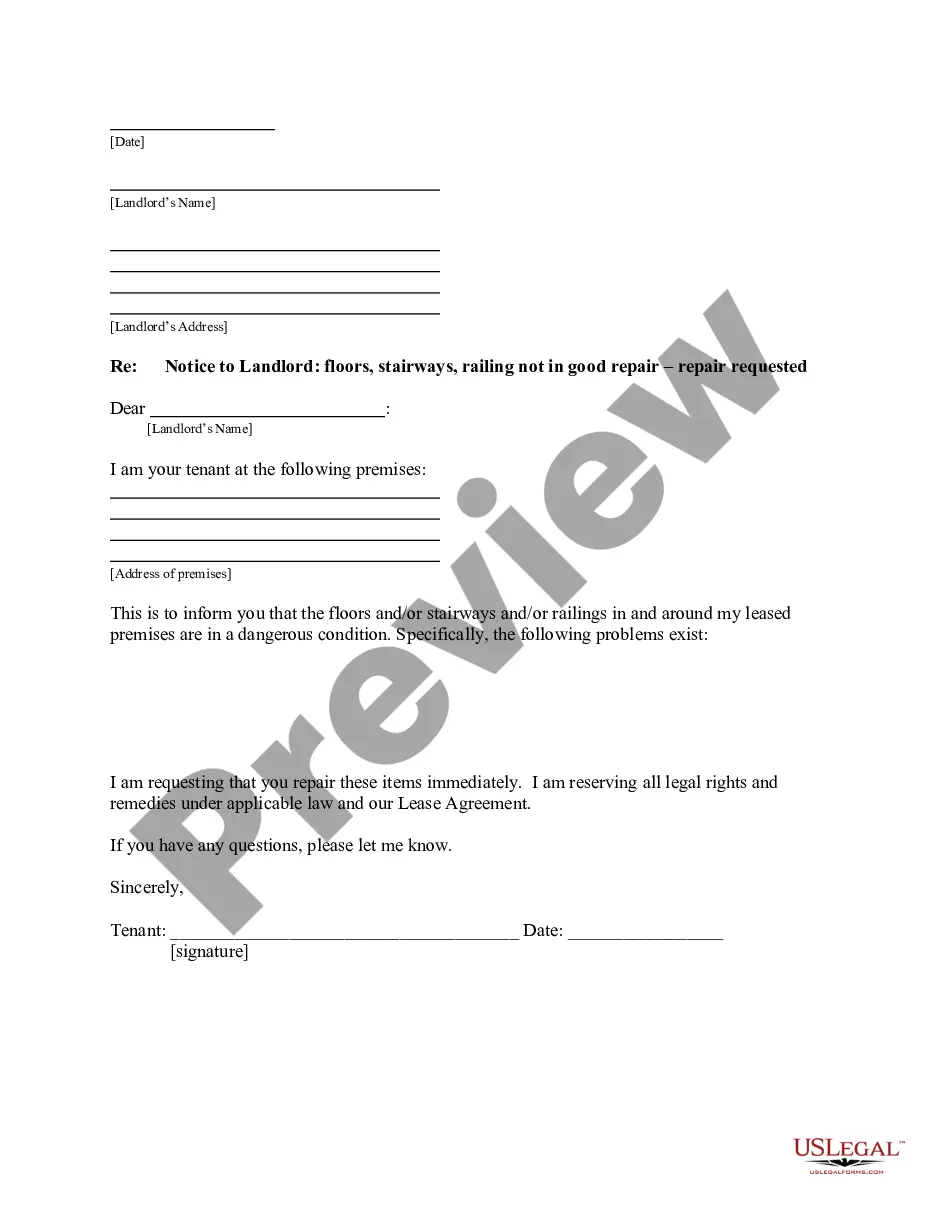

How to fill out Cuyahoga Ohio Letter To Report Known Imposter Identity Theft To Social Security Administration?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare official paperwork that varies throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and download a document for any personal or business objective utilized in your county, including the Cuyahoga Letter to Report Known Imposter Identity Theft to Social Security Administration.

Locating templates on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the Cuyahoga Letter to Report Known Imposter Identity Theft to Social Security Administration will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to obtain the Cuyahoga Letter to Report Known Imposter Identity Theft to Social Security Administration:

- Ensure you have opened the right page with your localised form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template corresponds to your requirements.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Cuyahoga Letter to Report Known Imposter Identity Theft to Social Security Administration on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

If you know your Social Security information has been compromised, you can request to Block Electronic Access. This is done by calling our National 800 number (Toll Free 1-800-772-1213 or at our TTY number at 1-800-325-0778).

How to Protect Your SSN Offer an Alternative Form of ID.Ask Why They Want It and How It Will Be Handled.Leave Your Card at Home.Shred Mail and Documents With Personal Details.Don't Use Your SSN as a Password.Don't Send Your SSN via an Electronic Device.Don't Give It out to Strangers.

If you suspect someone is using your number for work purposes, you should contact us to report the problem. We'll review your earnings with you to ensure our records are correct. You also may review earnings posted to your record on your Social Security Statement.

Contact the Federal Trade Commission at 1-877-FTC-HELP, 1-877-ID-THEFT, or online at .

By checking your bank statements and credit card statements, you can determine whether someone has conducted fraudulent transactions on your accounts. Unfortunately, there is no way of knowing whether someone has your Social Security number until they use it.

You can contact the OIG's fraud hotline at 1-800-269-0271 or submit a report online at .

File fraudulent tax returns Your Social Security number is also used to file your taxes in most cases. Someone who has your SSN can file a fraudulent tax return in your name to be able to claim a refund or stimulus money. You often don't know that a fraudulent tax return has been filed until you go to file your own.

If you believe someone is using your Social Security number to work, get your tax refund, or other abuses involving taxes, contact the IRS online or call 1-800-908-4490. You can order free credit reports annually from the three major credit bureaus (Equifax, Experian and TransUnion).

Under California law, you can report identity theft to your local police department. Ask the police to issue a police report of identity theft. Give the police as much information on the theft as possible. One way to do this is to provide copies of your credit reports showing the items related to identity theft.

If you believe someone is using your Social Security number to work, get your tax refund, or other abuses involving taxes, contact the IRS online or call 1-800-908-4490. You can order free credit reports annually from the three major credit bureaus (Equifax, Experian and TransUnion).