Sample Letter to City Clerk regarding Ad Valor em Tax Exemption — Clark, Nevada Subject: Request for Ad Valor em Tax Exemption for Property in Clark, Nevada [Date] [City Clerk's Name] [City Clerk's Office] [City Hall Address] [City, State, ZIP] Dear [City Clerk's Name], I hope this letter finds you in good health and high spirits. I am writing to request an Ad Valor em Tax Exemption for my property located in Clark, Nevada. I am the proud owner of [Property Address], which is a [describe the property, e.g., residential, commercial, industrial, vacant land]. As a responsible citizen and property owner in Clark, I firmly believe in the importance of contributing towards the overall growth and development of our community. I have recently become aware of the Ad Valor em Tax Exemption program offered by the City of Clark. Based on my understanding, this program aims to promote economic development, job creation, and community revitalization by granting eligible properties an exemption from certain property taxes. After conducting thorough research and considering the eligibility criteria outlined by the City of Clark, I am confident that my property meets all the necessary requirements for ad valor em tax exemption. The property has been utilized [mention specific purpose, e.g., for environmentally-friendly business operations, affordable housing, conservation purposes] and aligns perfectly with the objectives set forth by the City. I kindly request that you review my property's eligibility for the Ad Valor em Tax Exemption program in Clark, Nevada. Enclosed are all the required documents, including property ownership details, proof of utilization, and any additional supporting materials as necessary. I am more than willing to provide any further information or evidence that would facilitate the evaluation process. If my property is granted the Ad Valor em Tax Exemption, it will not only provide me with financial relief but also incentivize further investments by property owners committed to the growth and prosperity of our community. Moreover, this exemption will enable me to contribute more effectively towards the betterment of Clark by allocating saved funds towards the crucial areas of education, infrastructure, and public welfare. I appreciate your time and attention to this matter. I kindly request a prompt review and consideration of my application for the Ad Valor em Tax Exemption program. Please keep me informed regarding any additional requirements or next steps in this process. Thank you for your dedication to serving our community and for your assistance in ensuring a fair and equitable tax system for property owners in Clark, Nevada. Yours sincerely, [Your Name] [Your Address] [City, State, ZIP] [Phone number] [Email address] Keywords: Clark, Nevada, Ad Valor em Tax Exemption, City Clerk, property owner, eligibility criteria, economic development, job creation, community revitalization, property taxes, environmentally-friendly, affordable housing, conservation purposes, financial relief, investments, growth, prosperity, education, infrastructure, public welfare, application, tax system, property ownership.

Clark Nevada Sample Letter to City Clerk regarding Ad Valorem Tax Exemption

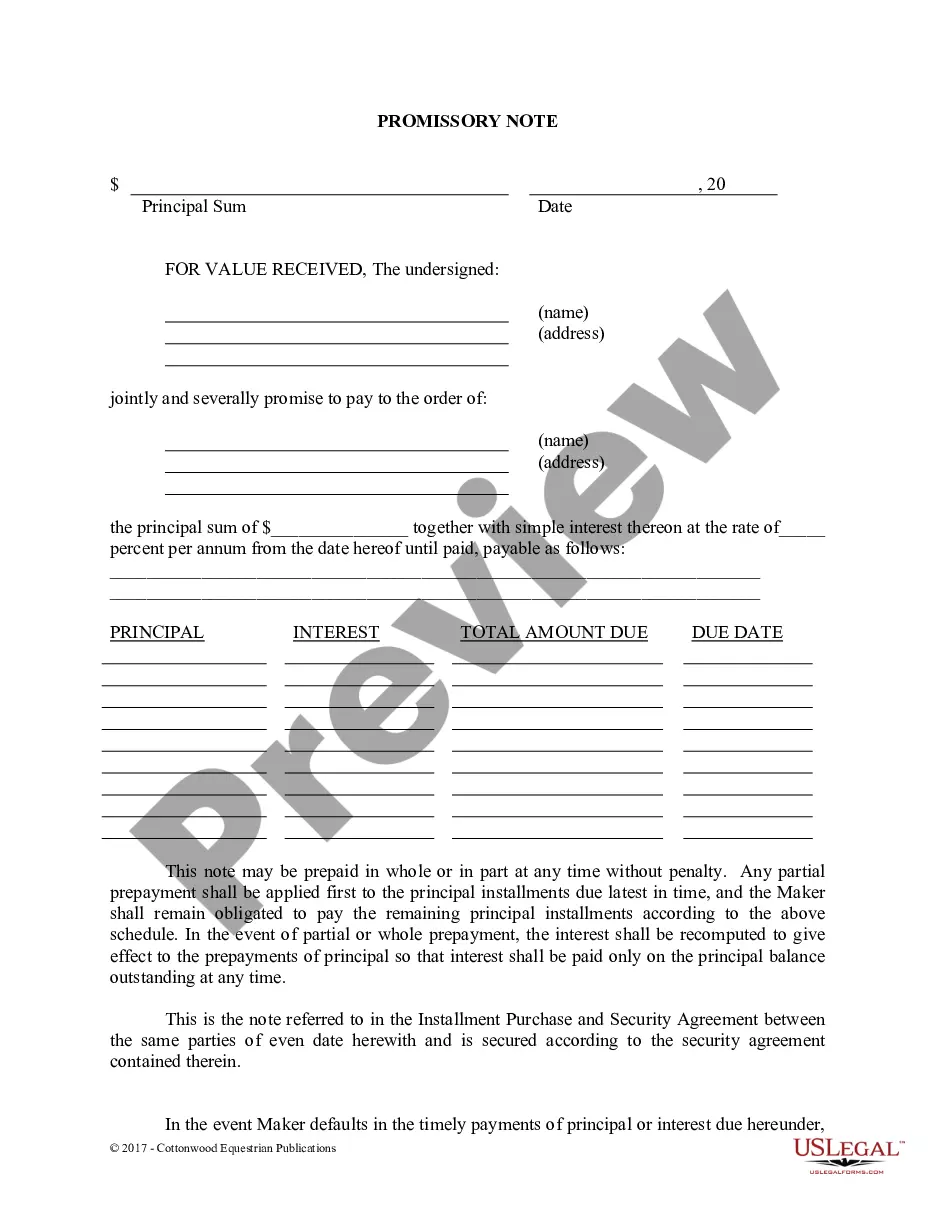

Description

How to fill out Clark Nevada Sample Letter To City Clerk Regarding Ad Valorem Tax Exemption?

Creating forms, like Clark Sample Letter to City Clerk regarding Ad Valorem Tax Exemption, to take care of your legal affairs is a tough and time-consumming process. A lot of cases require an attorney’s involvement, which also makes this task expensive. However, you can acquire your legal affairs into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal forms intended for different cases and life circumstances. We make sure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Clark Sample Letter to City Clerk regarding Ad Valorem Tax Exemption template. Simply log in to your account, download the form, and personalize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is just as simple! Here’s what you need to do before downloading Clark Sample Letter to City Clerk regarding Ad Valorem Tax Exemption:

- Ensure that your document is specific to your state/county since the rules for creating legal documents may vary from one state another.

- Learn more about the form by previewing it or reading a quick intro. If the Clark Sample Letter to City Clerk regarding Ad Valorem Tax Exemption isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to begin using our website and get the form.

- Everything looks great on your side? Click the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment details.

- Your form is ready to go. You can go ahead and download it.

It’s an easy task to locate and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other perks you can get with US Legal Forms!