Dear City Clerk, I hope this letter finds you well. I am writing to inquire about the process of obtaining an Ad Valor em Tax Exemption in Hillsborough, Florida. As a homeowner/business owner in the community, I am interested in understanding the eligibility criteria and application procedure for this exemption. The Hillsborough County Ad Valor em Tax Exemption is a valuable benefit provided to eligible property owners within the county. This exemption allows qualified individuals to reduce their property tax liability based on specific circumstances, such as homestead status, disability, or certain types of properties. One of the most common types of ad valor em tax exemptions in Hillsborough, Florida, is the Homestead Exemption. Homestead exemption provides eligible individuals with a significant reduction in their property tax by exempting a portion of their property's assessed value. This exemption applies to primary residences and provides substantial savings for homeowners. Another type of ad valor em tax exemption available in Hillsborough, Florida, is the Disability Exemption. This exemption is intended for individuals who have a qualifying disability as defined by the law. It provides additional relief on property taxes for disabled individuals and ensures that they can afford to retain their homes despite financial challenges. To apply for an ad valor em tax exemption in Hillsborough, Florida, property owners must submit a formal application to the Hillsborough County Property Appraiser's Office. The application process typically involves providing necessary documentation, such as proof of residence, proof of disability (if applicable), and any supporting documentation required by the specific exemption category. I kindly request that you provide me with the necessary application forms and guidance to help me navigate the ad valor em tax exemption process successfully. Additionally, it would be greatly appreciated if you could inform me of any deadlines or important dates related to these exemptions, ensuring I submit the application within the required timeframe. Thank you for your attention to this matter. I am grateful for the services that the City Clerk's Office provides, and I look forward to receiving your prompt response. Should you have any further questions or require additional information, please do not hesitate to contact me. Sincerely, [Your Name] [Your Address] [City, State, ZIP] [Phone Number] [Email Address]

Hillsborough Florida Sample Letter to City Clerk regarding Ad Valorem Tax Exemption

Description

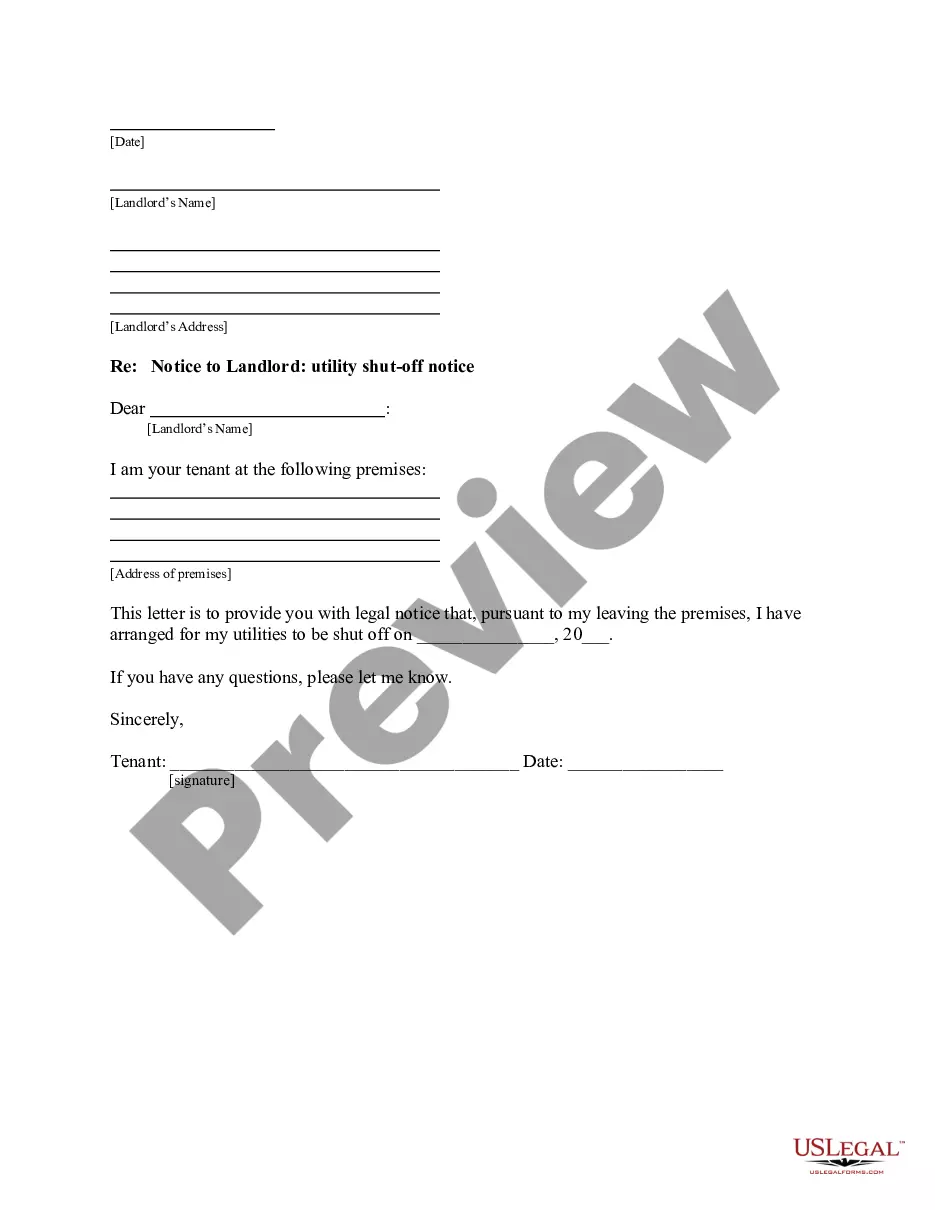

How to fill out Hillsborough Florida Sample Letter To City Clerk Regarding Ad Valorem Tax Exemption?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and lots of other life situations demand you prepare official documentation that differs from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any individual or business purpose utilized in your region, including the Hillsborough Sample Letter to City Clerk regarding Ad Valorem Tax Exemption.

Locating samples on the platform is amazingly simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Hillsborough Sample Letter to City Clerk regarding Ad Valorem Tax Exemption will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to get the Hillsborough Sample Letter to City Clerk regarding Ad Valorem Tax Exemption:

- Ensure you have opened the correct page with your regional form.

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form satisfies your requirements.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the appropriate subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and download the Hillsborough Sample Letter to City Clerk regarding Ad Valorem Tax Exemption on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!