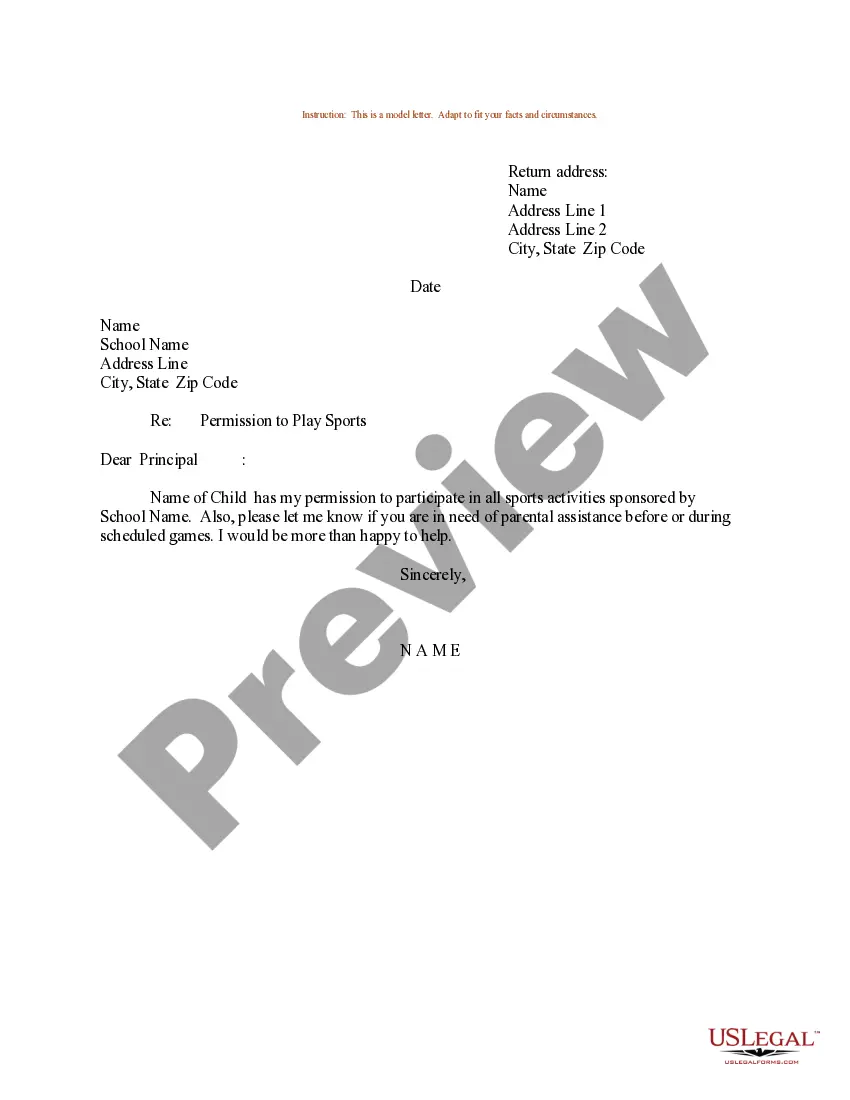

Subject: Request for Ad Valor em Tax Exemption — Los Angeles, California [Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date] [City Clerk's Name] [City Clerk's Office] [City Hall Address] [City, State, ZIP] Dear [City Clerk's Name], RE: REQUEST FOR AD VALOR EM TAX EXEMPTION I am writing to formally request an ad valor em tax exemption for my property located at [property address] in Los Angeles, California. As a law-abiding citizen and a responsible property owner, I would like to avail myself of the benefits extended to homeowners under the tax code regulations in order to alleviate the financial burden associated with property taxes. Los Angeles, California, is a vibrant and diverse city known as the entertainment capital of the world. It is synonymous with glitz, glamour, and limitless opportunities. Home to numerous iconic landmarks like the Hollywood sign, Griffith Observatory, and the Getty Center, Los Angeles attracts millions of visitors each year. The city's cultural richness encompasses a thriving arts scene, enticing culinary offerings, and a diverse range of neighborhoods that cater to people from all walks of life. Within this dynamic urban metropolis, property ownership plays a significant role. The ad valor em tax system, which calculates property taxes based on the assessed value of a property, can often place a substantial financial burden on homeowners. However, the state legislature provides a mechanism whereby homeowners may apply for an ad valor em tax exemption, granting partial or complete relief from the financial obligation associated with property taxes. Cities like Los Angeles afford property owners the opportunity to apply for ad valor em tax exemptions on a variety of grounds. Some permissible grounds for obtaining tax relief are: 1. Homeowner's Exemption: This exemption applies to a primary residence or owner-occupied residential property and provides a reduction of up to $7,000 each year from the assessed value of the property. 2. Senior Citizens Exemption: This exemption is available to homeowners aged 62 or older and offers additional relief from property taxes. 3. Disabled Veterans Exemption: This exemption assists disabled veterans by exempting a portion of the assessed value of their property, providing them with financial relief. 4. Welfare Exemption: Non-profit organizations engaged in charitable activities may qualify for a welfare exemption, providing them with an exemption from paying property taxes. Given the aforementioned options and their potential benefits, I kindly request that you provide the necessary forms and guidelines required for applying for an ad valor em tax exemption in Los Angeles, California. I would greatly appreciate any assistance you can offer in making this application process as smooth and efficient as possible. Please find attached copies of all relevant documents, including proof of ownership, identification, and any supporting materials required for the exemption application process. If there are any additional forms or information needed, please let me know, and I will promptly provide them. I understand the importance of adhering to the governmental regulations and complying with all necessary procedures involved in this process. Therefore, I hope to receive your assistance and guidance in fulfilling the requirements for the ad valor em tax exemption. Thank you for your attention to this matter. I look forward to hearing from you soon. Yours sincerely, [Your Name]

Los Angeles California Sample Letter to City Clerk regarding Ad Valorem Tax Exemption

Description

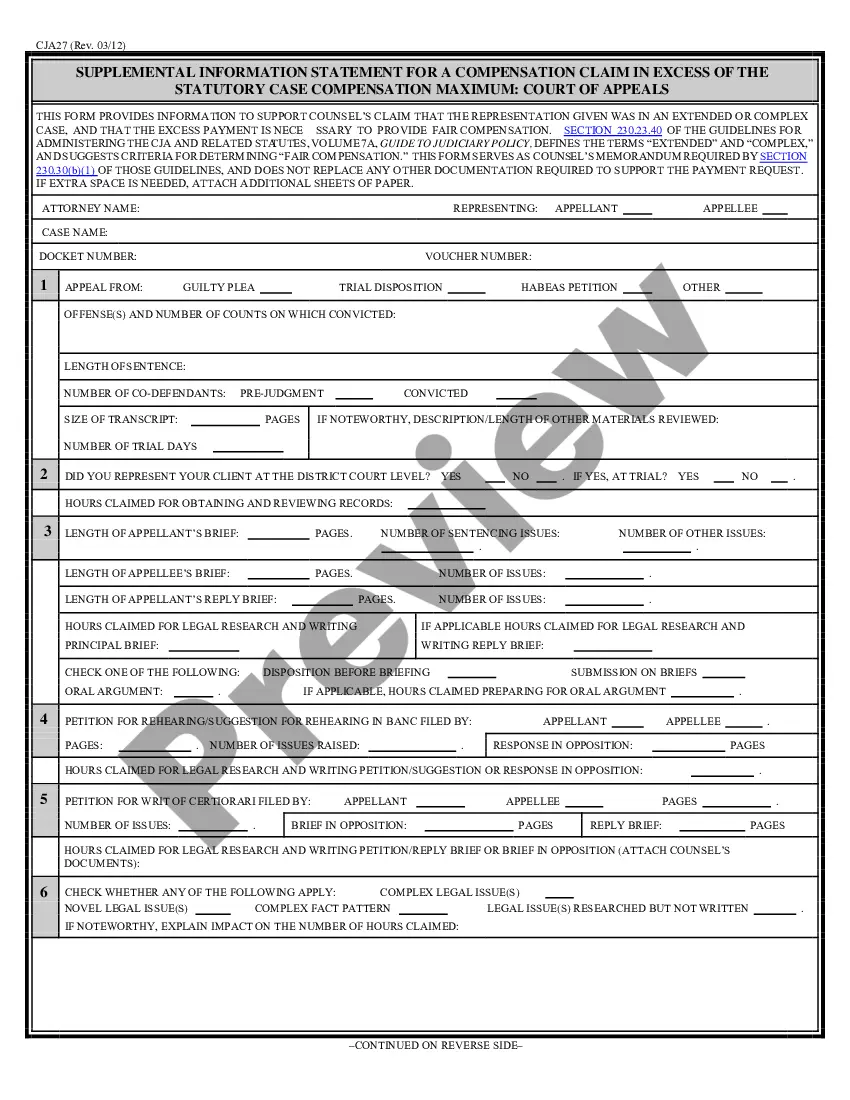

How to fill out Los Angeles California Sample Letter To City Clerk Regarding Ad Valorem Tax Exemption?

Draftwing paperwork, like Los Angeles Sample Letter to City Clerk regarding Ad Valorem Tax Exemption, to take care of your legal matters is a challenging and time-consumming process. Many cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can get your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal documents created for different scenarios and life situations. We ensure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how straightforward it is to get the Los Angeles Sample Letter to City Clerk regarding Ad Valorem Tax Exemption template. Simply log in to your account, download the form, and customize it to your needs. Have you lost your document? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is just as straightforward! Here’s what you need to do before downloading Los Angeles Sample Letter to City Clerk regarding Ad Valorem Tax Exemption:

- Make sure that your document is specific to your state/county since the rules for creating legal papers may differ from one state another.

- Discover more information about the form by previewing it or going through a brief intro. If the Los Angeles Sample Letter to City Clerk regarding Ad Valorem Tax Exemption isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or create an account to start utilizing our service and download the document.

- Everything looks great on your end? Click the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment information.

- Your template is all set. You can go ahead and download it.

It’s an easy task to find and buy the needed template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!