Dear [Lender's Name], I am writing to request the reinstatement of my loan for [loan type] with [loan number]. I understand that there have been some delays in my payment schedule, which I deeply regret. I assure you that I am committed to resolving this situation promptly and ensuring that all future payments are made on time. Houston, Texas, renowned as the fourth-largest city in the United States, serves as the economic and cultural hub of the Southern region. This vibrant and diverse metropolis prides itself on its rich history, thriving industries, world-class dining, and exceptional quality of life. However, unforeseen circumstances have impacted my financial stability, resulting in the temporary disruption of my loan repayment. Houston offers a plethora of loan reinstatement options to cater to various needs and situations. These may include: 1. Conventional Loan Reinstatement: For borrowers who follow the traditional mortgage process, a formal request can be submitted to reinstate their loan with the lender, outlining their commitment to settle the outstanding dues promptly. 2. Federal Loan Reinstatement: Individuals with federal loans, such as student loans, may qualify for loan reinstatement options provided by government agencies. These programs allow borrowers to rectify their payment history and regain eligibility for specific loan benefits. 3. Vehicle Loan Reinstatement: Houston residents who encounter difficulties in repaying their automobile loans can engage with the lender to discuss the possibility of loan reinstatement. Proactive communication and a detailed explanation of the situation can assist in outlining a suitable plan for resuming the loan payments. In requesting the reinstatement of my loan, I would like to propose a revised repayment plan that aligns with my current financial circumstances. I have taken significant steps towards improving my financial situation and would appreciate your consideration during this challenging time. To demonstrate my commitment, I have enclosed supporting documentation, including recent pay stubs, updated bank statements, and a detailed budget plan. These documents illustrate my willingness and ability to meet the revised payment schedule without any further delays or inconvenience. I acknowledge the importance of maintaining a good credit history and the implications that the current delay may have on my financial future. I genuinely value the relationship I have with your esteemed institution, and I am determined to rectify this unfortunate situation promptly. Seeking loan reinstatement reflects my dedication to fulfilling my financial obligations and preserving my creditworthiness. I kindly request that you review my case and provide clear guidelines on the necessary steps to move forward with the reinstatement process. If there are additional documents or information required, please let me know, and I will promptly fulfill your request. Thank you for your understanding, patience, and consideration in this matter. I look forward to resolving this issue and continuing my positive relationship with your institution. Yours sincerely, [Your Name] [Your Contact Information]

Houston Texas Sample Letter for Reinstatement of Loan

Description

How to fill out Houston Texas Sample Letter For Reinstatement Of Loan?

Preparing papers for the business or personal needs is always a big responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to consider all federal and state laws of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it burdensome and time-consuming to create Houston Sample Letter for Reinstatement of Loan without professional help.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Houston Sample Letter for Reinstatement of Loan on your own, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal templates that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

If you still don't have a subscription, adhere to the step-by-step guideline below to get the Houston Sample Letter for Reinstatement of Loan:

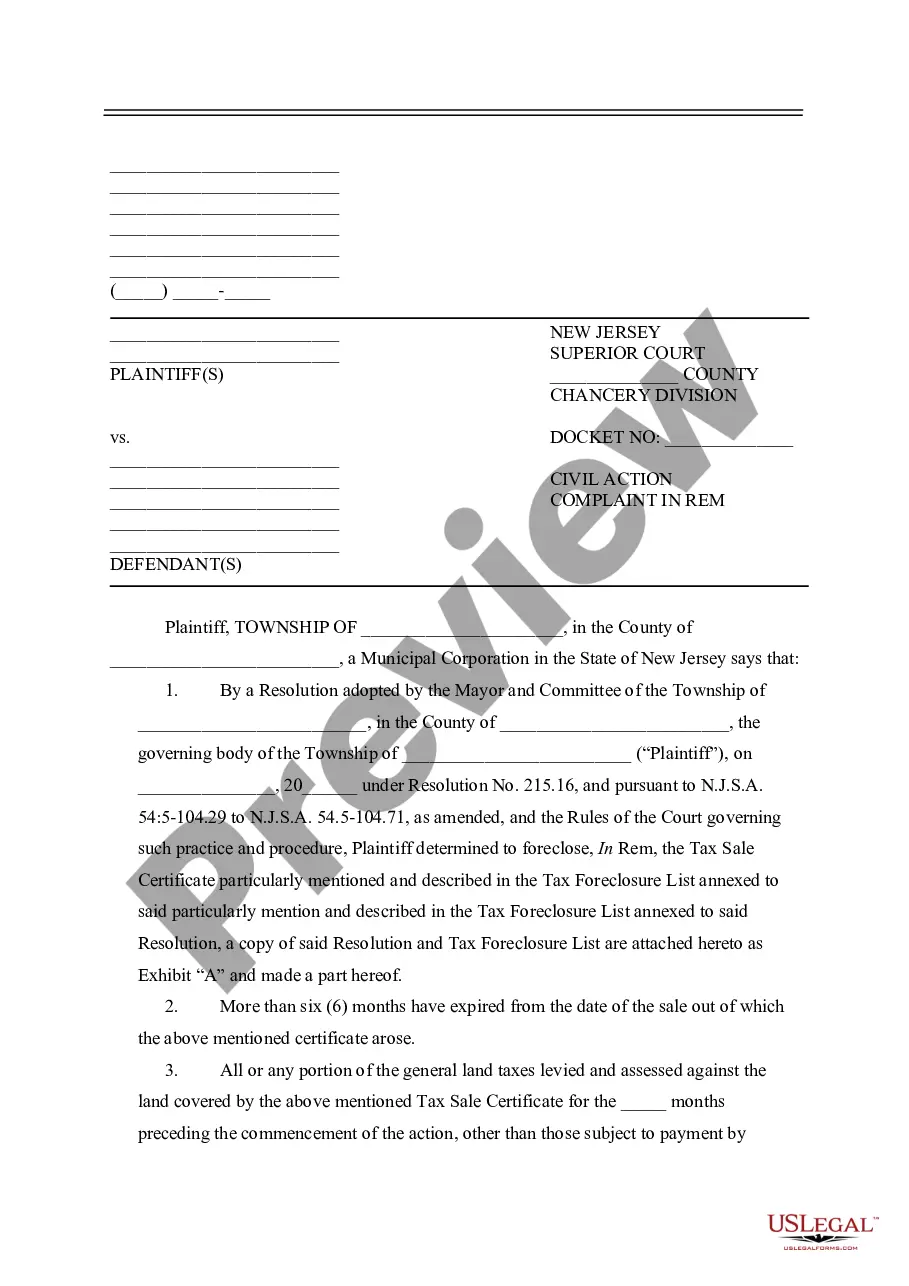

- Examine the page you've opened and verify if it has the sample you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that suits your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily get verified legal templates for any use case with just a few clicks!