The Cook Illinois Agreement to Redeem Interest of a Single Member in an LLC is a legal document that outlines the terms and conditions for redeeming the interest of a single member in a limited liability company (LLC) based in Cook County, Illinois. This agreement is specifically designed to facilitate the buyout or withdrawal of a member from the LLC, providing a clear process and guidelines for the redemption of their ownership interest. By executing this agreement, the single member agrees to sell, transfer, and assign their ownership interest in the LLC to the remaining members or the Company itself. The agreement lays out the redemption price, which may be determined based on a predetermined formula or through negotiation between the parties involved. The redemption price may take into account factors such as the member's original investment, the current value of the LLC, or any applicable discounts or premiums. The Cook Illinois Agreement to Redeem Interest of a Single Member in an LLC also addresses various important provisions related to the redemption process. These provisions can include the timeline for redemption, the method of payment, and any restrictions or conditions that need to be met for the redemption to occur. Additionally, the agreement may outline the consequences of non-compliance or non-payment, as well as any dispute resolution mechanisms that may be implemented. It is important to note that there can be different types or variations of the Cook Illinois Agreement to Redeem Interest of a Single Member in an LLC, as these agreements can be customized to suit the specific needs and circumstances of the LLC. For instance, there may be an agreement that addresses the redemption of a member's interest upon retirement, death, or disability, or one that accounts for the redemption of a minority member's interest in the controlling or majority member. In conclusion, the Cook Illinois Agreement to Redeem Interest of a Single Member in an LLC is a crucial legal document that outlines the process and terms for redeeming a single member's ownership interest in an LLC. It provides a structured framework for the buyout or withdrawal of the member and ensures a fair and efficient redemption process.

Cook Illinois Agreement to Redeem Interest of a Single Member in an LLC

Description

How to fill out Cook Illinois Agreement To Redeem Interest Of A Single Member In An LLC?

A document routine always accompanies any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and many other life scenarios require you prepare official paperwork that differs from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any individual or business purpose utilized in your region, including the Cook Agreement to Redeem Interest of a Single Member in an LLC.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Cook Agreement to Redeem Interest of a Single Member in an LLC will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to get the Cook Agreement to Redeem Interest of a Single Member in an LLC:

- Ensure you have opened the correct page with your local form.

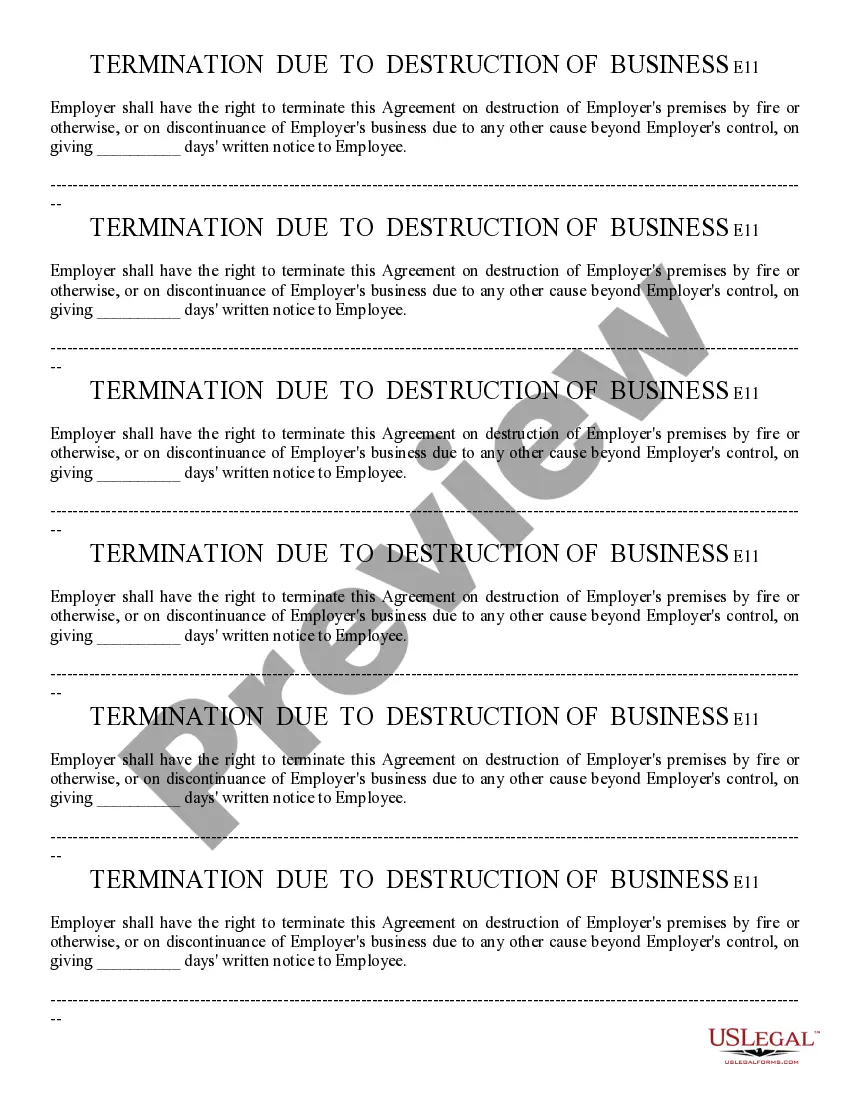

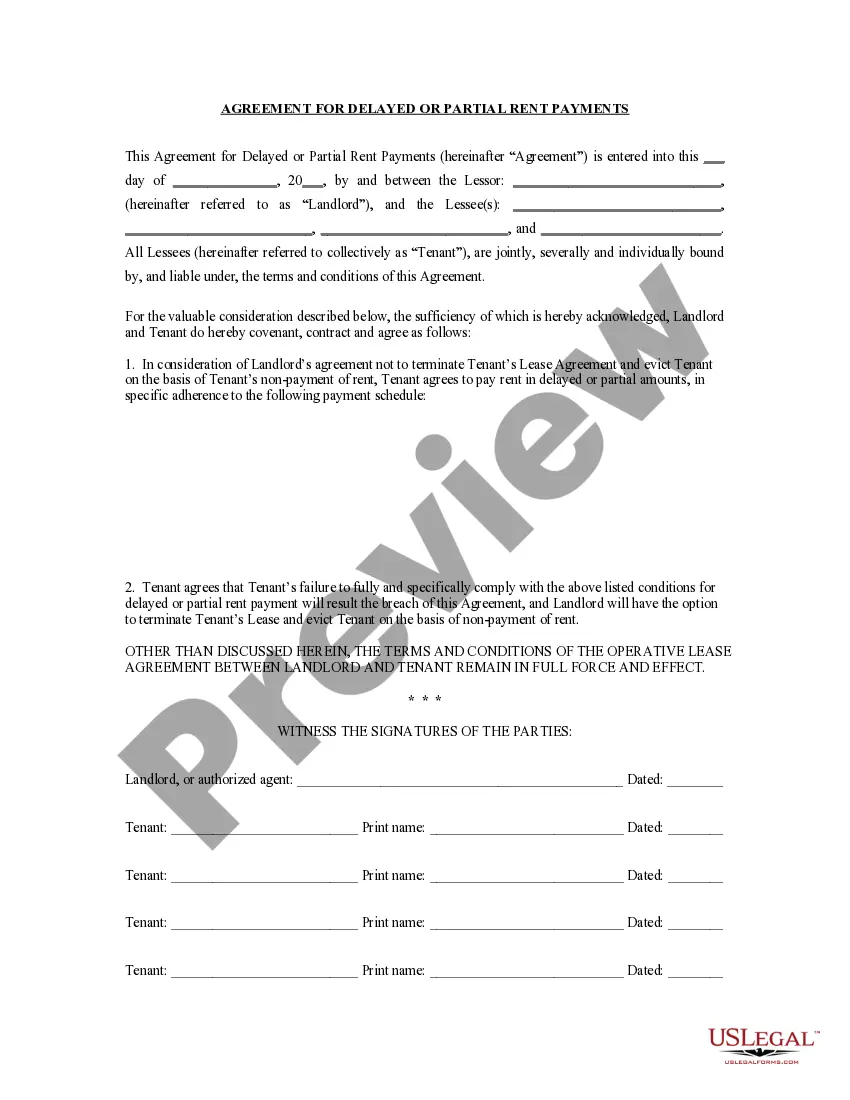

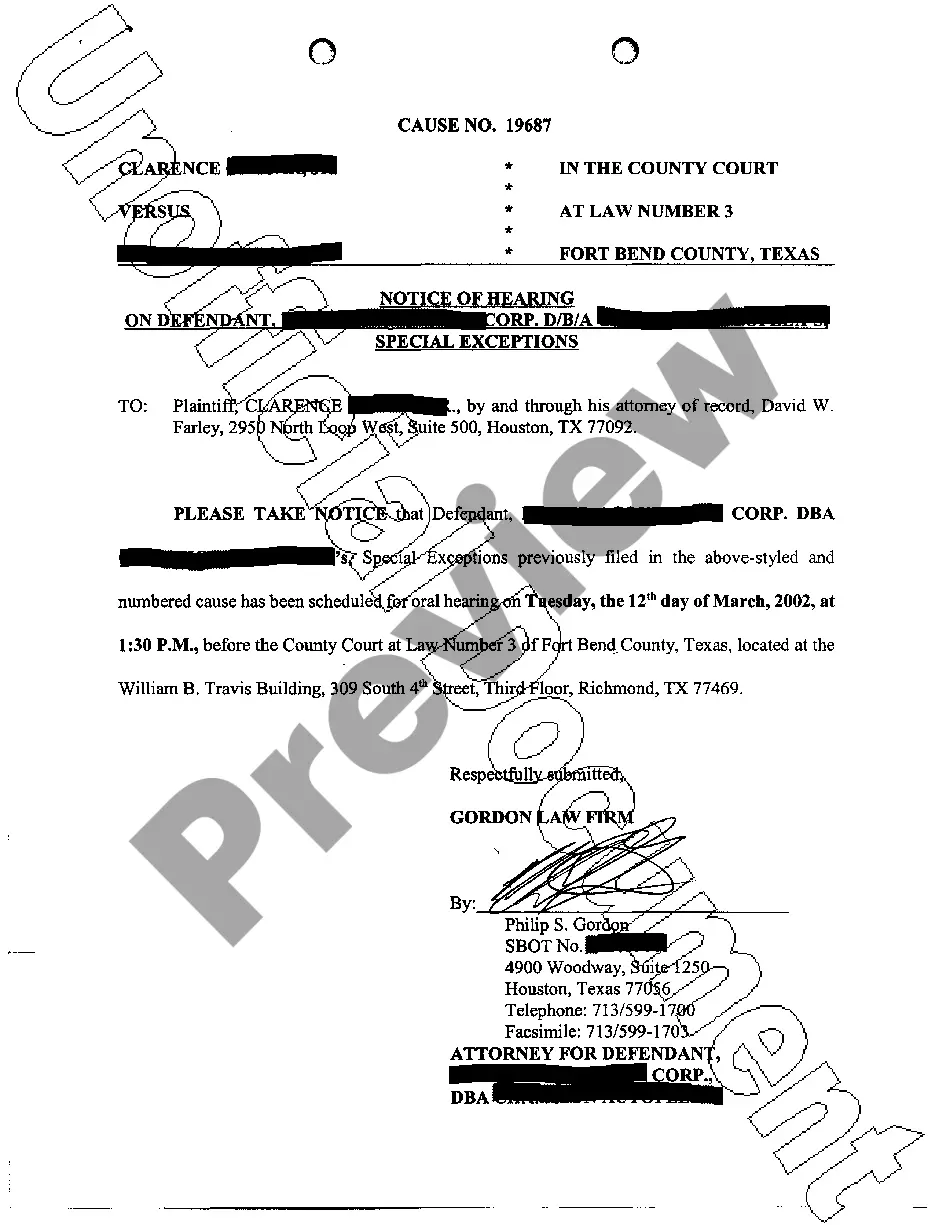

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Look for another document using the search option in case the sample doesn't fit you.

- Click Buy Now when you find the necessary template.

- Decide on the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Cook Agreement to Redeem Interest of a Single Member in an LLC on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!

Form popularity

FAQ

A REDEMPTION AGREEMENT ALLOWS A DEPARTING SHAREHOLDER, PARTNER OR LLC MEMBER TO SELL OUT THEIR INTEREST IN THE BUSINESS TO THE COMPANY INSTEAD OF THEIR CO-OWNER. Another common type of buy-sell agreement is the stock redemption agreement.

A REDEMPTION AGREEMENT ALLOWS A DEPARTING SHAREHOLDER, PARTNER OR LLC MEMBER TO SELL OUT THEIR INTEREST IN THE BUSINESS TO THE COMPANY INSTEAD OF THEIR CO-OWNER. Another common type of buy-sell agreement is the stock redemption agreement.

This agreement sets out the terms and conditions by which a management equityholder rolls over exiting equity in the target portfolio company and receives equity in a newly-formed holding company in a tax beneficial exchange.

How to Write an Operating Agreement Step by Step Step One: Determine Ownership Percentages.Step Two: Designate Rights, Responsibilities, and Compensation Details.Step Three: Define Terms of Joining or Leaving the LLC.Step Four: Create Dissolution Terms.Step Five: Insert a Severability Clause.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one. And by drafting it, I'm referring to creating a written operating agreement.

The Supreme Administrative Court ruled that the transfer of shares for redemption is a special legal transaction which cannot be classified as a paid transfer of assets or rights. Additionally, Art.

Non-Redemption Agreements means certain non-redemption agreements with certain holders of SRNG's Class A ordinary shares, pursuant to which such holders agree not to exercise their redemption rights in connection with the Business Combination.

Tip: It is unwise to operate without an operating agreement even though most states do not require a written document. Regardless of your state's law, think twice before opting out of this provision. Where should operating agreements be kept? Operating agreements should be kept with the core records of your business.

The transfer of membership interest in LLC entities is done through an LLC Membership Interest Assignment. This document is used when an owner (member) of an LLC wants to transfer their interest to another party. They are typically used when a member plans to leave or wants to relinquish their interest in the business.

Sale and Contribution Agreement means the Sale and Contribution Agreement dated as of even date herewith, relating to the sale and contribution by Credit Acceptance to the Seller of the Conveyed Property, as defined therein. Mandatory Redemption means a redemption of ETP Securities in accordance with Condition 8.7.