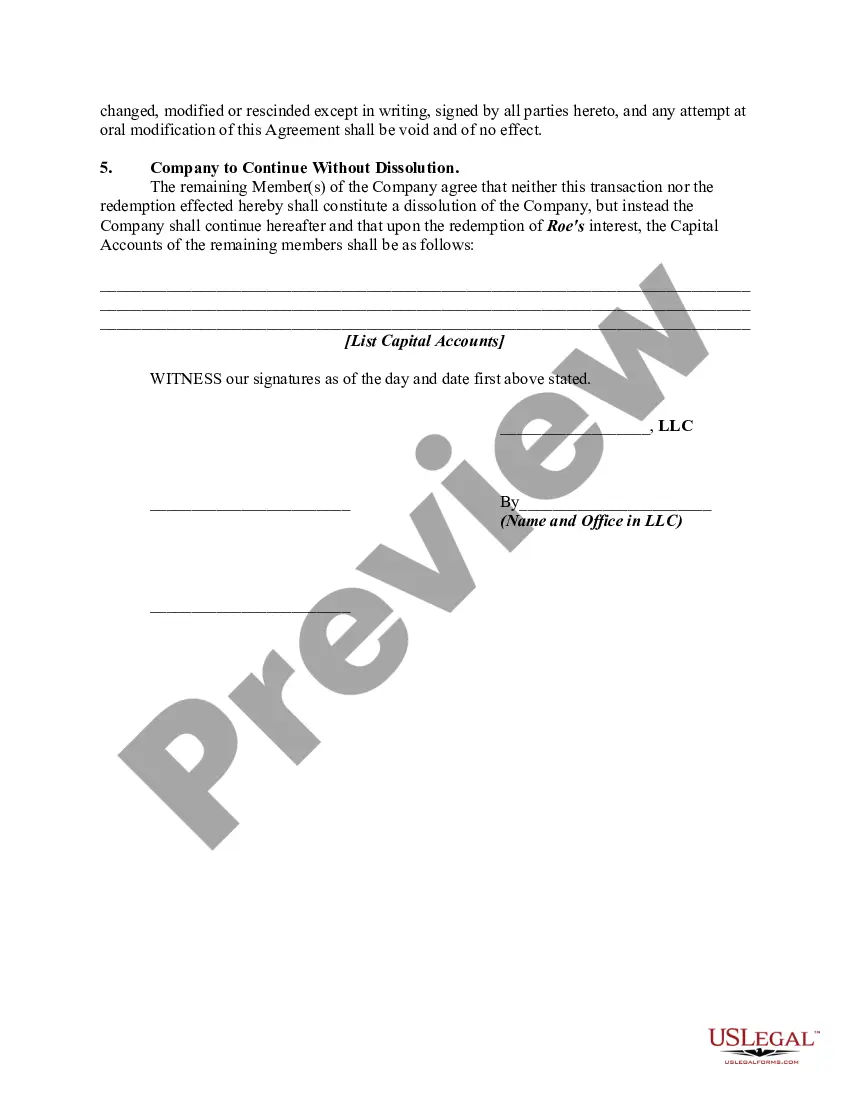

Maricopa Arizona Agreement to Redeem Interest of a Single Member in an LLC is a legal document that outlines the terms and conditions under which a single member of a limited liability company (LLC) can redeem their ownership interest in the company. This agreement offers a framework for the buyout or redemption process, dictating how the redemption price is determined and the steps involved in completing the transaction. In Maricopa, Arizona, there are several types of Agreement to Redeem Interest of a Single Member in an LLC that can vary based on specific circumstances. Some common variations include: 1. Voluntary Redemption Agreement: This type of agreement occurs when the single member of an LLC decides to voluntarily sell or redeem their interest in the company. It typically highlights the conditions and mechanisms for determining the redemption price, such as using a formula based on the company's net worth or through a negotiation process. 2. Involuntary Redemption Agreement: This agreement comes into play when certain triggering events, defined in the LLC's operating agreement or state law, necessitate the redemption of a single member's interest. Such events may include bankruptcy, death, disability, or a breach of the operating agreement by the member. The agreement outlines the steps, valuation methods, and terms for redeeming the interest in these situations. 3. Partial Redemption Agreement: In cases where a single member wants to redeem only a portion of their ownership interest in an LLC, a partial redemption agreement is used. This agreement specifies the percentage or amount of the interest to be redeemed, the redemption price calculation, and the impact on the member's remaining ownership stake. 4. Mandatory Redemption Agreement: This type of agreement is put in place when the LLC's operating agreement or state law requires the redemption of a single member's interest after a predetermined timeframe, which may be for tax or other business reasons. It sets out the terms and conditions, including the redemption process, valuation methods, and consequences of non-compliance. Maricopa Arizona Agreement to Redeem Interest of a Single Member in an LLC covers critical aspects such as the redemption price determination, payment terms, timeframes, dispute resolution mechanisms, and the impact of redemption on the member's rights and responsibilities. It protects both the LLC and the member, ensuring a fair and transparent process in the event of an interest redemption or buyout. Seeking legal expertise is highly recommended when drafting or entering into such agreements to ensure compliance with Arizona laws and the specific needs of the LLC and its members.

Maricopa Arizona Agreement to Redeem Interest of a Single Member in an LLC

Description

How to fill out Maricopa Arizona Agreement To Redeem Interest Of A Single Member In An LLC?

Are you looking to quickly draft a legally-binding Maricopa Agreement to Redeem Interest of a Single Member in an LLC or probably any other document to handle your own or corporate affairs? You can go with two options: contact a legal advisor to draft a legal document for you or draft it entirely on your own. Thankfully, there's another solution - US Legal Forms. It will help you receive neatly written legal paperwork without paying sky-high fees for legal services.

US Legal Forms provides a huge catalog of over 85,000 state-specific document templates, including Maricopa Agreement to Redeem Interest of a Single Member in an LLC and form packages. We offer documents for an array of use cases: from divorce papers to real estate documents. We've been on the market for more than 25 years and got a spotless reputation among our customers. Here's how you can become one of them and obtain the needed document without extra troubles.

- To start with, double-check if the Maricopa Agreement to Redeem Interest of a Single Member in an LLC is tailored to your state's or county's regulations.

- If the form comes with a desciption, make sure to verify what it's suitable for.

- Start the searching process again if the form isn’t what you were seeking by utilizing the search bar in the header.

- Select the subscription that best fits your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Maricopa Agreement to Redeem Interest of a Single Member in an LLC template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to find and download legal forms if you use our catalog. Additionally, the documents we offer are reviewed by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Owners of an LLC are called members. Most states do not restrict ownership, so members may include individuals, corporations, other LLCs and foreign entities. There is no maximum number of members. Most states also permit single-member LLCs, those having only one owner.

Sole Proprietor: The IRS considers the owner of a one-member LLC as a sole proprietor. Despite protection of their personal assets against the debts of the company, a single-member LLC owner must be responsible for all functions of the LLC.

Single Member LLC Post Formation in Arizona Step 1: Draft and Sign an LLC Operating Agreement.Step 2: Get a Federal Tax ID (EIN)Step 3: Get a Business License.Step 4: Publish Notice of LLC Formation.Step 5: Open a Business Bank Account.Step 6 (Optional): File a Trade Name Registration.Step 7: Get a Sales Tax License.

Is an Operating Agreement REQUIRED in Arizona? No, an operating agreement is not required in Arizona. It is recommended that one is created as it holds the ownership of the entity.

Owners of an LLC are commonly referred to as members. If a manager is hired to run the LLC, that person is often called a member-manager. While not as common, corporate titles can be assigned to members, such as President, Founder, Chief Financial Officer (CFO), or Chief Executive Officer (CEO).

Arizona allows formation of single-member LLCs Arizona LLCs are governed by the Arizona Limited Liability Company Act (Arizona Revised Statutes, Title 29, Chapter 4).

A REDEMPTION AGREEMENT ALLOWS A DEPARTING SHAREHOLDER, PARTNER OR LLC MEMBER TO SELL OUT THEIR INTEREST IN THE BUSINESS TO THE COMPANY INSTEAD OF THEIR CO-OWNER. Another common type of buy-sell agreement is the stock redemption agreement.

Arizona allows formation of single-member LLCs Arizona LLCs are governed by the Arizona Limited Liability Company Act (Arizona Revised Statutes, Title 29, Chapter 4).

With LLCs, members own membership interests (sometimes called limited liability company interests) in the Company which are not naturally broken down into units of measure. You simply own a membership interest in the Company and part of your agreement with the other members is to describe what and how much you own.

Compare business structures Business structureOwnershipSole proprietorship Business structureOne person OwnershipPartnerships Business structureTwo or more people OwnershipLimited liability company (LLC) Business structureOne or more people OwnershipCorporation - C corp Business structureOne or more people Ownership3 more rows